- English

- 中文版

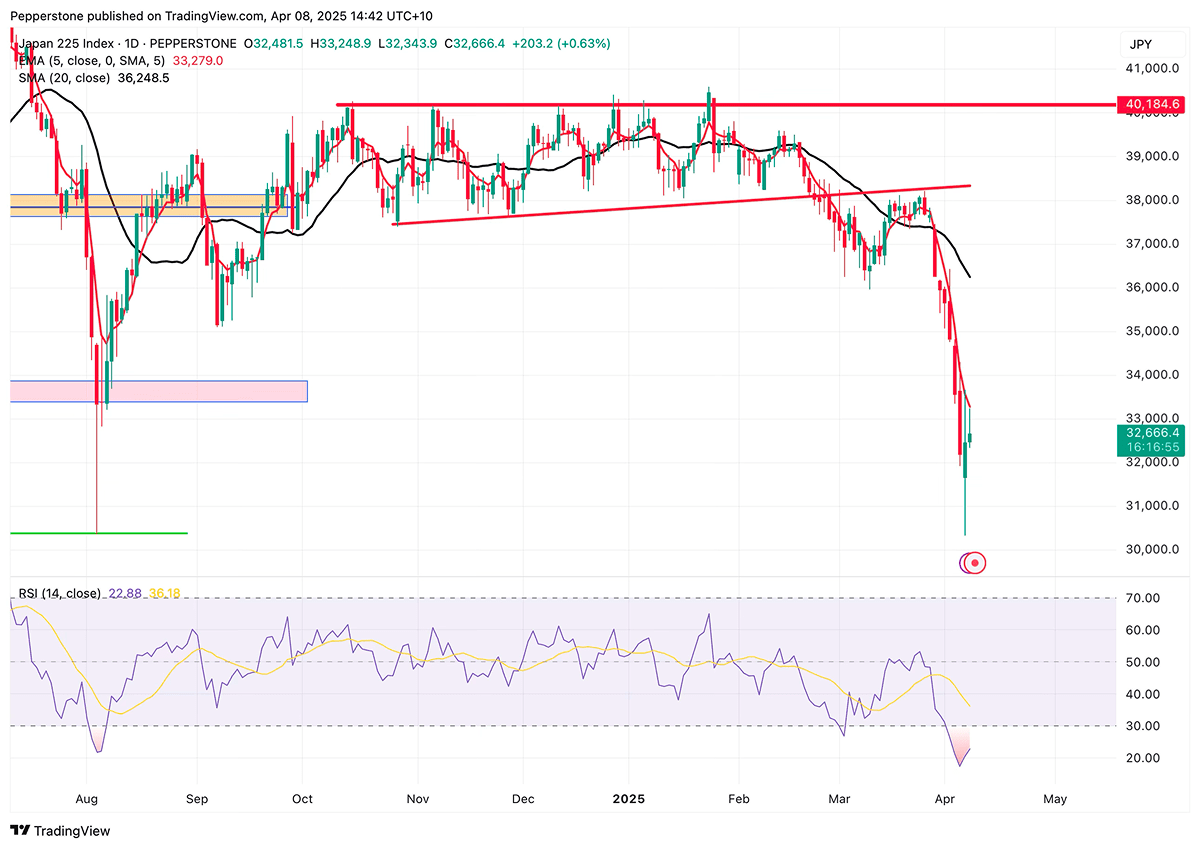

Nikkei Rebounds: More of a Short-Term Correction than a Trend Reversal

.jpg)

On Monday, the Nikkei briefly dropped below 31,000 points, marking its lowest level since August 2024 and triggering a circuit breaker. Since its peak on March 26, the index has corrected by more than 20%, officially entering a technical bear market.

While there has been a bounce-back, with the index now hovering above 33,000, this looks more like a short-term correction driven by technical overselling, rather than a signal of a full trend reversal. In the medium term, there is still no significant improvement in the underlying fundamentals or policy outlook, and the market remains clouded by high uncertainty.

The sharp drop in the Nikkei reflects the increasing external pressures, especially the recent tariff decisions from the U.S. The trade tensions between the U.S. and China have escalated much faster than anticipated, and concerns about a slowdown in the U.S. and global economies have intensified. This has triggered a broader sell-off in Asian assets and increased fears about the global economic outlook.

Meanwhile, President Trump's 24% tariff on Japanese goods—well above the 10%-20% range previously expected—has delivered a significant blow to Japan's export-driven economy, especially in sectors like automotive and semiconductors. The 25% tariff on car imports has caused a sharp decline in Japanese car stocks, further dragging down the broader market.

Although the White House has granted tariff exemptions for certain pharmaceuticals and semiconductors, the chip sector remains under pressure, which clearly signals that investors are focused on the broader policy direction, rather than isolated exceptions.

In addition, the yen's appreciation, driven by increased demand for safe-haven assets, has squeezed exporters' profit margins. The Nikkei's pullback is not just a short-term emotional reaction but a reassessment of earnings expectations for key industries.

Of even greater concern is Japan's own economic fragility. PMI data for March showed declines in both manufacturing and services, pointing to a broader trend of slowing economic growth. The latest Tankan survey from the Bank of Japan revealed a sharp drop in confidence among major manufacturing firms, while non-manufacturing sectors have found some support from tourism and cost pass-through. This uneven economic performance makes the Bank of Japan's policy decisions even more complicated.

Despite a surge in three-year inflation expectations to a record 2.4% and rising wages—factors that could theoretically support a rate hike by the BoJ—Trump's tough tariff policies could continue to weigh on Japan's manufacturing sector, prompting the BoJ to delay any interest rate hikes and push back its normalization timeline.

Japan seems to be actively engaging with Trump in an effort to ease tariff pressures, but recent comments from White House advisor Peter Navarro have done little to boost market sentiment. He stated, "Reducing tariffs to zero in Vietnam means nothing to us – we care about non-tariff barriers." This suggests that even if Japan makes concessions on tariffs, it may struggle to achieve substantial benefits, which only increases market unease.

From a market perspective, the Nikkei's correction is not just about concerns over the U.S.-Japan trade conflict but also highlights growing awareness of Japan's risks of stagflation and limited policy flexibility. If tensions ease, the Nikkei could experience a more sustainable rebound. However, if trade disputes escalate further and Japan's domestic growth continues to slow, the index may face additional downward pressure in the medium term.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.