- English

- 中文版

Summary

- Election Chatter: Japanese media reports around a potential early election have intensified, as PM Takaichi seeks to capitalise on sky-high approval ratings

- Implications: An LDP majority in the lower house could lead to even more expansionary fiscal policy, in turn exerting pressure on the JPY

- Intervention Risk: Softness in the JPY has sparked chatter that the MoF may soon step in, intervening to prop up the currency

The rumour mill has gone into overdrive in Japan, amid chatter that PM Takaichi may be considering a ‘snap’ lower house election as soon as next month.

Where did early election rumours come from?

Said rumours began last week, amid reports via Yomiuri, though participants took the reporting with a degree of caution, not least considering the outlet’s misplaced headlines when it came to the resignation of PM Ishiba last year. However, since the initial story broke, it has been followed up and corroborated by other outlets, adding credibility to the reports. While the government have made no official comment, it appears increasingly likely that an election will be called when the Diet returns on 23rd January, with polling day likely to come in early-Feb.

Why might Takaichi call an early poll?

Such an election would be for the lower house only which, while meaning that the LDP would still be without a majority in the upper house, would – in the event of a Takaichi victory – make passing budgetary legislation considerably easier. For context, the LDP presently hold 199 of the 465 seats in the House of Representatives, relying on the support of Ishin in order to obtain a workable majority in excess of 233 seats. Takaichi’s hope, clearly, is that an early election will allow the LDP to obtain a majority on their own, lessening the need to make concessions to other parties.

The rationale behind calling an early election is relatively clear. Takaichi’s approval rating currently stands north of 70% per most polling, and even higher among younger cohorts. The thinking, hence, is that the PM should ‘strike while the iron is hot’, on the assumption that approval ratings are likely to increase much further, and could fall from here on in. There may also be a desire for an element of surprise involved here too, with the LDP potentially seeking to catch opposition parties off guard, not only by calling an election much earlier than it was previously expected, in the spring, but also by running such a short campaign period.

Potential Implications From An LDP Majority

So, what might this all mean, assuming that an election is called, and that Takaichi is successful in gaining an LDP majority?

From a fiscal perspective, the implications are relatively obvious. Were there no longer a need to make concessions to opposition parties, the LDP would likely be able to go bigger, and bolder, in terms of any proposed fiscal loosening, delivering the ‘bazooka’ that market participants had previously expected when Takaichi first ascended to office. Such a policy package would, clearly, be a boon for domestic equities (i.e., the Nikkei & Topix), though would clearly pose stiff headwinds to long- and ultra-long JGBs, particularly if issuance were to be ramped up significantly.

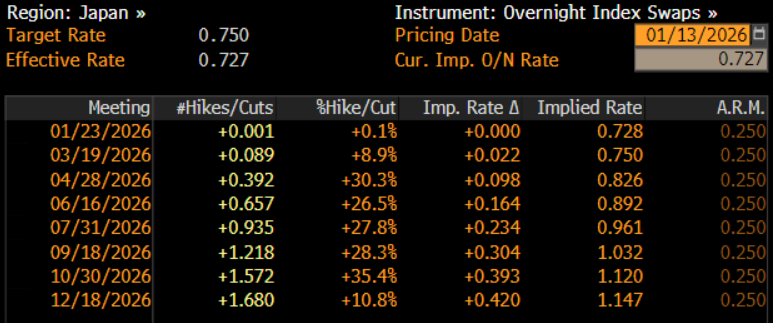

As for monetary policy, an early election is unlikely to materially alter the BoJ’s thinking. Presently, while the BoJ have pledged to deliver further tightening if their economic outlook is realised, a cadence quicker than one 25bp hike every 6 months or so seems highly unlikely. Given that the BoJ last raised rates in December, a February election doesn’t change much on that front, especially considering that policymakers would likely want to see the results of spring wage negotiations before pulling the trigger on another hike. In any case, the JPY OIS curve doesn’t fully discount another 25bp hike until September.

Finally, for the JPY, reports of an early election have been met with a chunky bout of softness, with spot USD/JPY briefly trading north of the 159 figure, to its highest levels since July 2024. This softness comes, principally, as markets price a looser fiscal backdrop, with the JPY failing to benefit from expectations that a likely LDP majority would lead to a considerably more stable domestic political landscape.

Naturally, as the JPY has weakened, chatter around potential intervention to prop up the currency has grown. Here, it’s important to remember that any MoF intervention typically depends firstly on the speed of any moves seen, as well as on whether the value of the JPY is seen as being ‘detached’ from its fundamentals. For the time being, those criteria don’t appear to have been met, particularly with both implied and realised vol remaining relatively subdued.

_D_2026-01-13_10-05-18.jpg)

While ‘yentervention’ remains a risk that participants should keep on the radar, it’s plausible to expect that that may not become a serious consideration unless spot trades back above the 160 figure, or a further rapid bout of weakness emerges.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.