- English

- 中文版

Summary

- Rates on Hold: The FOMC will stand pat at the January meeting, maintaining the fed funds rate at 3.50% - 3.75%

- Labour Market Stability: Tentative signs of labour market stability allow policymakers to pause, and take stock of last year's rate reductions

- Further Cuts Coming: Additional reductions will likely be delivered later this year, however, with the fed funds rate still on track to return to a more neutral level later in 2026

Standing Pat For Now

As noted, the FOMC are set to stand pat at the January confab, maintaining the target range for the fed funds rate at 3.50% - 3.75%, in a decision that would mark the first time that the Committee have held policy steady since last summer.

Money markets, per the USD OIS curve, price next-to-no chance of any rate move at the upcoming meeting, with the next 25bp cut not fully discounted until July, by which stage a new Fed Chair will be at the helm, though the identity of that individual – at the time of writing – is as yet unknown.

The decision to hold rates steady, though, is unlikely to be a unanimous one among FOMC members, even though the annual voting rotation of regional Presidents doesn’t materially shift the hawk-dove balance of the Committee.

In any case, uber-dovish Governor Miran is almost certain to dissent in favour of a rate reduction, potentially one as large as 50bp, at what could be his last meeting on the Board, before returning to the CEA. There is some chance that Governor Bowman may also dissent, having recently flagged labour market ‘fragility’ and her belief that the Fed should signal a ‘readiness to move rates closer to neutral’. Any dissents beyond those two members, though, are unlikely.

Two Reasons To Hold Steady

Policymakers are likely to cite a couple of reasons as the rationale behind standing pat to start the year.

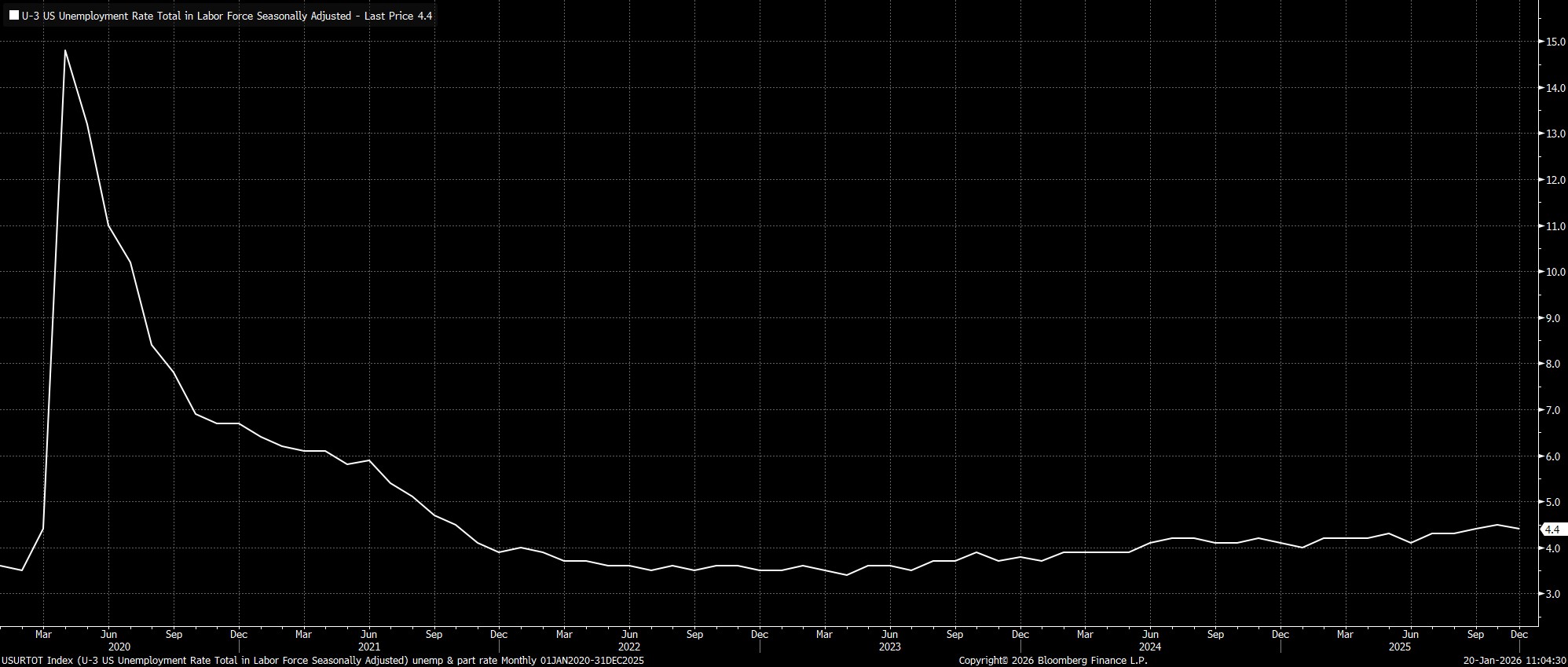

Firstly, and most importantly given the Committee’s current reaction function, is likely to be some emerging signs of stability in the labour market. Headline unemployment fell to 4.4% in December, from a downwardly revised 4.5% a month prior, in turn ending the year below the median year-end expectation outlined in the December SEP. In other words, per that baseline, the labour market is in better shape than had been expected, lessening the need for imminent further policy adjustments.

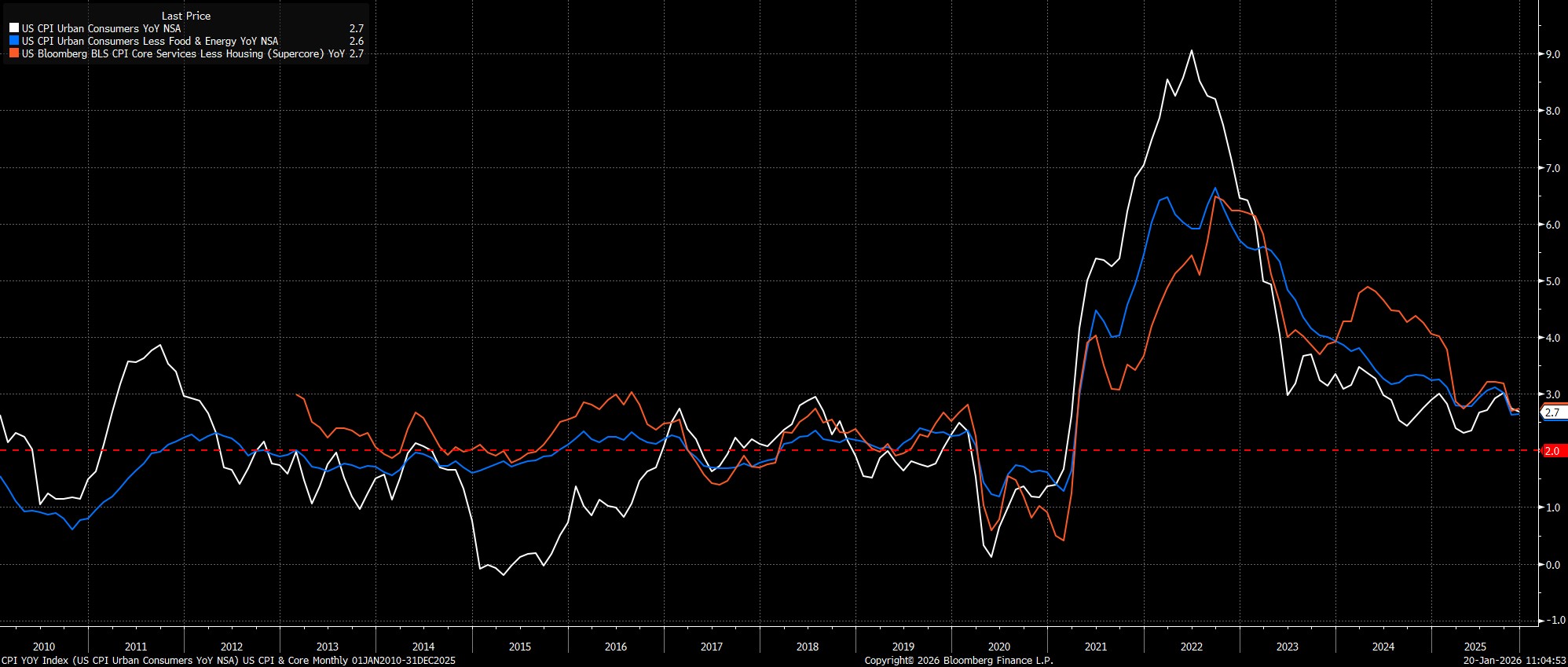

Secondly, on the inflation side of things, there remains a degree of concern among Committee members, especially those of a more hawkish inclination, as to the continued impacts of tariff pass-through, as well as the potential risk of inflation settling at a level somewhat above the 2% target. President Trump’s latest tariff threats over the issue of Greenland are unlikely to cool any nerves on this front, while concerns over the quality of the latest CPI data, which was likely skewed lower by various BLS assumptions made due to the Government shutdown, also augurs for a ‘wait and see’ approach right now.

Misplaced Confidence?

The aforementioned developments should, by and large, mean that the FOMC’s description of current economic conditions in the policy statement should remain broadly unchanged, with policymakers again describing job gains as having ‘slowed’, and inflation as remaining ‘somewhat elevated’, even as overall economic activity expands at a ‘moderate pace’.

All that said, there are some signs that the FOMC’s confidence in the labour market stabilising, and jitters over inflation, could be misplaced.

On the labour side of things, while the unemployment rate did indeed stabilise in December, this came solely as a result of people leaving the labour force – in other words, giving up on trying to find employment.

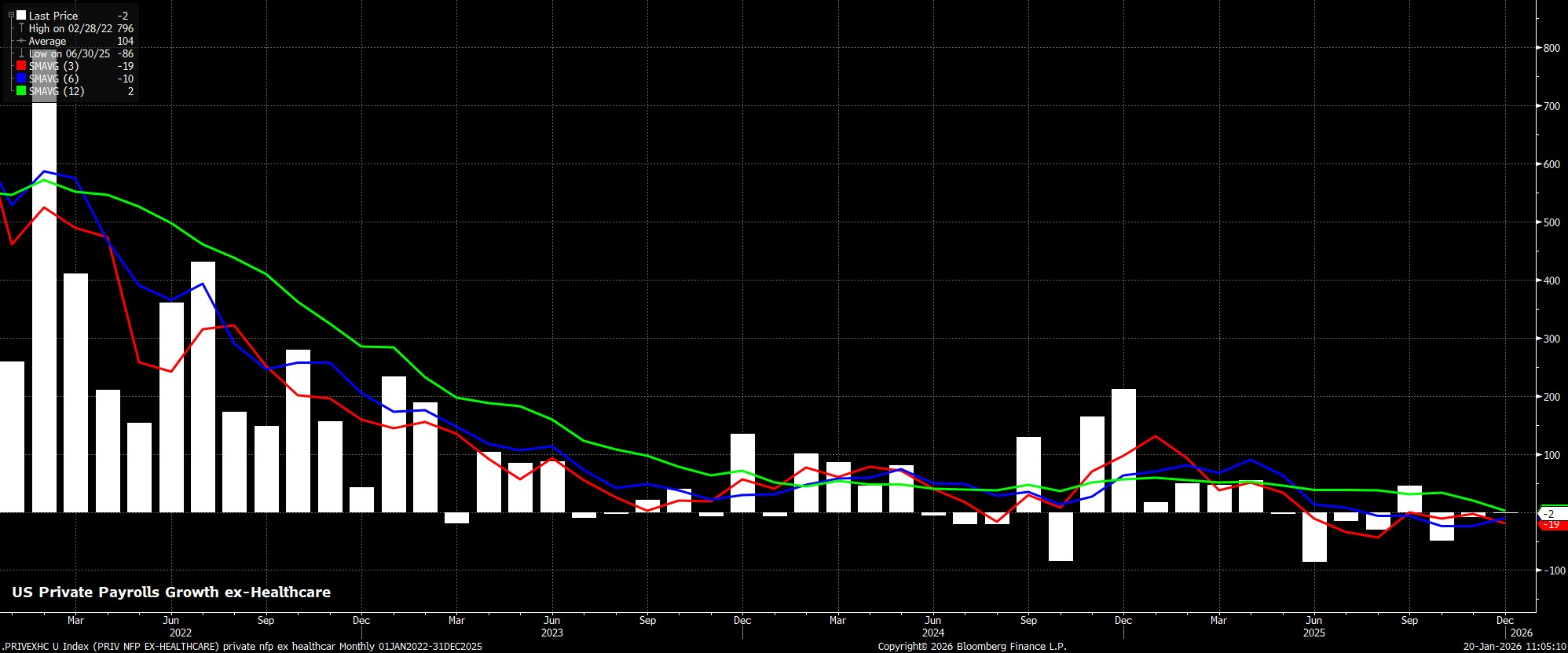

Meanwhile, employment growth remains very tepid indeed, with the 3- and 6-month averages of headline nonfarm payrolls growth hovering around zero, and with private payrolls ex-healthcare having fallen in every month bar one since last April. Given the non-rate sensitive and non-cyclical nature of the healthcare industry, this implies that the economy wouldn’t be adding any jobs at all, if the population weren’t naturally aging.

As for the inflation side of the mandate, there are increasing signs that tariff-induced price pressures have likely peaked, particularly with core goods disinflation now relatively well-embedded, with this component having peaked at 1.5% YoY in September.

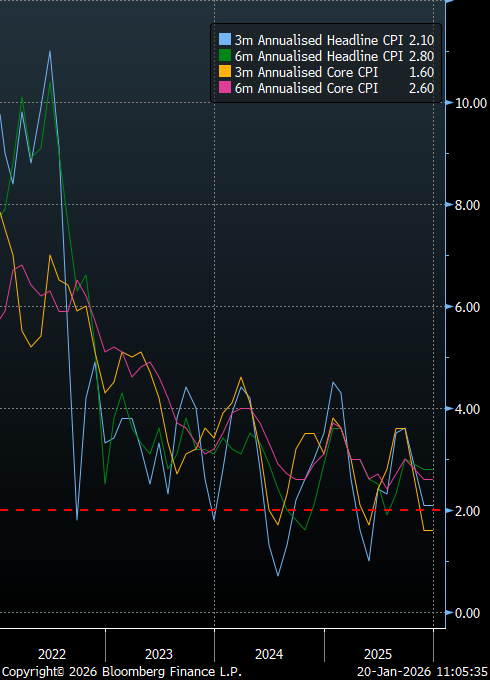

More broadly, 3-month annualised headline and core CPI are now both running at rates in line with the 2% inflation aim, even allowing for a skew lower as a result of the aforementioned shutdown-induced data quirks. Though this is almost certainly not enough to tilt the Committee in favour of any action just yet, this does nonetheless emphasise how prices are now starting to trend back towards target on a more consistent basis.

Independence Concerns Persist

Away from imminent monetary policy matters, perhaps the most significant development since the December FOMC meeting has been a further ratcheting up of concerns over the Fed’s monetary policy independence.

Primarily, said concerns stem from the Trump Admin’s, and the Department of Justice’s, unprecedented move to issue the Fed with subpoenas, and threaten criminal charges, ostensibly in relation to Chair Powell’s Congressional testimony on building renovations. In reality, though, these subpoenas should be viewed as part of a broader pressure campaign, and part of the Administration’s ongoing efforts to push the Fed into delivering larger, and quicker, rate cuts.

Chair Powell is, when asked at the post-meeting press conference, likely to broadly reiterate the above sentiments, in keeping with the statement he issued a few weeks ago. On the other major independence concern, namely Governor Cook’s Supreme Court challenge over Trump’s attempts to dismiss her, Powell is likely to offer no comments, while Powell is also unlikely to make any commitments as to his future post-May, and whether he plans to see out his term as a Fed Governor, expiring January 2028.

Conclusion

Stepping back, the January FOMC meeting seems likely to be something of a placeholder for the Committee, as policymakers hit ‘pause’ on the easing cycle for the time being, though do nothing to indicate that said cycle is at an end.

Instead, further rate reductions over the course of the year remain on the cards, with policymakers still seeking to return the fed funds rate to a more neutral level. The timing of those reductions, however, will hinge largely on developments in the labour market, and particularly the speed at which any further slack may emerge. A resumption of the easing cycle at the March meeting can’t be ruled out, though delivery of a cut at that juncture will require a further deterioration in labour conditions over the remainder of Q1.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.