- English

- 中文版

WHERE WE STAND – Friday was, unsurprisingly, a pretty dull day for financial markets, with Independence Day seeing US desks shut, and little going on elsewhere.

As always, any market moves seen on a public holiday, especially a US one, need to be taken with a huge pinch of salt, given the incredibly thin conditions in which they take place. Conditions which, typically, exacerbate even the smallest of moves, leading to a tendency for some to be blown out of all proportion.

In any case, despite equity futures finding some downside on both sides of the pond, the bull case remains intact, especially on Wall Street. Thursday’s jobs report spoke to the continued resilience of the economy, which in turn should see the pace of earnings growth remain strong, while continued progress towards trade deals, and cooler rhetoric, helps to provide further support. The path of least resistance continues to lead to the upside.

On the subject of trade, probably the most interesting development has been President Trump’s promise to soon send out letters informing countries of the tariffs that they will have to pay, if they are unable to reach a trade deal with the US. Of course, this comes as the ‘Liberation Day’ tariffs are due to go back into effect on Wednesday, as the pause implemented in early-April expires. While the US has agreed just 2 trade deals (UK & Vietnam) in that time, far short of the ’90 deals in 90 days’ that we were promised, I don’t think there’s too much reason to panic.

Not only have the Trump Admin shown, numerous times, that they are unwilling, unable, or both, to stomach super-high tariff levels akin to a trade embargo, even those letters give plenty of wriggle room. Not only are they being sent before the pause expires, but the tariffs in said letters won’t actually come into effect until 1st August. Hence, this has all the hallmarks of another ‘escalate to de-escalate’ strategy, teeing us up nicely for another TACO moment in pretty short order.

Besides that, the weekend’s most interesting development came in the crude space, with OPEC+ agreeing a larger than expected 550k bpd output hike from August. Clearly, the focus here remains on the ‘war for market share’ idea that I’ve been talking about in these notes for some time, with Saudi likely also seeking to punish some producers for non-compliance.

Anyway, from a market perspective all this means one thing – downside for crude benchmarks. The market was already over-supplied, amid a dour demand outlook, now OPEC+ are bringing back more barrels, at the same time as the Trump Admin seek to ramp up the ‘drill baby, drill’ agenda. It’s tough to build a sustainable bull case for crude against that backdrop.

I also find it tough to build a durable bull case for the dollar right now, though for very different reasons. At its core, the greenback remains highly unattractive, with participants focused not on the resiliency of the US economy, nor the FOMC’s relatively more hawkish stance in comparison to G10 peers. Instead, it is the continued erosion of Fed policy independence, and the highly unorthodox style of policymaking in Washington DC, which is giving international investors cause for concern. Capital outflows show no sign of slowing, and with a barren data docket this week, further declines could well be on the cards for the greenback.

I’ve still got 1.20 in the EUR and 1.40 in the GBP pencilled in as medium-term targets. While neither are exactly bastions of political stability right now, both continue to be viewed as safer, and more predictable, options than sitting in the buck – the Swissie fits this bill too, incidentally, though with the SNB lurking, longs here are harder to have conviction in.

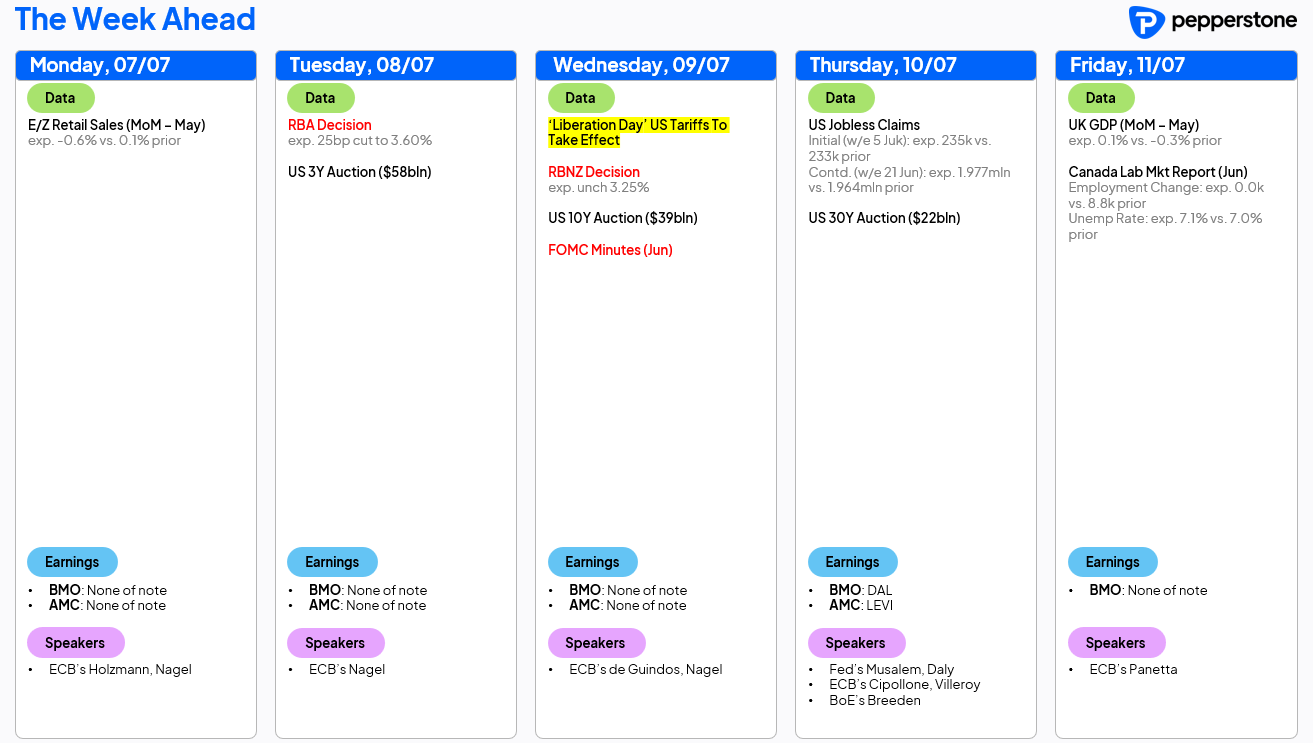

LOOK AHEAD – The week ahead docket is pretty sparse (see below), meaning focus will almost certainly fall on what feels like an inevitable deluge of trade- and tariff-related headlines as we move through the week ahead.

As for scheduled events, though, it’s very slim pickings. The RBA will deliver a very well-telegraphed 25bp cut in the early hours of tomorrow morning, with this set to be followed by the RBNZ standing pat on Wednesday. Minutes from the June FOMC meeting are also due, though with July having now become a nothingburger, these probably won’t be worth worrying about.

On the data front, Friday’s monthly UK GDP data is too noisy to be of any use, while the weekly US jobless claims data, and Canadian employment stats, will probably get a cursory glance, and little else.

There is, though, a fairly chunky week of Treasury supply on deck, with 3-, 10- and 30-year sales due. The latter two are likely to be of particular interest, especially with fiscal jitters remaining in light of the ‘One Big Beautiful Bill’ having been signed into law on Friday. Were one, or both, of those sales to be poorly received, fears over the unsustainable trajectory of US debt will be re-ignited once more.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.