- English

- 中文版

October 2025 FOMC Preview: Cuts To Continue As QT Nears An End

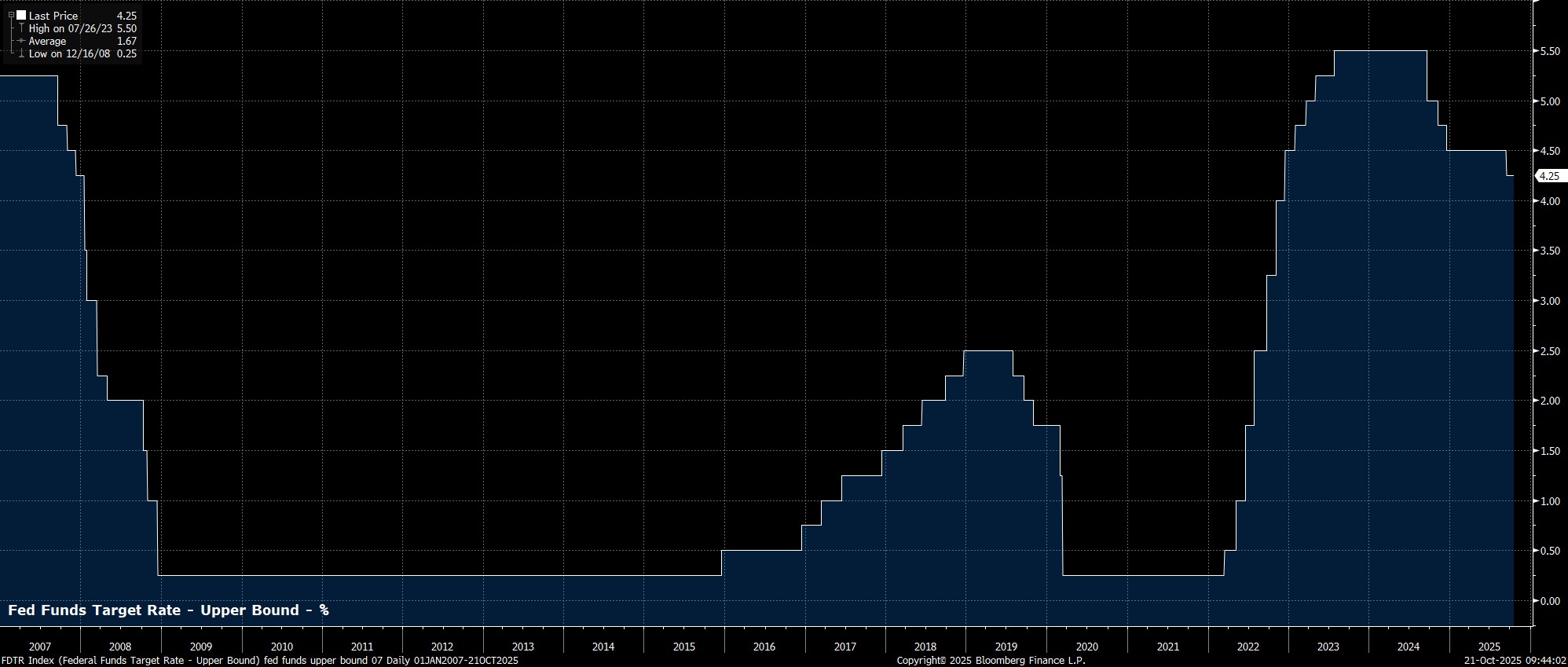

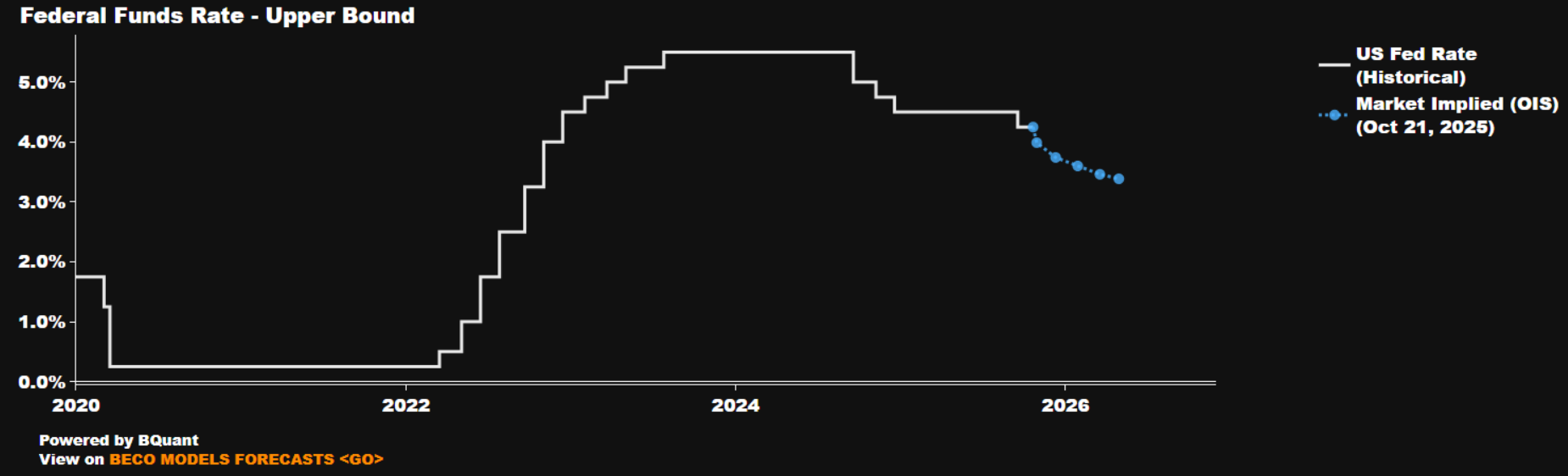

As noted, the target range for the fed funds rate is set to be cut by a further 25bp at the conclusion of the upcoming confab, a move that would mark the first back-to-back rate reductions since this time last year. Unsurprisingly, money markets, per the USD OIS curve, fully discount such a cut at the upcoming meeting, and another such cut at this year’s final meeting, in December.

Having said that, the Committee’s vote in favour of such action is once again unlikely to be unanimous. Uber-dovish new Governor, and puppet of President Trump, Stephen Miran is almost certain to dissent in favour of a cut of at least 50bp, reflective of his September ‘dot’ that an additional 125bp of easing should be delivered before the end of the year. The remainder of the Committee, however, are all but certain to vote in favour of a more modest, and sensible, 25bp move.

Mercifully, the accompanying policy statement is likely to be a much more straightforward affair, largely reflective of the lack of US economic data releases since the September FOMC meeting, owing to the ongoing government shutdown.

Consequently, the Committee are again likely to describe growth as having ‘moderated’ in H1, with job gains having ‘slowed’, and the unemployment rate ‘remaining low’. Inflation, meanwhile, is set to have remained ‘somewhat elevated’, with the September CPI figures due this Friday, though that data remains highly unlikely to materially alter the near-term policy outlook.

As for forward guidance, that is also likely to remain largely unchanged from last time out, with the Committee again adopting a data-dependent stance when considering ‘additional adjustments’ to the fed funds rate, and not making any pre-commitment to a particular policy path.

Clearly, the lack of economic data since the September meeting leads to both policymakers, and market participants, ‘flying blind’ to a certain degree, even if there are a handful of private sector releases (e.g. ADP employment, and the ISM PMIs) which can build some sort of a picture as to how the economy is evolving.

By and large, the data that we have received points to a continuation of the momentum seen pre-shutdown, namely an economy where underlying growth remains resilient, and where the labour market continues to operate in a ‘no hire, no fire’ mode, with the pace of employment growth, and the pace of layoffs, having both stalled. In any case this, coupled with a largely unchanged economic outlook over the last six weeks, means that the ‘path of least regret’, despite the ongoing data void, still leads towards further policy easing.

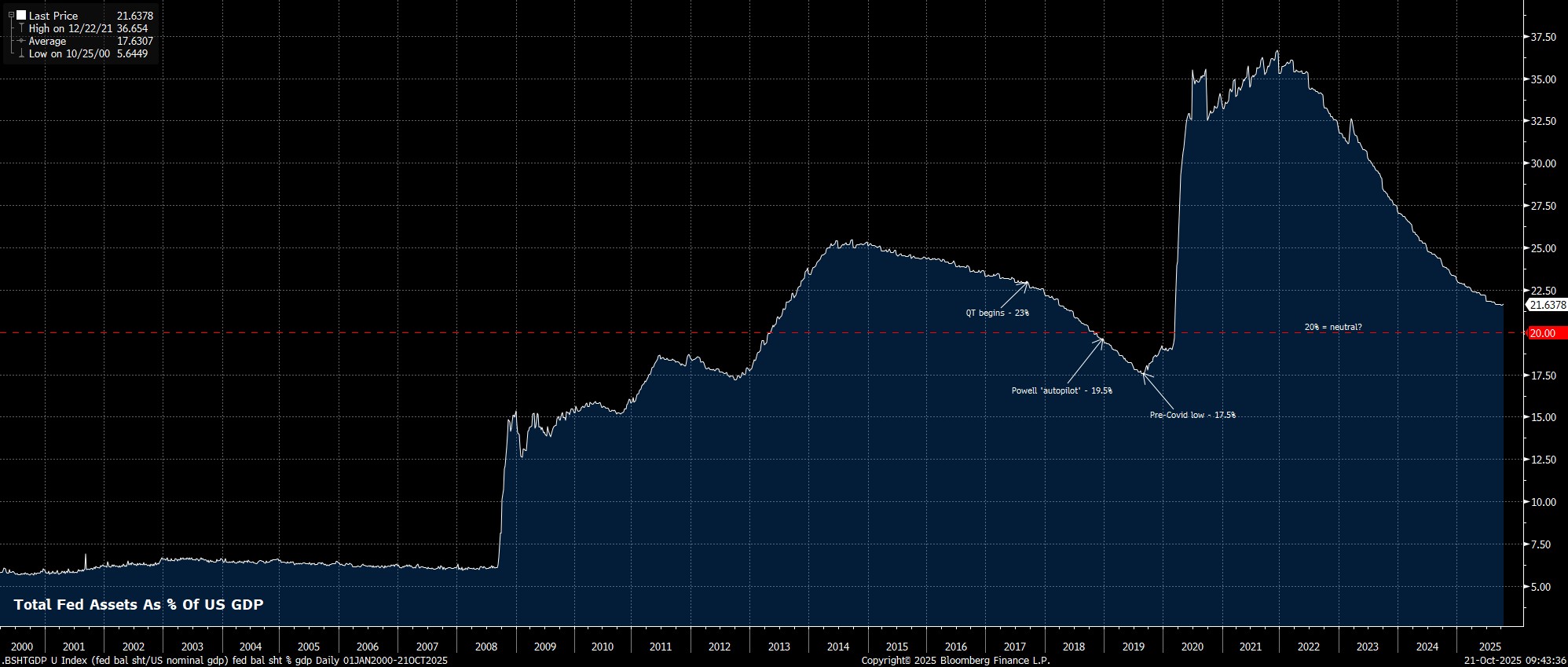

In addition to delivering another rate reduction, the October meeting is also likely to see the FOMC being discussions over concluding the ongoing process of balance sheet run-off, or quantitative tightening (QT). In recent remarks, Chair Powell noted that this process may end ‘in the coming months’, a hint that was taken by many to be a nod towards QT wrapping up before the end of the year.

Quite clearly, the FOMC are getting towards the point where QT has been pushed as far as it can, not only as the balance sheet nears the 20% of GDP level often considered to represent a ‘neutral’ setting, but also amid increasing signs of tightness in US money markets, and the lack of ‘wriggle room’ for policymakers, with usage of the NY Fed’s o/n repo facility having dropped to essentially zero. My base case is that discussions over ending QT begin at the October meeting, before a formal decision, and announcement, to end the process is taken at the end of the year, though risks clearly skew towards that call coming sooner, if money market conditions tighten to a much greater degree.

Turning to the post meeting press conference, Chair Powell is almost certain to stick rigidly to the script used in recent appearances, including the September presser.

As a result, Powell will likely reiterate that the direction of travel for rates remains to the downside, though that such a path will be plotted in a relatively cautious manner, owing to inflation continuing to rise, even if the Committee plan to look-through the impacts of tariffs as a ‘one-time shift’ in the price level. Any comments from Powell on the balance sheet, especially the potential timing of QT coming to an end, will also be closely watched.

Taking a step back, the October FOMC meeting is likely to bring ‘more of the same’, as the Committee continue to place greater weight on the employment side of the dual mandate, and continue to gradually remove policy restriction in an attempt to prop up a stalling US labour market. Consequently, further rate reductions remain on the cards, with another 25bp cut almost certain to be delivered at this year’s final meeting in December, with that easing set to continue into 2026, before the fed funds rate returns to a more neutral, 3%, level next summer.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.