- English

- 中文版

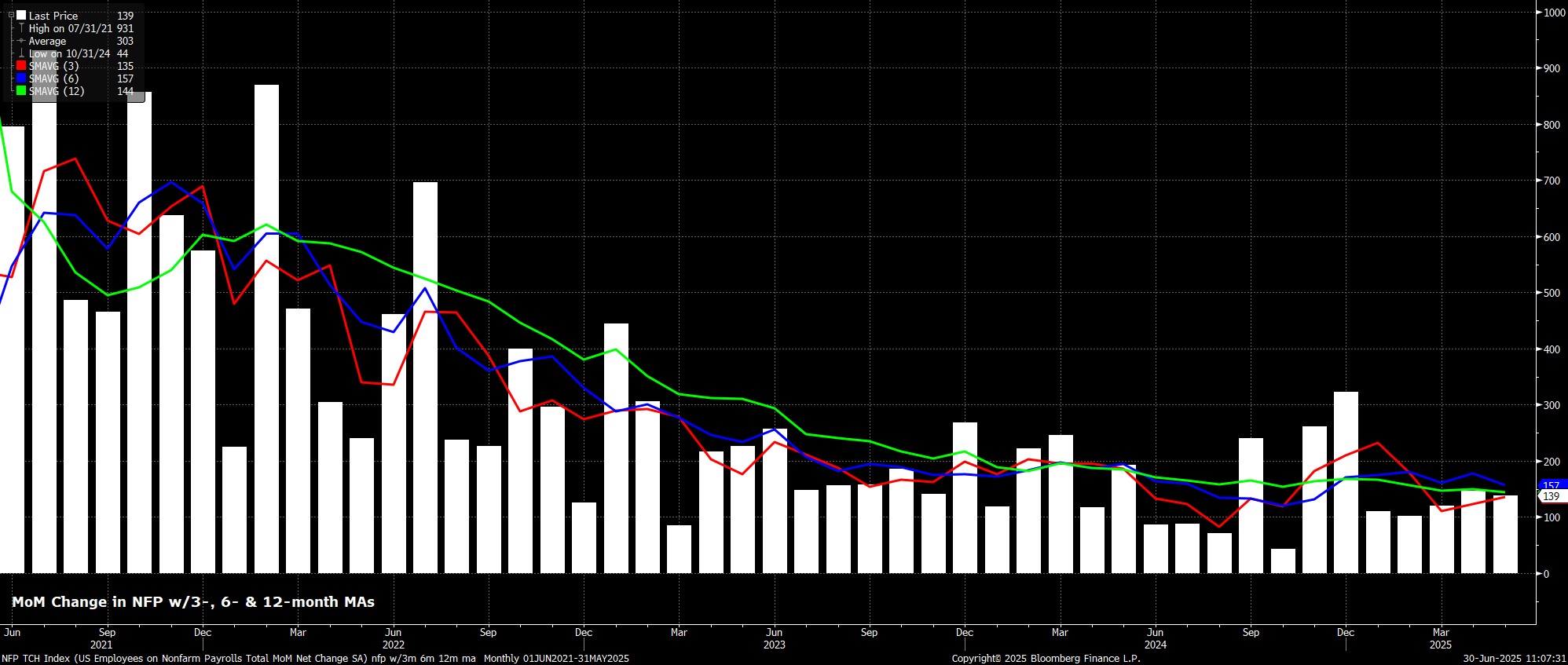

Headline nonfarm payrolls are set to have risen by +110k in June, a modest slowing from the +139k pace seen in May, albeit one that would still be north of the breakeven rate, at around 100k, required for growth in employment to keep pace with the expanding size of the labour force. Once again, the range of estimates for the payrolls print is surprisingly tight, between +70k and +160k. Along with the headline payrolls print, focus will also fall on revisions to the prior two months of data, which have trended negative in recent months.

Leading indicators for the headline payrolls metric point to downside risks, at least in terms of ‘hard’ figures. Initial jobless claims rose by 20k between the May and June survey weeks, while the continuing claims metric rose by 67k over the same period, now sitting at cycle highs. These metrics combined, though, point more towards a labour market in stasis, where the pace of both hiring, and firing, is relatively slow, as opposed to one where significant cracks are developing. Meanwhile, the NFIB’s hiring intentions indicator points to a payrolls gain of around +105k, though its relationship with the NFP print has become considerably looser in recent months.

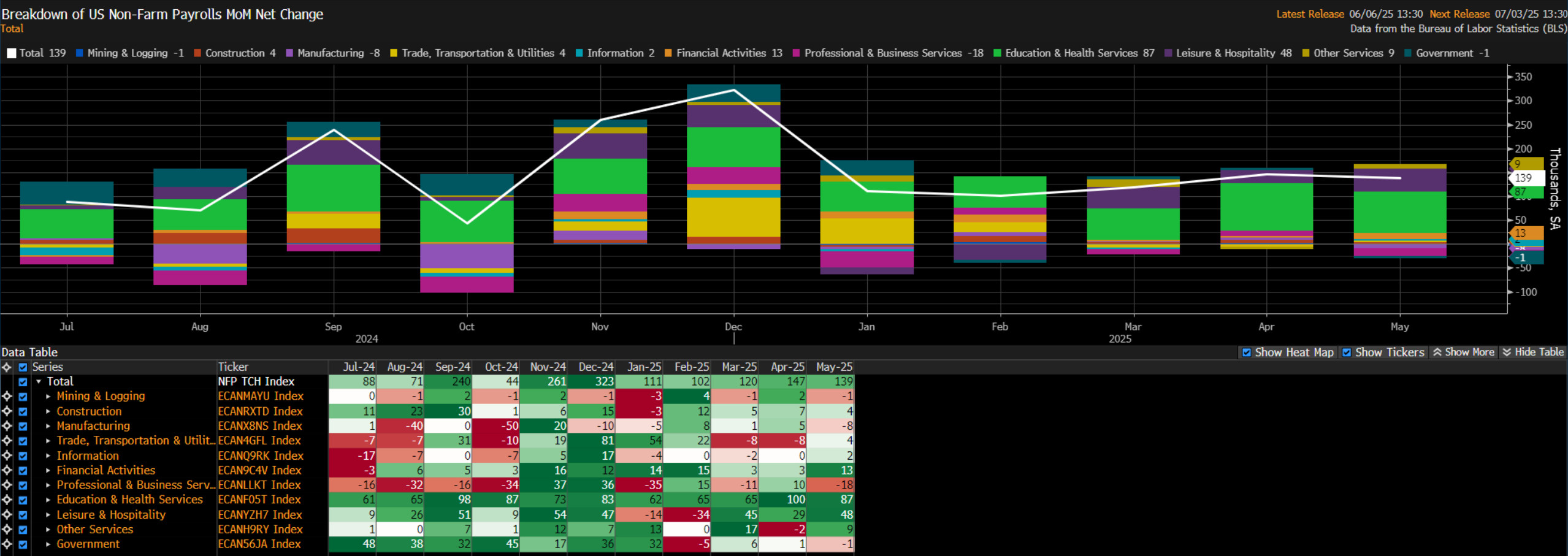

Elsewhere, the pace of federal layoffs looks to have slowed in June, to around half the pace seen in May, though a hiring freeze remains in place. Meanwhile, there may also be a drag on payrolls growth from immigration, not only due to a rise in the pace of deportations in June, but potentially also as increased immigration enforcement may have led some to skip work.

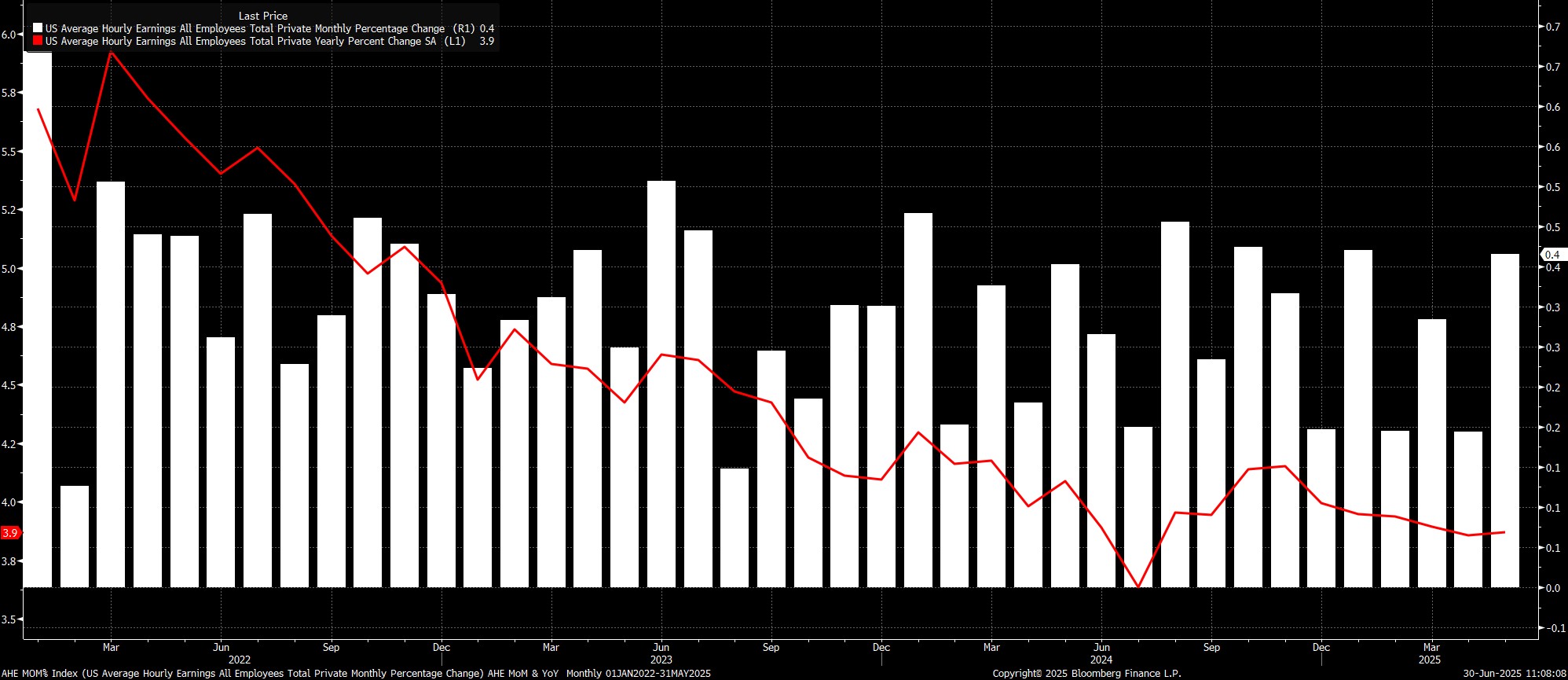

Meanwhile, average hourly earnings are set to have risen 0.3% MoM in June, 0.1pp slower than the pace seen in May, which in turn is likely to drag the annual rate lower by the same magnitude, to 3.8% YoY. This should come amid an unchanged workweek hours figure, at 34.3, though there is the potential for a modest decline here, especially if sectors such as Transportation & Warehousing see a slower pace of activity, as the impacts of tariff front-running from Q1 continue to fade.

That said, data in line with those earnings expectations would again reinforce the long-standing view of FOMC policymakers that the labour market does not appear a significant source of upside inflation risks at the present time.

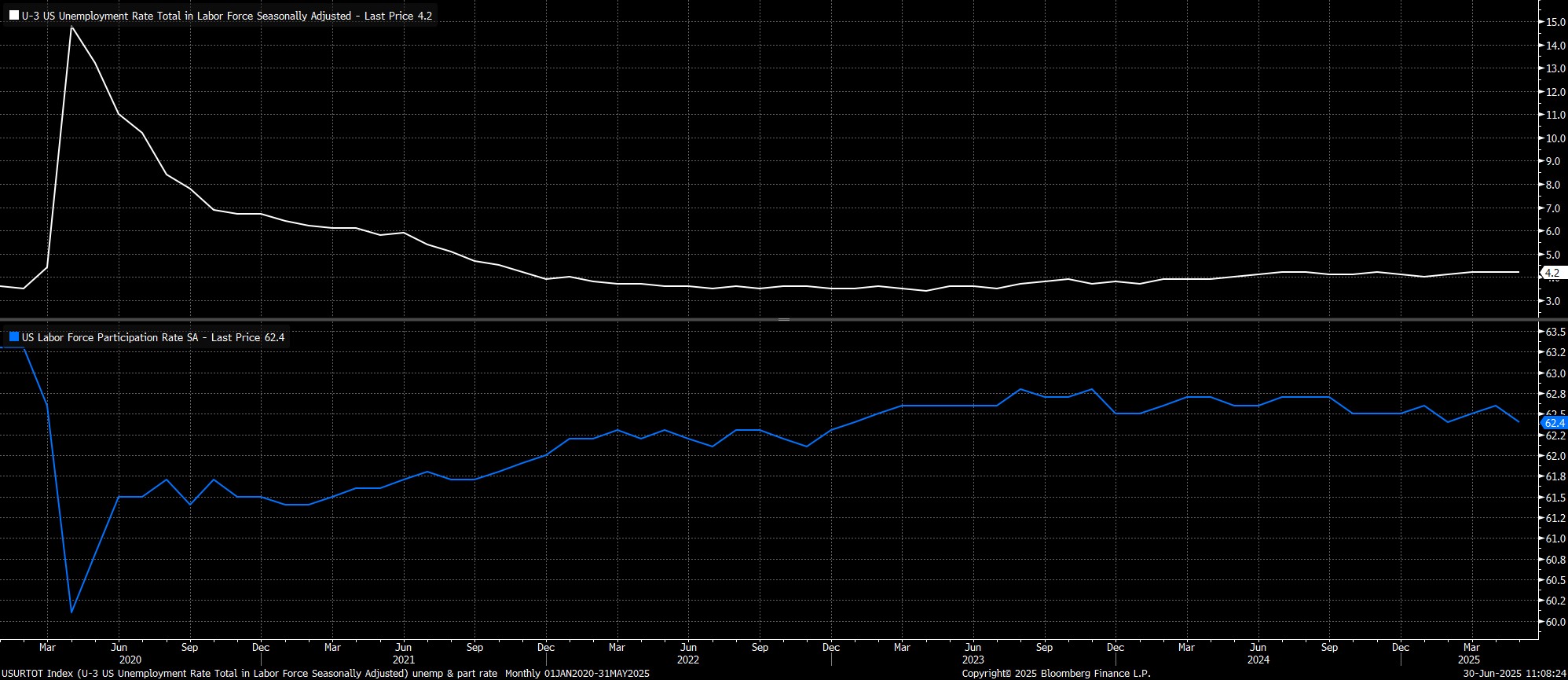

Turning to the household survey, unemployment is set to rise 0.1pp to 4.3% in June, though the direct relationship between higher jobless claims, and higher unemployment, remains a relatively loose one. In any case, in May, unemployment printed 4.2443% on an unrounded basis, hence only a very modest jump is required for the unrounded figure to print at 4.3%, which risks tilted towards the potential for a more significant jump to 4.4%.

Labour force participation, having fallen to 62.4% in May, is likely to rebound modestly, to 62.5%, in line with the average seen during this cycle. Such a rise, however, would also likely prove a further upside risk to the unemployment rate.

In any case, the household survey remains volatile, with the BLS continuing to struggle with the rapidly changing composition of the labour force, and with falling survey response rates. Hence, some degree of caution is required in interpreting the figure.

‘Caution’ is also an apt way to describe how the FOMC will likely interpret the report, with policymakers remaining in ‘wait and see’ mode for the time being. Therefore, it’s tough to imagine the June jobs report materially altering the near-term policy course, with the target range for the fed funds rate set to remain unchanged at the July meeting, even if Governors Bowman and Waller embark on a politically-inspired dovish dissent.

That said, a soft June jobs report does raise the risk of a cut at the September meeting, preceded by a pivot at Jackson Hole, provided that significant tariff-induced inflationary pressures don’t emerge in the meantime. On the other hand, figures in line with, or better than expectations, will simply solidify the FOMC’s view that it is most appropriate, for the time being, to continue sitting on the sidelines.

While policymakers will take a calmer, and more rational approach, to digesting the jobs data, the same probably can’t be said of financial markets. Focus, at least initially, seems likely to fall on the macroeconomic story told by the data, as opposed to any dovish policy implications, particularly with a rather aggressive 66bp of easing already discounted by year-end, and with a significant miss likely to see participants rapidly re-focus on the risks of a ‘stagflationary’ backdrop panning out in H2.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.