- English

- 中文版

September 2025 FOMC Preview: Resuming The Journey Back To Neutral

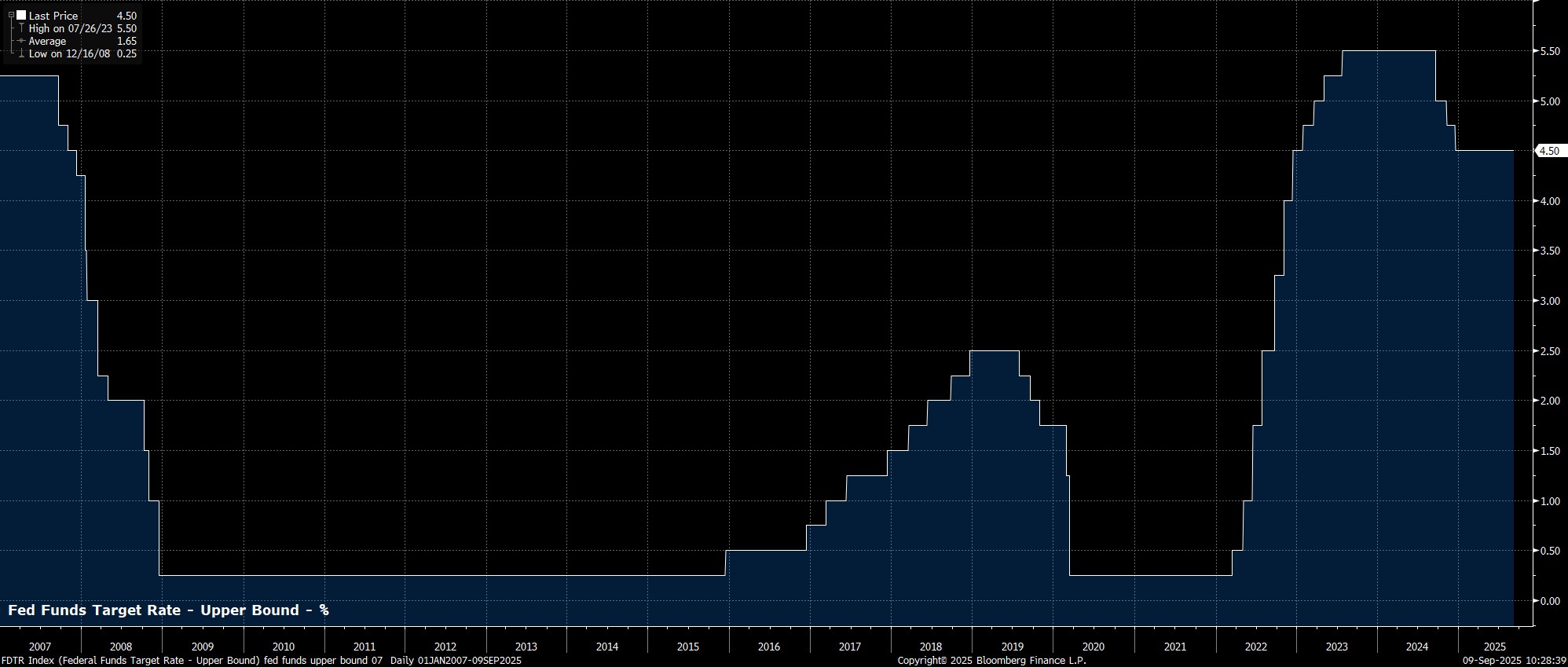

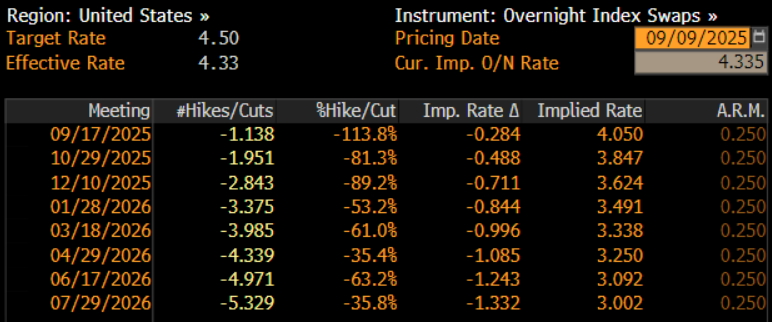

As mentioned, the target range for the fed funds rate is set to be cut by 25bp at the conclusion of the September confab, to 4.00% - 4.25%, in a move that will mark the Committee’s first rate reduction since the tail end of last year. Money markets, per the USD OIS curve, fully discount a 25bp cut at the upcoming meeting, and price a total of 71bp easing by year-end.

That decision, though, seems unlikely to be a unanimous one among Committee members.

Assuming he is confirmed by the Senate in time to participate in the meeting, CEA Chair Miran, who is due to fill ex-Governor Kugler’s spot on the Board, is likely to dissent in favour of a larger move. Said dissent would, probably, be in the form of a vote for a 50bp cut, though could be more sizeable given not only Miran’s previously-espoused dovish views, but also the risk of political interference in his decision from the Oval Office. Governors Waller and Bowman, who dissented in favour of a 25bp cut in July, are also potential candidates to plump for a larger rate move.

On the other hand, although a lower probability than the aforementioned dovish dissents, there is also the potential for votes in favour of holding the fed funds rate steady. Potential candidates for a hawkish dissent include St Louis Fed President Musalem, as well as Kansas City Fed President Schmid, both of whom have noted in recent remarks that the current ‘modestly restrictive’ stance is appropriate, albeit in comments that were made before the dismal August jobs report.

No matter the vote, the accompanying policy statement is likely to see policymakers seek to preserve as much optionality as possible in terms of the future policy path. As such, guidance is likely to be unchanged from that issued in July, and in fact from that used in the easing cycle last year, in emphasising the data-dependent nature of future policy ‘adjustments’. That could be rephrased to ‘rate reductions’, were the Committee seeking to convey a more dovish message.

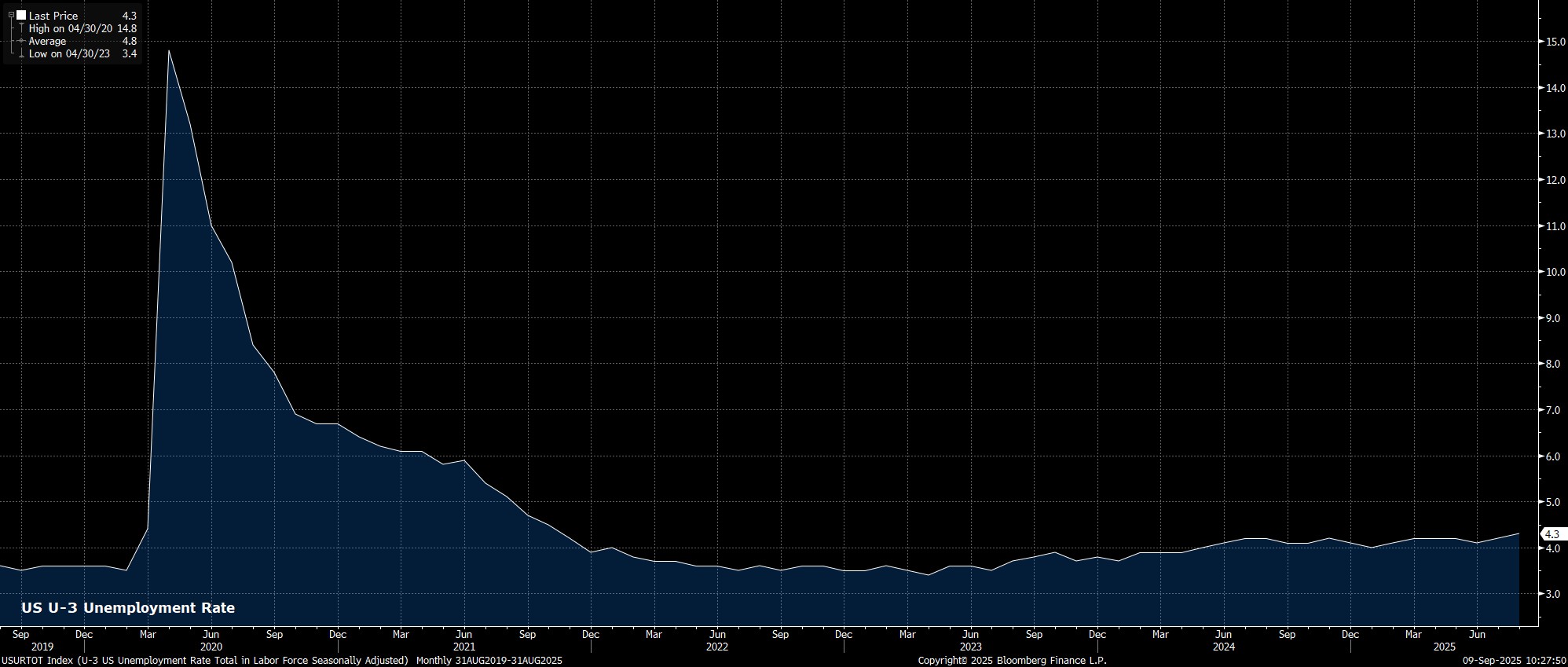

It is, of course, the stalling labour market, coupled with Chair Powell’s dovish pivot at the late-August Jackson Hole Symposium, that have spurred expectations not only of a cut this time around, but a series of cuts into year-end and beyond, as payrolls growth falls to about half the breakeven pace, and unemployment stands at a cycle high 4.3%.

It should be noted, however, that while the labour market is clearly losing momentum, largely as a result of ongoing trade- and tariff-related uncertainty, the FOMC had already pencilled in a slow but steady easing in employment conditions in the June SEP.

Most likely, that path remains broadly unchanged in the updated SEP this time around, with the Committee’s median expectation again pointing to unemployment rising to 4.5% this year and next, before then falling once more towards the end of the forecast horizon. The September SEP, as always, will provide our first look at the FOMC’s 2028 economic expectations, though projecting over such a long time horizon, in a macro environment as volatile as the current one, is somewhat folly.

Meanwhile, on inflation, the updated SEP is likely to reiterate expectations for both headline and core PCE to end the year around the 3% mark, though there is the possibility that next year’s projection is nudged slightly higher, to reflect what appears to be a delayed pass-through of tariff-induced price pressures. Pressures which, of course, Powell & Co are now largely viewing as a ‘one-time shift in the price level’, which should ensure that the longer-run price projections point to a return to the 2% inflation target.

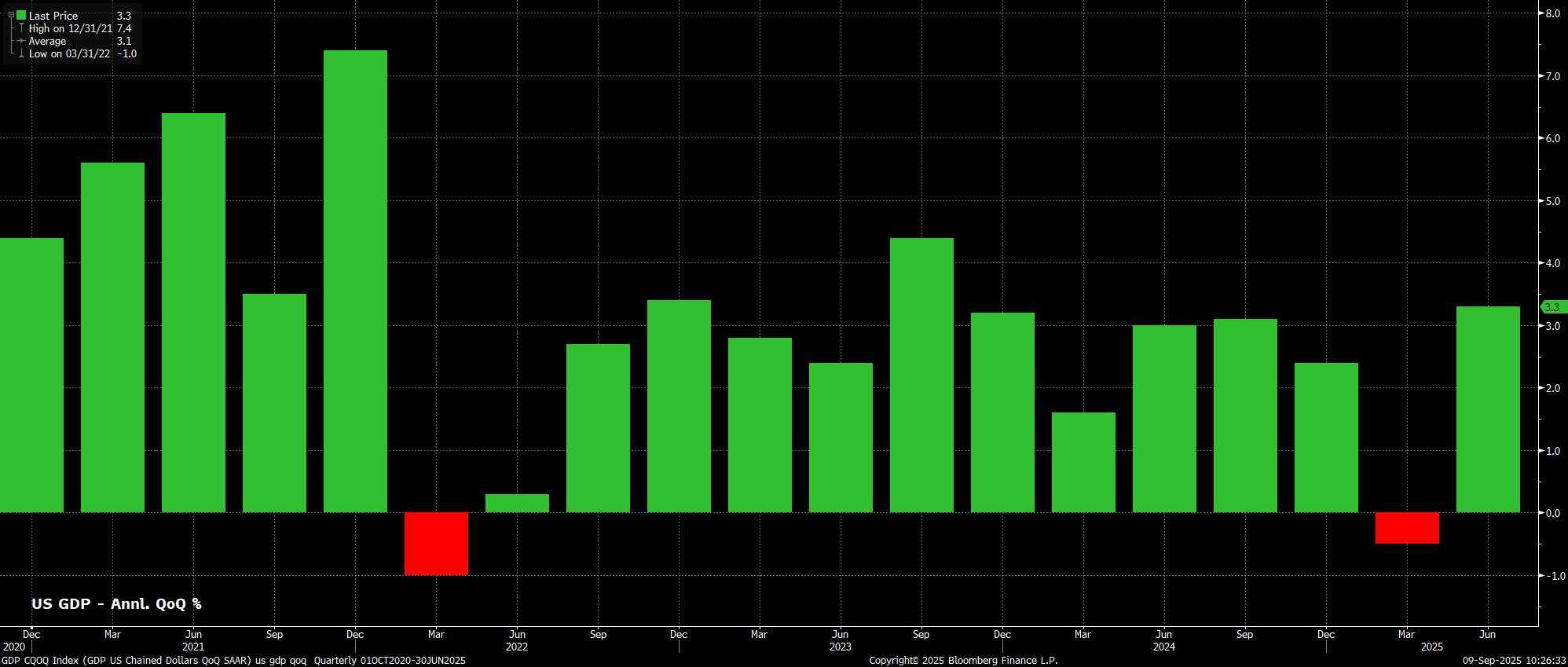

The growth outlook may also see some notable revisions, with the current median expectation of 1.4% GDP growth this year appearing too pessimistic, even if the impacts of tariff front-running, and the volatile nature of net exports data in H1, continue to skew the data. Regardless, an 0.2pp or 0.3pp upward revision to that figure seems plausible, with the pace of expansion further along the horizon also likely to be nudged higher, potentially pushing the longer-run expectation back towards 2%.

Meanwhile, at his post-meeting press conference, Chair Powell seems likely to stick largely to the script used at the Jackson Hole Symposium late last month.

As a result, Powell is set to reiterate his expectation that tariffs will prompt a ‘one-off shift in the price level’, so long as inflation expectations remain well-anchored. Furthermore, while noting that downside labour market risks have increased, Powell will likely reiterate that the FOMC will ‘proceed carefully’ in the months ahead, given the increasing likelihood that risks to each side of the dual mandate are increasingly coming into conflict. To be clear, Powell will likely seek to retain as much flexibility on the outlook as possible and, while likely nodding towards further cuts in the months ahead, shan’t pre-commit on either the magnitude or timing of said moves.

Powell is also likely to keep mum on the issue of his future, namely whether he plans to leave the Fed next May, or serve out the remainder of his term as a Governor until early-2028. In a similar vein, Powell shan’t be drawn on any political matters, either as it pertains to the Trump Admin’s continued calls for sizeable rate cuts, or the ongoing attempts to remove Governor Cook over allegations of mortgage fraud.

Taking a step back, the September confab will mark an important moment, not only as the FOMC resume the easing cycle, but also as focus shifts back towards the employment side of the mandate, amid a belief that tariff-induced price hikes don’t pose a risk to price stability over the medium-term. While that, clearly, poses a risk that inflation expectations to un-anchor from target, preventing labour market weakness from spiralling further appears the Committee’s priority for the time being.

As a result, further rate reductions are on the way, they are set to come at a relatively gradual pace, in order to ensure that inflation expectations remain compatible with the 2% target over the medium-term. My base case, hence, is that just one further 25bp cut will be delivered this year, most likely at the December meeting, though risks tilt towards a more dovish outturn, and consecutive cuts being delivered, if the labour market weakens at a more rapid rate.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.