- English

- 中文版

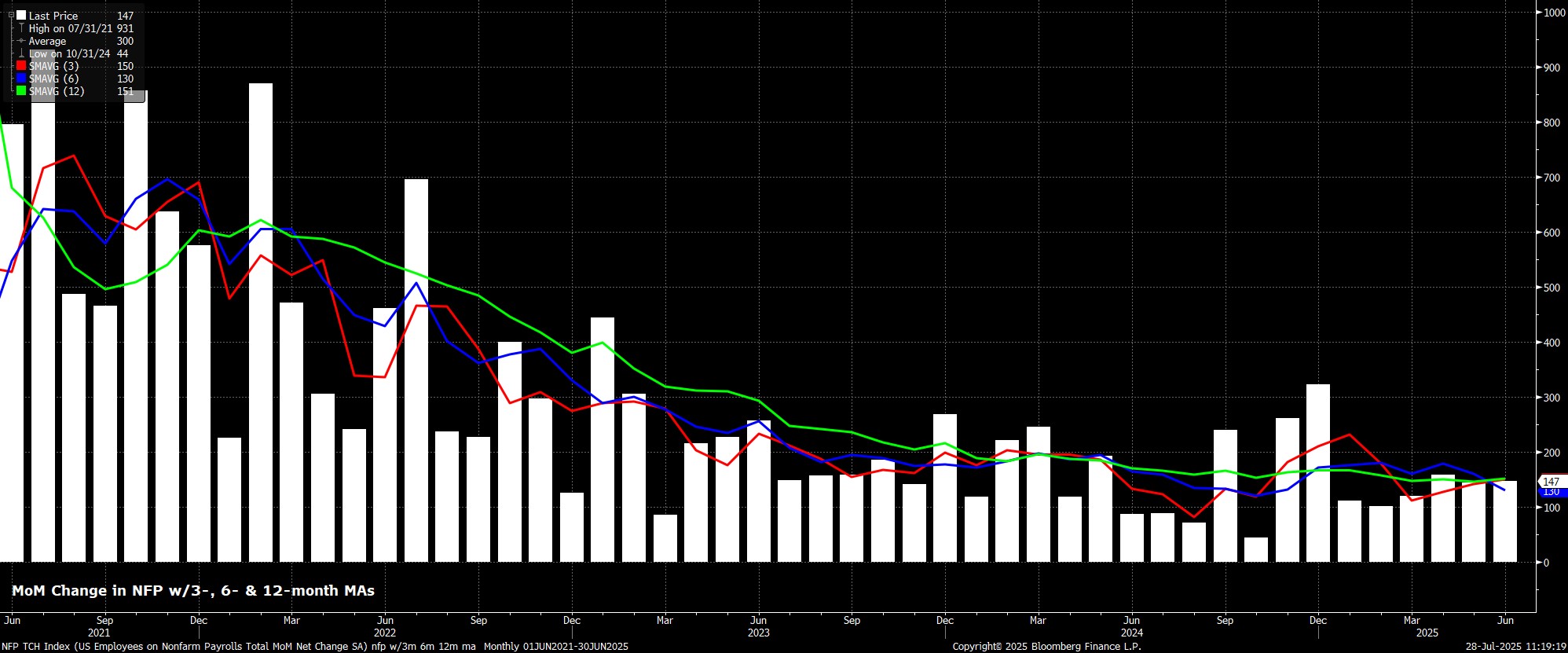

Headline nonfarm payrolls are set to have risen by +110k in July, a modest slowdown from the +147k pace seen last time out, in June, but a rate that would still be comfortably above the breakeven pace of approx. +80k. As usual, the range of estimates for the headline payrolls print is wide, between 0k to the downside, and +170k to the upside. Furthermore, revisions to the prior 2 payrolls prints will be closely watched, with these having trended negative in recent months.

Leading indicators for the headline NFP print, on balance, tilt in a positive direction, though the full suite of such indicators is not yet available, with neither of the ISM surveys having been released at the time of writing.

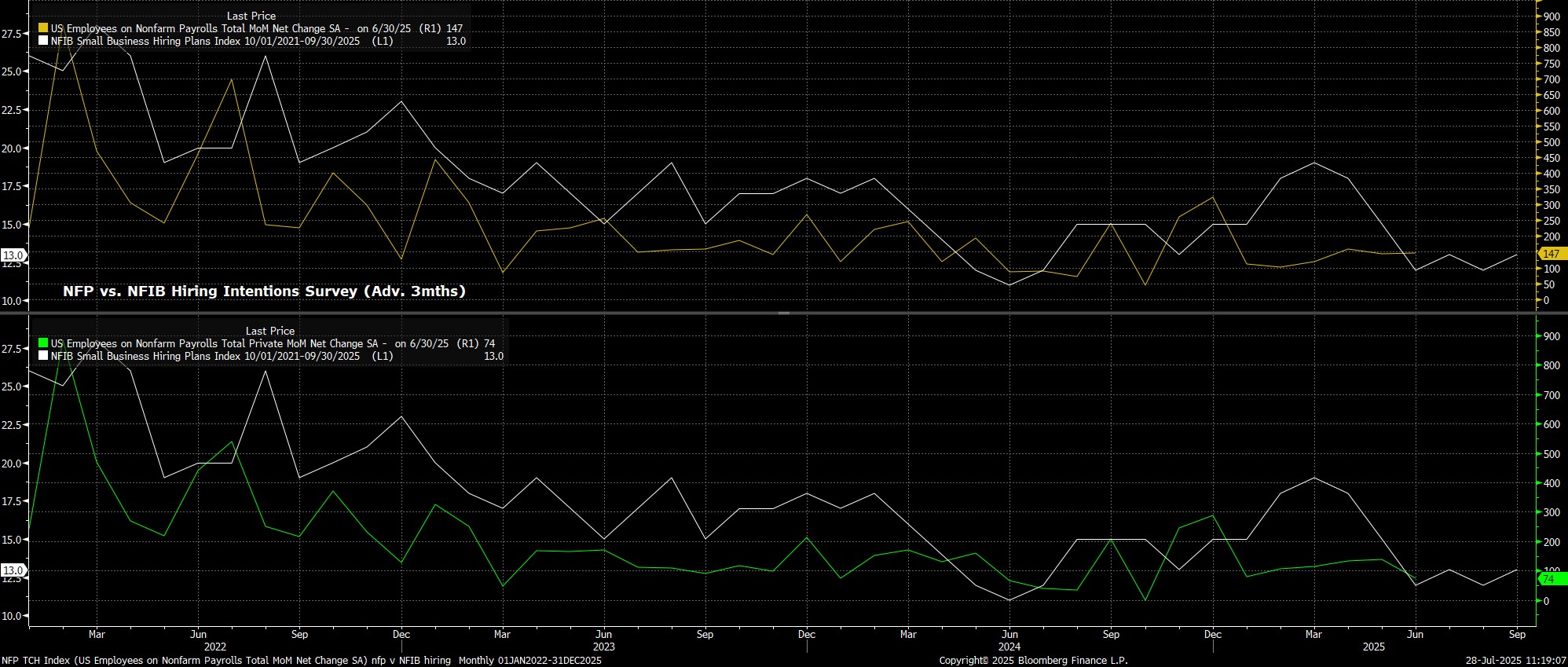

In any case, initial jobless claims fell by 25k between the June and July survey weeks, touching 4-month lows in the July reference period, while continuing claims fell by a more modest 9k over the same period. Meanwhile, the NFIB’s indicator of small business hiring intentions, which was remarkably accurate last time out, points to headline payrolls growth of around +140k, of which +110k would be private jobs.

As for other potential factors to watch, the June NFP print was likely underpinned by some slightly erroneous seasonal adjustments in the state & local education sector, associated with the end of the school year, a factor which is likely to unwind this time around. In addition, there remains the issue of increased immigration enforcement to consider, which continues to depress payrolls to some extent, while federal layoffs have continued, and a federal hiring freeze remains in place, both factors which could not only act as a drag on employment, but also place a greater burden on private sector hiring to prop up the overall figure.

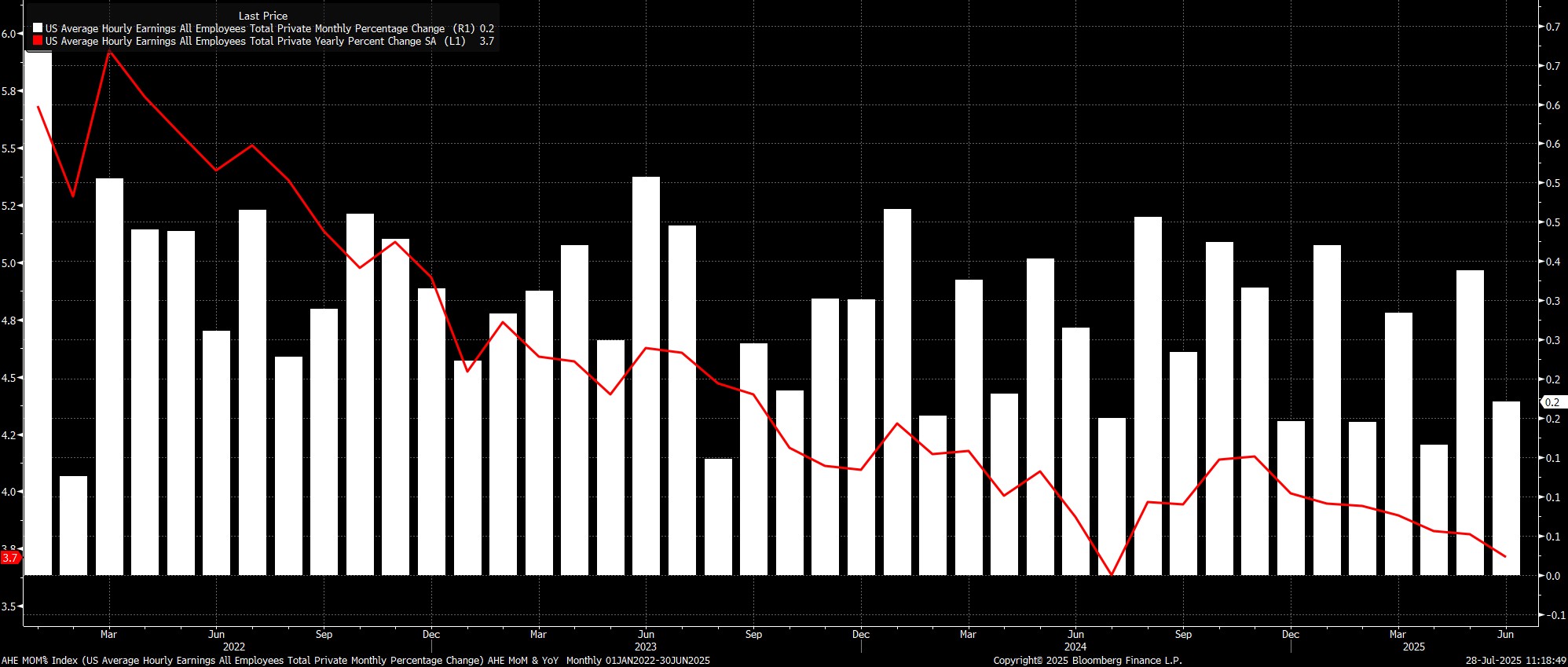

Sticking with the establishment survey, average hourly earnings are set to have risen by 0.3% MoM in July, a very modest uptick from the 0.2% MoM pace seen last time out. Such a rise would, in turn, take the annual pace of earnings growth to 3.8% YoY, also a modest uptick from the 3.7% pace that was chalked up in June.

Figures of this ilk, which should come amid an unchanged workweek at 34.2 hours, would provide further reinforcement to the longstanding view of FOMC policymakers, that the labour market is not a source of significant upside inflation risks at the current time. Those risks, though, are of course present, stemming largely from the imposition of tariffs, as evidenced by the near 2-year high core goods inflation seen last month.

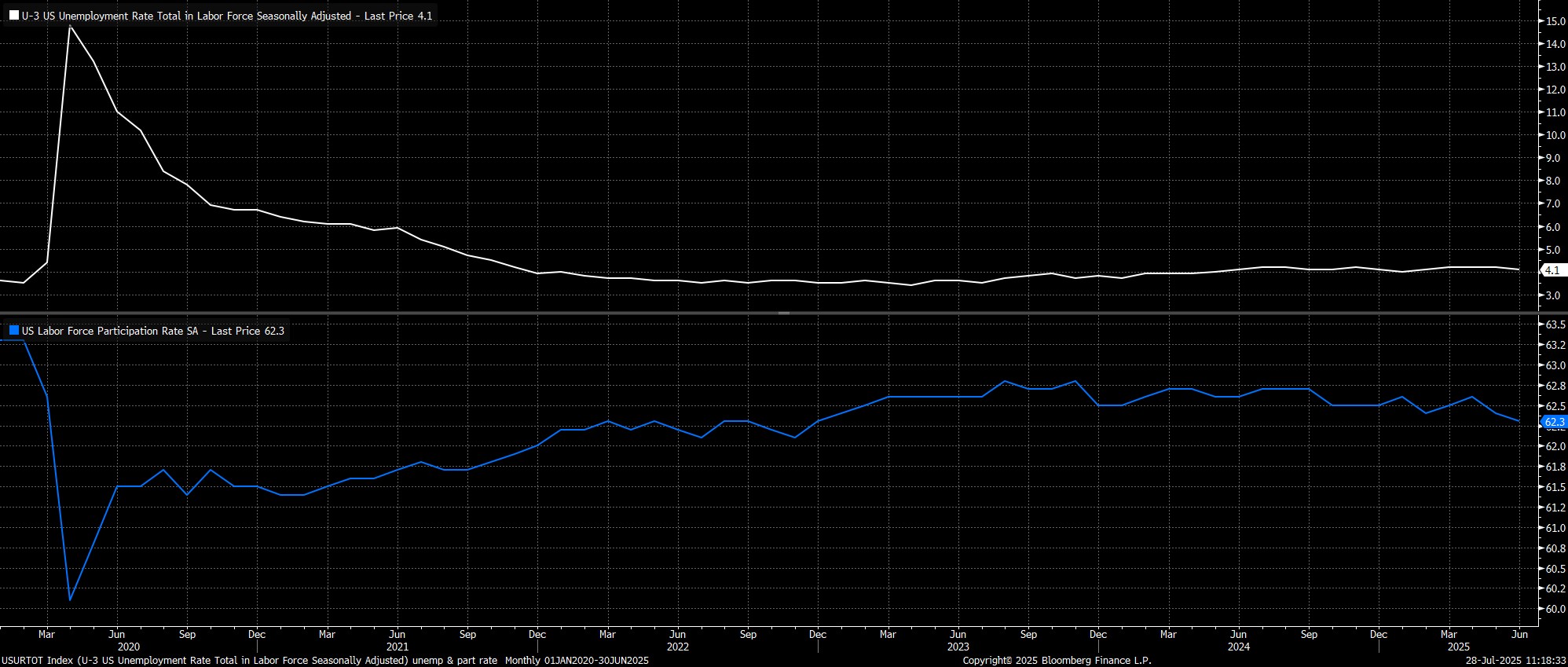

Turning to the household survey, having fallen to 4.1% in June (4.1173% to be precise), unemployment is set to tick higher to 4.2% this time out, with the June figure having been dragged lower by a surprising fall in labour force participation. Participation should rise marginally in July, though still print 62.3% when rounded, though such a move would still be enough to boost headline joblessness by 0.1pp.

Still, a 4.2% unemployment rate would not be especially worth worrying about on its own, and would also be some considerable way off the FOMC’s 4.5% unemployment rate forecast for the end of the year. As time goes on, however, and assuming that the present degree of uncertainty persists, it will be interesting to see whether firms seek to cut hours, or cut jobs, as headwinds mount.

That aside, it is again worth flagging that the household survey continues to be unusually volatile this cycle, as the BLS continue to grapple with the rapidly changing makeup of the labour force, and falling survey response rates. Caution, hence, is still required when interpreting the figures.

Taking a step back, the market’s reaction function to the July jobs report is, once again, likely to hinge more on the macroeconomic story that the data tells, as opposed to any monetary policy implications of the figures. In short, for risk appetite, good news is good, and bad news is not.

For the FOMC, the report is highly unlikely to be a gamechanger, with policymakers’ focus for the time being remaining on the inflation side of the dual mandate, amid the risk that tariff-induced price pressures result in an un-anchoring of inflation expectations. There remain two plausible paths for Fed policy over the remainder of the year, with the FOMC set to stand pat at the July meeting.

Were inflationary pressures to remain contained, or the labour market to become somewhat less resilient, there is a chance that the FOMC may feel comfortable enough to deliver a rate cut at the September meeting, which would in turn open the door to 2x 25bp cuts coming this year, the second in December. My base case, though, remains that we will see just one 25bp rate reduction this year, most likely at the final meeting of the year, as upside inflation risks persist, and as the economy at large remains resilient, allowing the FOMC to stick with their current ‘wait and see’ policy stance.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.