- English

- 中文版

October 2025 FOMC Review: QT Reaches An End As Rate Cuts Continue

Rate Cut Delivered But FOMC Remains Divided

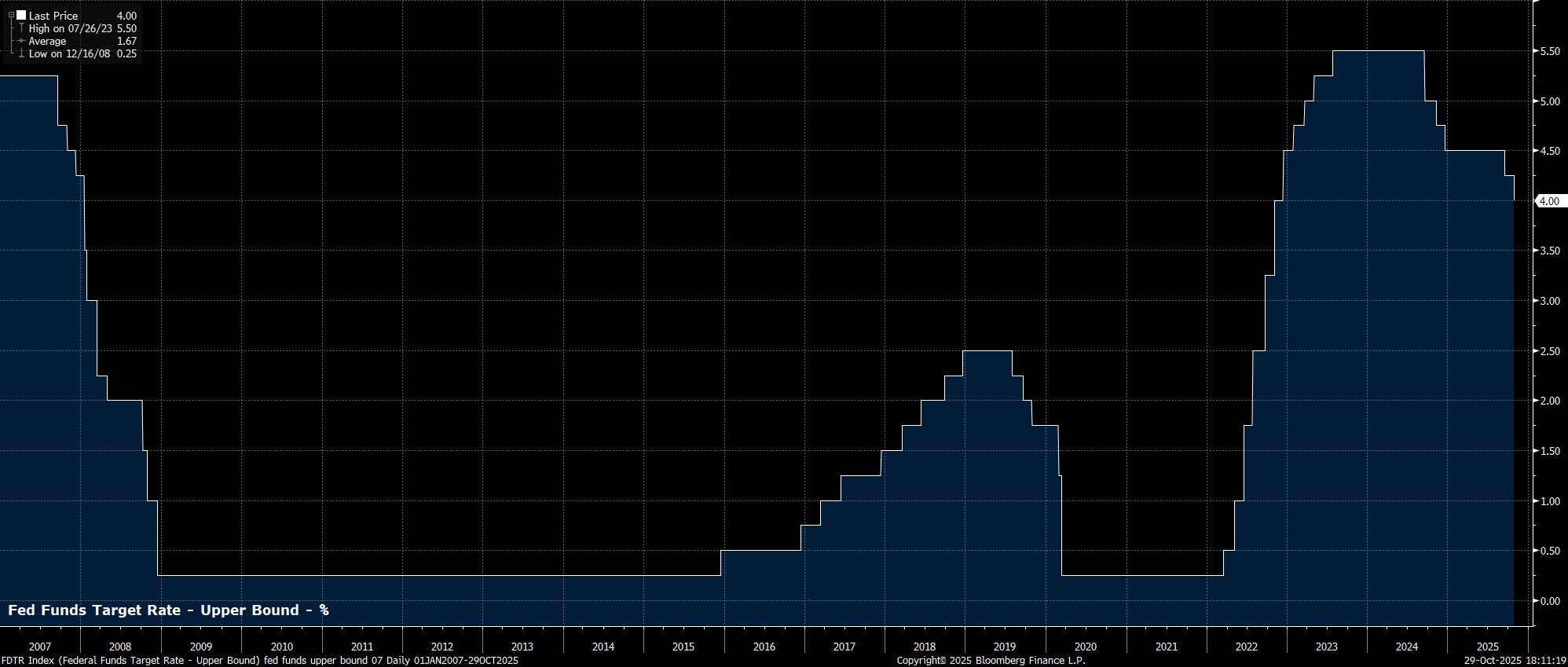

As noted, the FOMC duly announced the 25bp cut that money markets had fully discounted, and that every man and his dog had been expecting, at the conclusion of the October meeting.

Such a move lowers the target range for the fed funds rate to 3.75% - 4.00%, its lowest level since summer 2022, and marks the second straight cut, after a similar rate reduction was delivered in September. This gradual policy easing comes as policymakers seek to support a stalling US labour market, and as tariff-induced price pressures appear softer than had been anticipated, even if the ongoing government shutdown limits the amount of official data that policymakers can observe.

Once more, though, the decision to deliver a 25bp cut wasn’t a unanimous one.

Governor Miran, as he had effectively pre-announced in the run up to the meeting, dissented in favour of a larger 50bp cut, presumably continuing to rely on what appears to be a heavily politically-skewed perception of how low the neutral rate (or r*) may be. Meanwhile, Kansas City Fed President Schmid dissented in favour of holding the target range for the fed funds rate steady, a dissent that while somewhat surprising, is broadly in keeping with his recent public remarks.

In any case, the remainder of the Committee, including Governors Bowman and Waller who are in the running to succeed Powell as Chair, voted for the 25bp move that was delivered.

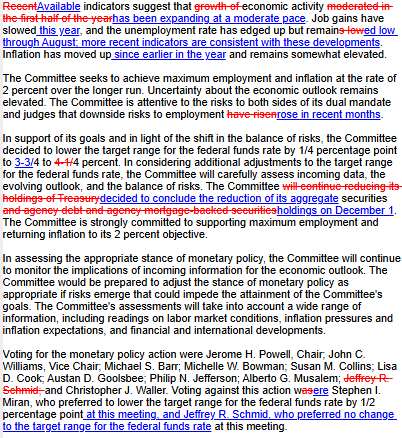

Policy Statement Brings Few Changes

Unsurprisingly, the policy statement accompanying the aforementioned decision brought little by way of significant updates, owing to both the lack of top-tier data released since the September meeting, but also to how the outlook has changed little over the last six weeks or so.

Consequently, the Committee continued to describe the unemployment rate as ‘low’, job gains as having ‘slowed’, and inflation as ‘somewhat elevated’. Policymakers, meanwhile, reiterated that a data-dependent approach will continue to be followed in terms of future policy shifts, though another cut in December remains essentially a ‘done deal’.

Runoff Runs Out Of Road

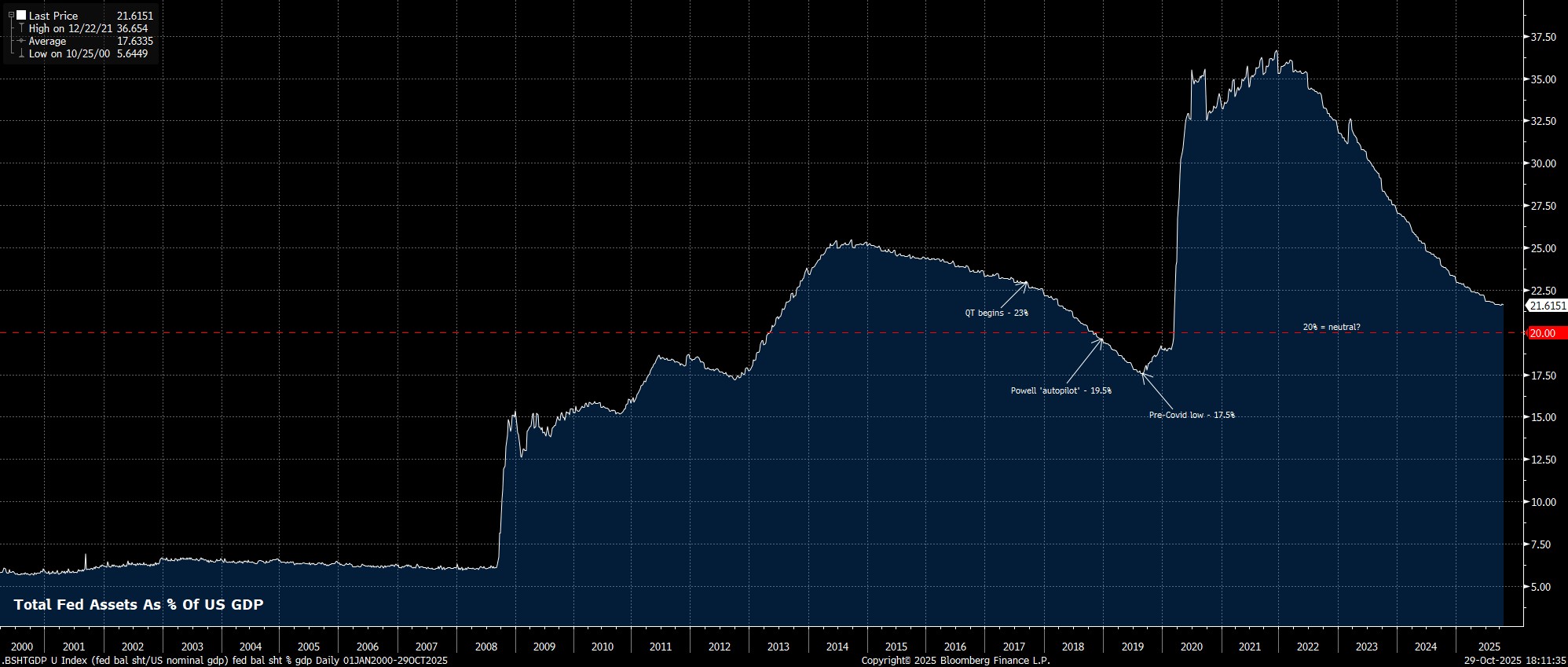

Perhaps the most interesting aspect of the meeting was the FOMC’s decision to announce that balance sheet run-off, or quantitative tightening (QT) will come to an end at the start of December.

While such a decision was contrary to my base case that QT would continue to year-end, it is perhaps not a huge surprise that the Committee sought to err on the side of caution here, seeking to bring QT to an early conclusion, in an attempt to avoid a repeat of the significant funding squeeze seen back in 2019.

Chair Powell Sticks To The Script

Taking into account the lack of statement changes, and dearth of fresh information since the September meeting, it was also unsurprising to see Chair Powell ‘stick to the script’, largely repeating not only the remarks made at the September presser, but also those made in a mid-October keynote.

As such, the press conference saw Powell reiterate his view that the outlook ‘hasn’t changed much’ since the last meeting. That said, Powell was at pains to stress that another cut in December is not a ‘foregone conclusion’, with it being notable that this remark was made in the prepared statement, suggesting it to be a deliberate policy signal, before reiterating such a point in the post-meeting press conference.

Money Markets Little Changed

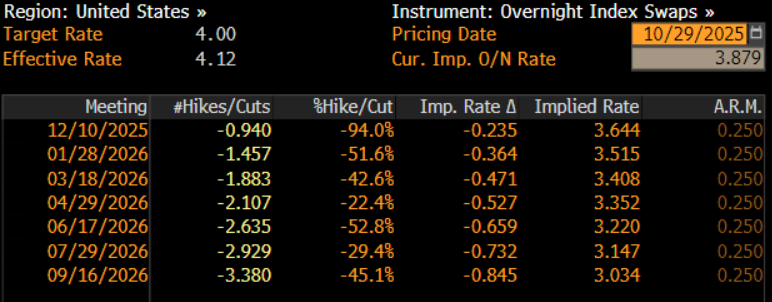

In digesting all of the above, money markets were little changed, continuing to discount a 25bp cut for the December meeting, while also discounting another such move by next March.

Consecutive Cuts To Continue

Taking a step back, the October FOMC meeting brought little by way of significant surprises, and doesn’t materially alter the policy outlook moving forwards.

My base case remains that the Committee will deliver a third straight 25bp cut at the next meeting in December, as the reaction function continues to lean heavily, if not entirely, towards supporting the labour market, and as upside inflation risks appear more contained than had been expected. This ‘run it hot’ approach is likely to result in cuts at the first couple of 2026 meetings as well.

Meanwhile, on the balance sheet, the decision to bring quantitative tightening to an early conclusion represents a pro-active, risk-management based choice, which further emphasises how the Committee are increasingly prepared to act in a way that provides support to markets where necessary, and in a manner which attempts to get ahead of the curve in terms of potential funding issues.

Putting that together, you have not only a fed funds rate on its way back to neutral, but also a balance sheet bottoming out at a neutral level. That is, frankly, about as positive a cocktail for risk assets as it’s possible to imagine!

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.