- English

- 中文版

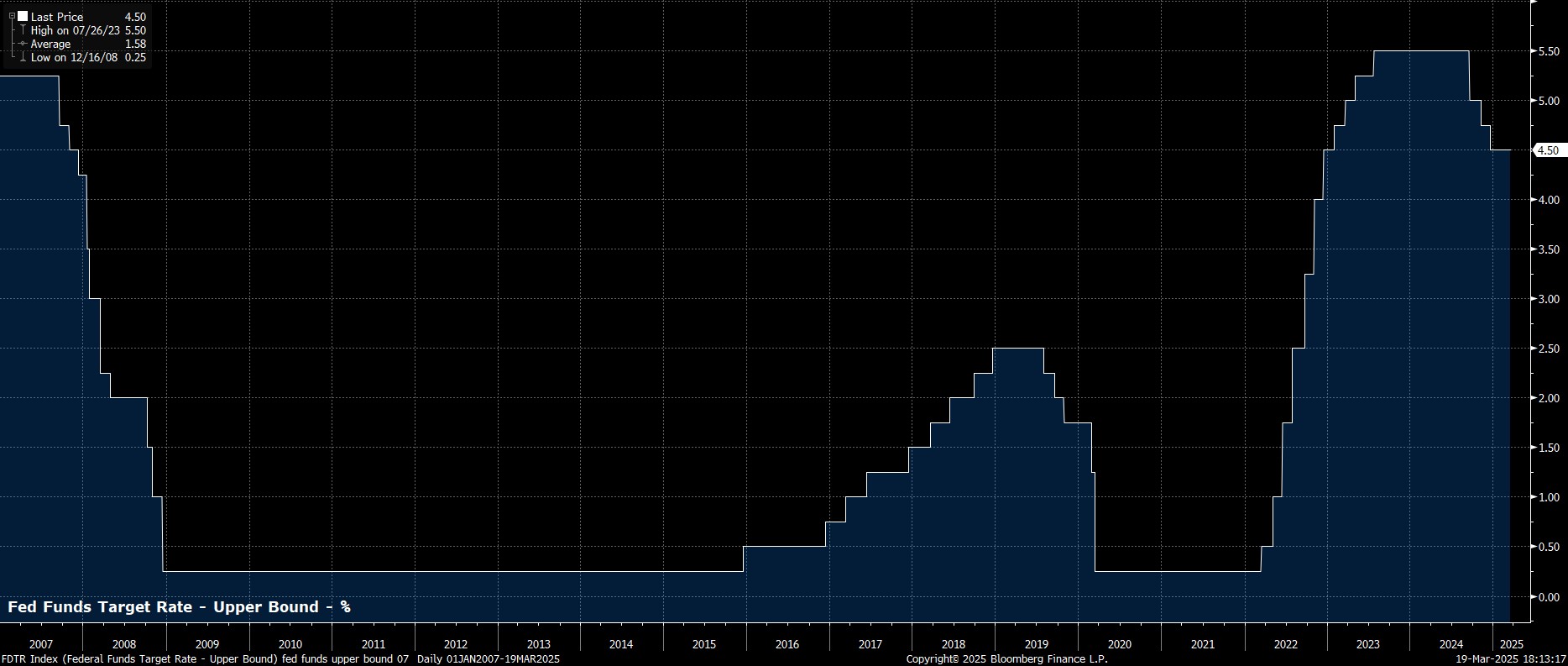

In line with both consensus expectations, and market pricing, the FOMC maintained the target range for the fed funds rate at 4.25% - 4.50% at the conclusion of the March meeting, via a unanimous vote among policymakers.

Such a decision continues the pause which begun at the prior meeting, in January, and allows policymakers to take stock of both the lagged impacts of last year’s steps back towards a more neutral policy stance, and time to digest the effects of the Trump Administration’s policies, and the uncertainties that have recently been introduced to the economic outlook.

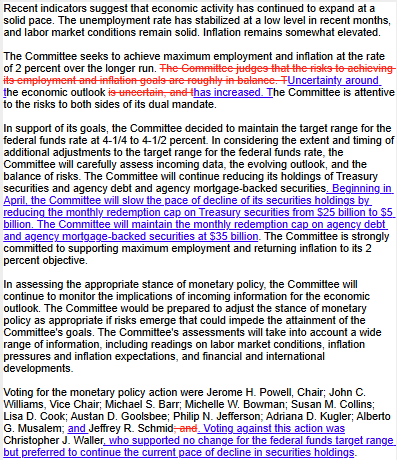

Accompanying the decision to hold rates steady was a policy statement that was contained some notable revisions compared to that issued last time around.

Consequently, the Committee noted that, while the economy continues to expand at a “solid pace”, and that inflation remains “somewhat elevated”, uncertainty around the outlook has “increased”. In light of this, the statement notably removed reference to risks around the dual mandate being “roughly in balance”, as had been flagged in January.

The statement also included a notable change on the balance sheet, with the pace of quantitative tightening (QT) set to slow from April, as monthly Treasury redemptions fall to $5bln, from the current $25bln. This is likely a reflection of not only increasing economic uncertainty, but also the looming debt ceiling. This shift could be a boon for long-end Treasuries, and might be interpreted as a nod to the Trump Admin, with a full end to balance sheet run-off probably now coming at the May meeting.

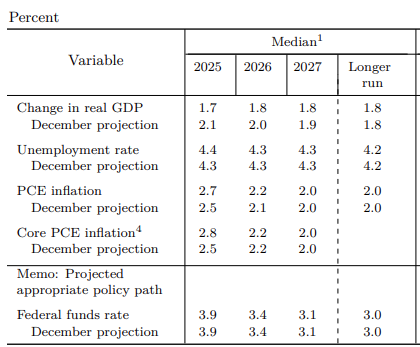

In addition to the updated policy statement, the March confab also saw the release of the Committee’s updated Summary of Economic Projections (SEP), including the key ‘dot plot’.

The latest round of economic projections is outlined below, though the major takeaway is a higher inflation profile, and slower growth trajectory, both being a reflection of increased uncertainties in the outlook, as well as the Trump Administration's protectionist trade policies. Still, headline PCE is seen falling back to the 2% target by the end of the forecast horizon.

It is, however, important to note that these forecasts could well have a relatively short shelf-life, and that conviction among policymakers behind the figures that they’ve pencilled in is likely to be relatively low, given the huge degree of prevailing economic uncertainty, and the ever-changing of the Trump Administration’s trade policies.

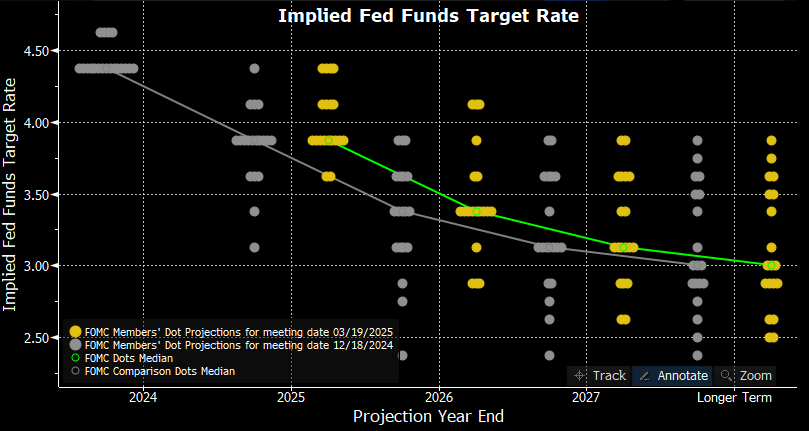

In light of these forecast changes, the updated dot plot pointed to more hawkish risks around the rate path, but the median rate expectation ultimately remaining unchanged. As such, the dots still signal 50bp of cuts both this year and next, with the “longer-run” dot – a proxy for the neutral rate – still pencilled in at 3%.

After all of that, focus turned to Chair Powell’s post-meeting press conference.

At the presser, Powell largely stuck to what is now a familiar script, noting that the FOMC need not be in a hurry to adjust their policy stance, with the Fed “well positioned” to wait for greater clarity, amid the “unusually uncertain” economic outlook. Unsurprisingly, Powell also distanced the Committee from their dot plot, stressing that policy is not on a “preset course”, and that the process of forming the dots was “challenging” given prevailing uncertainty.

On inflation, Powell noted that price pressures have begun to increase due to tariffs, and that it is “too soon to say” whether the Committee will entirely look through this, even if the base case is that inflation will prove “transitory”. Worryingly, we’ve all seen a movie with that name before.

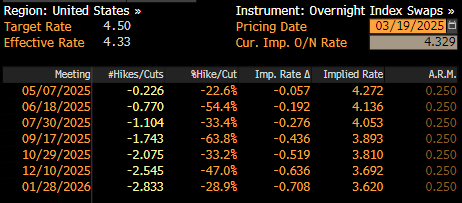

As participants digested this deluge of information, market-based rate expectations were broadly unchanged, with the next cut still fully discounted by the July meeting, and around 60bp of easing priced by year-end, just a modicum more dovish than the path priced pre-meeting.

Stepping back, the March FOMC meeting is not one that will go down as a game-changer in terms of the broader policy outlook. Unsurprisingly, policymakers are having about as much difficulty in assessing, and forecasting, the economy as every other market participant which, with the economy remaining in a good place, and risks to the dual mandate broadly balanced, results in them seeking to ‘play for time’.

For the time being, the bar for any rate reductions being delivered in H1 remains a relatively high one, even if the direction of travel for rates clearly remains lower. To take further steps back towards neutral, however, policymakers will want to not only obtain a greater degree of confidence in the economic outlook, but also see further concrete progress back towards the 2% price target.

That said, amid the emergence of renewed potential upside inflation catalysts, risks around the policy outlook remain considerably more two-sided than in the last couple of years. As such, market participants will have to continue to operate without the comfort blanket of a ‘Fed put’ for the time being. This, in combination with the chaotic nature of policymaking in the Oval Office, should see cross-asset volatility remain elevated, while also leaving equity rallies as selling opportunities.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.