- English

- 中文版

JPMorgan Chase (JPM, 11:30am BST/6:30am ET, 13 January)

JPMorgan traded well in 2025, rallying around 35% over the course of the year, comfortably outperforming the S&P 500, and the financials sector. The stock remains an index heavyweight, standing as the 13th largest name in the S&P, while also being a Dow constituent, with a 4.1% weight in the average. For the upcoming report, options tied to the stock price a move of +/-3.2% in the 24 hours post-release, though JPM has sold-off over that period following each of the last two quarterly reports. This time out, consensus expects adjusted EPS at $5.01, on revenues of $46.4bln.

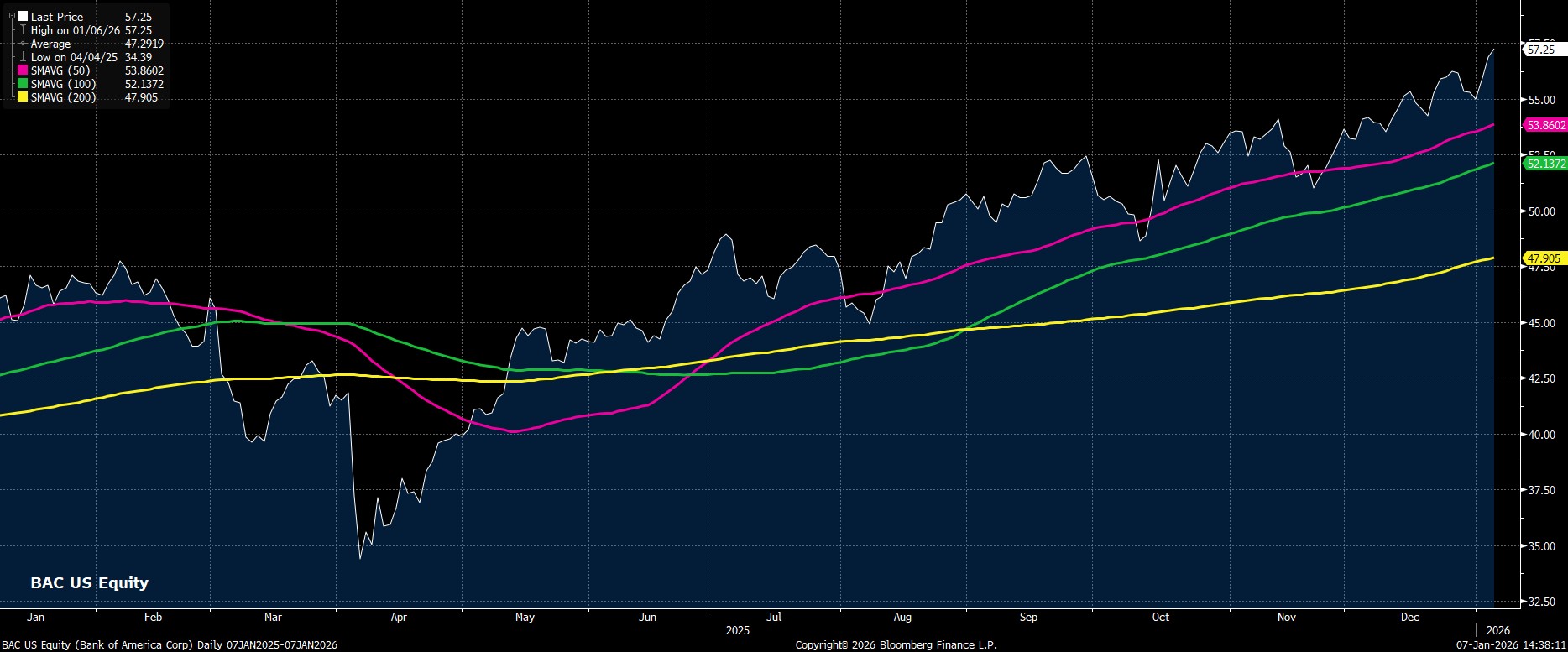

Bank of America (BAC, 11:45am BST/6:45am ET, 14 January)

Although BofA ended last year with a gain of around 25%, more than double that of the financials sector, the US’ second largest bank underperformed its major peers in rather notable fashion. That said, the stock remains the 20th largest in the S&P 500, with BAC options implying a move of +/-3.5% around the upcoming report. Recent post-earnings performance has been patchy, with an equal split of gains and losses following the last four updates. For Q4 25, the street foresees adjusted EPS at $0.95m, on revenues of $27.4bln.

Wells Fargo (WFC, 11:45am BST/6:45am ET, 14 January)

Wells traded in solid fashion last year, ending 2025 with an annual gain of just over 30%, about double that of the S&P 500, though that performance is perhaps not as positive as one could’ve hoped for given that WFC’s asset cap was, finally, lifted midway through last year. All that said, the stock comes into earnings season as the 31st largest in the S&P. Options on the name price a move of +/-4.1% over the upcoming report, though the shares have lost ground following 2 of the last 3 quarterly updates. In terms of expectations, for the upcoming report, consensus expects adjusted EPS at $1.67, on revenues of $21.6bln.

_2026-01-07_14-37-48.jpg)

Citi (C, 1pm BST/8am ET, 14 January)

Citi stood as the best performing major US bank last year, rallying a notable 66% in 2025, making the bank the 27th best performer in the S&P, having even outperformed Alphabet (GOOG/L). Also of note is that C’s price-to-book ratio has now moved back above 1, for the first time in seven years, implying that the bank is again viewed as being worth the sum of its parts. In any case, options on the stock imply a +/-4% move over the Q4 25 report, with the name having advanced post-earnings on each of the last 4 occasions. This time out, the street foresees adjusted EPS at $1.62, on revenues of $20.6bln.

_Dail_2026-01-07_14-36-55.jpg)

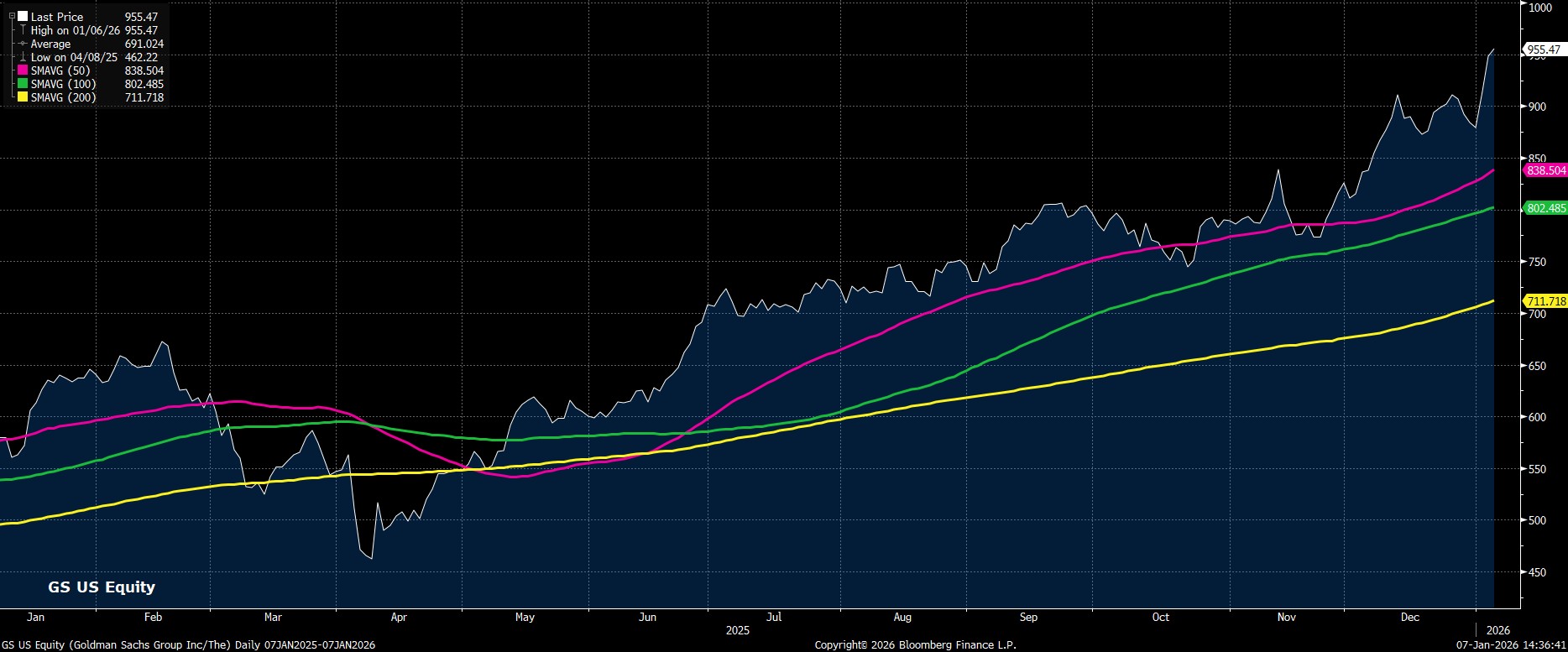

Goldman Sachs (GS, 12:30pm BST/7:30am ET, 15 January)

Goldman returned just over 50% in 2025, vastly outperforming both the S&P 500, and the financials sector. Unsurprisingly, the ‘squid’ continues to possess a sizeable weight in benchmark indices, not only making up about 0.5% of the S&P, but also being by far the largest name in the Dow, with a slightly ridiculous 12% weight in the latter. GS options price a move of +/-3.7% in the day following the upcoming report, with the Q3 25 earnings release marking the first quarter in four that the stock saw a post-report decline. For the coming quarter, consensus has pencilled in adjusted EPS at $11.43, on revenues of $14.3bln.

Morgan Stanley (MS, 12:30pm BST/7:30am ET, 15 January)

Morgan Stanley round out reporting season, having gained just over 40% in 2025, roughly in the ‘middle of the pack’ when it comes to major US banks. From an index perspective, the name stands as the 32nd largest in the S&P, with an approx. 0.5% weight, broadly similar to that of Wells Fargo and Goldman Sachs. Options on MS imply a move of +/-3.7% over the upcoming report, with the name having rallied following every quarterly report, bar one, since Q1 24. For the Q4 25 report, consensus expects adjusted EPS at $.241, on revenues of $17.6bln.

_Da_2026-01-07_14-36-05.jpg)

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.