- English

- 中文版

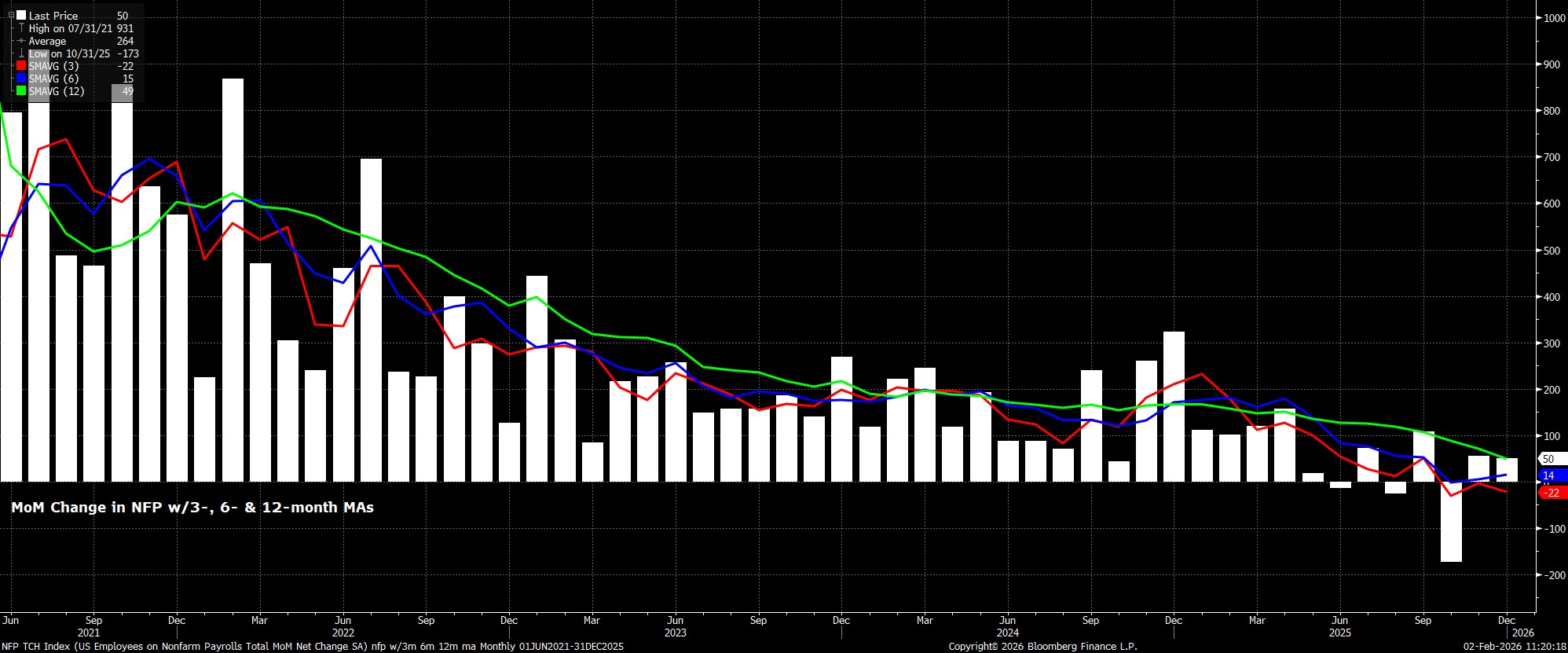

Payrolls Growth In Line With Breakeven Rate

Headline nonfarm payrolls are set to have risen by +65k last month, a modest quickening from the +50k pace seen in December, though broadly in line with the breakeven pace of job creation, which presently lies in a range of around +30k to +80k.

In any case, the range of estimates for headline job creation is as wide as ever, from a low of -10k, to a high of +130k, while revisions to the prior two months’ of NFP data also bear watching closely. Additionally, as usual, the January report will also bring with it the annual benchmark revision, applicable to the March 2025 employment level. The preliminary QCEW data previously suggested a record -911k downward revision, roughly cutting the previously released employment level in half, with the final figure likely to be broadly in line with that figure.

Leading Indicators Largely Unchanged

Leading indicators for the payrolls print are, on balance, largely unchanged from where they stood this time a month ago, though at the time of writing we are yet to receive either of the monthly ISM surveys, or the monthly ADP employment report.

In any case, both initial and continuing jobless claims fell between the December and January survey weeks, by 14k and 48k respectively, though the former seems largely a reflection of seasonal adjustment factors, as opposed to underlying labour market shifts. Meanwhile, the weekly ADP employment report pointed to a total of 31k jobs having been added in the four weeks to 3rd January, a week prior to the BLS reference week.

Meanwhile, the NFIB hiring intentions survey has continued to tick higher in recent months, and suggests a considerably above-consensus private payrolls gain of around +180k. However, since last autumn, the correlation between hiring intentions, and actual hiring, appears to have broken down, not only lessening the utility of the metric as a lead for NFP growth, but possibly also suggesting that businesses remain reluctant to follow through on those plans, likely due to economic uncertainty, especially on trade, remaining at incredibly elevated levels.

Factors To Watch

As for other factors to watch in the jobs report, it’s important to recall that the January report typically sees a significant upwards skew as a result of seasonal adjustments, largely reflecting the significant turnover that is seen as the holiday season wraps up, temporary contracts end, and amid typically higher-than-usual retirement levels at year-end.

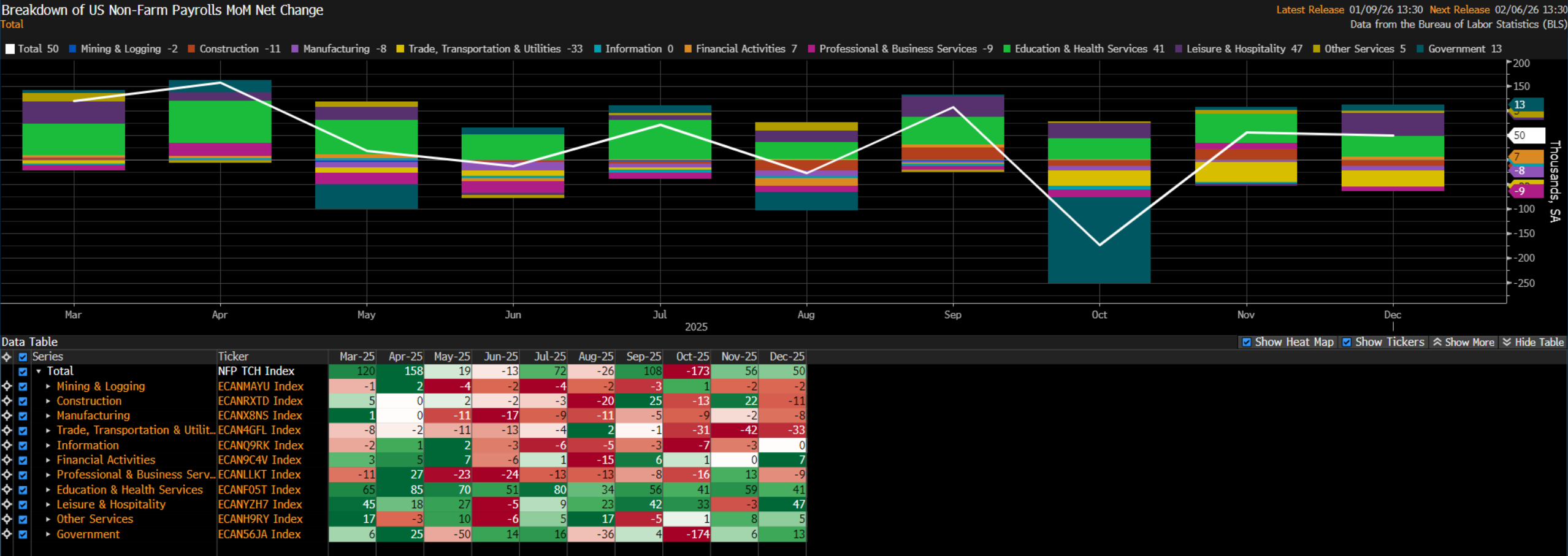

Speaking of the holiday season, the unwinding of some degree of temporary hiring around the festive period may act as a drag on headline payrolls growth, though it must be said that said hiring was conducted to a lesser degree in 2025 than had been seen in year prior, hence any impact on this front could well be negligible. Besides that, the recent cold weather snap hit the US after the conclusion of the January survey week, hence shan’t have any sort of significant impact, while the composition of hiring will also be closely watched, with the vast majority of private sector jobs over the last 12 months having come in the healthcare sector.

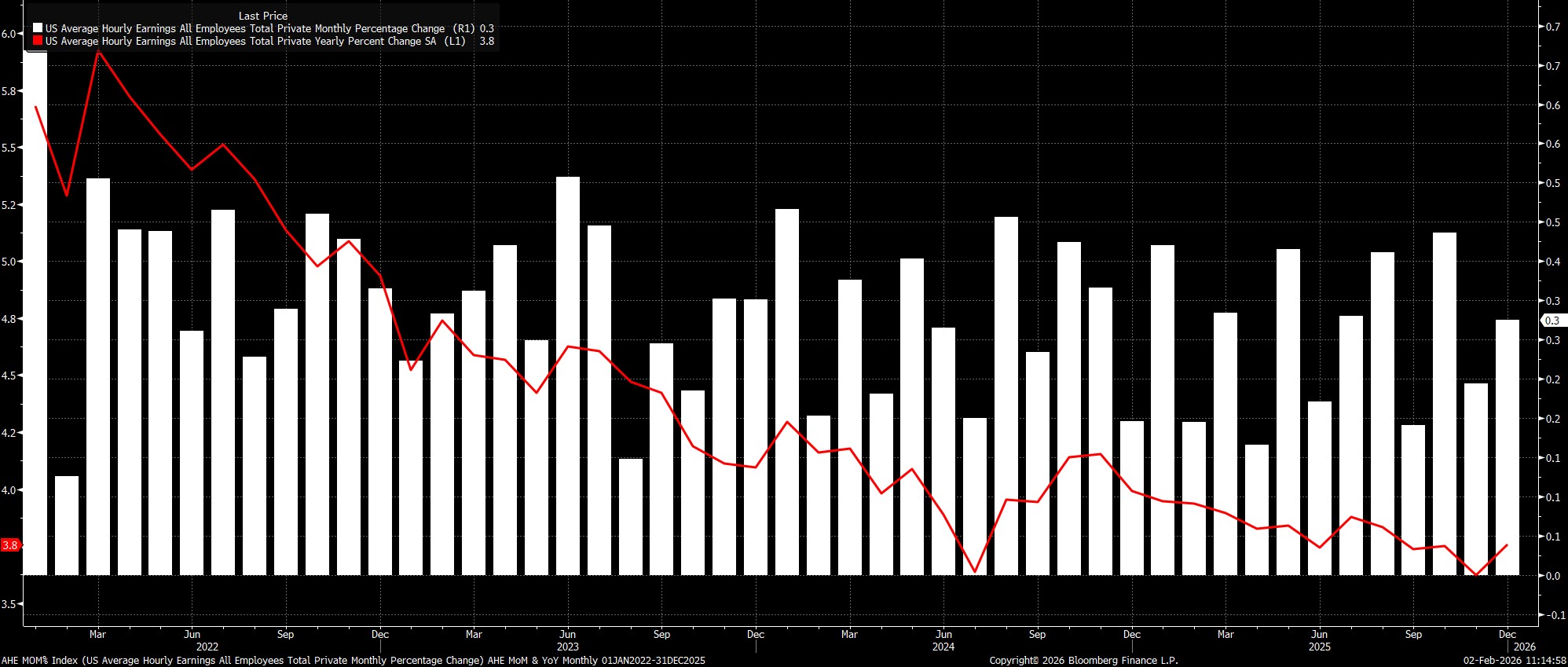

Earnings Pressures Remain Contained

Remaining with the establishment survey, earnings data is unlikely to be of especially much concern from an inflationary perspective, reinforcing the FOMC’s view that the labour market is not a significant source of upside price risks at the present juncture.

Average hourly earnings are set to have risen by 0.3% MoM in January, unchanged from the pace seen a month prior, which would in turn see the annual pace dip 0.2pp from the 3.8% YoY seen in December, to 3.6% YoY this time out. Such a pace would, by and large, be broadly compatible with a sustainable return to the 2% inflation aim over the medium-term.

Household Survey Key For FOMC

All that said, it is the household survey to which policymakers continue to pay considerably more attention, not least considering Chair Powell’s comments regarding headline payrolls growth, and the potential for the NFP print to be overstating job creation by as much as 60k per month. Hence, it is the details of the HH survey which are of much greater importance in terms of triggering shifts in the future policy path.

Headline unemployment is seen having held steady at 4.4% in January, having fallen to that level in December from a downwardly revised 4.5% November print. In fact, the December figure was a ‘low’ one, printing 4.3751% on an unrounded basis with this, and the more promising direction of travel, having given the FOMC confidence to stand pat on policy at their first confab of the year.

Labour force participation also bears watching closely, having fallen 0.1pp to 62.4% in December, implying that the overall size of the labour force had begun to fall, likely a result of the unemployed having given up their job searches. Participation should remain unchanged at that level this time out.

Fed Policy Implications

As noted, the FOMC stood pat on policy at the January meeting, while shifting to more of a ‘wait and see’ approach, with Chair Powell noting that policy is now ‘well-positioned’ moving forwards. With that in mind, we can reasonably conclude that the majority of the Committee are comfortable that the 75bp of ‘insurance’ cuts that were delivered at the tail end of last year will provide adequate support against potential downside labour market risks.

That said, while the base case now suggests that the fed funds rate will remain unchanged until at least June, when Kevin Warsh is due to take over as Chair, risks to this outlook skew in a dovish direction, not least considering the incredibly narrow breadth of hiring currently being seen. Hence, any signs of renewed labour market softness are likely to lead to a dovish repricing of market expectations, especially with just 9bp of easing discounted by the USD OIS curve between now and April. The FOMC, however, shan’t overreact to a single datapoint, particularly with the February jobs report also due before the next meeting, in March.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.