Analysis

February RBA Meeting Preview: Counting Down to the First Rate Cut Since 2020

With the RBA, the BoJ and Norges Bank being the only G10 central banks not to cut rates in 2024, there is an increased anticipation and interest from traders as to what it means for the AUD and Aussie equity.

Many question if the RBA embarking on an easing cycle could set off a fresh wave of AUD selling - which given the sharp depreciation seen through Q424 and into January could possibly increase the risk of imported inflation in the quarters ahead.

What Happens if the RBA Doesn’t Cut Interest Rates on 18 February?

With Aussie interest rate swaps having priced a greater than 70% chance of a cut at the February RBA meeting all year, if the RBA were to hold rates at 4.35% it would be seen as an obvious surprise and would almost certainly result in an immediate spike higher in the broad AUD. The extent and the duration of the AUD rally would then be conditional on the guidance for a cut at the April meeting.

Historically, it is incredibly rare that the RBA would go against such high levels of conviction of a policy change held by interest rate traders.

So, unless the RBA wanted to inject a higher level of policy uncertainty and volatility into the rates market, they would need to come out soon in a local news publication and guide the market that its expectations were too high or cut, as most expect.

It’s All About the Guidance and the New Economic Projections

All things being equal if we take the cut in isolation – given a 25bp cut is so well discounted – the AUD shouldn’t move to any great degree, should it eventuate. However, what could move the AUD and interest rate-sensitive equities, is the RBA’s guidance and the appetite for ongoing cuts.

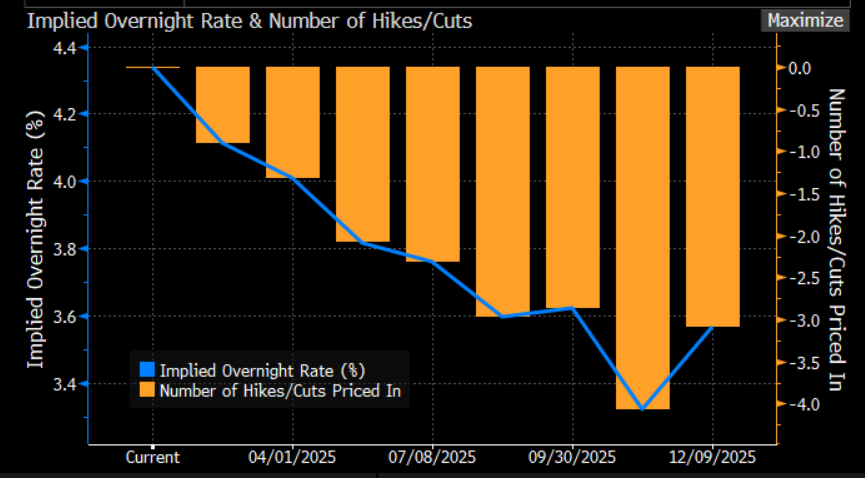

As a benchmark, we can look at market pricing and the implied number of rate cuts in the tradeable interest rate futures and swaps market to see the level of implied rate cuts through to December.

This pricing is dynamic and will evolve as the market digests new economic data and changes in financial conditions. As we move towards the RBA meeting the collective weight of money currently implies 85bp in cumulative rate cuts by December – essentially, implying a 25bp cut in February, another 25bp cut in May with conjecture on whether we get one or two more 25bp cuts by December.

Will the RBA’s Guidance Meet the Market’s Implied Pricing?

It seems a high probability that the RBA statement will lack the commitment to meet that implied level of cuts through the year, and they will almost certainly acknowledge that ongoing cuts will be driven by their assessment of the incoming data, developments in financial conditions and global economic trends.

The RBA will welcome the pace of disinflation seen in the Q424 CPI print, and while it should give them the confidence to cut at this meeting, they should stress that the job of bringing inflation to target is not yet complete. Looking ahead, we note that the Q125 CPI release is due on 30 April and the Q225 CPI print is due on 30 July – the outcomes of both releases will go some way to dictating the extent of rate cuts seen through 2025.

The RBA’s New Economic Forecasts Will be Closely Scrutinised

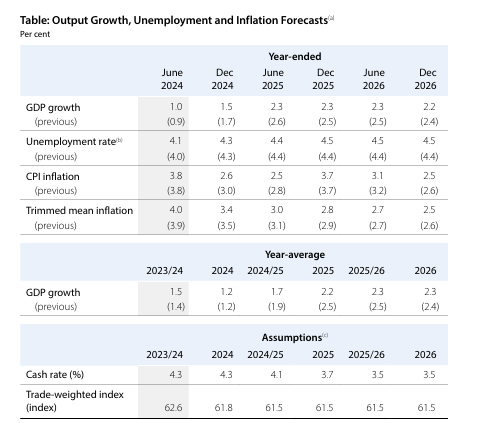

Westpac’s economists made an interesting call today, with a forecast for headline inflation to fall to 1.75% by June 2025, with the trimmed mean inflation measure forecast to moderate to 2.4%. The RBA will release a new set of economic forecasts at this meeting (in its Statement on Monetary Policy/SoMP) and while we note that Westpac’s forecasts are just one sample – they are materially lower than the RBA’s prior forecast of 2.5% and 3% respectively laid out in the November SoMP.

With that in mind, the RBA will offer a new set of economic assumptions in the February SoMP (released at the same time as the RBA’s policy statement) and there will be scrutiny to see if the RBA alter its inflation forecasts by a similar magnitude.

Of course, the RBA doesn’t just set policy to inflation, although, it is currently the bank’s core consideration. Trends in the labour market, the assumed levels of government spending and developments in the global economy also impact its view on policy.

One could argue that on current trends and the forecast levels of spending in the government’s recent MYEFO this dynamic could anchor the level of rate cuts seen in 2025.

The Trade?

While the RBA cutting rates is a psychological development for any central bank who are late to the easing party – the fact that the cut is fully priced with the market pricing 2 to 3 additional cuts this year suggests that a fully data-dependent bank offers modest upside risk for the AUD over the meeting. It would suggest that its forecasts for inflation over the coming quarters may not be as aggressive as some of the private sector forecasts.

Consider that once the dust has settled and we’ve heard from Governor Bullock in the post-meeting press conference that it won’t take long for the market to revert to trading the AUD as a China proxy, or as an expression of positive/negative sentiment in the equity markets – i.e. the S&P500 higher, AUD higher.

For those who want to trade a tactical view on rates through the FX channels, then AUD vs the FX cross rates is the better play. We also consider that the clearer reaction could be seen in interest-sensitive Aussie equity, where consumer-focused stocks may find further tailwinds. Either way, to many a rate cut can’t come soon enough, the question is how far and how fast they can lower rates.

The data will hold the answer to that debate.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.