- English

- 中文版

Playbook For The December Banxico Decision

The Central Bank of Mexico's meeting is scheduled for Thursday afternoon, and it's happening during a week when it won't be alone in making important decisions. Other heavyweights like the Federal Reserve (FED), European Central Bank (ECB), and the Bank of England (BOE) are also convening, and the world is eager to glimpse their playbook for steering the monetary policy ship in 2024.

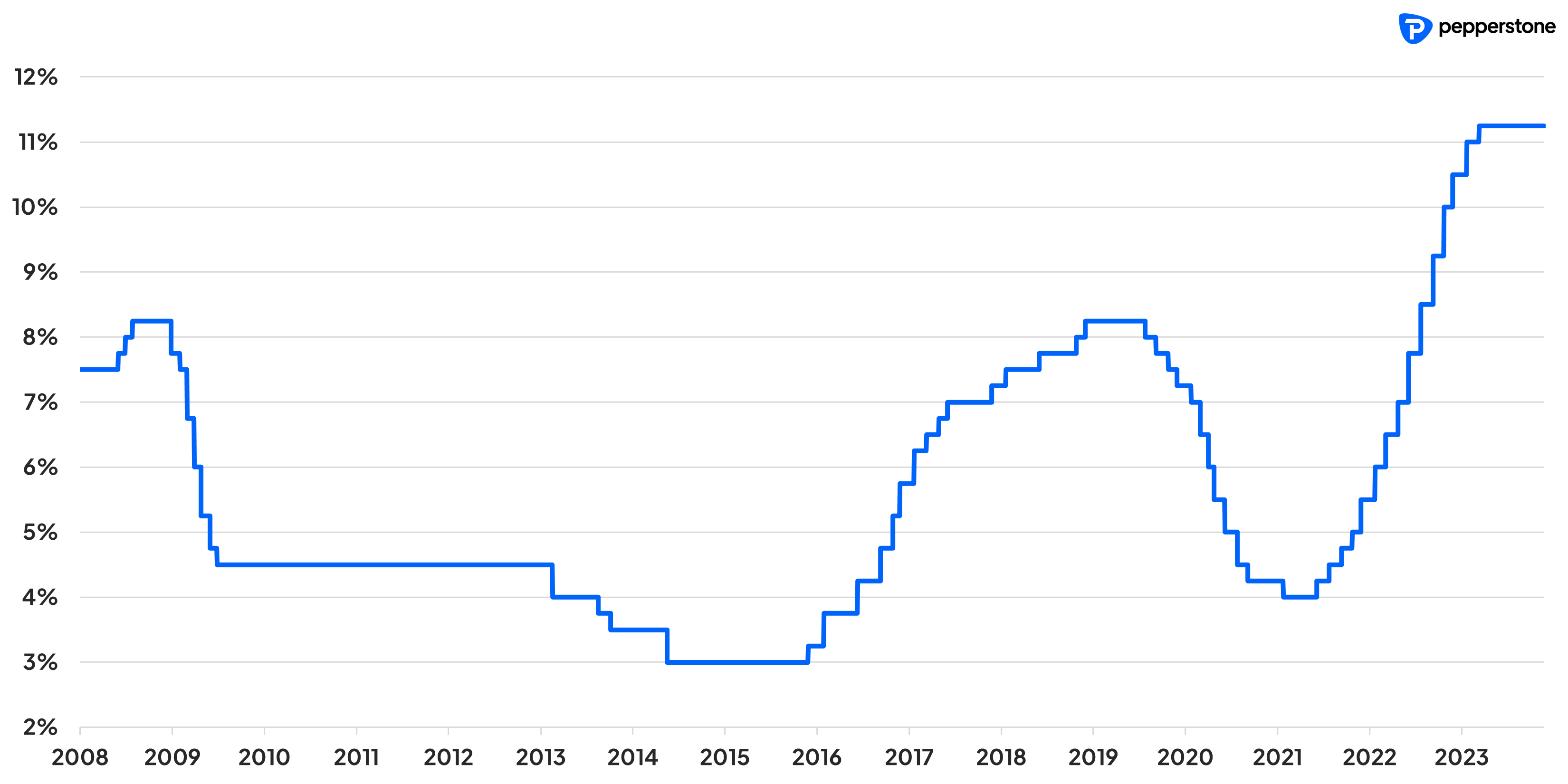

Regarding Banxico's decision, expectations are that the Mexican entity will maintain the cost of money at levels of 11.25% during the December meeting.

Banxico Interest Rate

This would represent the sixth consecutive time that the entity has kept the cost of money at its highest level since 2008 when the entity began considering inflation objectives.

From an economic point of view, the decision to maintain the cost of money at these record levels takes place in an environment where the Mexican economy has shown considerable resilience compared to its counterparts in the region and disinflationary pressures aimed at converging with levels acceptable by Banxico of 4% next year.

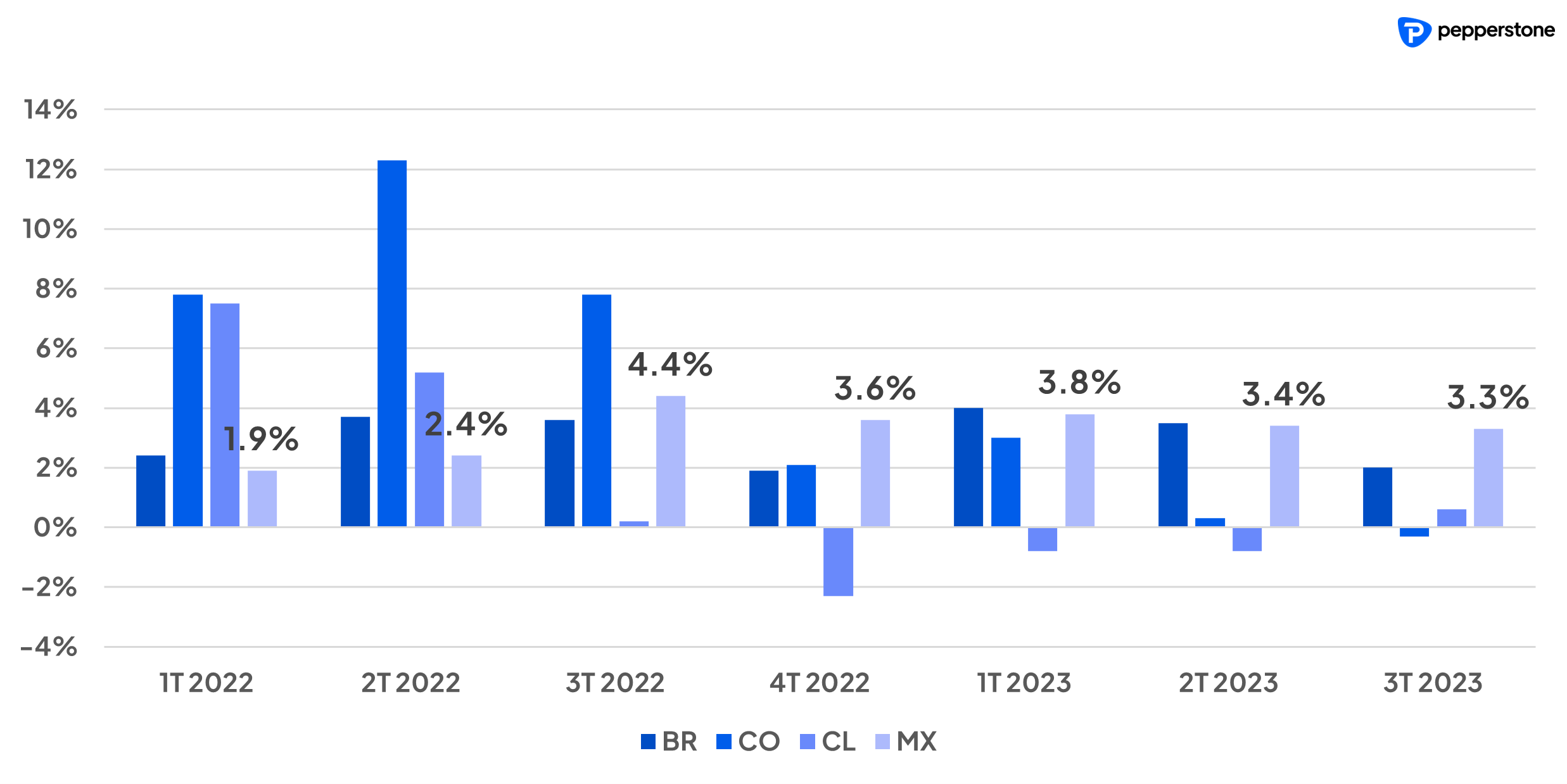

Economic growth

Regarding Mexico's GDP, and where other regional economies such as Colombia, Brazil or Chile have been seeing their economy slow down or fall into contraction territory, Mexico has maintained solid economic growth since practically 2022, mainly supported by strong trade relations and better performance of the US economy and benefits of the now famous “nearshoring”.

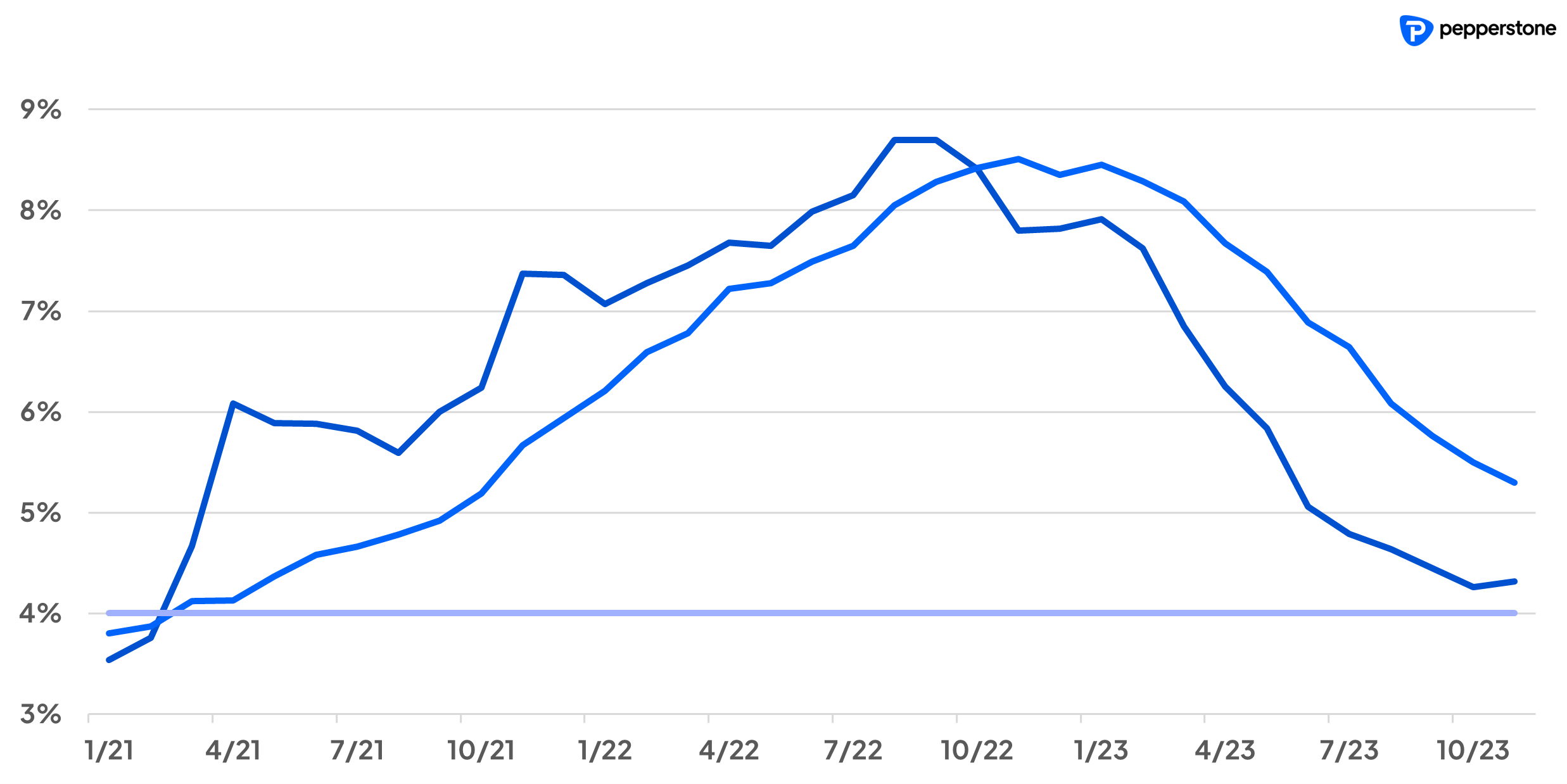

Inflation

On the inflationary front, although during the November reading we saw a slight rebound on the headline print, the dynamics continue to support a disinflationary structure which will continue during next year and thus allowing inflation in Mexico to converge with the upper band of the target of +-1% of 3%.

Mainly supported by this front and given that the fall in price increases has allowed the real rate to be established at higher levels, this is allowing the Mexican entity to begin to consider relaxing its monetary policy for the future.

As we remember, the initial pivot could be traced back to the last meeting in November where at that time, the Mexican entity withdrew the phrase in its press release that “high interest rates were going to be required for a prolonged period of time”. More recently, the governor of Banxico, Victoria Rodríguez Ceja, opened the doors to the flexibility process a little more clearly, citing the previously mentioned disinflationary dynamics and that this would allow Banxico to somewhat relax its ultra-restrictive stance.

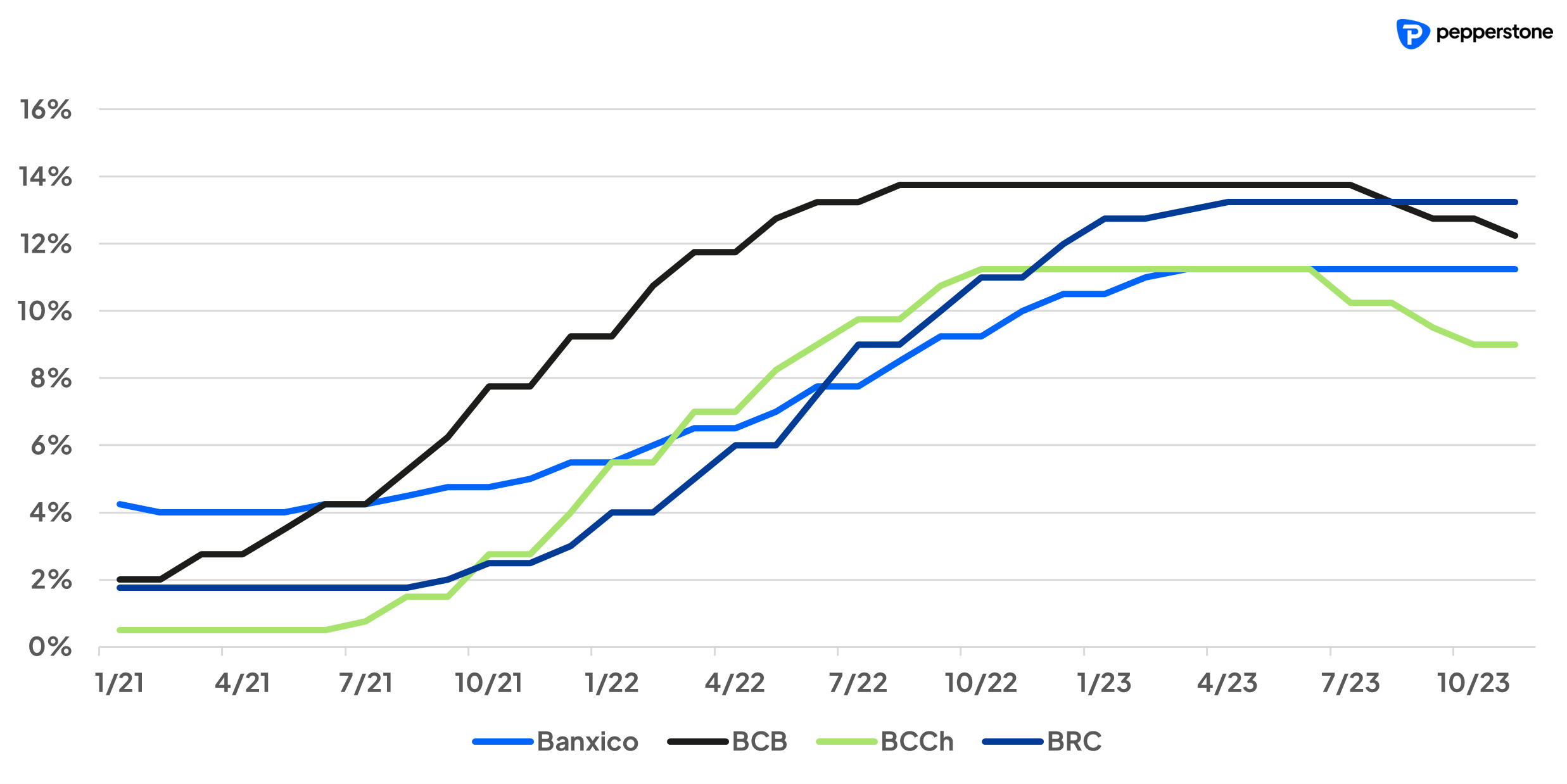

This dynamic, which is currently expected to begin during the first quarter of 2023, and mainly during the March meeting, would be incorporating Banxico into other Central Banks such as Brazil or Chile, which previously initiated easing cycles.

Rate cuts

Having mentioned this, unlike its regional counterparts, however, and due to better control in the dynamics of price increases and with a less affected economy recently, it’s fair to mention that Banxico's plan would be falling a little more towards a tactical approach to monetary policy recalibration in comparison of more conventional monetary policy easing cycles.

This is going to be one of the most important parts to monitor in the statement presented by the Mexican entity, since the investing public is going to be quite attentive in trying to dissect the publication seeking to understand how much we could expect Banxico to relax next year.

USD/MXN Technical Analysis

USD/MXN Weekly Chart

From a technical point of view, after recovering from the October lows and having found resistance at the psychological level of 17 pesos per dollar, the peso has been losing value against the dollar for the last three weeks.

While it is still early to sound the alarm regarding a structural shift in favor of the dollar against the peso, the recent bearish swing in the USD/MXN could be setting a higher low if trading continues to favor the dollar during the next few weeks. In this scenario, if we see an upside breakout of 18 pesos per dollar and a generation of a higher high compared to the levels seen in October, that would change the outlook in favor of the dollar.

Having mentioned this, however, the fundamental backdrop at the moment does not seem to support this narrative given that, just as in the case of Banxico, although possibly at different paces, the FED is also expected to begin to relax its monetary policy next year. Additionally, the global economic front seems to be leaning towards a possible “soft landing” so this should somewhat support the currencies most commonly associated with risk, such as the Mexican peso.

Taking all this together, the USD/MXN could be heading for a brief period of consolidation between 18 and 17 pesos per dollar.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.