- English

- 中文版

Playbook For The July ECB Decision

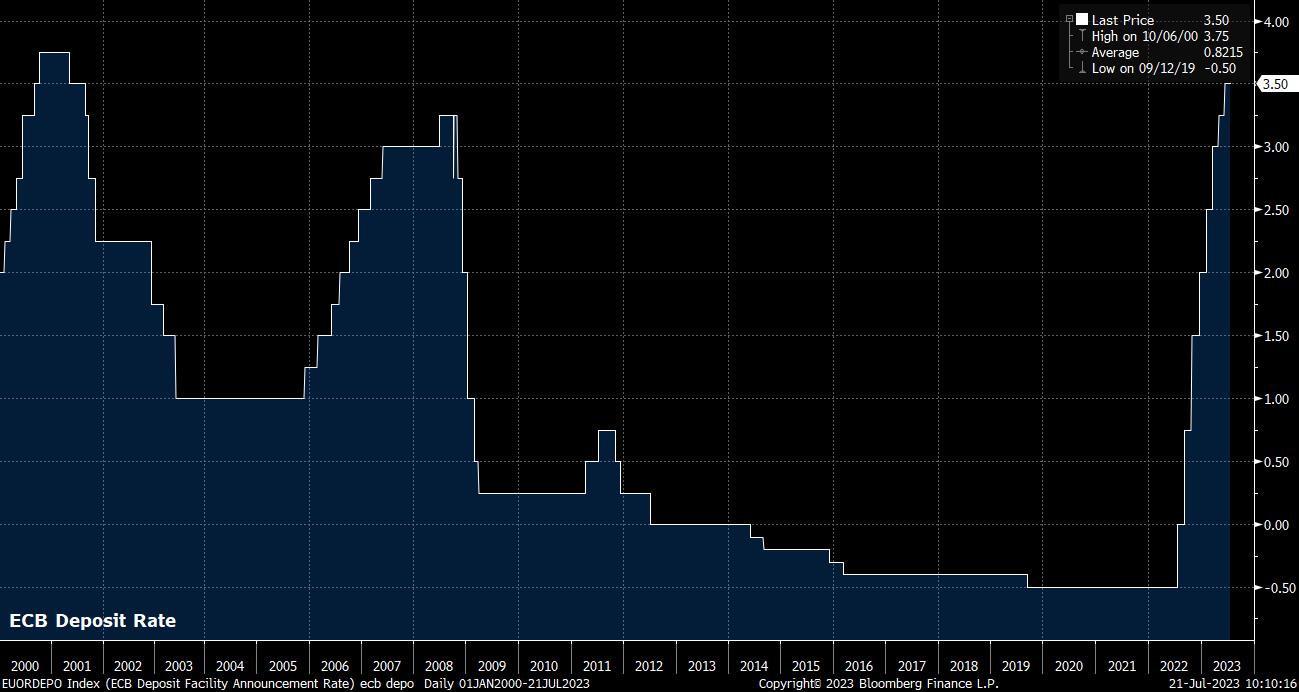

As noted, another 25bps hike to all three of the ECB’s key interest rates is the base case for the July meeting, a move which money markets fully price, and which would take the deposit rate to 3.75%, equal to its highest level on record, which was last seen in early-2001.

Given that markets fully price such an outcome, focus is likely to fall on the guidance that policymakers provide for decisions after the summer break, with a further 25bps increase at the September meeting currently seen as a roughly 2-in-3 chance based upon current pricing.

The prospect of any firm guidance for the September meeting, however, seems rather remote. Instead, the ECB are likely to reiterate the “data-dependent approach” currently being taken when deciding policy shifts, while also repeating that said shifts continue to hinge on three factors – the inflation outlook, underlying inflation dynamics, and the strength of monetary policy transmission.

That said, it is notable that even some of the most hawkish Governing Council members have recently started to cool on the idea of further tightening beyond the summer. Typically hawkish Klaas Knot, President of the Dutch Central Bank, typically one of the most vocal GC members in pushing for more aggressive policy, has noted that hikes beyond July are “possible, but not certain” and that further hikes shifts the “balance of risks towards doing too much”. While data-dependency will remain the order of the day for now, these comments do cast some doubt on how much further the ECB will tighten, with a September hike – if delivered – likely being the last of the cycle.

The economic backdrop paints a mixed picture, helping to explain why the policy outlook is presently so murky, and why policymakers are seeking to give themselves as much flexibility as possible. While headline inflation has continued to recede from the 10.6% highs seen last year, and is likely to further roll over during the remainder of the year due to falling energy prices and the impact of base effects, core inflation remains elevated.

Despite having appeared to peak in March at 5.7% YoY, core inflation within the bloc has recently begun to re-accelerate, rising to 5.5% YoY in June, and showing few signs of experiencing the same disinflationary forces the headline number exhibits. It is this elevated level of underlying inflation, where rising labour costs continue to pose further upside risks, that is likely to see rates remain at elevated levels for the foreseeable future, no matter whether the final hike of the cycle comes this month, or in September.

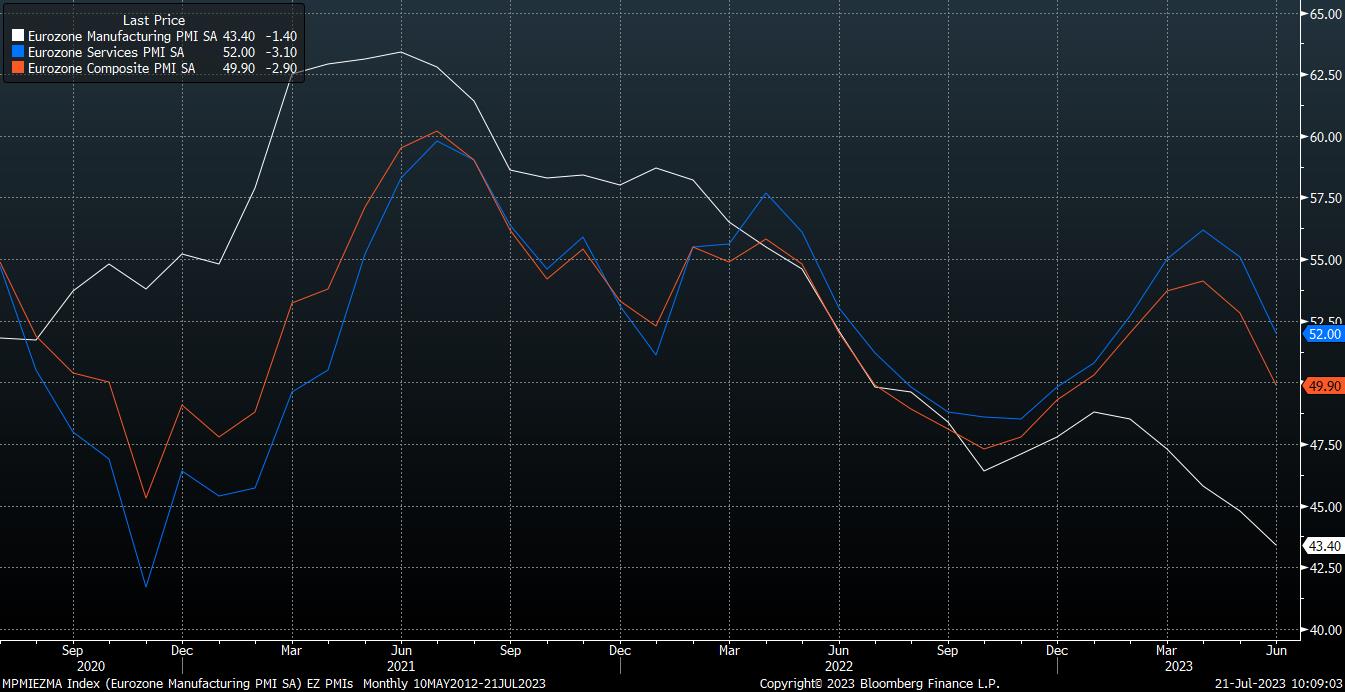

The growth side of the equation is also rather murky. While a recent upward revision to Q1 GDP meant that the eurozone avoided a technical recession over the winter, the economy still stagnated in the first three months of the year. Leading indicators point to such a stagnation continuing, with recent PMI surveys pointing to a continued loss of economic momentum, with the composite gauge having fallen below 50.0 – the breakeven mark between expansion and contraction – for the first time since late-2022 in June.

Importantly, this sharp slowdown in economic output is coming before the full lagged impacts of the ECB’s policy tightening have been felt. Taking this, and the continued slow progress of the economic recovery in China, one of the eurozone’s biggest export markets, into account, it seems likely that growth will remain rather sluggish for the remainder of the year.

In terms of the market reaction, it may be the case that the ECB meeting produces few fireworks, given how well-priced the market is for a hike this month, and given the low likelihood of any explicit guidance for the September meeting, or shifts in terms of the balance sheet run-off. Furthermore, at the post-decision press conference, President Lagarde is unlikely to deviate too significantly from what is now a familiar script, seeking not to rock the boat before the summer break.

Another complicating factor is that the ECB’s decision comes a mere 18 hours after the FOMC’s next policy update, where a 25bps hike is also expected. In any case, with the EUR having backed away from the recent 1.1275 highs and starting to consolidate, traders should have the prior 1.1075 highs on their radar as the next support, and the aforementioned cycle high noted as the next intermediate-term resistance; however, as alluded to, the FOMC are likely to have a greater influence here than policymakers in Frankfurt.

_eurusd_mb_2023-07-21_10-08-46.jpg)

As for European equities, the recent range – which has broadly been in place since March – by and large remains in place, though the DAX is nudging towards the top of said range at 16,275. Once more, however, it seems that upside earnings surprises, or simply Europe tagging along with the rally on Wall St., are likely to prove more significant, and durable, upside catalysts, than whatever the ECB may have to say.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.