Analysis

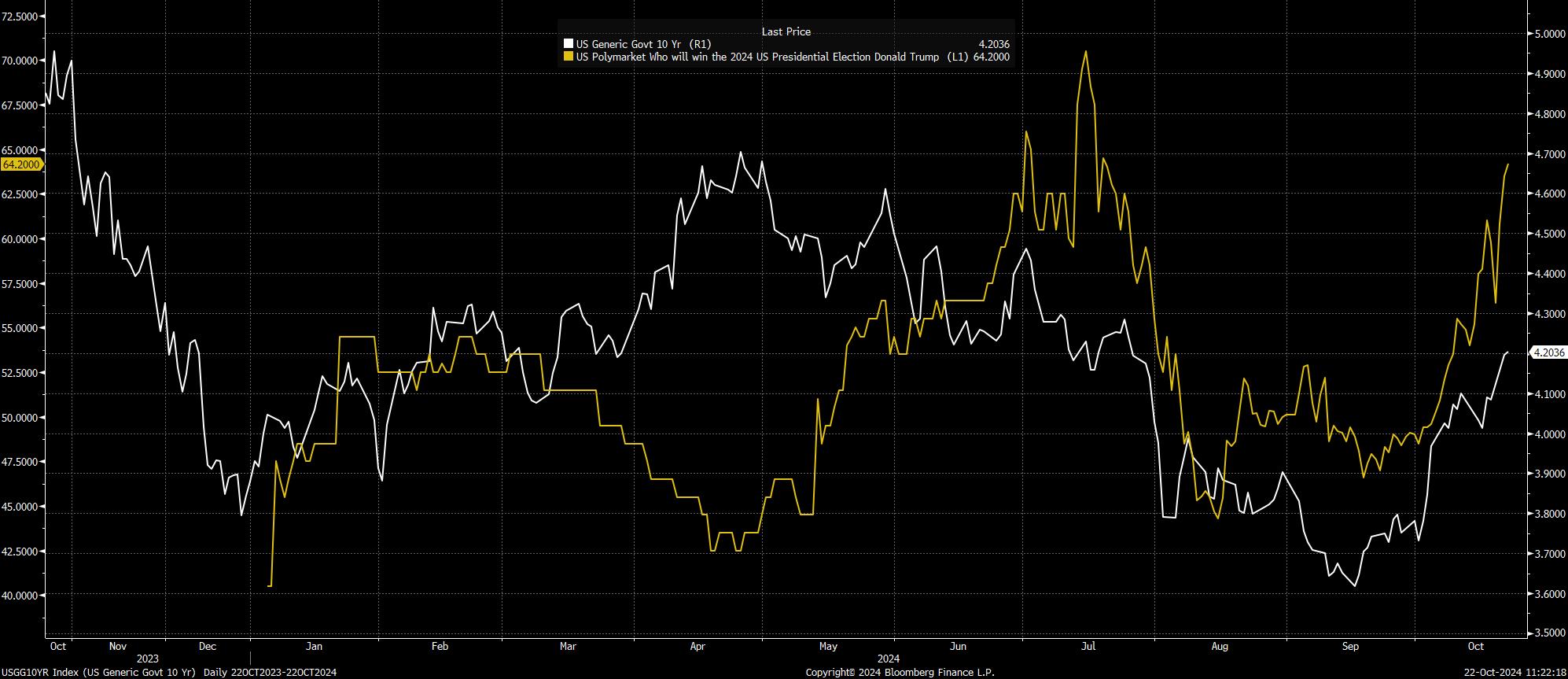

I’m still rather dubious of the whole thesis that expectations of a Trump victory are driving this Treasury downside, even if it does look pretty on a dual axis chart – which we should always be rather cautious of!

There are a couple of things that participants appear to be forgetting here.

Firstly, swing state polls have hardly moved in recent weeks, and in most cases still have Trump and Harris neck-and-neck, well within the margin of error. Extrapolating a definitive signal from these is a tough, if not impossible, ask.

Secondly, there is the fact that long-end yields are not traditionally a reflection of which particular political party inhabits the White House, but are instead a reflection of longer-run growth expectations. To these ends, the recent run of upside surprises in incoming US data releases, helpfully evidenced by Citi’s long-standing economic surprise index, likely has more to do with the recent sell-off than anything else.

There is also the matter of Treasury supply though, as I’ve remarked throughout the election campaign, there is little-to-no significant difference between the two candidates’ fiscal stances, with neither showing any particular concern over the vast amount of government spending, and ballooning federal budget deficit.

Furthermore, on this note, while a Congressional sweep for either party is possible, and more likely for the GOP, it remains likely that control of Capitol Hill will be split. In such an environment, a natural limit will be placed on the fiscal largesse of whoever wins the presidential election.

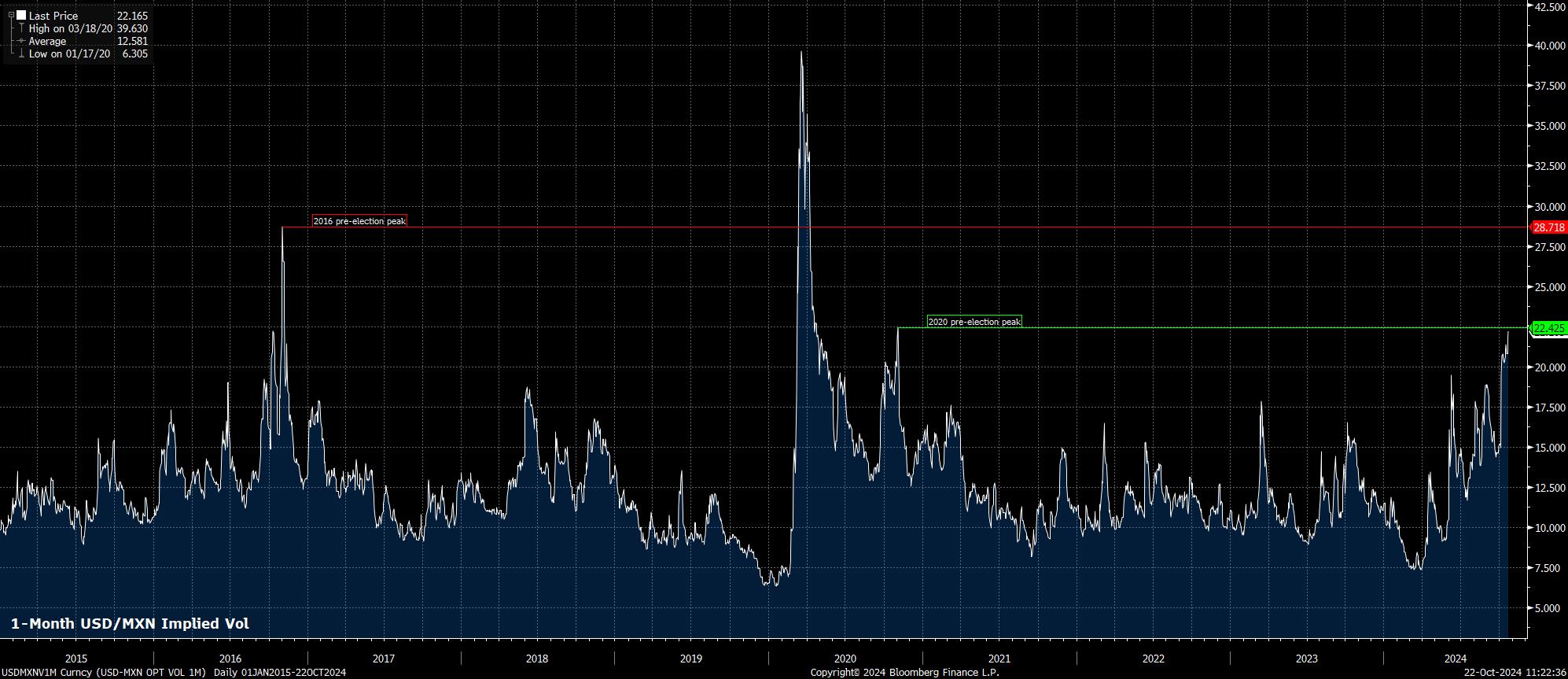

If one is seeking a pre-election ‘Trump trade’, the cleanest expression of the theme is likely to be found in the derivatives space. One-month USDMXN implied vol, for example, remains some considerable distance below the pre-election highs in both 2020, and 2016. Buying vol would be my favoured strategy, over short Treasuries.

That is, though, not to say that the dollar can’t continue to strengthen.

In fact, I remain bullish on the buck for now, particularly as the focus among FX participants has moved away from rate differentials, amid a relatively synchronised pace of policy normalisation among DM and EM central banks, with focus falling back on relative growth differentials instead. In this light, and with the market again happy to reside in the left-hand side of the ‘dollar smile’, it remains tough to bet against the buck over the medium-term, especially considering the anaemic pace of economic expansion seen on this side of the Atlantic, and China’s long-running structural issues.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.