- English

- 中文版

October 2025 ECB Preview: Don’t Be Expecting Any Fireworks

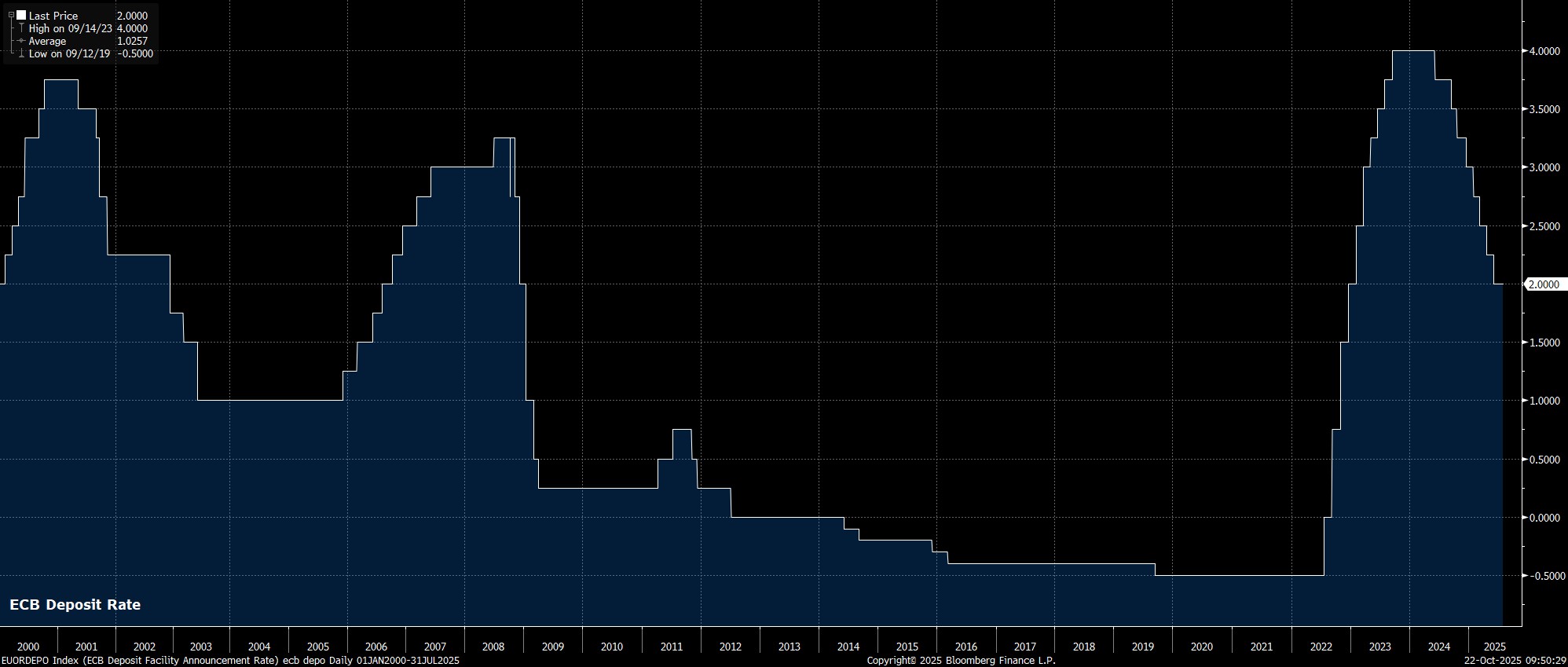

Consequently, the deposit rate is set to remain at 2.00%, with policymakers having given no indication of an imminent need to deliver further easing, and with money markets pricing no chance whatsoever of any policy action this time out. Looking ahead, the EUR OIS curve discounts just 4bp of easing by year-end, which is likely more reflective of tail risk hedging, as opposed to outright bets on a more dovish policy path.

Along with a relatively straightforward rate decision, the accompanying policy guidance is also likely to be a fairly simple affair. Here, the Governing Council are likely to repeat was has now become very familiar rhetoric indeed, noting that future decisions will continue to be taken by following a ‘data-dependent’ and ‘meeting-by-meeting’ approach, with policymakers also again making no ‘pre-commitment’ to a particular policy path.

Put simply, the reason for the upcoming meeting likely being a rather dull affair, is because there is little-to-no reason for the ECB to be doing anything at this juncture.

While headline CPI did rise north of the 2% mark in September, for the first time since April, this is likely to be of little concern to policymakers for the time being, not least considering that the September staff macroeconomic projections pencil in an inflation undershoot both next year, and in 2027.

Other significant economic releases have been somewhat lacking since the prior Governing Council meeting, with the initial read on third quarter GDP, and the October CPI report, both due on the day of the upcoming decision itself – though, one would expect policymakers to receive advanced sight of these figures.

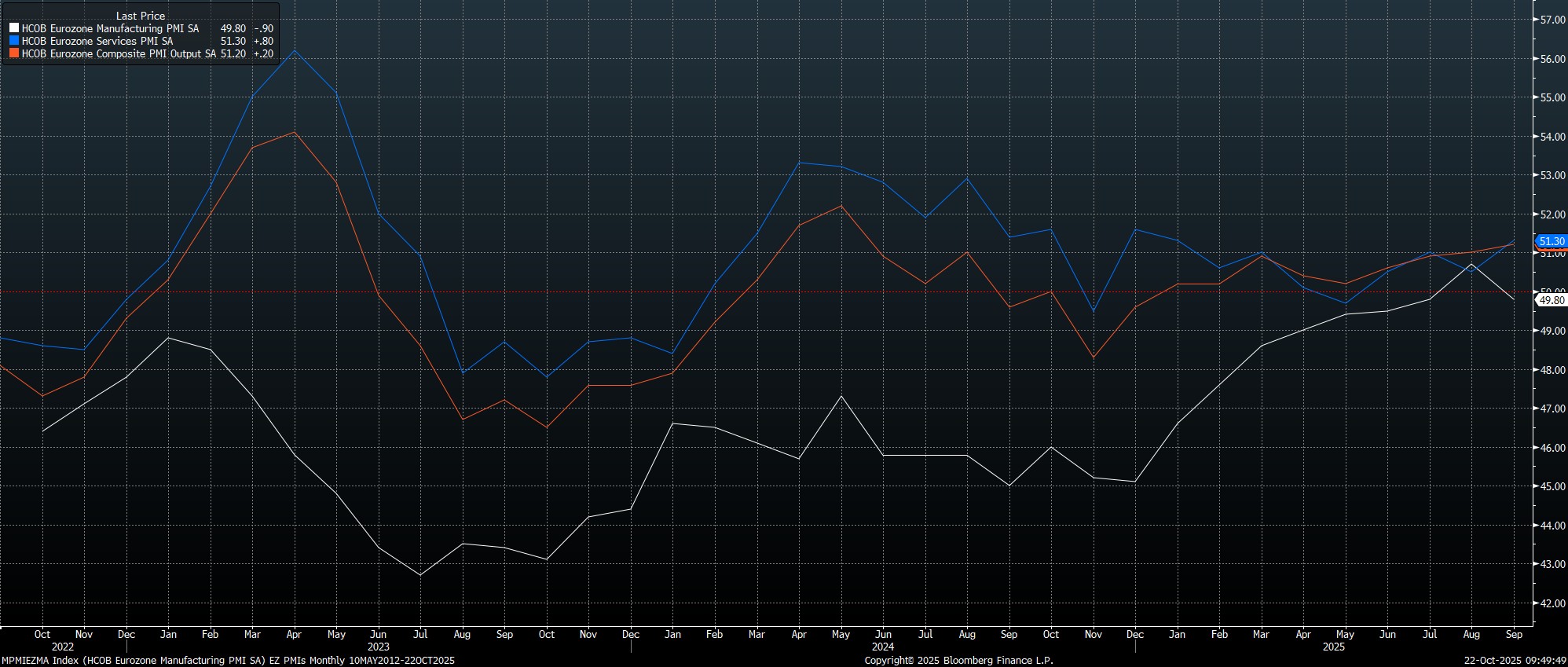

In any case, the most recent round of PMI surveys pointed to a continued recovery in the eurozone economy last month, most notably with the composite output metric rising to 51.2, a 16-month high.

Furthermore, risks to the outlook have somewhat diminished in recent weeks.

While trade uncertainty continues to linger, especially as the Trump Administration increasingly turn attention towards sector-specific tariffs, the US-EU trade deal agreed during the summer continues to hold, thus reducing the potential downside impact of said uncertainty on the eurozone economy.

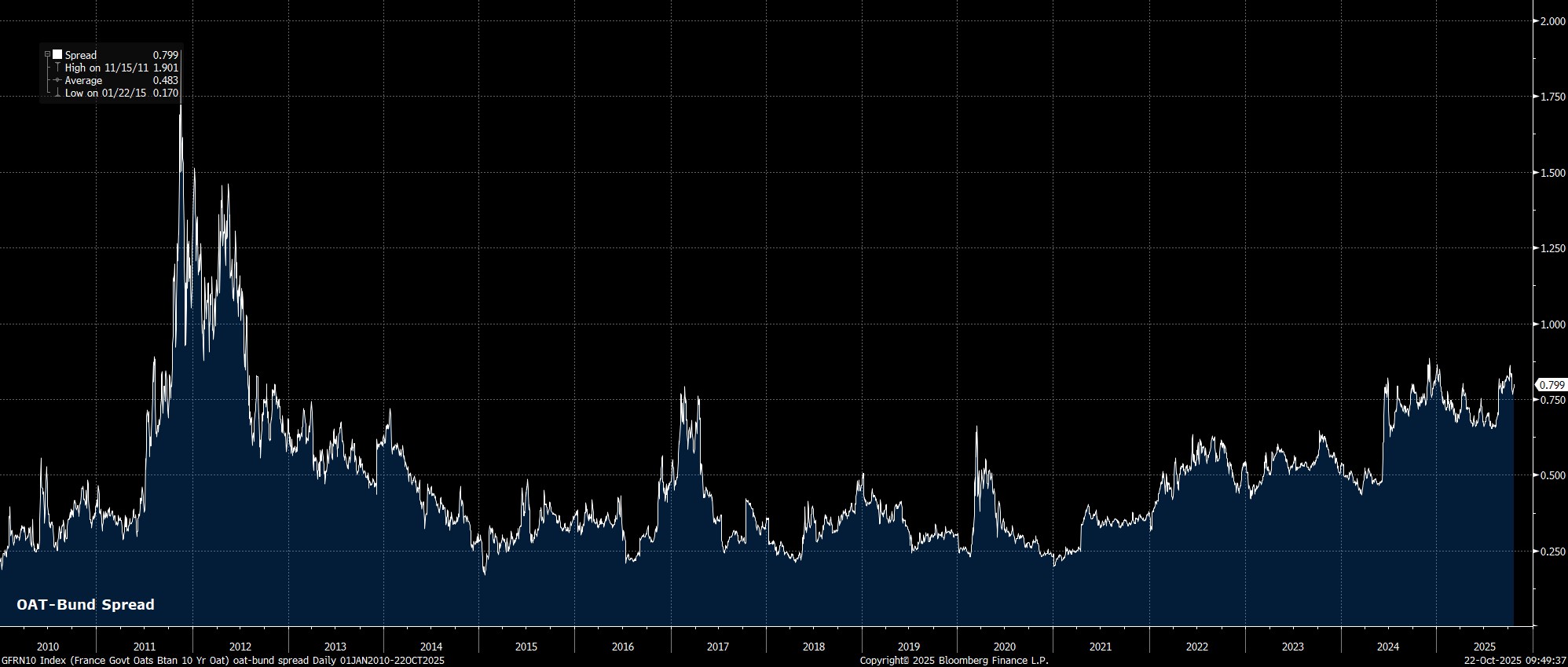

Meanwhile, although the situation remains an unstable one, for the time being at least it appears that French political risks have notably subsided, with PM Lecornu winning a couple of confidence votes, and now looking likely to pass a budget before year-end. Of more importance to the ECB, is that while remaining wider than would be desired in an ideal world, the OAT-Bund spread has stabilised of late, thus reducing the risks of the aforementioned political pantomime impairing monetary policy transmission.

In addition, it remains the case that the Governing Council’s more dovish members seem set to continue to keep their powder dry for the time being, likely holding out until the December meeting, and an updated round of economic projections, before more forcefully arguing their case that further policy easing is required. That, in turn, also suggests that things are likely to be a relatively straightforward affair this time out.

President Lagarde’s post-meeting press conference also seems unlikely to set the world alight. In keeping with the policy statement, Lagarde will be at pains to stress that policy is not on a ‘pre-set’ or ‘predetermined’ path, and that a ‘meeting-by-meeting’ approach remains the appropriate one to take. Lagarde is also likely to repeat that the disinflationary process in the eurozone has now come to an end, while likely also again viewing growth risks as ‘balanced’, and not tilted to the ‘downside’ as had been the case for much of the year until the September meeting.

Taking a step back, the October ECB decision is not going to go down as one for the history books, and is likely to be rather unremarkable all things considered. My base case remains that the easing cycle is now at an end, with the Governing Council now set to maintain the deposit rate at 2.00%, until the end of 2026.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.