Analysis

January 2025 US Employment Report: Resilience Continues Into The New Year

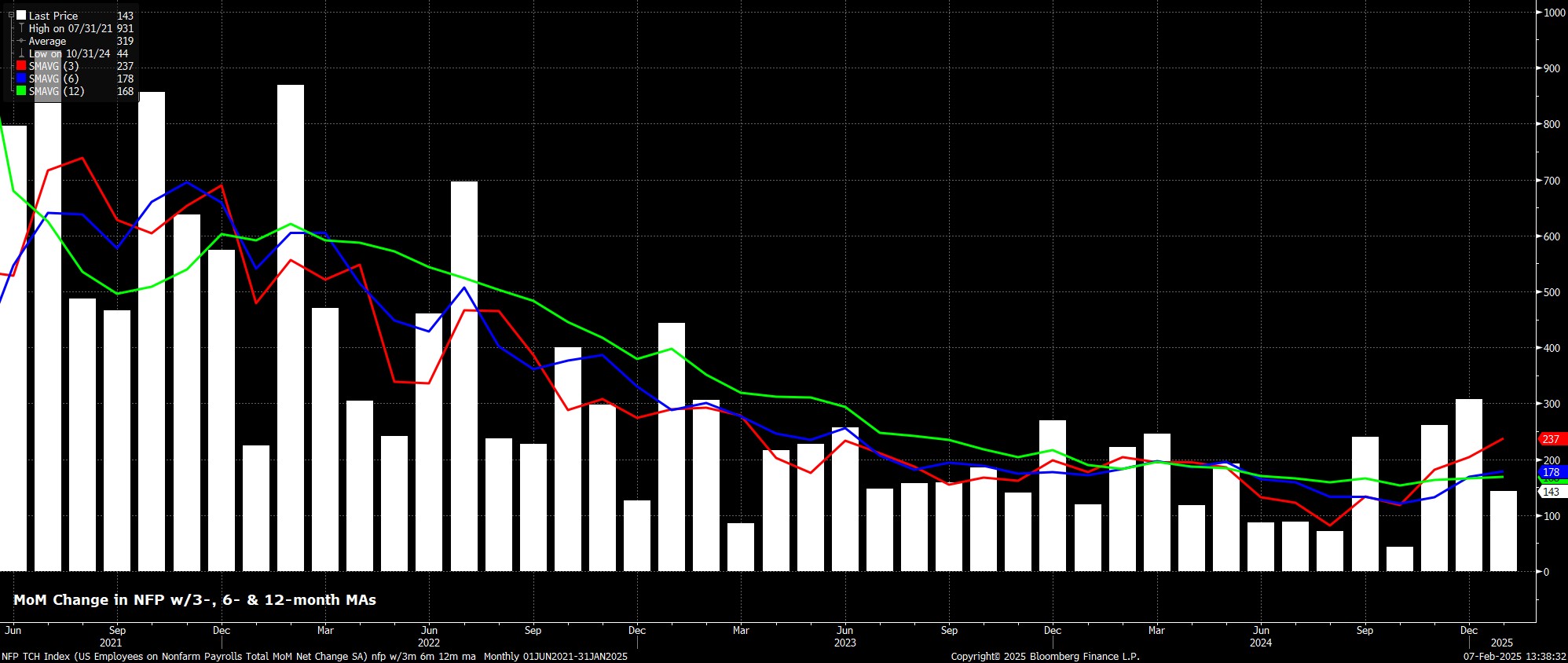

Headline nonfarm payrolls rose by +143k in the first month of the year, marginally below consensus expectations for a +175k increase, though within the forecast range of +105k to +240k. Concurrently, the prior two payrolls prints were revised by a net +100k, in turn taking the 3-month average of job gains to +237k, its highest level in almost 2 years.

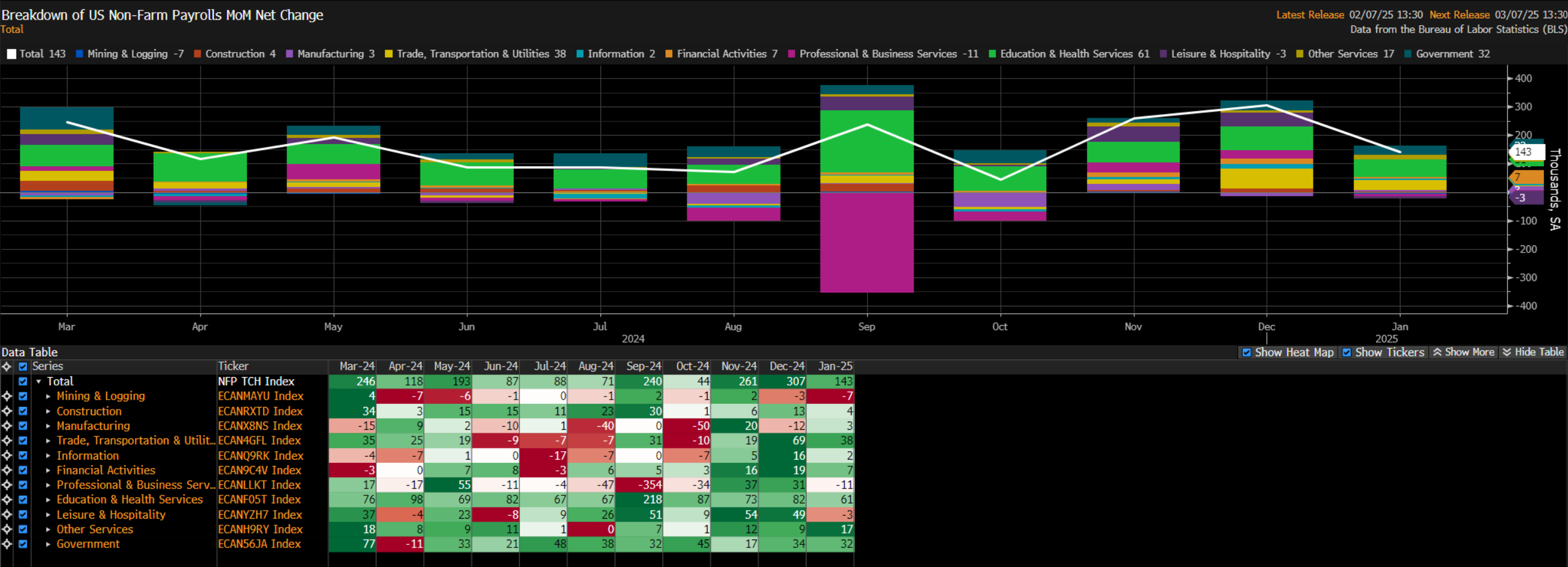

Digging further into the report, despite the headline miss, the sectoral split did point to relatively broad-based employment growth, with just 3 sectors – Mining & Logging, Professional & Business Services, and Leisure & Hospitality seeing modest MoM employment declines.

Furthermore, as usual, the January report also brought the annual benchmark revision to the establishment survey, as of March 2024. Compared to the preliminary revision of -818k, the January report pointed to a final revision of -589k, a shift considerably greater than the typical +/-0.1% revision seen over the last decade, typifying the increasingly volatile nature of incoming employment figures, and the labour market at large.

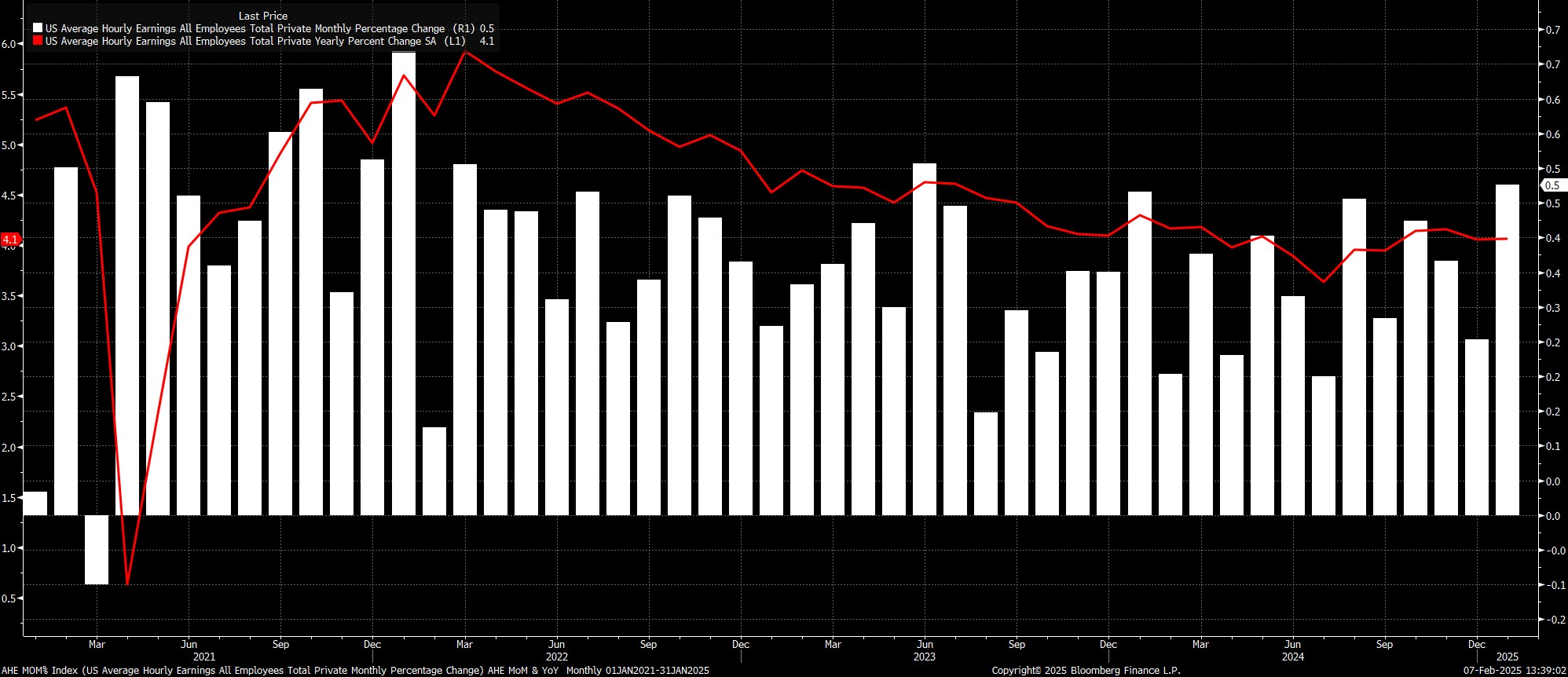

Sticking with the establishment survey, the jobs report also pointed to earnings pressures remaining relatively contained. Average hourly earnings rose 0.5% MoM in January, 0.2pp hotter than consensus expectations, in turn taking the annual rate of earnings growth to 4.1% YoY.

That said, data of this ilk is unlikely to shift the long-standing views of many FOMC policymakers, who have stated on numerous occasions that the labour market is not, at present, a source of notable price pressures and doesn’t pose significant upside inflation risks.

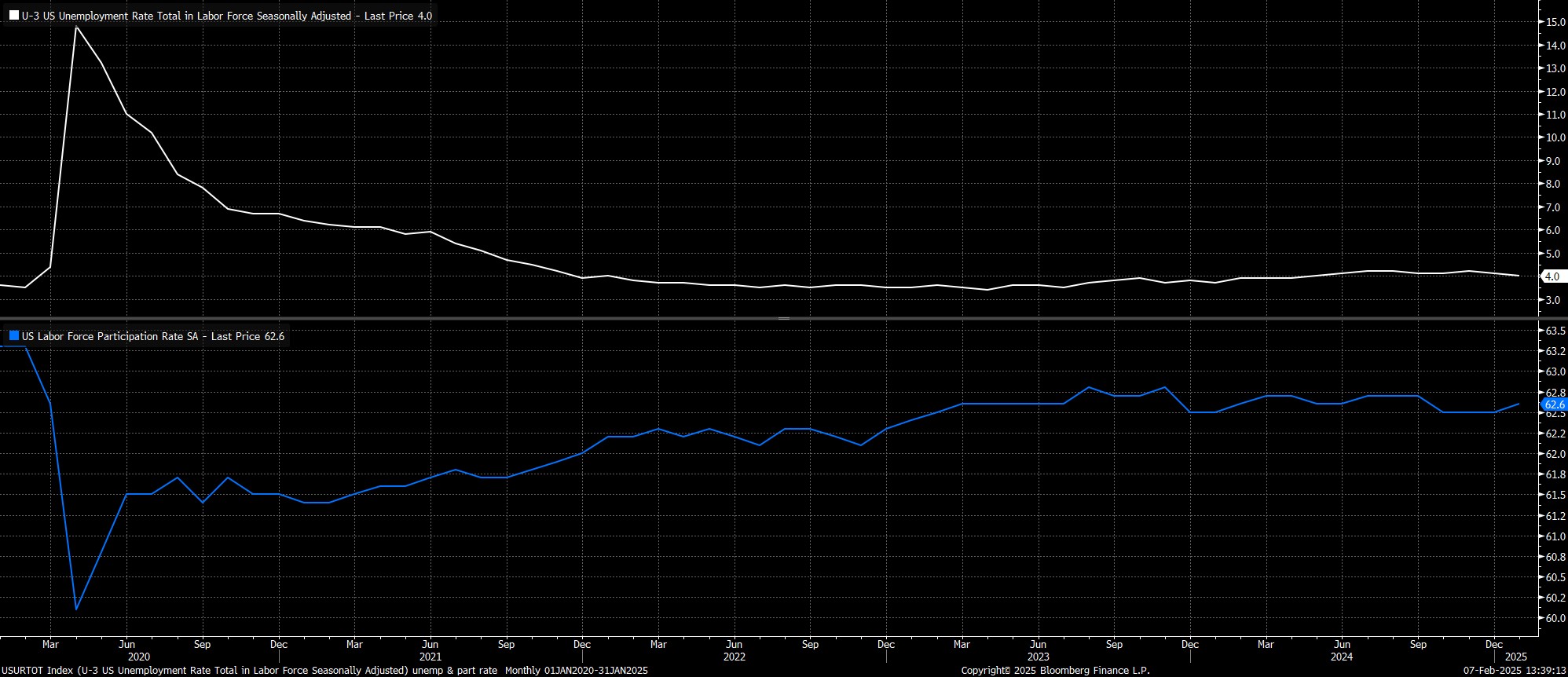

Meanwhile, turning to the household survey, unemployment unexpectedly fell to 4.0% as the new year got underway, even as labour force participation rose to 62.6%, a touch above expectations.

These figures, though, must be interpreted with the usual health warning, in that the household survey has struggled, this cycle, to take account of the shifting composition of the labour force, while also grappling with falling survey response rates.

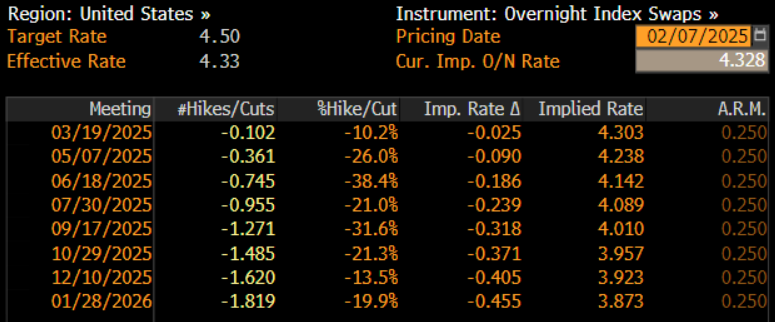

As participants digested the jobs report, market-based rate expectations were little changed in the longer-run, with participants continuing to fully price the next 25bp cut for July, and discounting around 42bp of easing by year-end. That said, pricing for the March meeting has pared, with now just a 10% chance of a 25bp cut, compared to around 15% pre-release.

On the whole, it’s difficult to envisage the January jobs report being a game-changer from a Fed policy perspective. When standing pat on policy last week, Chair Powell noted that either “real” inflation progress, or “some” labour market weakness would be required to unlock the possibility of another rate cut and that, in any case, there was no need to hurry to remove further policy restriction.

As a result, particularly with the labour market continuing to tick along well, it seems likely that the FOMC will remain on the sidelines for the time being, as January’s ‘skip’ becomes a more prolonged ‘pause’ in the easing cycle. While on pause, the FOMC will continue to pay close attention to incoming data, as risks around the dual mandate remain broadly balanced, while also digesting the impact of President Trump’s trade policies, and the 100bp of easing that was delivered last year.

Still, the direction of travel for rates remains downwards, albeit a downward journey that will progress at a much slower pace than that seen last year. Two 25bp cuts in 2025 remains the base case, with the first of those cuts likely to be delivered, at the earliest, at the end of the first half of the year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.