Analysis

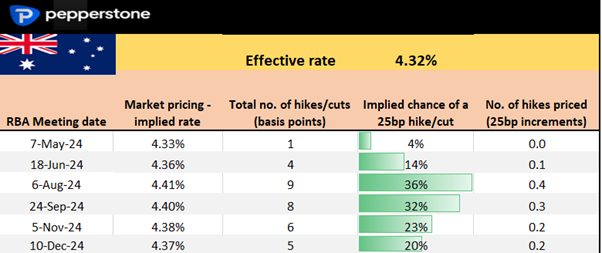

We do see one brave economist calling for a 25bp hike at this meeting, but the strong consensus is that the cash rate will be left unchanged at 4.35%. This is in fitting with market pricing, with Aussie interest rate futures pricing just 1 basis point of hikes (a 4% implied) for this meeting.

Aussie interest rate pricing – market expectations for future policy

Clearly, if we get a surprise 25bp hike then it would send shockwaves not just through Australian financial markets, but through many businesses and households too. A 25bp hike seems a very low probability but it can’t be completely ruled out.

The source of AUD volatility

Where we see potential volatility in the AUD is when we reconcile the tone and the guidance in the RBA statement, the Statement on Monetary Policy, and Gov Bullock’s speech, relative to the pricing (and expectations) currently seen in Australian interest rate futures. Where current market pricing implies a c.40% chance of a 25bp hike for the August RBA meeting.

This suggests the market is of the view that the statement and Gov Bullock's communication to the press will lean towards a hawkish outcome, with the RBA likely expanding on the triggers and the path that takes us toward future hikes.

Given these consensus expectations if the guidance is not tightened sufficiently towards a hike, then the AUD faces downside risks.

Why the sudden change of thinking?

There was growing talk two weeks ago that the next move from the Fed could be a hike and that could mean the RBA follow in sympathy. Well, after last week’s moderation in US payrolls and the FOMC meeting, where Fed chair Jay Powell suggested they weren’t looking at hikes, that view has receded.

Naturally, the RBA will be closely monitoring economics in the US, however, any change to RBA policy will be much more influenced by domestic factors.

The big consideration is therefore domestic inflation, where notably services inflation is running at 4.6%, with domestic non-tradable inflation at 5%.

At a headline level in the February Statement on Monetary Policy, the RBA was forecasting headline CPI at 3.3% and the trimmed-mean CPI measure at 3.6% for the June quarter.

Given we just saw the Q1 CPI print come in at 3.6% y/y and 4% y/y respectively, we’ll need to see prints in the Q2 CPI data (due 31 July) below 0.5% month-on-month if the RBA are to hit their estimates – and given consensus views are closer towards 0.7% m/m this seems unlikely.

It seems highly probable that the RBA raise their inflation forecasts for the June and December ‘24 quarters, which would justify the expected hawkish turn from the RBA.

The RBA’s current forecasts on economics

Recall the RBA was also forecasting the unemployment rate to reach 4.2% in the June quarter, and given it currently sits at a healthy 3.8%, this again implies upgrades (lowering) their forecasts in the SoMP.

More data required

Tactically it feels like now is too early to hike rates and it would be too much of a shock for Aussie households, many of whom had interest rate cuts projected into their thinking. Not that the RBA are there to protect over-levered borrowers, but they would want to prepare the landscape and to offer a roadmap for future changes to policy, and the triggers that get us towards renewed potential tightening.

Therefore, the August or September RBA meeting seems a more fitting timeline for hikes, if they come at all.

Given the RBA will continue to push the notion that they are driven by the data, by August we’d have a clearer understanding of the merits of more policy tightening – notably, we get the Q1 Wage Price Index (due 15 May), three more employment reports (16 May, 13 June & 18 July), two monthly CPI reads (29 May & 26 June), and the all-important Q2 CPI print (31 July).

As well as reads on retail spending, credit, business, and consumer confidence reports.

So, this RBA meeting promises to be insightful into their thinking – the AUD could well see increased volatility over the meeting, with the market sensing firmer guidance for future hikes. For many, the idea that after some 425bp of hikes - with the cash rate into restrictive territory - we could be seeing renewed hikes is a big development. It would also be firmly at odds with other central banks, many of whom will be looking to cut rates in July or July and that also has significant implications for exchange rates.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.