- English

- 中文版

How to Trade Bitcoin in 2026: From Bullish Myths to Rational Strategies

.jpg)

On January 1, 2026, the crypto market did not deliver a “New Year’s gift” to traders. Bitcoin experienced sharp swings during the thin liquidity of the year-end period, briefly dropping from $89,000 to around $87,000, triggering a wave of leveraged liquidations.

Although a technical rebound followed, trading volume noticeably contracted, and the Fear & Greed Index quickly plunged into extreme fear territory.

In my view, this is not a signal of systemic risk. Rather, it serves as a preview of the trading environment in 2026: Bitcoin remains resilient, but the market lacks consensus on trend direction; volatility persists, yet capital has become significantly more cautious. The era in which a single narrative could drive a full-cycle rally is now largely over.

Entering 2026, understanding Bitcoin requires more than just watching price moves—it demands a grasp of the underlying pricing dynamics, which can only be fully appreciated by looking back at 2025.

2025 in Review: Lower Prices, But a Fundamental Shift in Pricing

From a price perspective, 2025 was not ideal for Bitcoin bulls. Although Bitcoin briefly hit a record high of $126,200 in October, profits were taken and regulatory progress lagged expectations, pushing the price down.

By year-end, Bitcoin closed down 6.6%, underperforming gold and failing to reflect the typical resilience of risk assets in a rate-cutting cycle.

For many traders, the hardest part was not the decline itself, but that the reasons supporting further upside seemed already realized.

In 2025, regulatory conditions were unusually favorable. ETFs became mainstream allocation tools, the White House established a strategic Bitcoin reserve, and legislation supporting stablecoins emerged—government-level support continued to grow, and institutional participation steadily increased.

In any prior early cycle, such developments would have been enough to spark a euphoric rally. Yet in 2025, the market eventually responded with “cold treatment.”

However, judging 2025 solely by price misses a deeper transformation: Bitcoin’s holder structure and pricing logic are moving beyond the “purely speculative stage,” gradually transitioning into a mature asset.

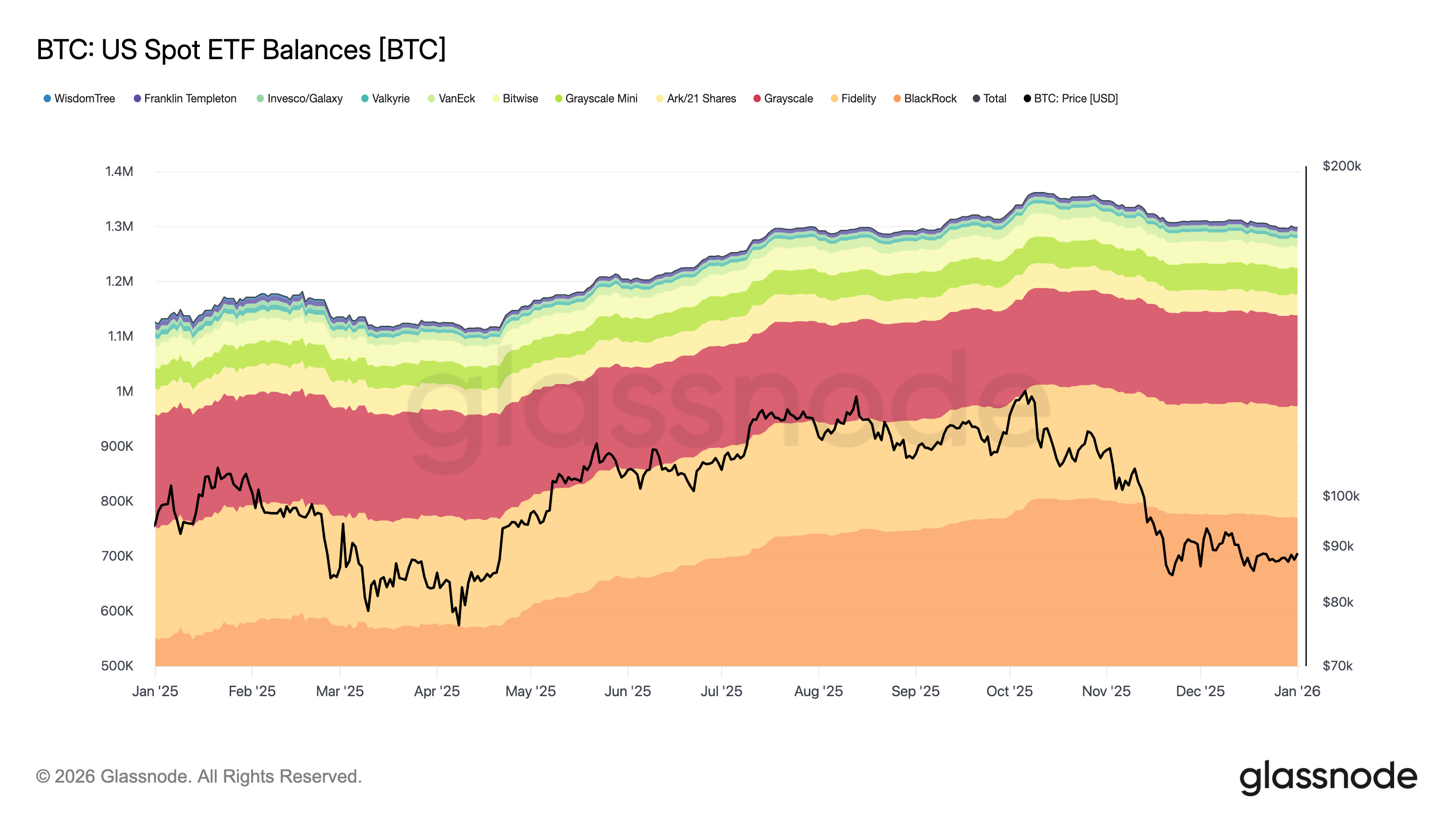

Spot Bitcoin ETFs demonstrated remarkable stability throughout the year—even as Bitcoin retraced over 30% from early October to year-end, Glassnode data shows total ETF holdings fell by only about 4.7%. This indicates that more capital is flowing into Bitcoin with a long-term mindset rather than chasing short-term gains, tolerating interim volatility.

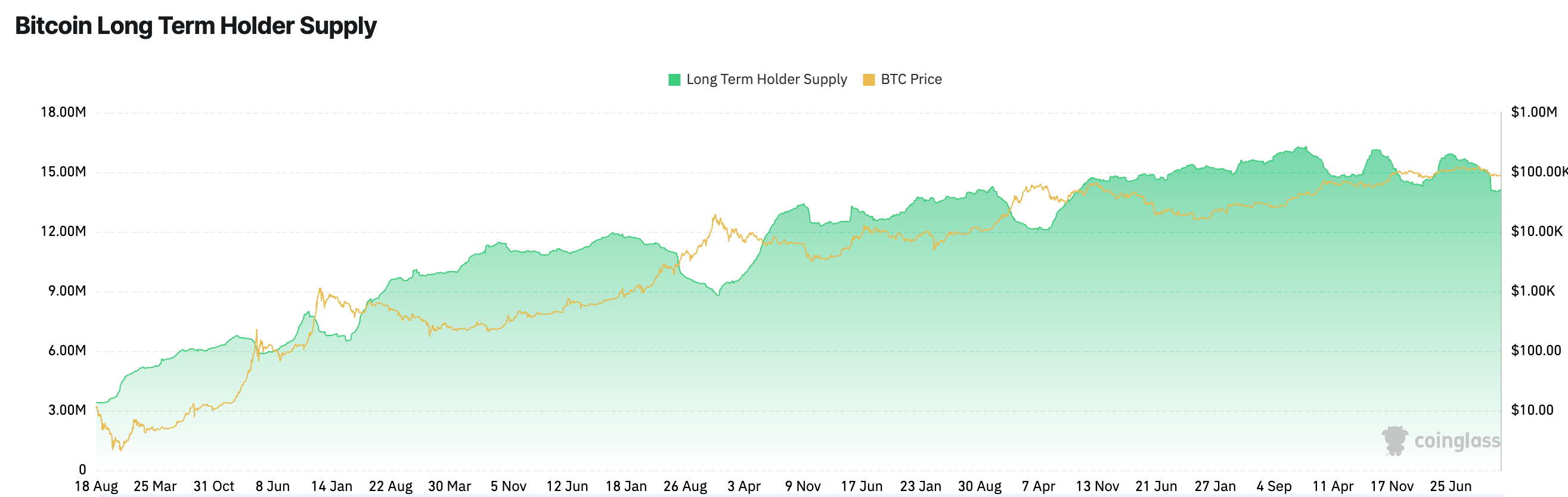

At the same time, the main selling pressure in 2025 came from long-term holders, not new institutional money.

Coinglass data shows that since July 2025, reductions in long-term Bitcoin holdings have exceeded those of any bull market in the past eight years. While the migration of older coins into compliant accounts temporarily pressured prices, it ultimately raised the cost basis and optimized the holder structure.

Therefore, I believe 2025 was not a “failed bull market,” but rather Bitcoin completing a necessary transition toward being a legitimate asset. Behind the muted price swings lies a market evolving from emotion-driven trading to structured pricing, setting the stage for the trading logic of 2026.

Trading Bitcoin in 2026: Weakening Single Narratives, Scenario-Based Decisions

Looking ahead to 2026, the key change is that Bitcoin’s price is no longer highly sensitive to any single internal narrative.

Scarcity remains, but prices are no longer driven solely by the “supply story.” They also depend on external factors, including global interest rate conditions, macro growth expectations, overall risk asset sentiment, and the pacing of institutional capital. At the same time, bulls face competition from alternative assets like AI-related tech and gold. This helps explain why Bitcoin did not rally linearly despite multiple rate cuts in 2025.

Moreover, with rising institutional participation and more developed derivatives markets, Bitcoin’s volatility structure is evolving. Extreme, one-sided moves are occurring less frequently, and prices now oscillate within broader ranges. This does not mean risk has disappeared; it means position management has become more important than directional bets.

In this context, single-direction forecasts are increasingly inadequate. Scenario analysis may be a more effective approach to understanding Bitcoin’s potential trajectory.

In a relatively optimistic scenario—stable ETF inflows, sustained marginal easing of macro policy, and no new regulatory shocks—Bitcoin could challenge previous highs and even achieve moderate new peaks. But these gains are likely to be gradual, with frequent pullbacks, rather than the rapid, one-sided surges seen in past cycles.

A more realistic path is range-bound trading. Without overwhelming catalysts, Bitcoin is likely to move sideways within a wide range. Volatility may spike at times, but trends are unlikely to persist. This environment is less conducive to long-term narratives but demands higher discipline in trading strategies.

Tail risks cannot be ignored. If a macro slowdown triggers deleveraging across risk assets, coupled with continued ETF outflows or forced selling by corporate or large holders, Bitcoin could still face a deep correction. Unlike prior cycles, such declines are more likely to be driven by liquidity and risk appetite dynamics than by challenges to the asset’s legitimacy or survival.

Abandoning the “Bull Market Template”: Focus on Timing and Risk

Regardless of which scenario unfolds, one principle holds for 2026: traditional “bull market thinking” may no longer be effective.

Bitcoin’s value now lies less in explosive narratives and more in its function as a global allocation asset, its sensitivity to liquidity shifts, and its role as a non-sovereign option in uncertain times. This shift may slow the upside curve, but overall risk structure is improving.

Within this framework, effective strategies are not about going all-in or making directional bets. Instead, they emphasize phased entries, scaling positions, and managing timing. Betting everything at once to capture a yearly top is increasingly inefficient; accepting that you may “miss the peak” and focusing on structured opportunities after pullbacks may align more closely with institutional logic.

Range-based thinking is increasingly important. In a low-volatility, weak-trend environment, chasing highs is often poor value, whereas staggered entries after pullbacks tend to improve the probability of success. Key technical zones and macro event points become more critical anchors than mere directional calls.

The role of derivatives also needs to be reassessed. In 2026, futures and options are not primarily tools to amplify bets—they are tools to hedge spot positions, manage volatility, and improve capital efficiency. Treating them as a “casino” when the market lacks clear trends can amplify errors.

In short, the Bitcoin market in 2026 is likely to favor traders who can manage positions, follow price rhythms, and respect market structure—rather than those who merely tell compelling stories.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.