Analysis

Pivotal Week For Growth Jitters As Geopolitical Risk Ratchets Up

WHERE WE STAND – This is a macro, not a political, note.

However, it is nigh-on impossible, this morning, not to at least make mention of the shambolic, and embarrassing, scenes in the Oval Office on Friday night, whereby President Trump, VP Vance, and Ukraine President Zelensky engaged in a 3-way shouting match in front of the world’s media. The only short-term winner from that mess is Russian President Putin, while the path to peace in Ukraine now seems – sadly – a much longer one than it had done.

In any case, despite this ratcheting up in geopolitical risk, sentiment was surprisingly firm into the weekend, with both the S&P and Nasdaq 100 vaulting over 1% higher into Friday’s close. To be clear, there was no particularly obvious catalyst for these gains, which looked more like a rush to rebalance portfolios into month-end, as opposed to participants adding fresh longs.

Clearly, jitters over the US economy remain, after a slew of poorer than expected releases of late, and amid the apparent absence of a ‘Trump Put’ – in contrast to expectations, where the President would pivot were his policies to be damaging the economy, or the equity market, Trump instead seems to be doubling down. The announcement of an additional 10% tariff on China last week is great evidence of this.

For the first time in a while, I’m genuinely nervy over the state of the US economy, and by extension prospects for Wall Street. It seems very telling that Treasury Secretary Bessent has begun to roll the pitch for a slowdown, noting how the economy is “brittle” under the surface. It also feels telling how Bessent has stated his desire to see a weaker USD, lower crude prices, and lower Treasury yields – but made no mention of equities. Maybe the supposed ‘Trump put’ is actually a ‘Bessent put’ in the T-note complex.

From a political perspective, I do wonder if the Trump Administration’s plan here is, while economic developments can be blamed on the prior Biden Admin, to double down on the ‘short-term pain for long-term gain’ strategy – slashing Federal spending, and the government workforce, in an attempt to reduce the budget deficit, while simultaneously hoping that the Fed would ride to the rescue if economic conditions were to dramatically worsen. Then, Trump & Bessent can claim credit for the inevitable macro and market turnaround. To be clear, that’s not my base case, but I wouldn’t rule it out entirely either.

Anyway, for the time being, the market remains stuck in a trap of softening economic data, coupled with an Administration happy to double down on the trade and geopolitical hawkishness, while at the same time delivering unpredictable and inconsistent policy proposals on a daily basis. Hardly a brilliant cocktail for risk appetite, or to entice any dip ubyers to enter the fray!

Naturally, this week’s ISM manufacturing and services PMI figures, as well as Friday’s labour market report, are the big event risks on the horizon. The playbook feels binary here – a full house of 3 solid prints and we can probably sweep macro worries under the carpet for a bit longer; softness in any, though, and it’s probably a case of ‘look out below’ for equity longs, with Mr Market in a far from forgiving mood.

Against this backdrop, the broader defensive bias on display on Friday, outside of the equity space, makes a lot of sense.

Treasuries rallied across the curve, with benchmark 2-year yields falling below 4.00%, while 10s briefly dipped under 4.20%. Though the rally across the curve has come a long way, in a short space of time, I still see the risk/reward as favouring bond bulls for the time being. Basically, it’s easy to see the Fed cutting 50/100/150bp this year, but tough – if not impossible – to see them tightening by the same magnitude. Sprinkle a growth scare on top, and there’s your bull case in a nutshell.

Similar can be said of the greenback, which notched its first weekly gain in four last week (per the DXY), as participants moved from the right- to the left-hand side of the ‘dollar smile’, bidding up the buck in a dash for havens. That said, even if the US economy is losing momentum, it is likely to remain the ‘best of a bad bunch’ for the time being. More broadly, cable’s inability to close north of the 1.27 mark, and the EUR’s continued reluctance to make significant headway above 1.05 are notable warning signs for dollar bears.

Finally, a word on gold, which seems to have lost its shine a little, closing below $2,900/oz on Friday, to close out its worst week of the year. Personally, I don’t think gold longs should be too concerned here, with this bout of downside more likely a result of the broad-based cross-asset momentum unwind being seen, as opposed to a sign that bullion’s salad days are over. I’d be comfortable buying dips here for the time being, especially as geopolitical risks are unlikely to subside any time soon.

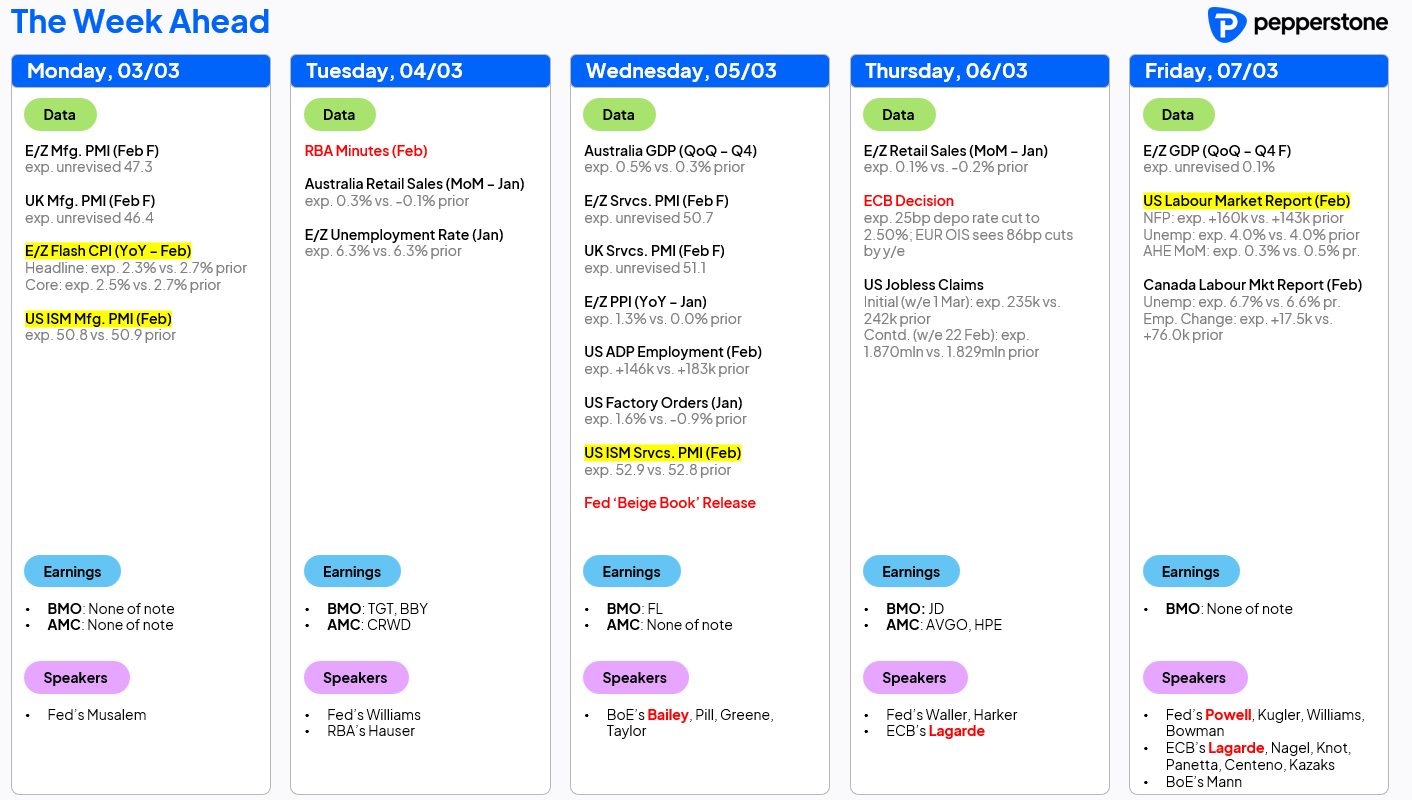

LOOK AHEAD – A busy week to kick-off the month of March.

Today, the aforementioned US ISM mfg. PMI will be a key barometer of whether the growth scare narrative will be exacerbated, or whether some nerves may be soothed, while this morning’s flash eurozone CPI figures shan’t move the needle for the ECB, who will regardless deliver another 25bp cut on Thursday.

While that may be this week’s only notable G10 policy decision, plenty of central bank speakers await, including BoE Governor Bailey, and Fed Chair Powell. Incidentally, I’d like a word with whoever scheduled J-Pow’s speech for 5:30pm on a Friday night here in London – maybe a pub can put it up on a big screen for us.

Besides that, the macro highlight naturally stands as Friday’s US labour market report, where participants will be paying close attention to any signs of softness as a result of federal layoffs, even if a chunk of January’s weather-related weakness is likely to be unwound. Wednesday’s US ISM services PMI, as noted, is this week’s other main data risk.

Finally, earnings season is now pretty much over, though Thursday’s report from Broadcom (AVGO) could provoke some interest, particularly as risks around the AI theme become increasingly two-sided amid the emergence of Deepseek.

The full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.