- English

- 中文版

No communication issue at the RBA: A Rate Cut in August is Good to Go

It is very rare for rates traders to price a 90%+ probability for a change in a central bank’s policy setting and to then be surprised by the outcome.

There’s a reason for this… if a central bank is seen as responsible for raising expectations for a cut through its forward guidance, then by not delivering on that perceived outcome risks it’s credibility and losing the effectiveness of forward guidance as a policy tool.

In the limited sample of cases where a central bank has gone against such high conviction in market pricing, this is typically a central bank wanting to inject uncertainty and volatility into interest rate pricing. Alternatively, it’s because of a poor communication strategy and not being aligned with markets.

Do the RBA have a communications issue?

In the case of the RBA’s surprise decision to keep the cash rate at 3.85%, many have been quick to opine that the RBA has a guidance and communication problem and is not in sync with the markets.

I disagree with this call, and while I had expected a rate cut, I think the RBA can easily justify its call to leave rates unchanged, and the bank’s guidance that was not the issue.

There is little doubt, though, that market players would have learnt some important lessons about how much weight the RBA ascribes towards market expectations in their policy settings.

Traders would have now had a strong distinction in how the RBA communicates to markets and guides expectations relative to that of the Fed or the ECB - institutions which welcome their central bankers speaking frequently and who provide explicit guidance on how they will vote in the upcoming policy meeting.

Relatively speaking, the RBA takes a much more nuanced and often vague approach in its policy guidance. This was true going into the July RBA meeting, and while market expectations were high, that pricing wasn’t because of any explicit guidance from the RBA.

Some will argue that the RBA’s failing was more than that they simply failed to push back on elevated market expectations for a cut. Gov Bollock addressed this very consideration in the presser, detailing it “inappropriate to try and influence the market before a decision”.

Timing vs direction

By way of new forward guidance, Gov Bullock detailed in her presser that the call on rates was more about “timing rather than direction”. In RBA speak, this is as defined as we will hear from a bank that has a history of being vague, but it also offers some belief that the bar to cut in the August RBA meeting is low.

The RBA should cut in August

The RBA did mention that they wanted to hold off and wait for the Q2 CPI data (30 July) to offer the visibility to take rates closer to neutral. The RBA forecast Q2 inflation (trimmed mean) at 2.6% y/y, and while Gov Bullock stressed the bank hasn’t got defined levels that would see them hold off from cutting in August, Bullock’s use of “timing” suggests some degree of cushion against a hotter-than-feared CPI print.

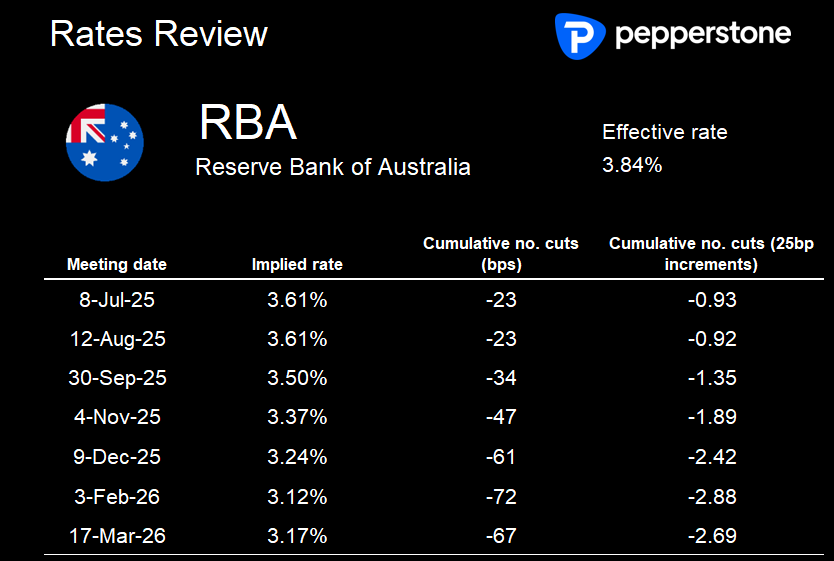

Aussie swaps price an 89% probability that the RBA cut in August – that implied probability will move dynamically to changes in market sentiment and the outcome of key economic data. However, if the June employment data (released 17 July), and Q2 CPI (30 July) don’t run too hot, then we could be back in a situation of markets going into the August RBA meeting with high expectations of cut – of course we can’t rule out another surprise, but traders will be more prepared this time around.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.