- English

- 中文版

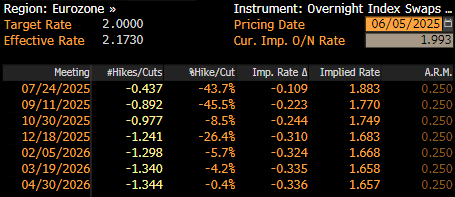

As noted, fully in line with both sell-side expectations and market pricing, the ECB duly cut rates by 25bp at the June confab, lowering the deposit rate to 2.00%, marking this cycle’s eighth reduction, and the fourth cut this year.

This decision, though, was not unanimous in nature, with one member, likely Robert Holzmann, not supporting the 25bp cut.

Along with that decision, the updated policy statement was, largely, a ‘carbon copy’ of that issued after the April meeting. Consequently, policymakers reiterated that they will continue to adopt a ‘data-dependent’ and ‘meeting-by-meeting’ approach to future decisions, while also making no ‘pre-commitment’ to a pre-set policy path. Guidance beyond that was sorely lacking.

Accompanying the decision and statement, were the ECB’s updated round of staff macroeconomic projections.

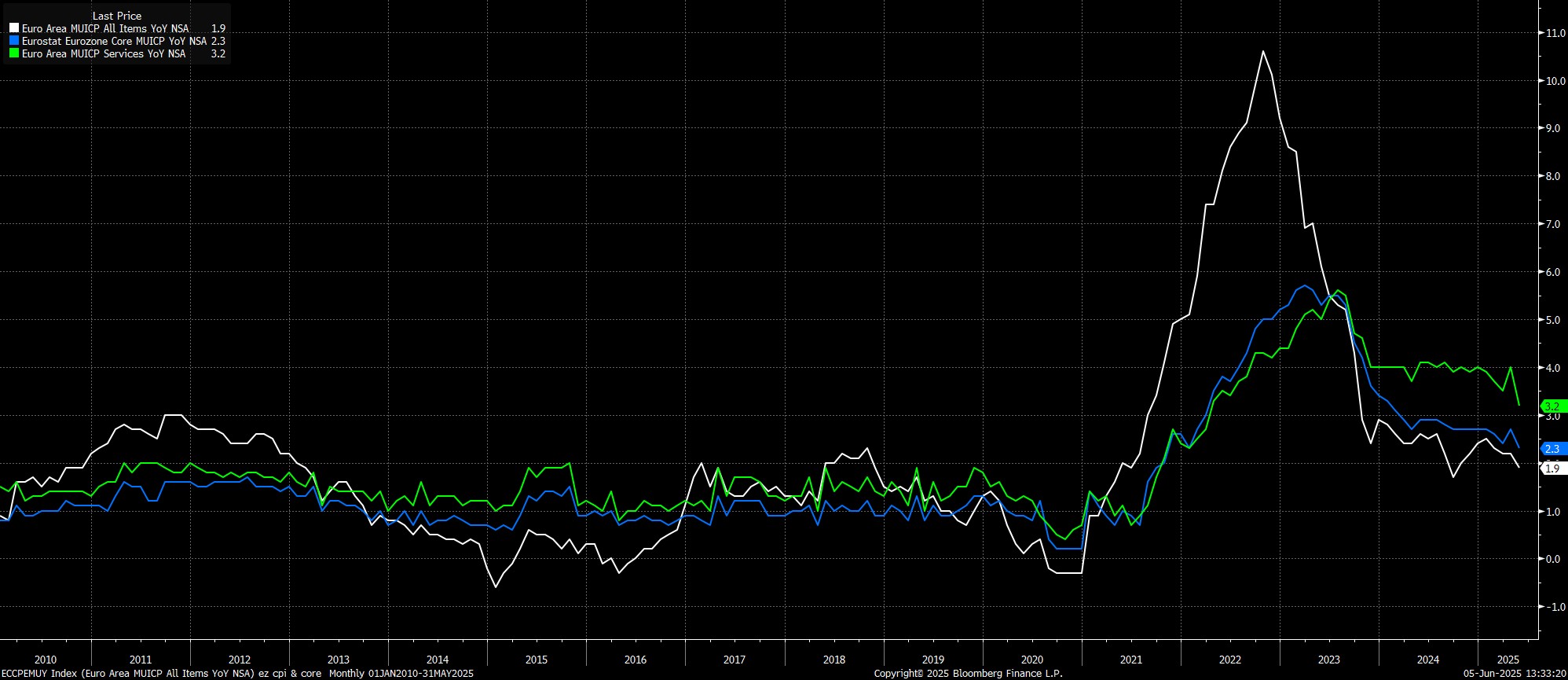

On inflation, as had been flagged in pre-meeting ‘sources’ reports, the profile for price pressures was revised lower, in light not only of elevated tariff uncertainty, but also by virtue of a considerably stronger EUR since the last forecast round in Q1. Hence, headline CPI is now seen at 2.0% this year, an 0.3pp downward revision compared to the March expectation, before falling further to 1.6% in 2026, a considerable undershoot of the price target over the next 18 months or so.

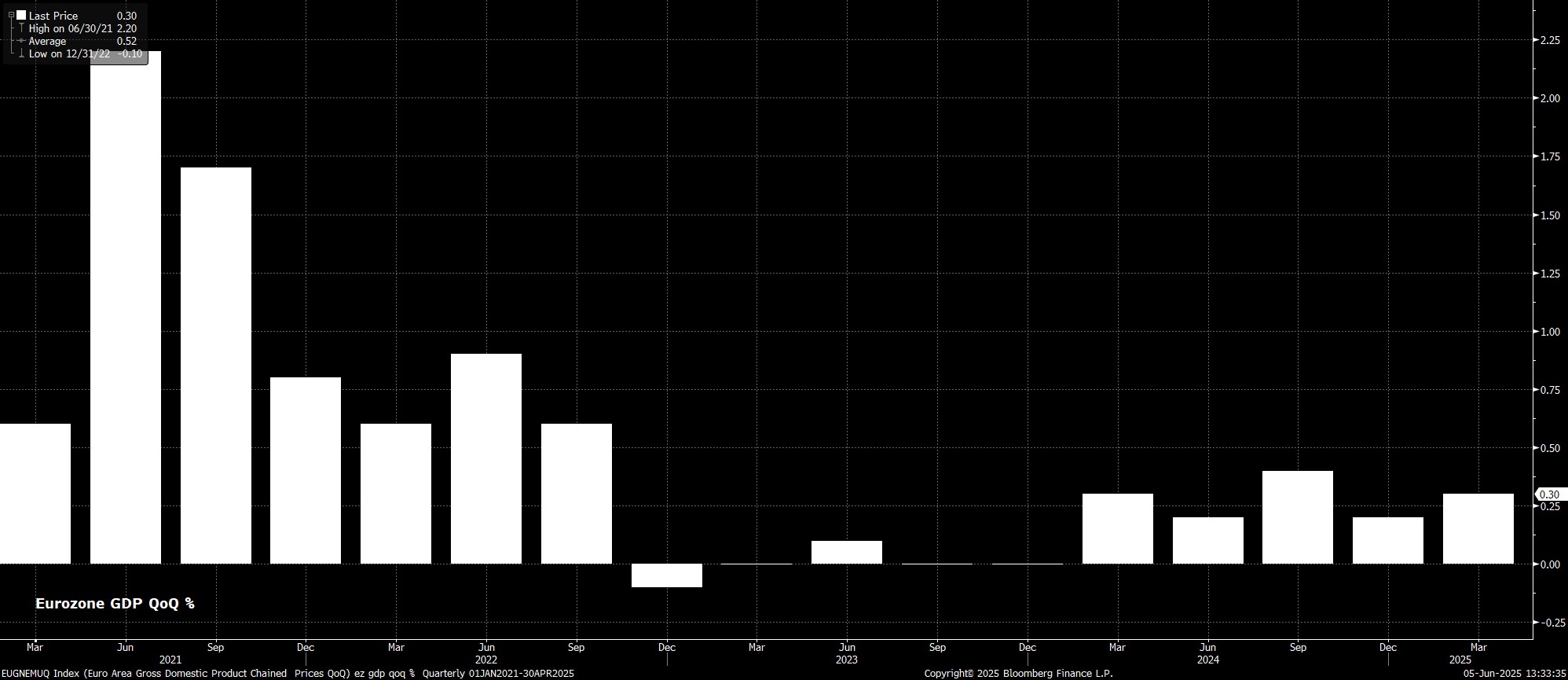

As for growth, the projections continue to point to a seemingly overly-optimistic 0.9% pace of GDP growth this year, though the 2026 growth expectation was nudged a touch lower, to 1.1%. Clearly, risks to these GDP expectations tilt firmly to the downside.

After all of that was digested, attention turned to President Lagarde’s post-decision press conference.

Here, having reiterated that risks to economic growth remain tilted to the downside, Lagarde noted that policy is “well positioned” to navigate uncertain conditions which, while stressing that data-dependency remains pivotal to the reaction function.

Taking a step back, all these mentions of policy being in a “good place” do pour some cold water on the idea that the ECB will deliver a substantial amount of further policy easing. It seems that, for the time being at least, the easing cycle is done & dusted – policymakers likely want to hold rates steady and wrap up the cycle here, though will keep options open as much as possible, lest external factors such as trade uncertainty force their hand into further easing.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.