- English

- 中文版

Peter Schiff vs Michael Saylor: The Battle for 2026 as Strategy’s (MSTR) Risk Profile Explodes

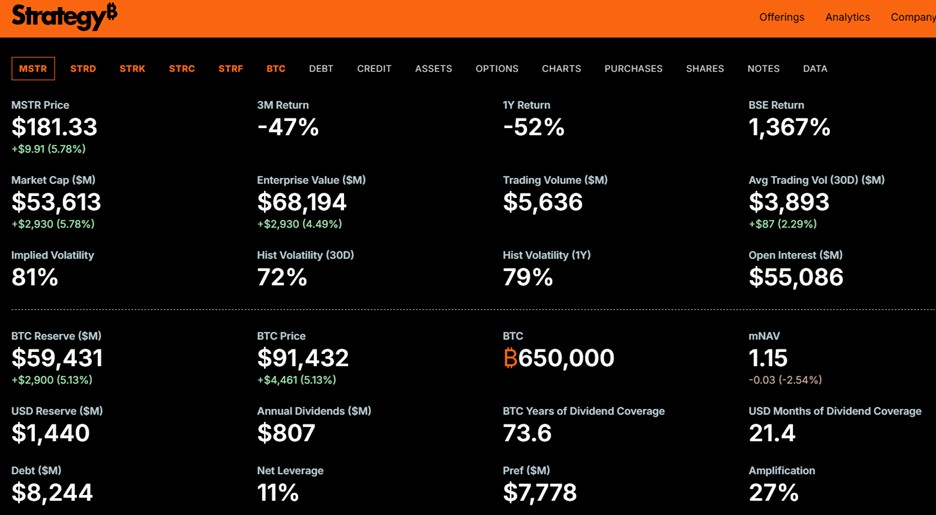

MicroStrategy’s $807 Million in Annual Interest and Dividends

The irony is that Strategy is relying on fiat to fund the $807m per year in interest and dividend payments across its debt and preferred-share tranches. Meeting these obligations is essential if Saylor is to keep the good ship MSTR afloat and keep the holders of the $17bn in preferred stock and convertible notes satisfied.

How MicroStrategy Must Finance Itself in 2026: Equity Issuance or Bitcoin Sales

To achieve this in 2026 (and beyond), Strategy will need either to continue issuing new shares or sell part of its 650,000 BTC holdings on the balance sheet.

Given the choice, Saylor has made it clear he will never willingly sell Bitcoin - but in 2026 that decision may well be taken out of his hands. Ultimately, Mr Market could decide it for him.

Schiff’s Incorrect Claim About MSTR Selling Bitcoin

On Monday, Schiff incorrectly claimed that MSTR had sold BTC on-market to fund upcoming interest payments. This misstep didn’t help his argument, even if his broader critique of MicroStrategy’s increasingly complex capital structure still resonates.

MicroStrategy’s $1.44 Billion Reserve Fund: 21 Months of Coupon Cover

MicroStrategy subsequently disclosed a US$1.44bn reserve fund to cover senior-debt obligations - providing around 21 months of dividend and coupon cover. This may offer short-term support to the MSTR share price. But the short sellers are circling, with short interest is now around 41%, a level that adds fuel to both upside squeezes and downside volatility.

Market Net Asset Value (mNAV): Why MSTR’s Premium and Discount Matters

Until recently, traders were focused on market net asset value (mNAV) - now around 1.15, meaning MSTR trades at a small premium to the total BTC value on its balance sheet. It has even traded at a slight discount, which historically would be extremely bearish for MicroStrategy.

Why TEV mNAV Is Now the Key Metric for MSTR’s True Valuation

With the company’s capital structure changing - and $17bn of senior claims above the equity — the market has pivoted to TEV mNAV (Total Enterprise Value / Bitcoin Value).

This metric captures:

- Total debt

- All preferred-stock tranches

- Equity market cap

TEV mNAV remains well above 1.0, suggesting Saylor still has options to raise capital and maintain the company’s leveraged Bitcoin strategy.

Why Saylor Needs TEV mNAV Above 1 to Keep Issuing Equity

As long as MSTRs TEV mNAV ratio stays comfortably above 1, Saylor can be reasonably confident that investors will support further equity issuance, enabling MicroStrategy to continue using leverage to accumulate more BTC.

What Happens if Bitcoin Falls Below $74,436? The Liquidation Risk

However, with $17bn above the equity, if BTC were to fall significantly below $74,436 (MicroStrategy’s average BTC purchase price) and traders increased its concerns for its future solvency, the deep subordination would radically increase the risk premium for MSTR common equity stockholders – a factor which could catalyze the selling.

Why MSTR Moves More Than Bitcoin: High-Beta Leverage and Short Interest

This is why, when Bitcoin rises, MSTR often sees a much larger percentage gain, with the move amplified by heavy short interest. It’s exactly why traders view MSTR as a leveraged, high-beta play on Bitcoin, not simply a proxy for BTC.

The Downside: Why MSTR Drops Faster Than Bitcoin on Red Days

Conversely, when Bitcoin trades lower, MSTR almost always suffers a larger percentage decline, reflecting its leveraged capital structure. In 2026, should we continue to see strong drawdown, the big debate will focus on the possibility that MSTR and many other crypto treasury entities could be forced to deleverage and sell down part of their crypto holdings.

MicroStrategy Holds 3% of All Bitcoin - Why That Matters for 2026–27

MicroStrategy owns around 3% of all BTC in circulation - a meaningful share, though not dominant. But Saylor is unquestionably the most prominent spokesperson for institutional Bitcoin adoption, making his financing decisions and interest-payment strategy highly relevant for BTC markets in 2026–27.

What Happens If Strategy Ever Has to Sell Bitcoin?

If BTC collapses and MicroStrategy is forced to sell part of its holdings, Peter Schiff will be the first to celebrate — loudly. In that scenario, MSTR could even start leading Bitcoin’s price action on down days, particularly when cross-asset volatility rises.

Trading Opportunities Ahead: The Saylor vs Schiff Battle Intensifies

This developing standoff between Saylor’s leveraged Bitcoin empire and Schiff’s warnings of structural fragility will make for fascinating market theatre — and a source of exceptional trading opportunities in 2026.

Who do you think ultimately wins this battle - Saylor or Schiff?

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.