- English

- 中文版

Jackson Hole Eyed As Trump-Putin Summit Yields Little

WHERE WE STAND – Friday, then. A day where we seemed to spend all day waiting for news from the Trump-Putin meeting, which turned out to be rather a damp squib. A bit like the Man Utd vs. Arsenal game, I guess, though at least the result there was a positive one from my perspective.

In short, the summit yielded nothing by way of concrete progress, and seemed to pretty much be a meeting about having another meeting to arrange more meetings, all while not achieving much. Sounds a bit like the corporate world, really!

Anyway, there’s not really much by way of fresh information for markets to discount on the geopolitical front. While Zelenskyy & Trump will meet today, and that may bear some fruit, I shan’t be holding my breath.

Away from geopolitical developments, or lack thereof, we at least had some data to get our teeth into as the week came to a close.

Arguably, Friday’s figures painted something of a mixed picture in terms of the health of the US consumer. On one hand, July’s retail sales stats were solid, as headline sales rose 0.5% MoM, in line with expectations, while the control group metric also rose 0.5% MoM, with the June data also revised nicely to the upside. That said, on the other hand, August’s UMich sentiment survey surprised to the downside, as the index fell to a paltry 58.6. That decline, though, was not only driven by a rise in inflation expectations, but also primarily by a sharp decline in sentiment among Democrat voters.

Taking into account the tiny sample size (approx. 500 people), I’m going to place much more weight on the retail sales stats than the UMich survey, and am content in my view that the US economy remains resilient under the surface. Furthermore, there remains nothing in incoming data that screams ‘Fed must cut now!’, at least not in my judgement.

With that in mind, I have little cause to shift my overall stance on markets for the time being, even if it was a rather dull end to the week.

Stocks slipped amid some de-risking and position squaring into the aforementioned Alaska summit, but the lack of concrete developments there is hardly likely to derail the overall bull case, which remains robust amid the underlying resilience of the US economy, and as the pace of earnings growth remains solid. Dips remain buying opportunities, and the path of least resistance continues to lead higher, even if hawkish remarks from J-Pow on Friday do potentially pose a bit of a hurdle in the short-term.

In the Treasury complex, steepeners remain the bet, not least after the 5s30s spread printed its widest since 2021 as last week drew to a close. While, again, that trade might face a few hurdles short-term if Powell (as I’d expect) seeks to preserve as much optionality as possible for the September FOMC, the continued erosion of policy independence by the White House, as well as the 2% inflation target seemingly now being a ‘floor’, and not a ‘ceiling’ as in the pre-pandemic world, bode well for the position in the medium-term.

I also remain of the view that the greenback will continue to face headwinds, especially with the Apprentice-esque race for Fed Chair, and a cacophony of voices calling for lower rates, also contributing further to the loss of policy independence mentioned above. As noted previously, the EUR, and gold, are likely to be the big beneficiaries here. That said, I still see little to like about the quid, though would rather sit short GBP in the crosses, in order to take some of that dollar-linked nonsense out of the equation.

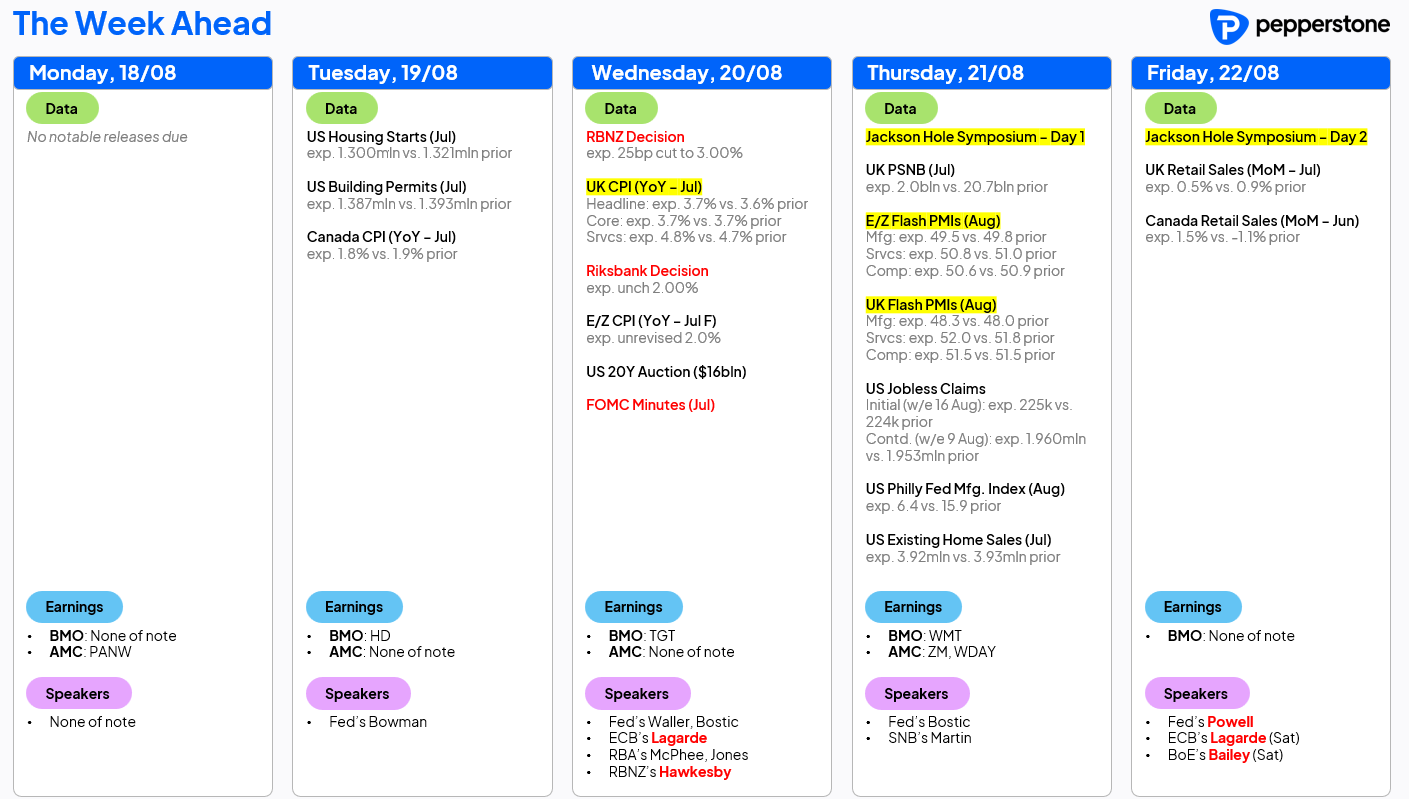

LOOK AHEAD – A rather busy week up ahead, albeit one which begins with a barren docket.

All eyes, though, will be on Wyoming as we progress through the week, and the Jackson Hole Symposium gets underway. Not only will participants be focused on whether Fed Chair Powell leans into the possibility of a September rate cut, but remarks from BoE Governor Bailey, and ECB President Lagarde, among others, will also be closely watched.

Staying on the policy front, the RBNZ will likely deliver a 25bp cut on Wednesday, lowering the cash rate to 3.00%, before the Riksbank stand pat later that morning. Also on Wednesday, minutes from the July FOMC meeting are due which, while stale, may shed some further light on Govs Bowman and Waller’s dovish dissents.

On the data front, ‘flash’ PMIs highlight the calendar, though the figures may not tell us much that we don’t already know – namely, that the global manufacturing sector continues to struggle, with the overall expansion still underpinned by the services complex. Besides that, it’s a busy week for UK prints, where Wednesday’s CPI data will likely show a further intensification in price pressures; Thursday’s borrowing stats are set to point to a narrower deficit as a result of a surge in self-assessment tax receipts; and, Friday’s retail sales report should point to solid consumer spending amid the warm weather seen last month.

On that note, US retail earnings from the likes of Home Depot (HD), Target (TGT), and Walmart (WMT) will be in focus this week, particularly in terms of guidance around the impact of tariffs.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.