- English

- 中文版

June 2025 UK Jobs Report: Conditions Continue To Cool

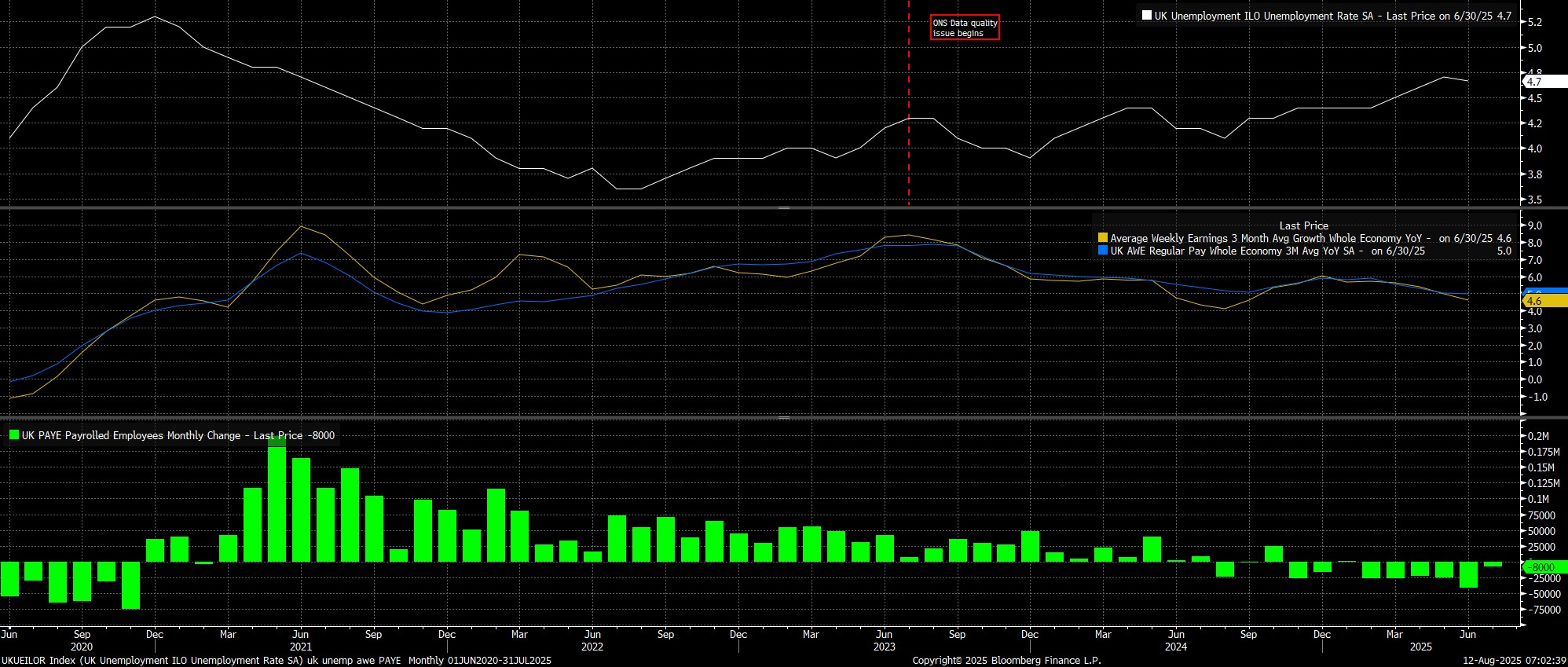

Unemployment, in the three months to June, remained at 4.7%, a four-year high, though data quality issues, which are unlikely to be resolved until 2027, continue to plague the Labour Force Survey.

Meanwhile, earnings pressures continued to moderate. Overall pay rose 4.6% YoY over the same period, the slowest pace since last September, and a touch softer than markets had expected, while regular pay rose 5.0% YoY, unchanged from the pace seen in May. While pay growth continues to moderate, slowly but surely, earnings are still rising at a rate roughly 2pp above that which would be compatible with a sustainable return to the BoE’s 2% inflation aim over the medium-term.

Turning to more timely metrics, the HMRC payrolls figure fell for a sixth straight month, and notched the 8th monthly decline in the 9 months since last October’s Budget. Unsurprisingly, if the cost of employment is increased so significantly, firms have little choice but to reduce headcount, raise prices, or both. That’s something that every man and his dog, apart from Chancellor Reeves or her Treasury team, saw coming a mile off.

Taking a step back, today’s data is unlikely to have a material impact on the near-term BoE policy outlook. After a bitterly divided MPC voted 5-4 to deliver a 25bp Bank Rate cut last week, the bar for further easing is now a significantly higher one, with those 4 hawks squarely focused on signs of easing inflation pressure, as opposed to labour market weakness, in determining when they may be comfortable voting for another rate cut.

That said, with the MPC having retained its ‘gradual and careful’ guidance, there remains a clear preference for regular, quarterly rate reductions, if conditions allow. For the time being, my base case still has the next 25bp cut pencilled in for November, though there is a long way to go, and a lot of data to come, before then.

In the meantime, given waning momentum, and further headwinds in the form of likely additional tax hikes in this autumn’s Budget, risks to the employment backdrop remain firmly tilted to the downside.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.