Analysis

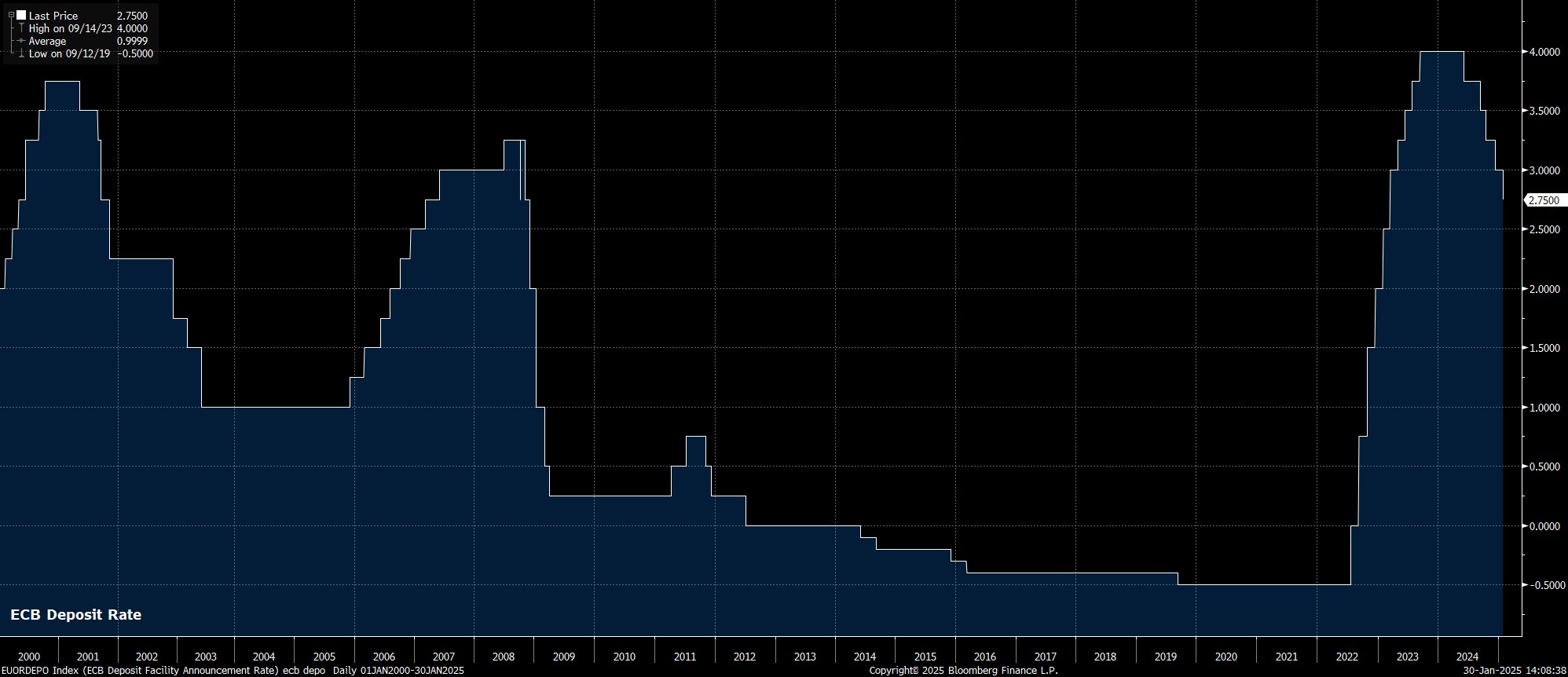

As mentioned, the Governing Council duly delivered a 25bp deposit rate cut at the conclusion of the January meeting, lowering the key policy rate to 2.75%, and marking the fourth consecutive cut of such magnitude.

Accompanying the widely-expected decision to reduce rates, was guidance with which market participants have now become extremely familiar, and which was largely unchanged from that issued after the December meeting.

Consequently, policymakers reiterated that they will continue to follow a ‘data-dependent’ and ‘meeting-by-meeting’ approach when it comes to determining future policy adjustments, with the Governing council making no ‘pre-commitment’ to a particular policy path.

As much as policymakers want to stick to this ‘data-dependent’ line, money markets remain resolute in a belief that further policy easing will be required in the short-term. The EUR OIS curve continues to fully price a 25bp cut at the next meeting in March, while also fully pricing three additional 25bp cuts by the end of the year.

President Lagarde, at the post-meeting press conference, broadly stuck with the above sentiments. Hence, Lagarde reiterated that policy is not on a pre-set course, though implied strongly that further easing is on the cards, nothing that policy remains in restrictive territory, and that it is “premature” to discuss where to stop rate cuts. It was also noteworthy that the decision to deliver a 25bp cut today was unanimous.

In reaction, eurozone assets were relatively muted, with some modest upside seen in both the EUR, and in eurozone government debt. The EUR firmness, though, seemed driven more by broad-based USD weakness after somewhat soft stateside GDP figures, as opposed to anything that Lagarde may have said.

_e_z_intra_2025-01-30_14-19-05.jpg)

To conclude, policymakers did little to ‘rock the boat’ at the first ECB decision of the year, continuing a relatively rapid pace of policy normalisation. Further rate cuts lie ahead in coming months, with the next set to be delivered in March, amid mounting risks of inflation undershooting target, and as risks to the growth outlook remain tilted firmly to the downside.

It remains likely that the Governing Council will need to take rates below neutral towards the middle of this year, though policymakers are likely to prefer a steady pace of cuts for now. If downside risks were to materialise, however, risks to this base case would tilt towards a more dovish path, as the potential for larger 50bp cuts would sharply increase.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.