- English

- 中文版

Macro Trader: The US Has Almost Made A ‘Soft Landing’

If there’s one thing the economist profession loves more than almost any other, it’s aviation analogies.

Since the start of the current cycle, as the world emerged slowly but surely from the covid pandemic, folk have spent an inordinate amount of time discussing the possibility of a hard, or a soft landing for the economy, as well as scenarios where the economy perhaps makes no landing at all, and the expansion simply carries on. We’ve also seen the aviation analogies stretched to tenuous extent, with some discussing how policymakers are ‘foaming the runway’ for such a landing to take place, by gradually removing policy restriction.

One must hope that, soon, we will be at a point where we can forget all of these analogies, and speak a more typical brand of English once more. Until then, though, allow me to indulge the idea of a ‘soft landing’, as the data points to the US economy being within inches of achieving this much vaunted situation, where inflation is brought under control, without causing collateral damage to the economy at large.

On inflation, the last 18 months or so have brought about a sustained fading of price pressures across the US economy. Headline inflation, per the CPI metric, peaked just north of 9% around 2 years ago, and has been on a steady – if at times bumpy – downtrend ever since. Core CPI, excluding the volatile food and energy components, has also faded from its own 6.6% peak, with both metrics now standing at a level which, given the current trajectory, gives policymakers and market participants alike confidence that the 2% inflation target will be sustainably achieved over the medium-term.

Meanwhile, the labour market remains in rude health. While the pace of headline nonfarm payroll growth has slowed somewhat in recent months, the 12-month average of job gains remains north of 200k, just shy of the breakeven pace required for job growth to keep up with expansion in the size of the labour force, and a level broadly consistent with the latter stages of recent economic cycles.

Furthermore, unemployment has remained low, with headline joblessness now standing at 4.1%, and having averaged 3.9% over the last 12 months. Both of those figures being around levels that the majority of economists would agree are broadly consistent with a labour market operating at, or close to, maximum employment.

The resilient nature of the labour market, coupled with inflation continuing to fade, has allowed consumer spending to remain solid, helping to support overall economic growth.

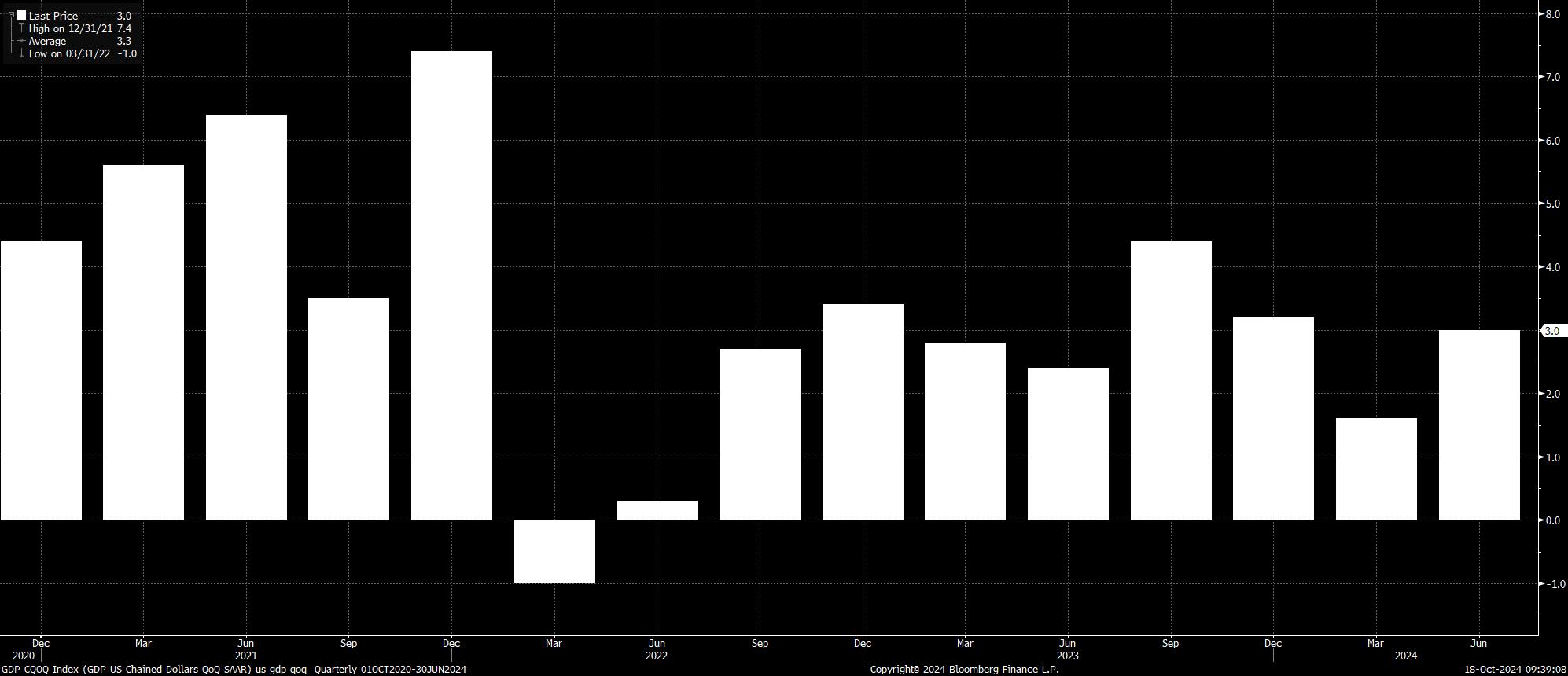

GDP growth is still going gangbusters stateside, with 7 of the last 8 quarters having seen GDP growth of over 2% on an annualised quarter on quarter basis – including 4 of those periods where the economy grew by over 3%. That solid momentum looks set to continue, particularly with the Atlanta Fed’s GDPNow metric, a reliable leading indicator this cycle, pointing to growth of 3.4% annl. QoQ for the three months just gone.

A cross-check of those three metrics, then, suggests that a soft landing might well have already been achieved.

Sadly, I’d recommend not popping the champagne corks just yet, as there is still one crucial piece of the jigsaw to consider.

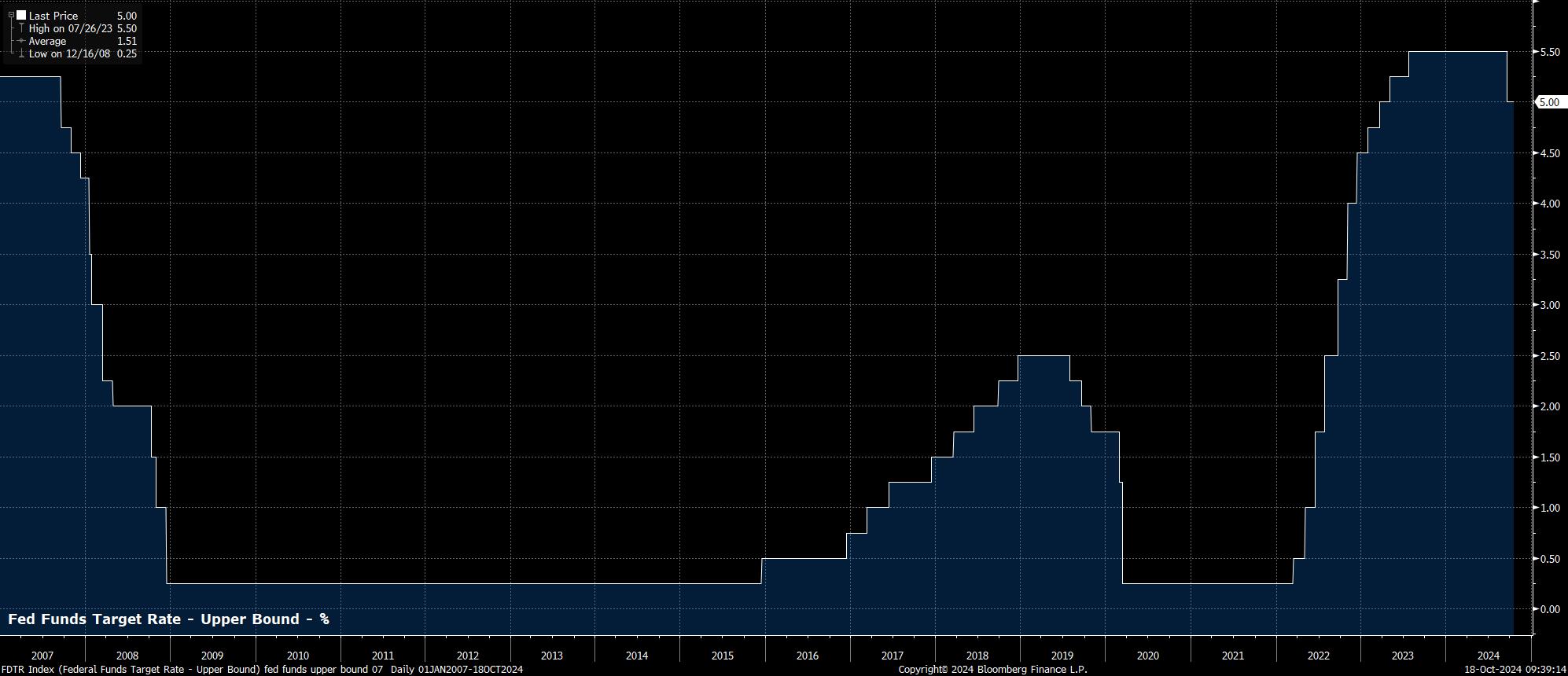

This, of course, is the level of the fed funds rate. While the FOMC delivered a 50bp cuit at the conclusion of the September meeting, and now look set to move back to a neutral policy stance in relatively short order, one must recall that rates remained at a terminal level of 5.25% - 5.50% for 14 months, considerably longer than the average period over the last 4 decades or so.

Furthermore, monetary policy operates with what are famously known as “long and variable” lags, often between 18 and 24 months, meaning that the full impacts of the monetary policy tightening delivered this cycle are not yet known.

Real rates are also an important consideration here, particularly when Chair Powell’s preferred measure of the inflation-adjusted fed funds rate, using one-year inflation breakevens, continues to hover around 4%. Clearly, this is still well inside restrictive territory, acting as a headwind that the economy must overcome. Some risks, on this front, are perhaps already beginning to emerge, particularly after this week brought the biggest WoW decline in mortgage applications since the early days of the pandemic.

That aside, for the time being at least, all indicators point to the US economy being able to safely and securely make that ‘soft landing’ alluded to earlier.

This has, in my mind, three primary market implications:

- Equities should continue to gain ground, with solid earnings growth underpinned by resilient economic growth and consumer spending, with the ‘Fed put’ providing a backstop to risk sentiment

- Treasuries are likely to continue to sell-off at the long end of the curve, which should bear steepen, as growth expectations reprice to the upside, and estimates of the neutral fed funds rate likely also rise

- The US dollar should continue to find favour against most G10 peers, with US growth continuing to vastly outpace that of other DM economies, leaving the market to continue happily residing in the left hand side of the ‘dollar smile’

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.