- English

- 中文版

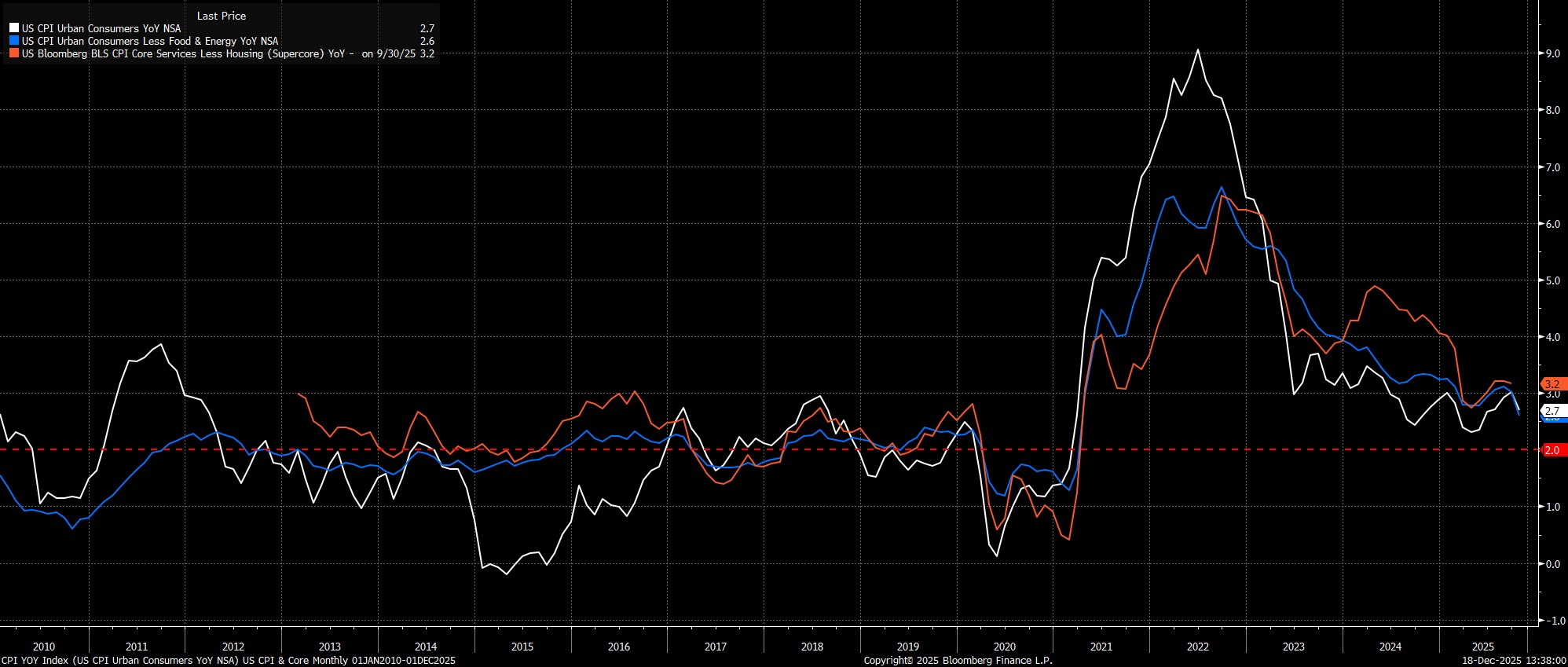

Inflation Eases Massively

Headline CPI rose just 2.7% YoY last month, well below consensus expectations for a 3.1% YoY increase, and the slowest pace since July. Metrics of underlying price pressures, meanwhile, also pointed to price pressures easing considerably, with core CPI having risen 2.6% YoY last month, the slowest pace since 2021.

Shutdown Disrupts Data

While the figures above pertain to the November CPI report, which the BLS have been able to collect in full, the same cannot be said of the October data. Owing to a lapse in funding, stemming from the federal government shutdown, the BLS were unable to collect October’s data, and were also unable to do so retroactively, in part owing to how a significant amount of data collection is still done manually, in-person.

Hence, while a small number of sub-indices were published for October, we have not received, and likely never will receive, headline or core CPI figures for the month, hence are unable to determine November’s MoM inflation figures, given that there is no prior to use in that comparison. Though the October data is somewhat stale at this stage, this is a point worth remembering, especially this time next year, in terms of any skew that may apply to the YoY inflation rates in October 2026, as a result of this base effect.

The Devil’s In The Details

Turning back to the November report, and as has now been the case for some time, participants and policymakers alike continue to pay very close attention to the composition of price pressures.

This, largely, comes as a result of continued efforts to gauge the precise impact of the Trump Administration’s tariff policies, chiefly the degree to which said trade levies are being passed on in the form of higher consumer prices. The FOMC, of course, continue to largely view said tariffs as a ‘one-time shift in the price level’, and not a factor that poses a risk of more longer-lasting inflation coming to pass.

In any case, core goods prices held steady at 1.5% YoY last month, implying that we may well be past the peak in terms of tariff pass-through, while core services inflation eased to a 3.5% YoY cycle low.

Looking Forwards

On the whole, it seems doubtful that the November CPI figures will materially move the needle in terms of the FOMC policy outlook, primarily given that policymakers’ reaction function currently tilts largely, if not entirely, towards supporting a stalling US labour market. Such a cool figure, furthermore, raises concerns over data quality, and also increases the likelihood that the Committee will seek further evidence of continued disinflation in coming months, as opposed to over-reacting to one report.

Against such a backdrop, the direction of travel for the fed funds rate remains clear, with further rate reductions back towards neutral, around 3%, likely over the course of the next few months. The timing of the next rate reduction, as mentioned, will hinge almost entirely on labour market developments between now, and the January 2026 meeting, with another cut at said meeting distinctly possible, if the employment backdrop continues to sour.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.