- English

- 中文版

June 2025 FOMC Review: Powell & Co Stay In ‘Wait & See’ Mode

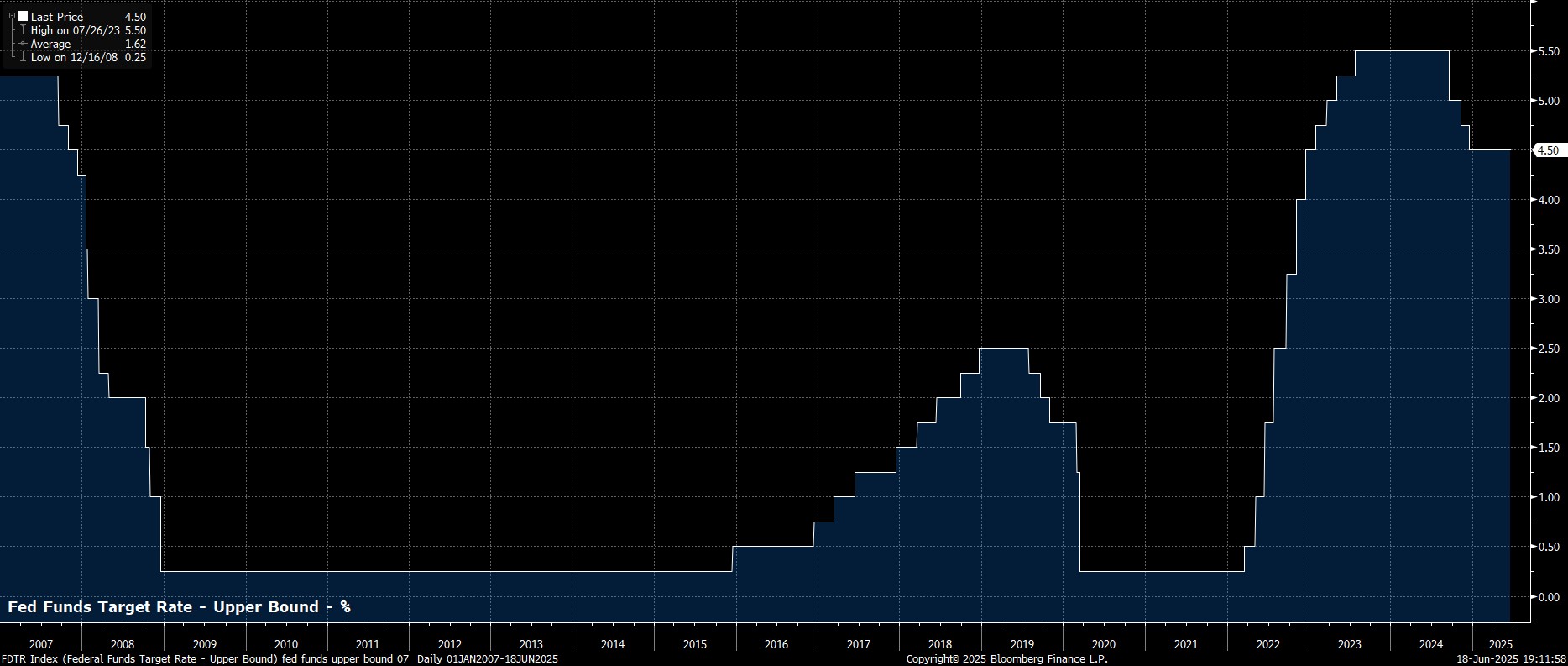

As expected, and as had been fully discounted by money markets, the FOMC maintained the target range for the fed funds rate at 4.25% - 4.50% at the conclusion of the June meeting, in what was a unanimous vote among Committee members.

Such a decision marks a continuation of the FOMC’s longstanding ‘wait and see’ approach to policy, as policymakers continue to assess how the Trump Administration’s policies, particularly in terms of tariffs, and associated uncertainty, are shifting the balance of risks to either side of the dual mandate.

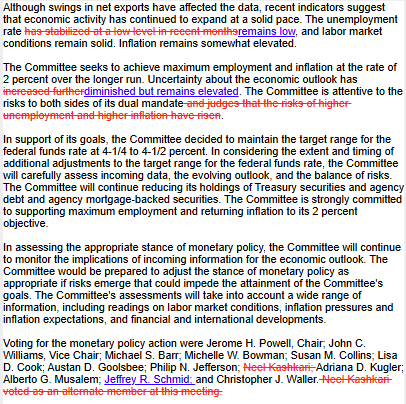

Alongside the decision to hold rates steady, the FOMC also released their updated policy statement.

This was, barring some minor housekeeping, largely a ‘carbon copy’ of that issued last time out, with the Committee again noting that economic activity continues to expand at a ‘solid pace’, that the labour market remains ‘solid’, and that inflation is still ‘somewhat elevated’.

Along with this, unsurprisingly, the FOMC again alluded to the ‘elevated’ degree of uncertainty which continues to cloud the outlook, though removed reference to the rising risks of the dual mandate goals coming into conflict, presumably because said risks have stabilised at a high level, not because they’ve entirely gone away.

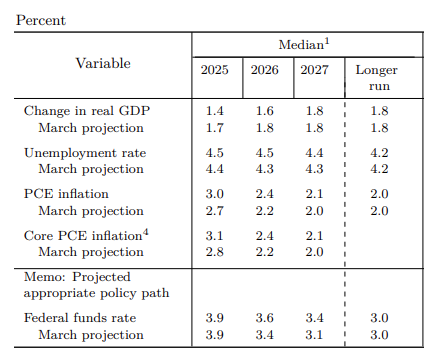

As well as the revised policy statement, the June confab also saw the release of the FOMC’s quarterly Summary of Economic Projections (SEP).

The SEP, which is again likely to have a relatively short shelf-life given the huge degree of prevailing economic uncertainty, was generally in line with expectations, in the short-term pointing to a slower pace of economic growth, and a considerably higher inflation profile. That said, both headline and core PCE are still seen returning to around the 2% target by the end of the forecast horizon.

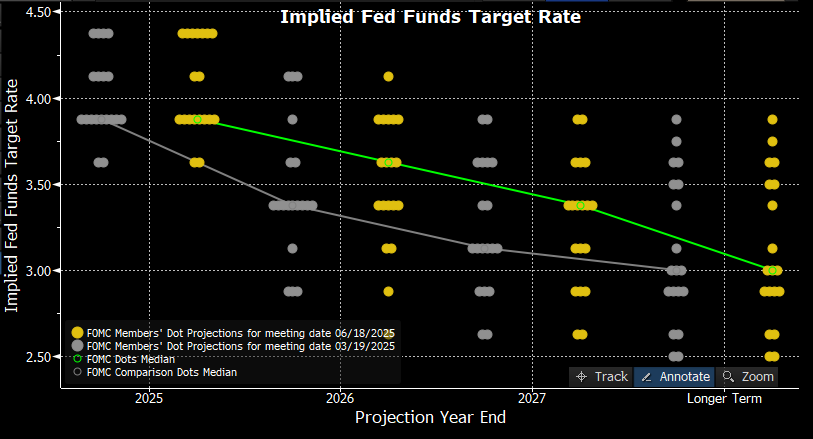

On the back of those updated economic projections, the FOMC’s latest dot plot continued to point to a median expectation of 50bp of easing this year, although 7 Committee members see no cuts at all in 2025. Further out, both the 2026 and 2027 dots were revised higher, with just one 25bp cut seen in each year, though the longer-run estimate remained at 3%.

Frankly, though, the ‘dots’ aren’t much use at the best of times, least of all at a time like this, and certainly don’t imply a concrete path that the fed funds rate will follow. In fact, given the choice, I imagine most FOMC members wouldn't even have wanted to jot down a 'dot' this time out.

The other highlight, though I use that word very loosely, of the June meeting was Chair Powell’s post-meeting press conference.

Here, Powell stuck resolutely to his recent script, noting that policy remains ‘well-positioned’, while also pouring cold water on the ‘dot plot’, remarking on many occasions that the dots aren’t held with ‘great conviction’. Still, Powell did at least re-confirm that the next move in rates will be lower, with it being ‘likely’ that the FOMC get to a place where rate reductions become appropriate.

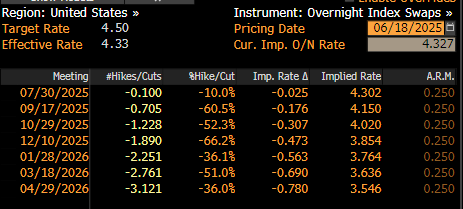

As all of this information was digested, money markets repriced very marginally in a dovish direction, continuing to fully discount the next 25bp cut for September, but now pricing around 48bp of easing by year-end, 3bp greater than pre-FOMC.

Taking a step back, it seems likely that the June FOMC meeting will again go down as a ‘placeholder’ one, with Powell & Co continuing to resolutely stick with a ‘wait and see’ approach to policymaking, particularly as the full economic impact of tariffs remains to be felt. Although the direction of travel for rates clearly remains lower, the Committee are clearly, and rightly, in no rush to take further steps back towards a more neutral policy setting.

Short-term, focus will remain on ensuring that inflation expectations remain well-anchored, necessitating that the FOMC sit on their hands for the time being. The bar for a rate cut before Q3 is over remains a very high one indeed, with my base case being that just one 25bp reduction is delivered this year, most likely in December.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.