- English

- 中文版

January 2026 US Employment Report: Keeping The Fed In ‘Wait & See’ Mode

Payrolls Growth Blitzes Expectations

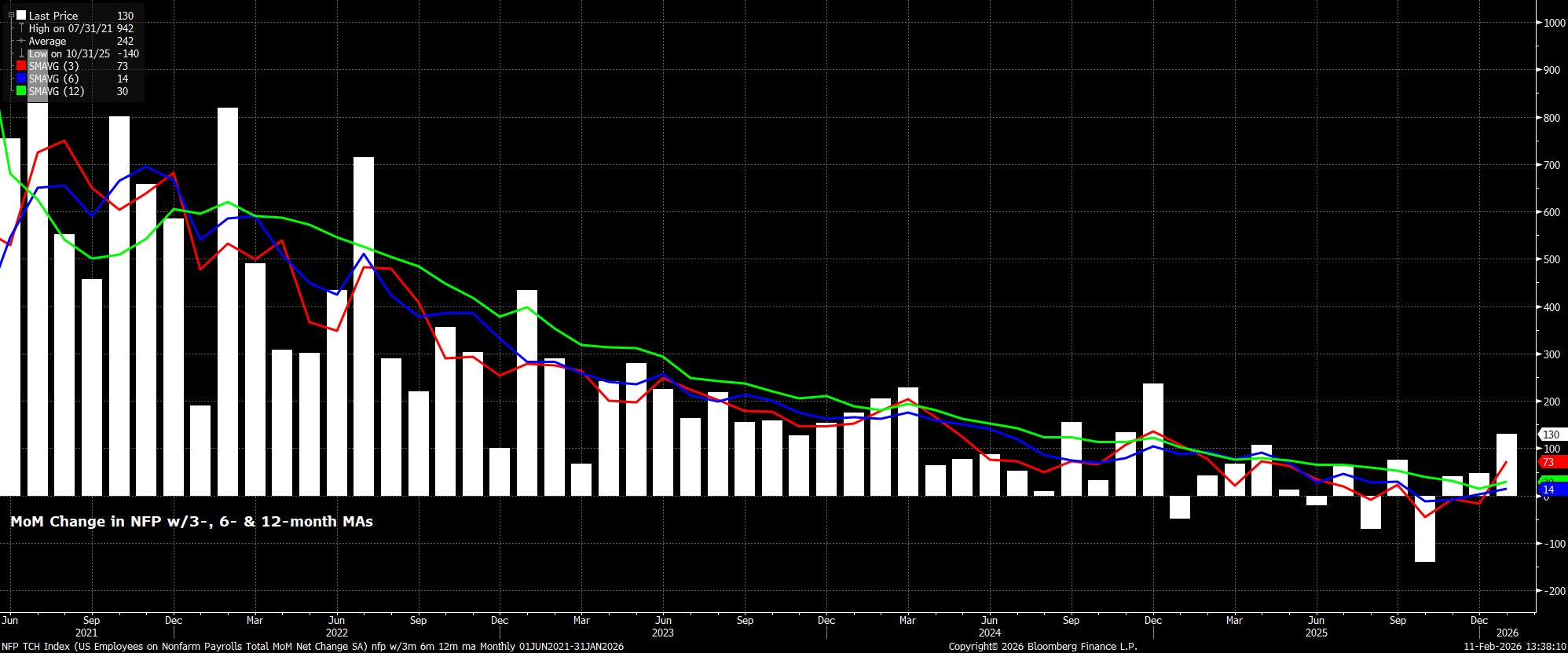

Headline nonfarm payrolls rose by +130k in January, above consensus expectations for an increase of +65k, albeit just within the always-wide forecast range, of -10k to +130k. That said, data quality concerns must continue to be borne in mind here, not least considering that Fed Chair Powell recently noted how the headline payrolls figure may well be overstating jobs growth by as much as 60k per month.

In any case, along with the January data, the prior two payrolls prints were revised by a net -17k, in turn taking the 3-month average of job gains to +73k, now running at more than double the breakeven pace, of around 30k.

Concurrently, as usual, the January report also brought the annual benchmark revision to the establishment survey, as of March 2025. Compared to the preliminary estimate of -911k, the final revision was somewhat less extreme, at -862k, though still representing a chunky revision.

Digging Into The Details

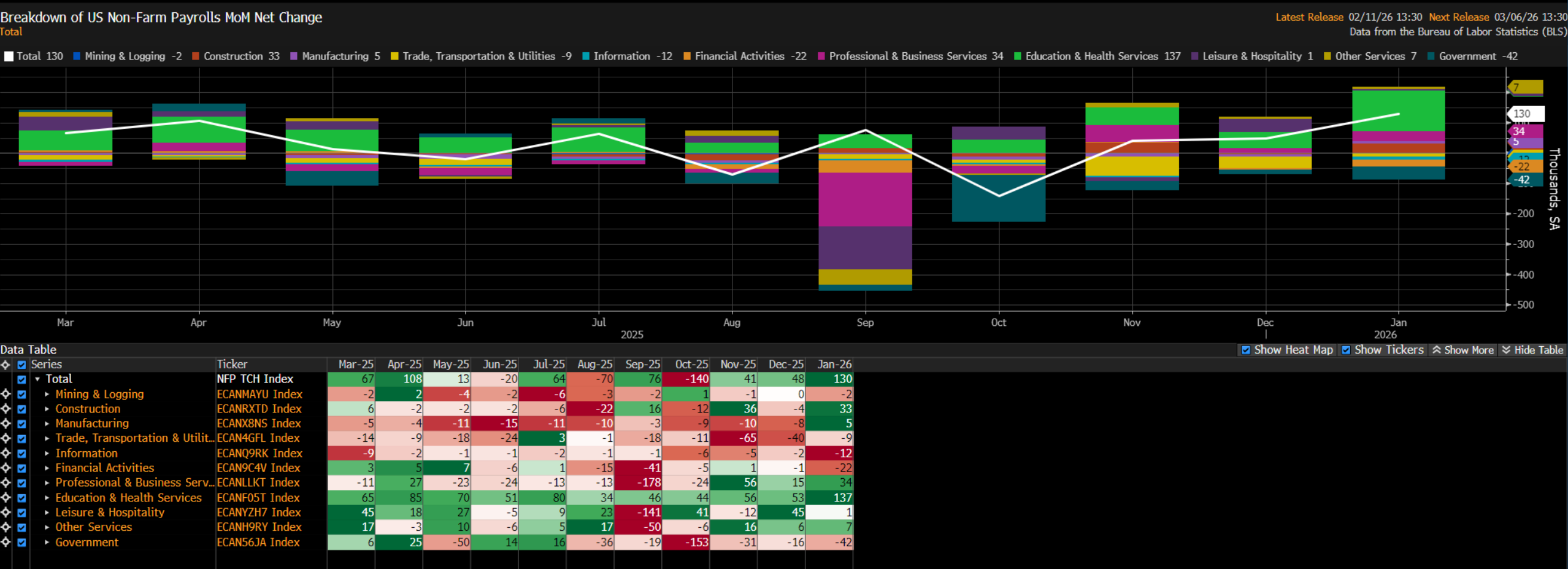

Returning to the January data, and digging into the details of the report, the sectoral split of job gains pointed to healthcare again providing the bulk of the job gains, with the sector adding +124k jobs on the month, followed by the construction sector with +33k. However, hiring still wasn’t exactly broad-based, with employment falling MoM in five of the eleven sectors that the BLS report on.

Earnings Growth Contained

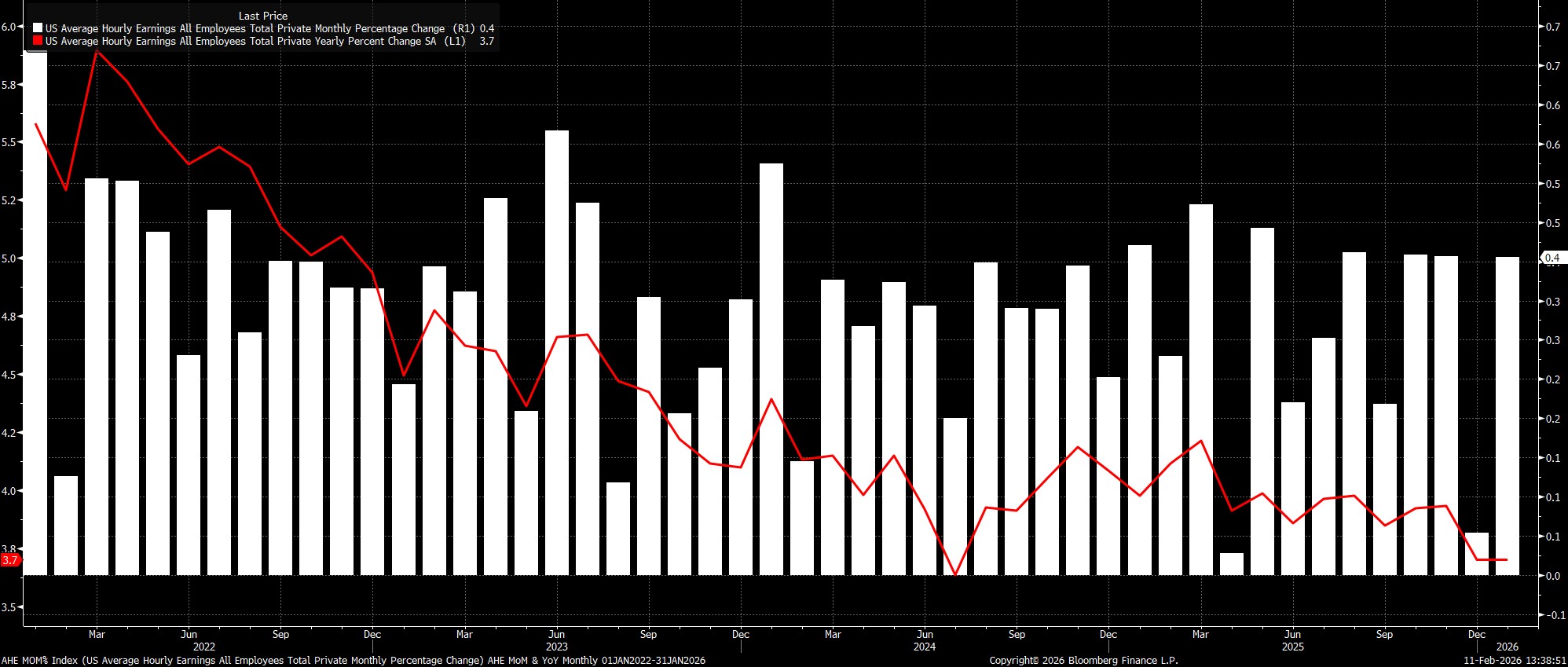

Sticking with the establishment survey, data pointed to earnings pressures having remained contained as the new year got underway. Last month, average hourly earnings rose by 0.4% MoM/3.7% YoY, the former a touch hotter than expected, though still of little concern.

Data of this ilk once more strengthens the long-running consensus view of FOMC members, in that the labour market does not presently represent a significant source of upside inflation risk, with earnings growth unlikely to imperil a return to the 2% price target over the medium term.

Household Survey Also Solid

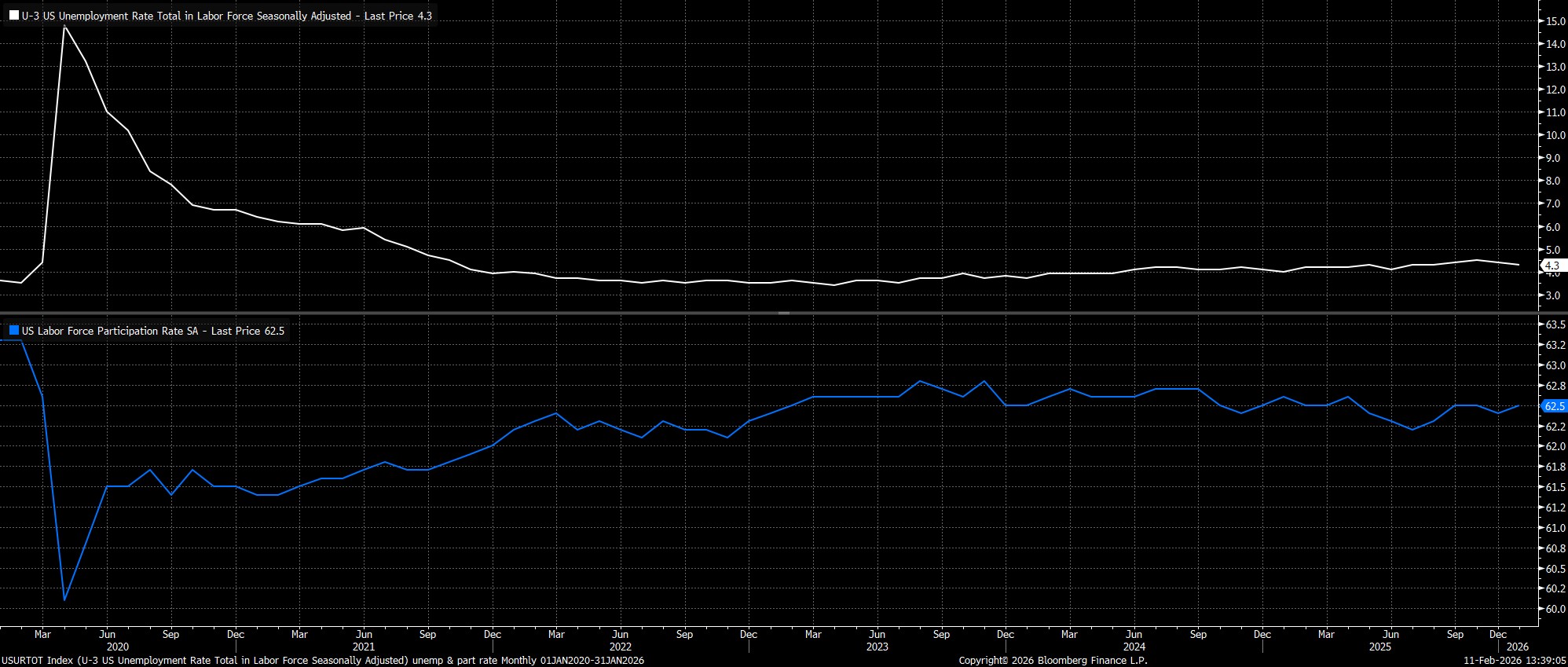

Turning to the household survey, unemployment unexpectedly declined 0.1pp to 4.3% in January, and for the ‘right’ reasons, with labour force participation concurrently rising by 0.1pp to 62.5%, just shy of the cycle highs seen in the middle of last year.

Though the policy implications of the HH survey are likely greater than that of the establishment data, at least judging by recent remarks from FOMC policymakers, this data must also be accompanied by something of a ‘health warning’, as survey response rates remain low, and as the BLS grapple with the rapidly changing size and composition of the labour force.

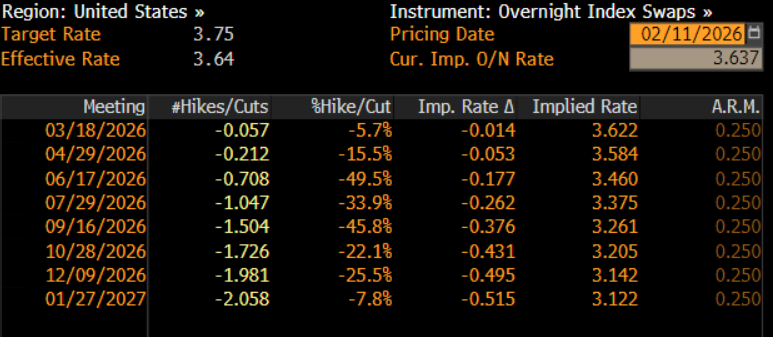

Money Markets Reprice Hawkishly

As the jobs report was digested, money markets repriced in a hawkish direction, with the next 25bp cut now not fully discounted until the July meeting, compared to expectations of June pre-NFP. Still, around 50bp of easing is expected by year-end, largely a function of expectations that Chair designate Warsh will adopt a more dovish approach.

Conclusion

Taking a step back, the January jobs report is unlikely to be a game-changer from a Fed policy perspective. With the FOMC having taken out insurance in the form of 75bp of cuts at the tail end of last year, today’s relatively stable data is unlikely to be enough to encourage policymakers to take further steps back towards a more neutral fed funds rate for the time being.

Although the February jobs report will be in hand before the next FOMC confab, along with both Jan and Feb CPI data, it seems likely that policymakers will retain their ‘wait and see’ approach for now, with the base case remaining that the fed funds rate will remain unchanged until at least June, at which point Kevin Warsh is due to take over as Chair. From then onwards, while Warsh is likely to advocate for a more dovish approach, the Chair is simply ‘first among equals’, meaning that notable disinflationary progress will likely need to be made by this stage, in order for a majority of Committee members to vote in favour of further easing.

Risks to this base case, however, do tilt in a dovish direction, with the FOMC willing and able to respond with additional easing, were further signs of labour market softness to emerge.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.