- English

- 中文版

WHERE WE STAND – 1st Sept is the new 9th July, probably.

It proved to be an incredibly noisy Friday to wrap up the week, and one where participants received a deluge of trade headlines. Most of that news flow, though, was almost entirely shrugged off, presumably amid pure exhaustion amid the tariff to-and-fro which has now been going on for almost half a year.

Probably the most important of all those headlines, though, were remarks from Treasury Secretary Bessent, indicating that the 9th July expiration of the pause on ‘Liberation Day’ tariffs could be extended, with Bessent noting that trade could be “wrapped up by Labor Day” (1st September).

This, along with various other bits of reporting indicating that deals are ‘close’ supports my working base case on the whole matter – tariffs won’t be going back to their early-April levels next week, and what will probably happen is an extension of the status quo, either via an outright pause, or after the US signs various ‘memoranda of understanding’ with the nations in question, pledging to hold tariff rates at the baseline 10% while further negotiations take place. Of course, if this latter scenario comes to pass, expect the memoranda to be the ‘biggest and best and most beautiful’ trade deals ever, at least in the likely words of the man in the Oval Office.

Trump, though, seems to have turned his ire towards Canada once more, halting all trade talks with the US’s northern neighbour, after the imposition of a digital services tax north of the border, and noting that new tariff rates will be set “within seven days”. We’ve all seen this film before – escalate to de-escalate, throw out a threat, bring Canada to the table, get the policy reversal Trump wants, and then continue with negotiations. In fact, this already seems to be happening, with Canada scrapping that digital srvcs tax over the weekend. Remember, TACO.

Markets have also, thankfully, wised up to this, and barring a brief wobble as those Canada lines crossed, shrugged things off relatively easily. Markets also continue to, rightly, ignore the Trump Administration’s continued tirades against Fed Chair Powell, though the erosion of monetary policy independence means that the dollar should continue to drift slowly, but surely, to the downside over the medium-term.

Trump, on Friday, noted that his pick for Fed Chair will be “somebody that wants to cut”, with the President believing that the US should be “paying 1% interest right now”. It was already pretty obvious, but this confirms that Powell’s successor will be a politically-compromised ‘yes man’, not only eroding the independence of the Fed, but also teeing up a ‘Board vs. Regional Presidents’ showdown next year, if Trump’s (by that stage) 4 Governor picks all attempt to turn uber-dovish and force through aggressive rate cuts. For now, though, that soap opera is irrelevant to the near-term policy outlook, with my base case still being just one 25bp cut this year, probably in December.

Incidentally, if Trump were to get the fed funds rate lowered to 1%, as he seems so desperate for, this would simply see every man and his dog pile into steepeners, and result in the long-end selling off aggressively, probably taking 10s and 30s to 6%, if not higher. Far from achieving the lower borrowing costs he’s so desperate for, such action would actually be akin to shooting oneself in the foot. Good luck to the White House aide whose job it is to try and explain this, though!

Anyway, in the here and now Treasuries remain relatively rangebound, with benchmark 10-year yields stuck in a 4.25% - 4.50% range, and benchmark 30s between 4.75% - 5.00%. These ranges seem likely to hold for the time being, with ongoing fiscal jitters preventing rallies from extending too far, while dip buying interest remains healthy at the upper point of those trading bands.

Ranges, though, are breaking elsewhere.

Equities gained further ground on Friday, with the S&P 500 notching its first record high since February, and spoos now comfortably north of 6,200. As I often say in these notes, record highs tend to beget further record highs, and there are few more bullish indications for a market than one continuing to print new ATHs.

This is particularly true when the bull case remains a solid one, with trade risks diminishing, earnings growth solid, and economic growth strong too. Upcoming risks include Thursday’s jobs report, followed by the tariff expiry deadline next week, and then Q2 earnings season starting the week after, but the path of least resistance continues to lead higher for now. Folk looking at the market and trying to ‘pick a top’ will likely not only fail to pick that top, but are barking up the wrong tree from a directional perspective as well.

As mentioned earlier, the path of least resistance leads in the opposite direction for the greenback. Participants continue to look past underlying economic resilience – Friday’s personal income figures were skewed lower by a fall in social security payments, so aren’t worth worrying about – and instead remain spooked by continued moves to erode, or perhaps even eradicate, monetary policy independence. While there is little to like about either the GBP or the EUR, it’s not hard to envisage prints of 1.40 and 1.20 respectively before too long, simply as a result of broad-USD weakness.

Gold, though, seems to have lost its lustre for the time being, failing to benefit from those continued USD outflows, closing Friday not only below $3,300/oz, but also below the 50-day moving average for the first time since January. I’d frame this more as a pause for breath, than an end to the yellow metal’s rally, especially as demand from those diversifying out of the greenback is unlikely to have dried up entirely. Bullion’s ‘salad days’ may return before too long.

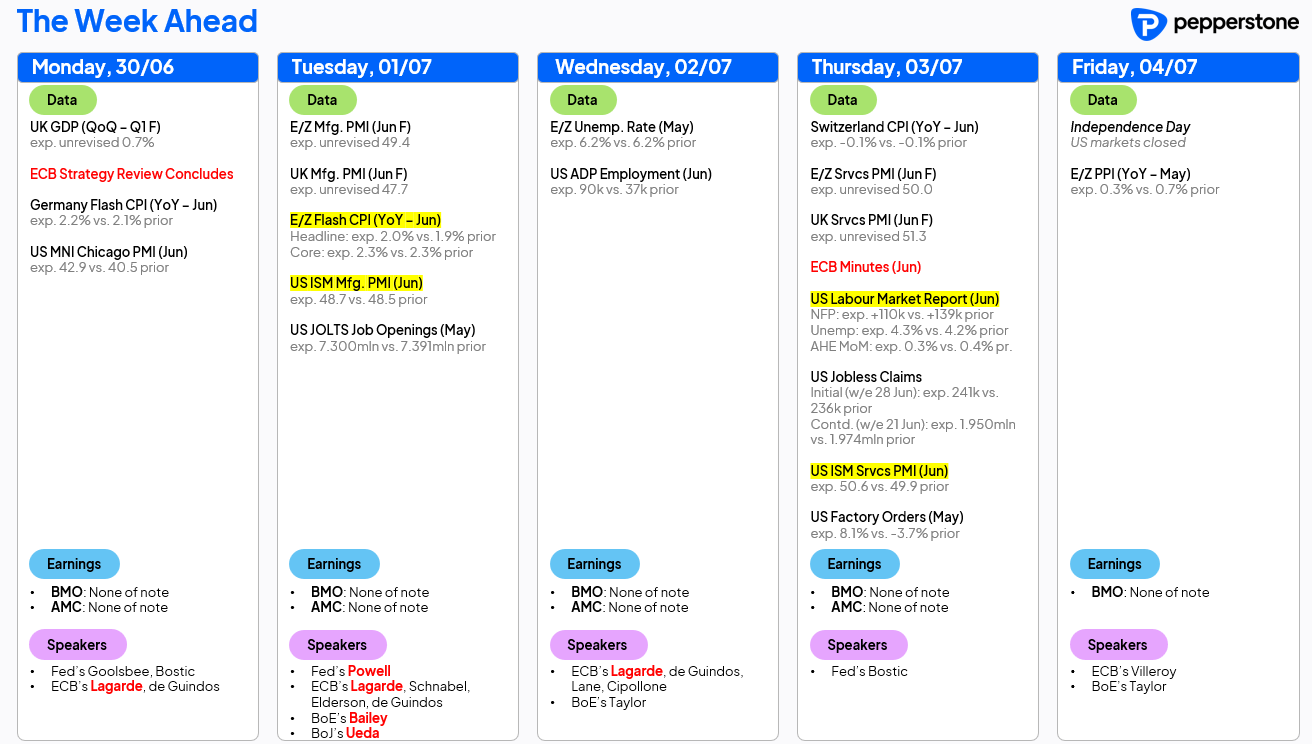

LOOK AHEAD – A holiday-shortened week up ahead, with Independence Day on Friday, but one that still contains plenty for participants to get their teeth into.

On the data front, Thursday’s US labour market report is the obvious highlight, with the economy set to have added +110k jobs in June, a slowdown from the pace seen in May, though a rate that would still be just above the ‘breakeven’ pace. Average earnings, meanwhile, should rise 0.3% MoM, a pace that would cause little concern about potential inflationary risks stemming from the labour market, while unemployment is set to tick higher to 4.3%, as the inertia of slow firing, but relatively slow hiring, continues.

Elsewhere, the latest eurozone inflation figures are set to show headline CPI having hovered around the ECB’s target once again in June, while the latest round of PMI figures are also due from most DM economies, with the ISM manufacturing and services metrics naturally of most interest.

Speaking of the ECB, it’s their annual shindig in Sintra this week, where the great and the good of the monetary policy world will be in attendance. The highlight of the schedule comes on Tuesday afternoon, with ECB President Lagarde, Fed Chair Powell, BoJ Governor Ueda, and BoE Governor Bailey all set to appear on a panel discussion together. The results of the ECB’s strategy review will also be released at the conference – and, yes, contrary to popular belief they do actually have a strategy over there!

Finally, there are no notable corporate earnings due for release this week, while trade and geopolitical headlines will of course also remain in focus.

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.