Analysis

November 2024 FOMC Preview: Continuing The Journey Back To Neutral

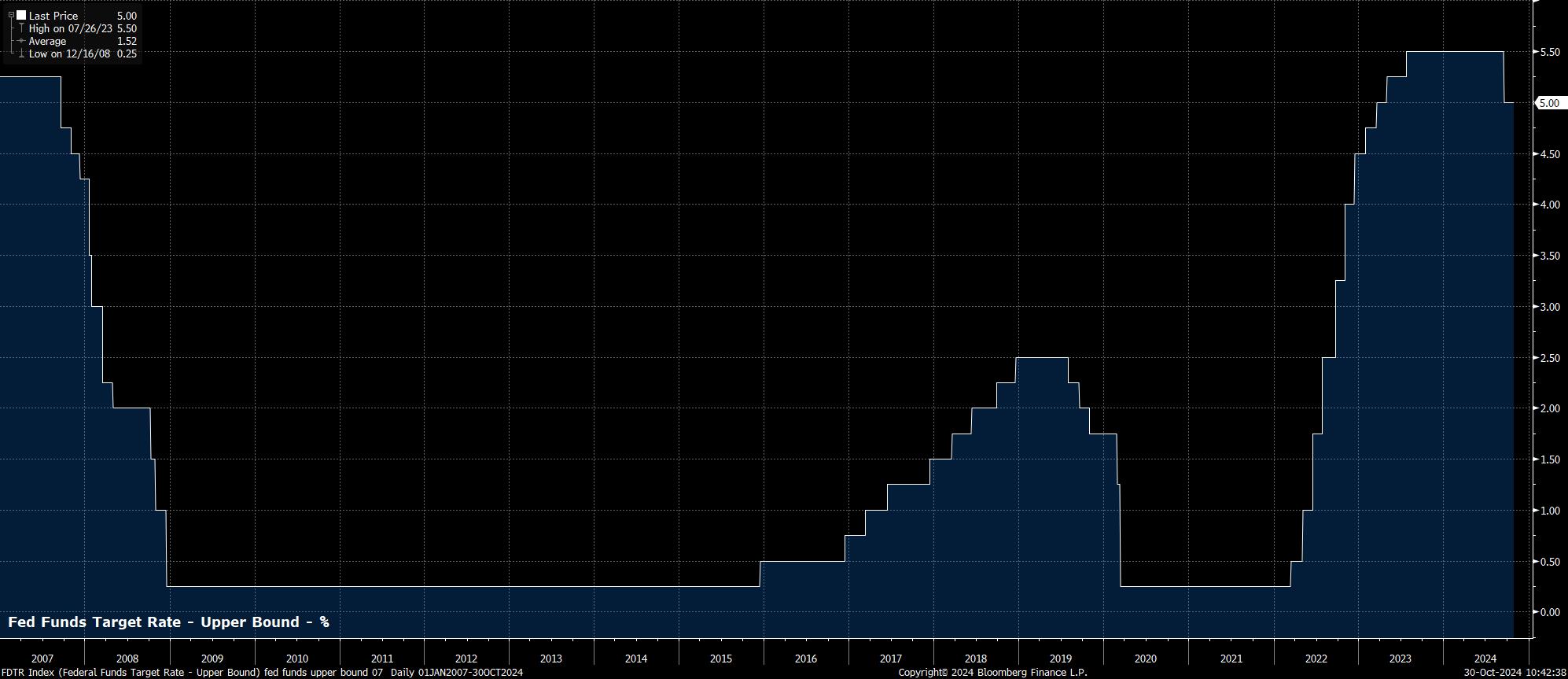

As mentioned, the FOMC are set to reduce the target range for the fed funds rate by 25bp, to 4.50% - 4.75% at the conclusion of the November confab. Such a cut would mark the second of the cycle, albeit also representing a slowing in the pace of policy normalisation, after the easing process kicked-off with a 50bp cut in September. Money markets, per the USD OIS curve, fully price such a cut, although such pricing is subject to change depending on the outcome of Friday’s jobs report.

While September’s decision to deliver a 50bp cut was not unanimous, the November cut is likely to be. Governor Bowman, who preferred a more modest 25bp reduction last time out, seems likely to fall back in line with the remainder of the Committee this time around.

Accompanying the 25bp cut is likely to be guidance that remains broadly unchanged from that published after the prior meeting. As such, the FOMC will likely re-commit to taking a ‘data dependent’ approach to future policy decisions, reiterating a pledge to “adjust the stance of monetary policy as appropriate” in the coming months.

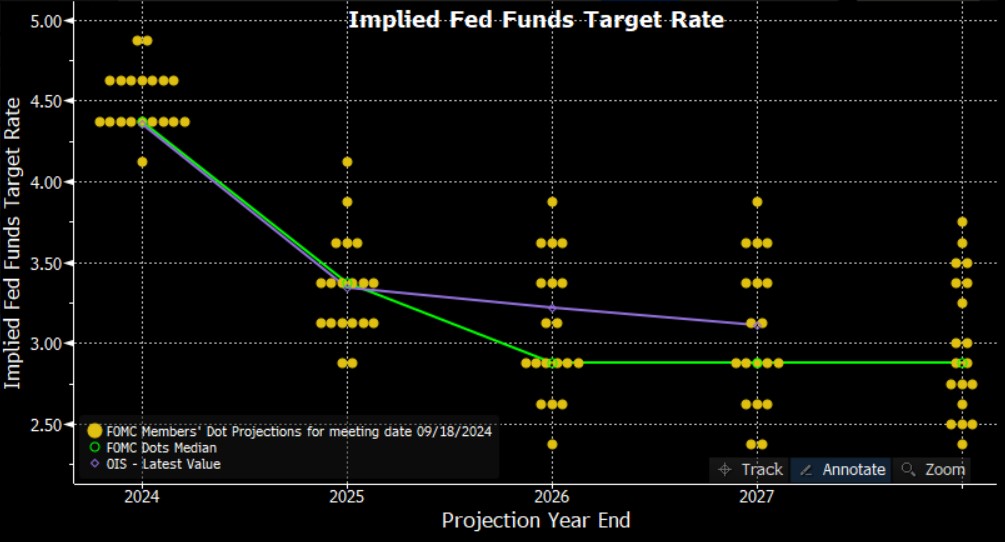

Nevertheless, taking into account the ‘dot plot’ released at the September meeting, which pointed to a total of 100bp of cuts in 2024, a 25bp reduction this time out would leave another such cut as the base case for December, were the ‘dot plot’ to be adhered to. Although, taking the dots as gospel is rather folly.

Markets, in fact, are somewhat more sceptical on the future rate path, pricing – at the time of writing – just a 60% chance that the FOMC will indeed deliver another 25bp cut at the final meeting of the year. Such pricing looks substantially too hawkish, in my view.

Since the prior meeting, the US economy has continued to evolve broadly in line with the FOMC’s expectations, consequently lessening the likelihood of any significant language changes in the Committee’s economic assessment. Of course, there is no Summary of Economic Projections due at this meeting.

On inflation, the economy has continued to make progress back towards the 2% target. Headline CPI rose by 2.4% YoY in September, the slowest annual headline inflation rate in over three years, while ‘supercore’ inflation – a metric that policymakers are known to watch closely – fell to 4.3% YoY, its lowest level since February. The latest PCE inflation figures, the FOMC’s preferred inflation gauge, have also painted a positive story, with headline PCE rising just 2.2% YoY in August, also its slowest pace in over three years.

Data of this ilk should ensure that the Committee retain sufficient ‘confidence’ in inflation returning towards the 2% target, on a sustainable basis, over the medium-term, thus enabling further policy restriction to be removed.

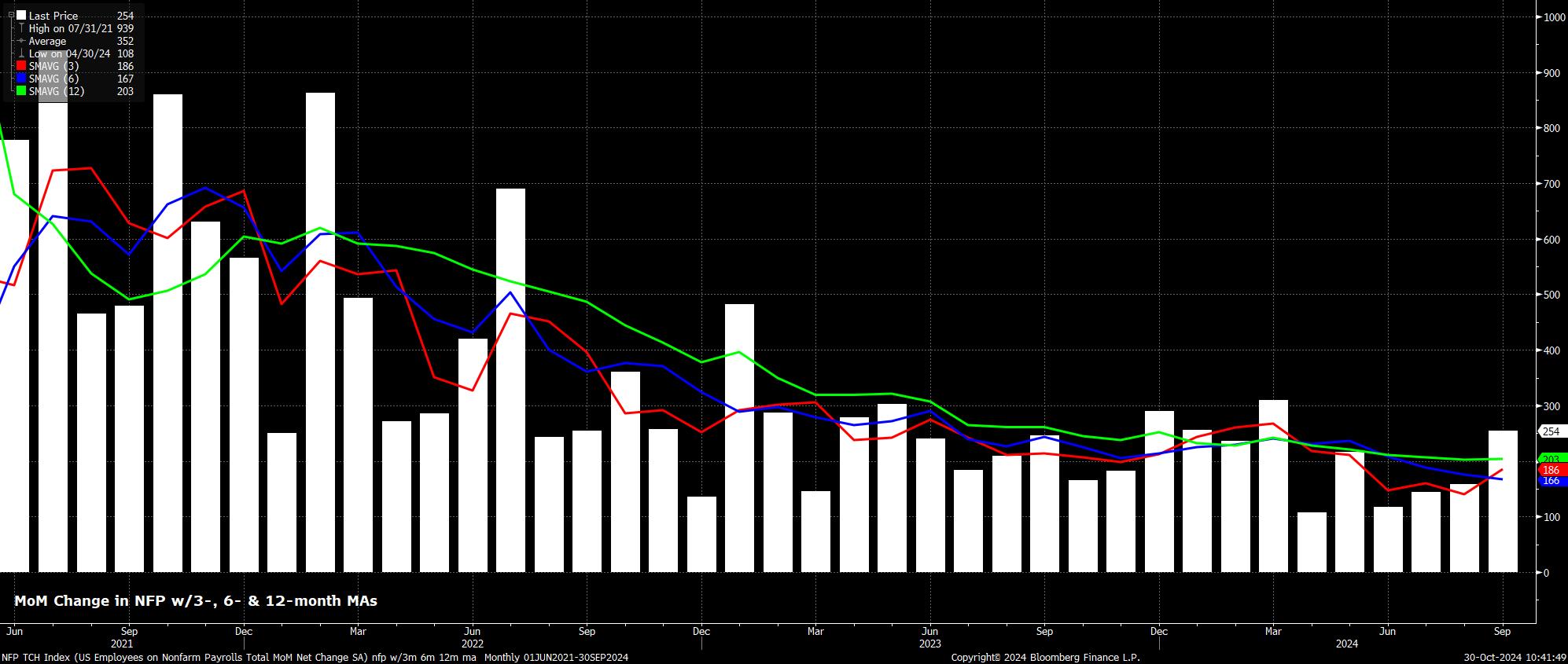

Meanwhile, incoming labour market data has proved better than expected.

Headline nonfarm payrolls rose +254k in September, the biggest MoM increase in employment since March, which in turn dragged the 3-month average of job gains to +186k, its highest point since May. Concurrently, unemployment fell to 4.1%, a 3-month low, as labour force participation remained unchanged at 62.7%, just shy of cycle highs.

Though downside risks to the October jobs report (due Fri 1st Nov) are plentiful, due to industrial action, and the impact of Hurricanes Helene and Milton, the broader trend of a gradually normalising labour market, albeit one that is doing so in relatively bumpy fashion, remains intact. Certainly, labour market developments give little cause for concern about a resurgence in inflationary pressures, with earnings growth contained at around 0.4% MoM.

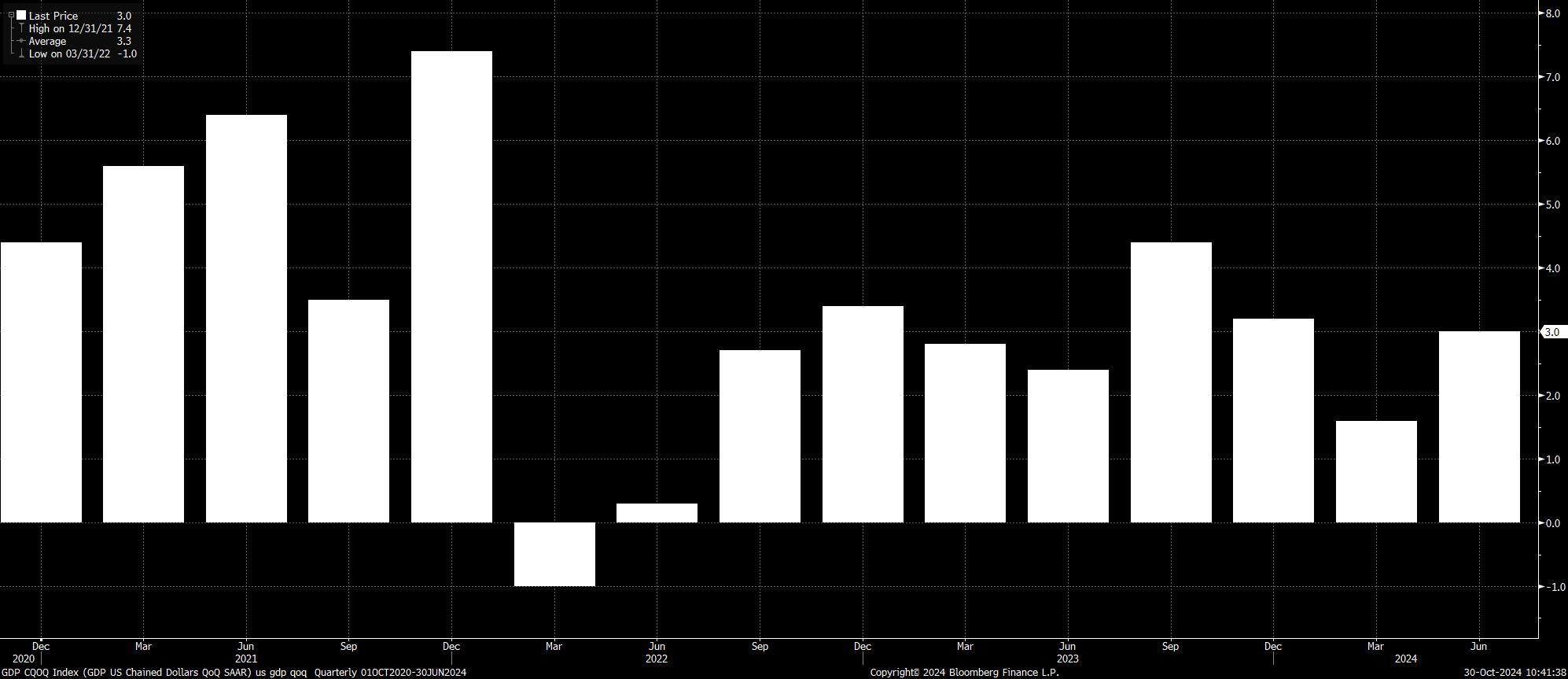

Overall, economic growth has continued to impress.

GDP has continued to expand at a solid clip, north of 2% on an annualised QoQ basis in seven of the last eight quarters (to Q2 24), while the Atlanta Fed’s GDPNow tracker points to growth of 2.8% in the third quarter. The FOMC’s prior description of economic activity expanding at a “solid pace” remains just.

For Chair Powell, the timing of the November FOMC meeting presents something of a hurdle to overcome – the decision will be announced just 2 days after the election, with every chance that the election result is not known, or called by the media, by the time Powell stands up for the post meeting press conference.

In any case, Powell will likely do his utmost to stress the FOMC’s independence from political developments, playing such questions with a ‘straight bat’, no matter how much journalists may probe him on the matter.

More broadly, Powell’s post-decision comments are likely to mirror those that have been issued recently. Namely, there is unlikely to be a pre-commitment to a particular rate path, with Powell instead reiterating that the FOMC will move policy to neutral “over time”, and that the speed of said journey will hinge on incoming data. In terms of the dual mandate, risks to achieving each goal are likely to remain “roughly in balance”, though the FOMC’s implicit reaction function from here on in hinges more on labour market developments, given the prior stated desire to avoid any further weakening in employment conditions.

For financial markets, the timing of the November FOMC also poses issues, particularly if an election result is not known by the time the announcement crosses news wires. In any case, with the USD OIS curve appearing to be priced too hawkishly, scope for USD upside remains, particularly with the economy continuing to vastly outperform peers from a growth perspective. Meanwhile, for equities, the November meeting will do nothing to remove the ‘Fed put’ which continues to backstop sentiment, in turn keeping dips relatively shallow, and continuing to present buying opportunities.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.