- English

- 中文版

RBA Hikes Rates by 25bp, AUD the Best Performing G10 Currency in 2026

Summary

• The RBA delivered a widely expected 25bp rate hike but struck a hawkish tone

• Inflation forecasts were revised higher, delaying a return to the target band

• AUDUSD rallied above 0.7000, lifting the Australian dollar to the top of the G10 leaderboard in 2026

• Markets are now pricing the risk of further rate hikes later this year

RBA Delivers a Hawkish Rate Hike

At its February meeting, the Reserve Bank of Australia (RBA) lifted the cash rate by 25 basis points. While the move itself was largely expected, with interest rate swaps implying a 73% probability of a hike, the initial reaction in the Australian dollar was more forceful than many had anticipated.

The RBA statement leaned decisively hawkish. The board acknowledged being surprised by the strength of private sector demand, noting that price pressures have risen materially, while housing prices and broader economic activity continue to firm.

Inflation Forecasts Revised Higher

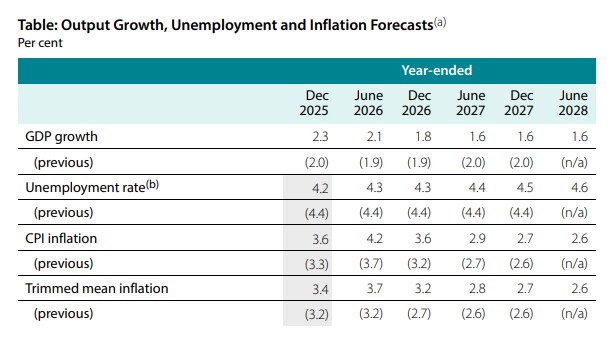

The updated set of economic forecasts reinforced the upside case for the Australian dollar. The RBA revised its core inflation projection for the June 2026 quarter higher by 50 basis points to 3.7%, and to 3.2% for the December quarter. Under these forecasts, inflation is not expected to return to the 2 to 3% target band until 2027.

In market terms, this was interpreted as a clear hawkish hike rather than a neutral policy adjustment.

AUD Rallies Across the Board

AUDUSD rallied sharply from 0.6965 to a session high of 0.7033, lifting the Australian dollar to the best performing G10 currency year to date. AUDJPY climbed to 109.28, approaching the July 2024 highs, while the Aussie also posted notable technical breakouts against the euro, Canadian dollar, British pound and Swiss franc.

RBA Gov Bullock Comments Trigger Modest Pullback

Momentum eased following Governor Michele Bullock’s press conference. Bullock clarified that a 50bp hike was not discussed at the meeting and indicated the board would approach further tightening cautiously, just as it would during an easing cycle. She also highlighted that persistent inflation pressures are being driven primarily by housing, durable goods and market services, areas where the RBA remains keen to restrain demand.

These comments prompted some profit taking, with AUDUSD pulling back toward the 0.7000 level. Even so, the Australian dollar remained one of the stronger performers on the day, leaving the door open to renewed demand as European and UK traders engage.

What Comes Next for Rates and the AUD

Market pricing now points to another rate hike in the June to August window, with growing discussion around the possibility of an additional move by year end. The next major macro catalyst will be the January monthly CPI release on 25 February, although upcoming wage data on 18 February and the employment report on 19 February could also prove influential if they continue to run hot.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.