- English

- 中文版

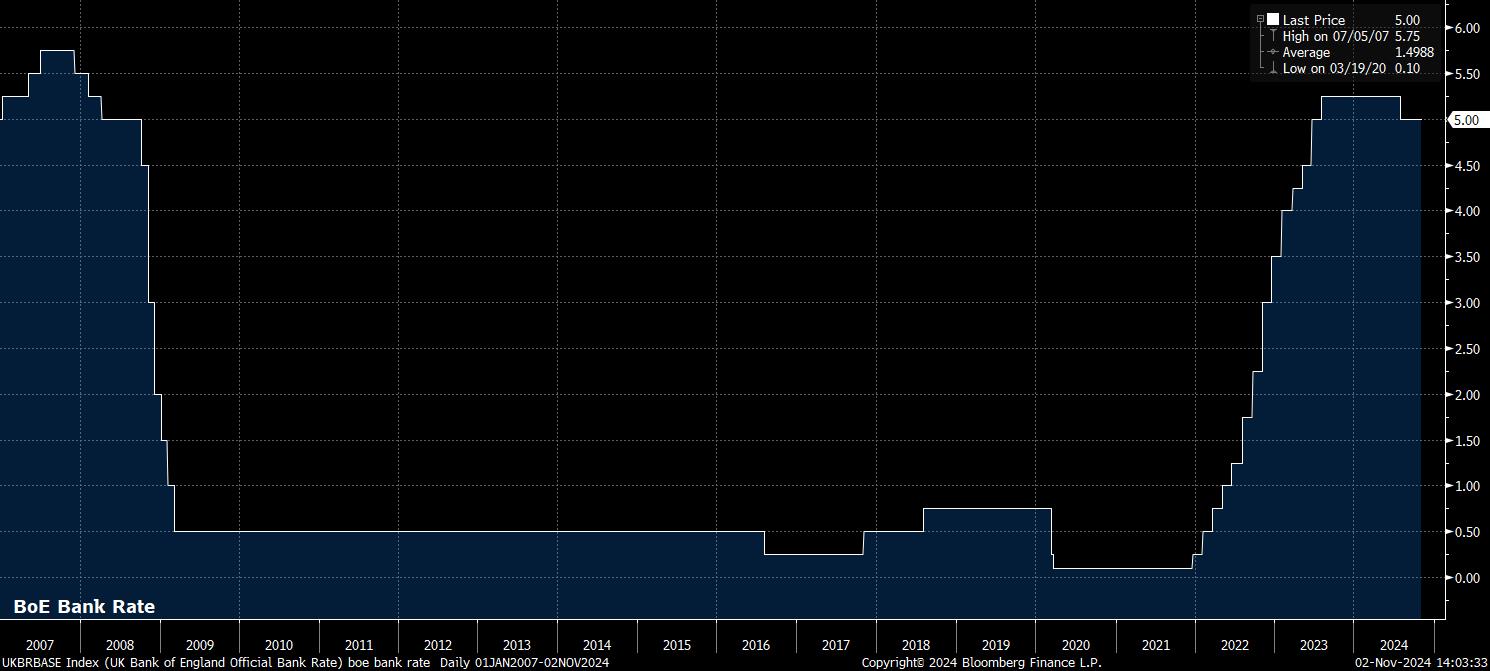

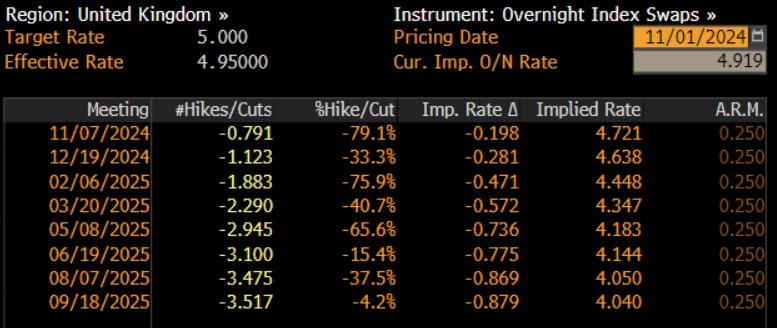

As noted, the MPC are set to deliver a 25bp cut at the November meeting, taking Bank Rate to 4.75%, and marking the second cut of the cycle, after the first delivered in August. Money markets, per the GBP OIS curve, imply around an 80% chance of such action, though price just a 10% chance of another such 25bp cut before the end of the year.

In contrast to the August cut, which was voted through by a 5-4 majority, the narrowest possible split on the 9-member MPC, the November decision is likely to be considerably more clear cut. Our base case is for an 8-1 vote in favour of a 25bp cut, with only external member Mann dissenting in favour of holding Bank Rate steady, given some hawkish commentary made a fortnight ago.

There are two-sided risks around that base case, however. External member Greene may also dissent in favour of keeping Bank Rate steady, given her recent remarks in favour of a “cautious, gradual” approach to monetary easing. Meanwhile, on the dovish side of the coin, external member Dhingra could vote for a larger 50bp move, cementing her place as the most dovish of all MPC members.

The matter of policy guidance, though, is somewhat more straightforward. Here the statement is likely to be a broad reiteration of that issued after the September meeting, noting that policy must remain “restrictive for sufficiently long”, and that the Committee will continue to take a data-dependent, and meeting-by-meeting approach to determining the appropriate stance of policy.

It would be highly unlikely, particularly in light of the October Budget, for the statement to contain any overtly dovish shifts, with Governor Bailey’s recent comments about the possibility of the Bank being “a bit more activist” in delivering rate cuts having aged rather poorly, after recent fiscal developments.

It remains to be seen the degree to which the aforementioned Budget announcements are accounted for in the projections unveiled as part of the updated Monetary Policy Report, with just one working week between Budget Day, and the MPR being released. In any case, the Budget delivered a fiscal loosening to the tune of around 1.2% of GDP in 2025, with £40bln of tax hikes being compared to almost double that magnitude of increased spending, a considerable degree of which will, obviously, need to come from greater amounts of government borrowing.

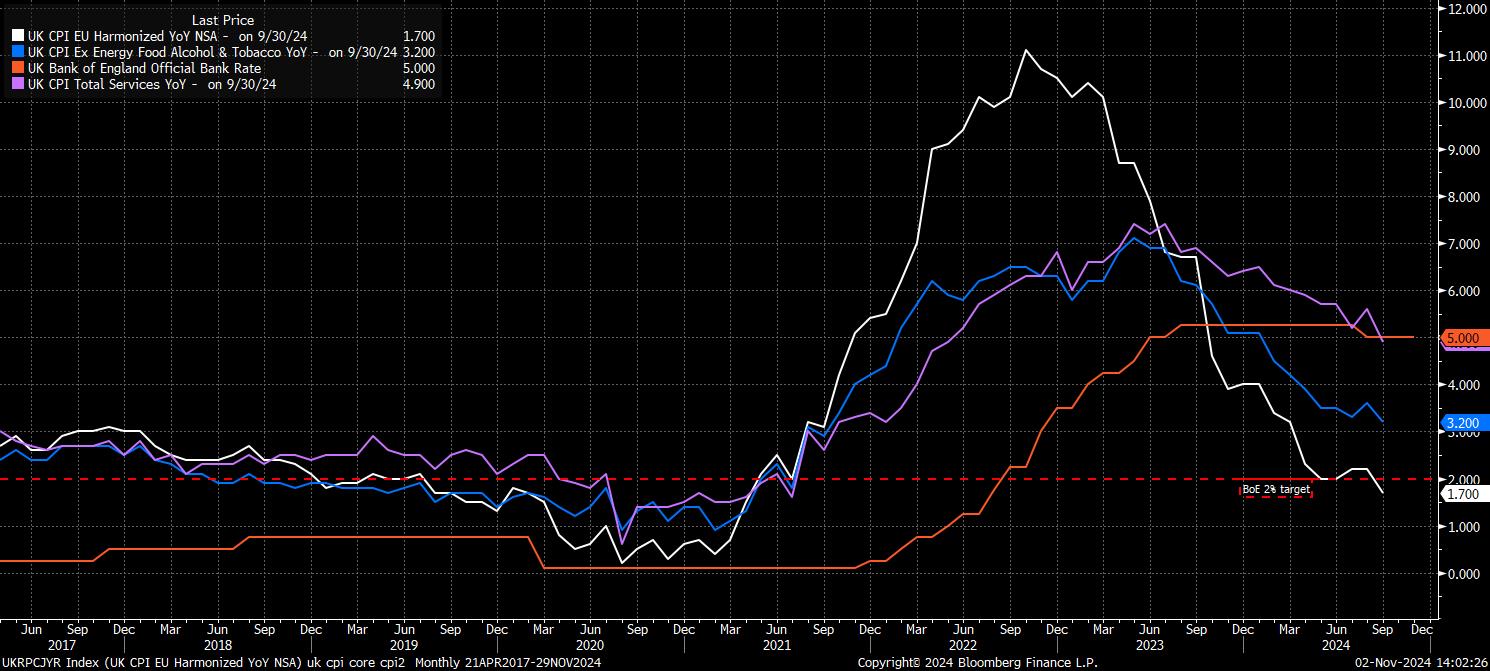

All else equal, the Budget should therefore have inflationary implications across the forecast horizon. While the OBR’s forecasts did not see the 2% inflation target being achieved until 2029, the latest MPR forecasts will probably still see headline CPI falling below 2% within the next 2 years, at least based on modal assumptions. Of course, it is not only the Budget that has inflationary implications, but also the considerably more dovish rate path that GBP money markets now discount compared to the prior forecast round in August.

Despite that, headline CPI did fall to a more than 3-year low in September, at 1.7%, while the core and services CPI metrics also notched fairly substantial declines. This is likely to give MPC policymakers increased confidence that inflation is on track to sustainably return to the 2% target, and may well see a degree of greater optionality over the potential for faster rate cuts introduced via the meeting minutes.

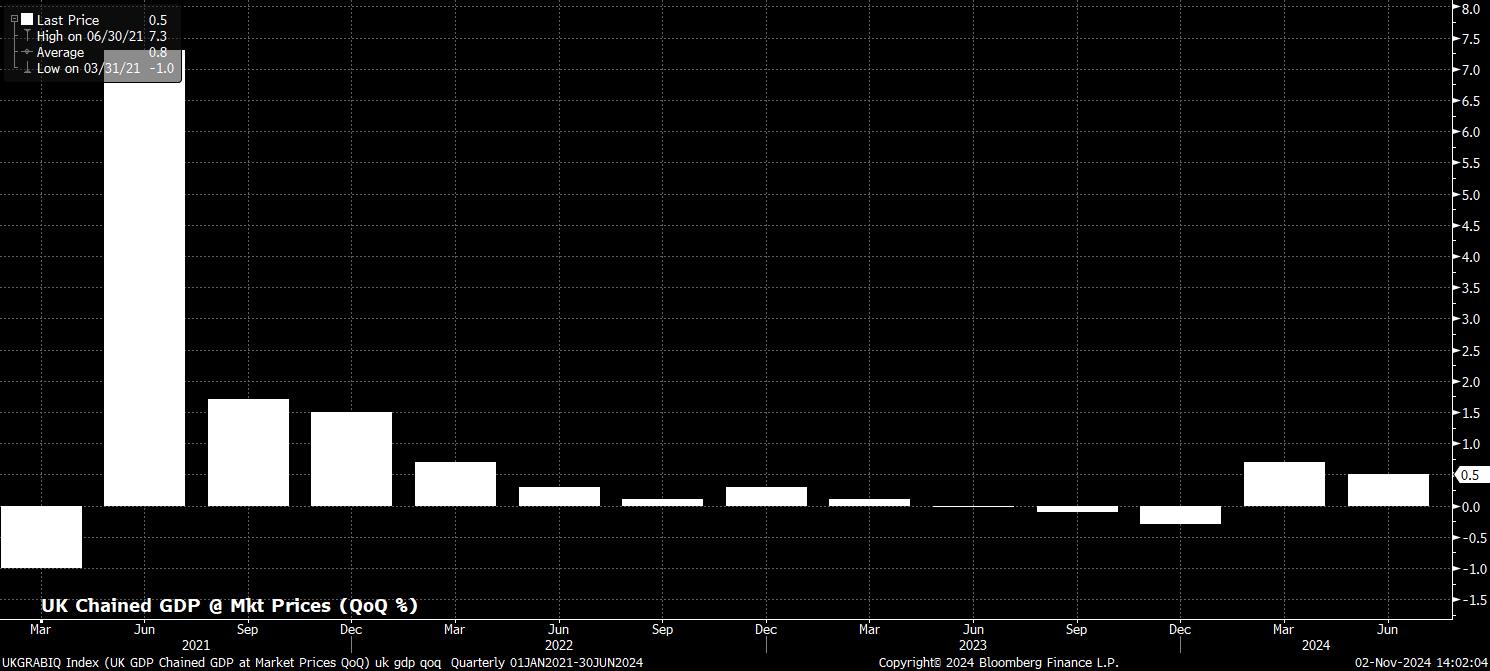

Meanwhile, the MPR’s GDP growth forecasts may also be revised a touch higher, with recent GDP growth figures having proved stronger than expected, while the front-loaded nature of additional government spending in the October Budge will also provide a near-term boost to GDP growth.

YoY growth is likely to be revised around 0.2pp higher in the next couple of years, before tailing off a little towards the back end of the forecast horizon.

As for unemployment, there remains little use in the forecasts, particularly when the ONS are still unable to produce an accurate and reliable headline unemployment rate figure, given ongoing data quality issues with the Labour Force Survey. Hence, employment developments continue to play little role in the MPC’s thinking, with inflation instead remaining the primary determinant of both the pace, and magnitude, of future policy shifts.

On this front, with the Budget having brought with it clear upside inflation risks, it seems likely that the November cut will be the Bank’s last in 2024, with a quarterly pace of 25bp Bank Rate cuts most likely to be followed for now.

At the post-meeting press conference, Governor Bailey is highly unlikely to explicitly commit to any pre-determined path of policy normalisation, instead sticking resolutely to the data-dependent approach with which market participants have now become familiar. There will also be extra incentive for Bailey not to ‘rock the boat’, given the adverse Gilt market reaction to the Budget, and huge uncertainties which come with the presidential election, being held just two days prior to the BoE decision.

The next Bank Rate cut, then, is unlikely to be delivered before the February 2025 meeting, by which time the dust will likely have settled on the dramatic change of fiscal tack domestically, while greater certainty will also be known when it comes to the US political backdrop. From that point onwards, if incoming inflation figures continue to fall in line with, or better than, the MPC’s latest projections, a faster pace of easing becomes more likely.

For the GBP, the November MPC decision seems unlikely to be a game-changer. As noted, a 25bp cut is all-but-fully discounted by the market curve, while the BoE are unlikely to aggressively lean into the idea of another cut before year-end, removing some potential for a dovish surprise. Furthermore, given the timing of the decision, sandwiched between the US election, and an FOMC decision, conviction among market participants is likely to be lacking, potentially further sapping BoE-linked volatility.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.