- English

- 中文版

October 2025 ECB Review: Standing Pat In A Good Place

Rates Remain On Hold

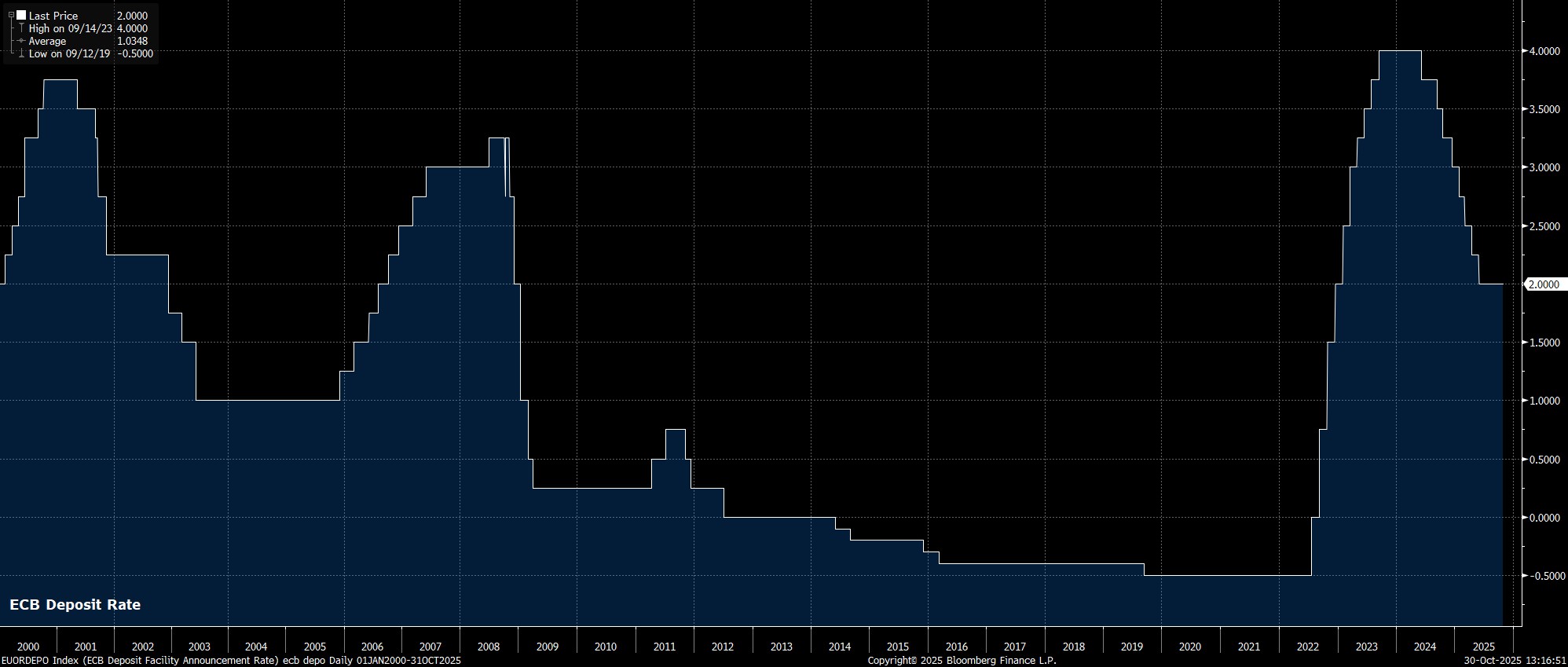

As had been widely expected, and fully discounted by money markets, the Governing Council maintained the deposit rate at 2.00% at the conclusion of the October meeting, standing pat for the third consecutive meeting.

While still, technically speaking, being a ‘pause’ in the ECB’s easing cycle, for all intents and purposes that cycle now looks to be at an end, with 2.00% likely marking the terminal rate, after policymakers delivered 200bp of easing since last summer.

Few Statement Changes

In an equally unsurprising move, the accompanying policy statement was little changed from that issued after the September confab.

Consequently, policymakers reiterated what has now become incredibly familiar forward guidance, namely that a ‘data-dependent’ and ‘meeting-by-meeting’ approach will continue to be followed in determining future policy shifts, while again noting that no ‘pre-commitment’ is being made to a particular rate path.

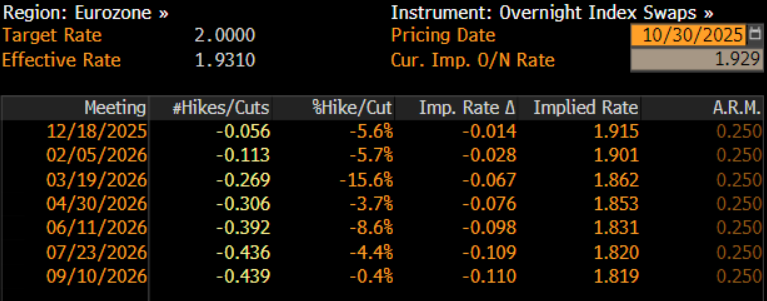

Though this guidance continues to give policymakers ample optionality in terms of future rate shifts, the lack of any explicit dovish shifts further suggests a lack of desire to deliver further easing this cycle. In fact, money markets, per the EUR OIS curve, discount just 2bp of cuts this year, and a meagre 10bp over the next 12 months, with that pricing largely being reflective of participants hedging potential tail risk, as opposed to explicit bets on a more dovish policy outturn.

Lagarde Sticks To The Script

Taking into account the lack of policy shifts, and statement changes, it was no surprise to see President Lagarde stick rigidly to her recent script at the post-meeting press conference, offering little by way of pertinent fresh information.

As such, Lagarde once again noted that policy is in a ‘good place’, that downside risks to growth have ‘abated’, and that the Governing Council was ‘all’ in agreement as to what those risks may be. It was also confirmed that today’s vote was a unanimous one. Frankly, though, even by Lagarde’s rather dismal standards, today was an extremely tedious and turgid affair.

Policy Outlook Little Changed

Given the lack of new information policymakers provided this time out, it’s safe to say that the October ECB meeting will not be one that goes down in the history books, nor will it be one that materially moves the needle in terms of the policy outlook.

My base case remains that the Governing Council are done & dusted for the cycle, with the deposit rate now set to remain at 2.00% through to at least the end of next year. Though some of the GC’s more dovish members may seek to debate another cut at the December meeting, depending on the picture painted by the updated macroeconomic projections, further rate reductions from here on in seem unlikely, barring a material re-escalation in trade tensions, or a significant and unexpected appreciation in the EUR.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.