- English

- 中文版

Firstly, some charts, and context.

There’s no better place to start than with a quick look at the FTSE 100 which, frankly, has now gone nowhere for around 18 months, with the index stuck between 7,250 to the downside, and 8,000 to the upside. That 8k handle was, briefly, broken for the first time at the start of last year, leading some to expect momentum to continue to the upside, though it was not long before trade became rather turgid once more, and the market reverted to form, and went back to moving sideways.

_Dail_2024-02-10_13-14-21.jpg)

Of course, the FTSE 100 is an internationally-focused index, hence the traditional inverse correlation it has with the value of the GBP, owing to the value of overseas earnings increasing upon repatriation to the UK as the currency weakens.

A much better measure of domestic equity performance is the FTSE 250. Sadly, this doesn’t bring any cause for positivity whatsoever, with the midcap index having fallen over 20% from the record high printed in mid-2021.

_Dail_2024-02-10_13-14-39.jpg)

Turning back to the FTSE 100, there are many reasons for the recent run of dismal performance. Perhaps the most significant is the composition of the index itself, with over 60% of the index being concentrated in the consumer staples, financials, industrials, and energy sectors. Not only are these some of the worst performing sectors, on a global basis, over the last year or so, there is also a notable absence of technology stocks – which have been booming for the last 18 months – in the FTSE 100.

In fact, the information technology sector has just a 1% weighting in the London benchmark, with just 2 members – Sage Group, and Halma – being present, neither of whom are anywhere near akin to Stateside tech behemoths such as Apple, Alphabet, Meta, etc.

This contrast becomes even sharper when one compares the recent performance of some of the largest stocks in the FTSE 100, and the S&P 500. By now, the ‘magnificent seven’ moniker is familiar, with those seven names – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla – being among the biggest US stocks by market cap, and having propelled Wall Street higher for much of the last year, and vastly outperforming peers.

One can construct a similar basket of the biggest stocks by market cap for the FTSE 100, which results in the following motley crew – AstraZeneca, Shell, HSBC, Unilever, Rio Tinto, BP and GSK. Two healthcare names, two in energy, a bank, a miner, and one in consumer staples. More of a ‘sick seven’ than a ‘magnificent’ one, as the chart below shows.

Clearly, that performance gulf is vast, and only becoming increasingly so, despite the dismal performance of TSLA since the turn of the year pressuring the ‘magnificent seven’ somewhat, with the EV manufacturer down around 20% YTD.

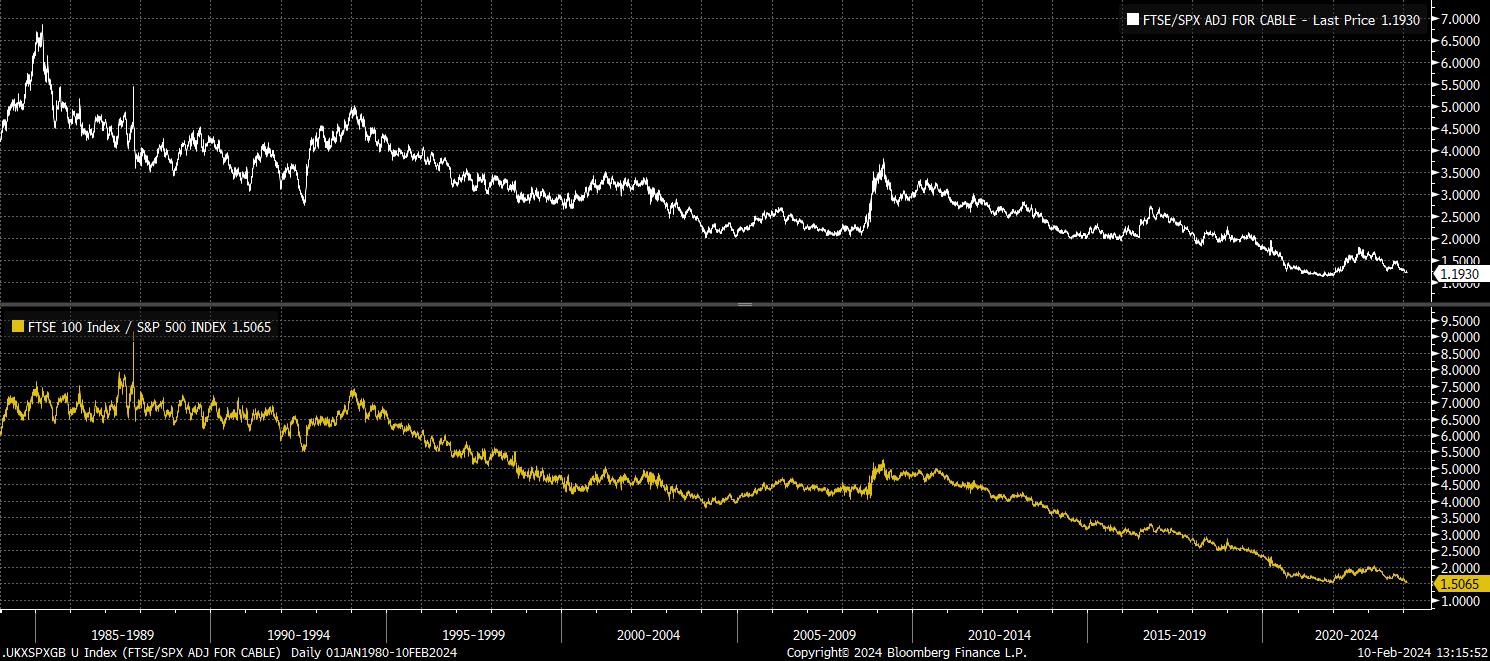

However, such a performance gulf is not only present by handpicking some select stocks, but is also clear at a broad index level. For instance, the FTSE 100 is now at record levels of underperformance against the S&P 500 in both FX-adjusted, and un-adjusted terms.

Given all the ‘doom and gloom’ in this note so far, I would typically try to end on a brighter note.

However, that shan’t be possible, with the outlook for UK equities remaining a rather pessimistic one – cheap valuations alone are not an excuse to be bullish, as the market can surely continue to get cheaper, just look at China for an example of that phenomenon in action. Furthermore, continued anaemic economic growth, including the possibility of the UK having slipped into a mild technical recession at the end of last year, along with a continued stream of institutional outflows are both set to pose continued headwinds.

Perhaps the best opportunity for sustained UK equity upside, a little concerningly, comes from the political realm, with politicians on both sides of the aisle at long last seemingly focusing on the shamefully poor state of the UK market. Proposed reforms to improve the attraction of London as a listing venue, in an attempt to resuscitate the tumbling number of IPOs – just 23 in 2023, a 69% YoY drop – are much-needed, and long overdue. Measures to improve equity demand, including rumoured changes to ISAs, as well as potential efforts to increase investment from pension funds, are also likely to be welcomed by the market.

On the whole, though, this ‘tinkering round the edges’ will do little to fix the long-running structural issues that have dogged the FTSE 100 for some time, such as the index’s ‘old-fashioned’, old economy composition, likely leaving the London market to underperform Wall Street for some time to come.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.