- English

- 中文版

It’s almost a given at this point, to the point of it becoming a joke, that equity bears will always shout louder than equity bulls.

Quite why, is beyond me. Running the numbers, since inception, the S&P has spent 7.5% of all trading days at a record high. Broadening things out, we’ve spent just under half of all trading days within 5% of a record, and just shy of two-thirds of those days within 10% of a record. In short, for the majority of market participants’ time on the desk, the benchmark global equity index has been at, or within touching distance of, an all-time peak.

Despite that, every day there are hundreds of column inches taken up with rhetoric around how ‘the end is nigh’. The latest ‘go-to’ narrative for those notes – equity market concentration.

This appears to be causing plenty of gnashing of teeth at the moment, with folk worrying about how the biggest stocks within benchmark indices simply keep on getting bigger, resulting in those indices becoming increasingly concentrated.

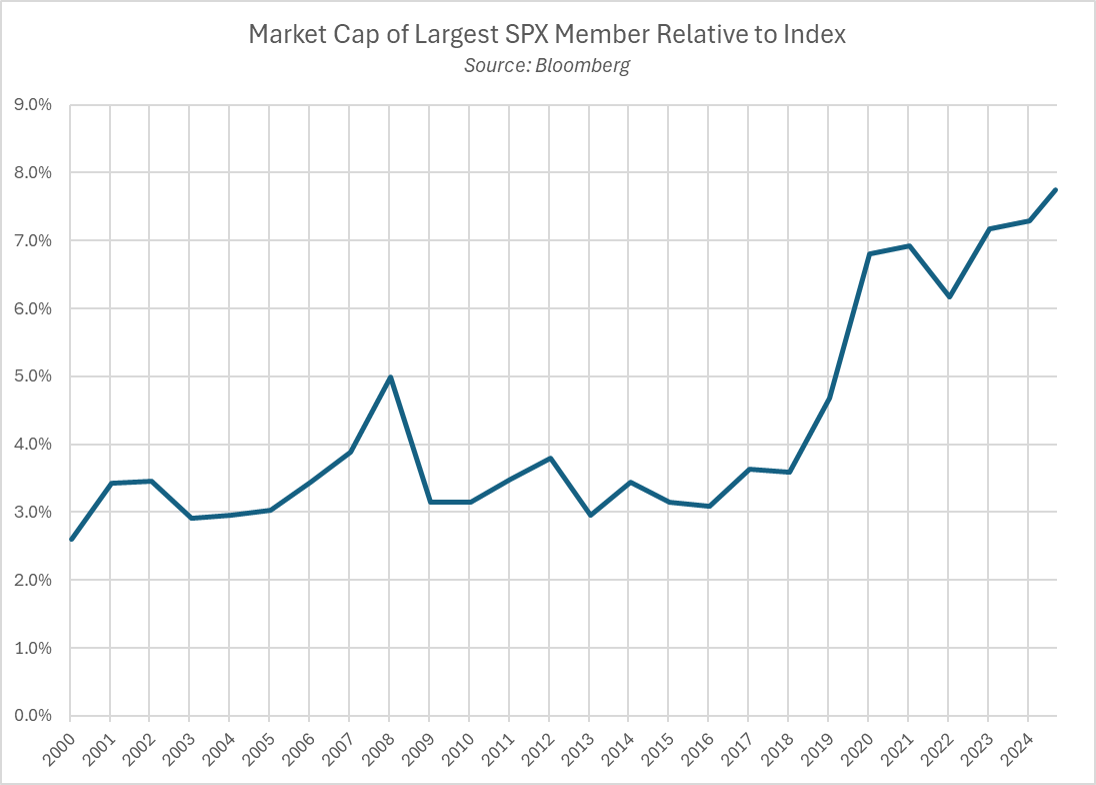

It is, however, key to note that this isn’t exactly a new phenomenon. Again, running the numbers, we see that – besides a brief blip in 2022 – the weight of the largest stock in the S&P 500 has been steadily increasing for almost a decade, having passed its pre-GFC peak shortly after the pandemic. If one had sold the SPX at that stage, one would have missed an 84% total return in the following period – past performance, of course, not being a reliable predictor of future results.

It’s not just the weight of the biggest stock that’s causing concern, but the concentration of ‘megacaps’ as a group, chiefly those at the forefront of the AI arms race.

For instance, Nvidia, along with the three hyperscalers (AMZN, GOOG/L & MSFT) now make up just shy of 25% of the S&P 500 on their own, while also making up a little under half of the gains seen in the benchmark index since the start of 2023.

While I don’t proclaim to be any sort of tech expert, I’d argue that there are three key points to bear in mind when looking at this, and at the market more broadly.

Firstly, as alluded to above, concentration is something that we should probably never really worry about too much. It’s simply a fact that, as the economy evolves, the biggest theme at any time will shift – at the start of the millennium it was all about ‘big oil’, then we moved on to ‘big tech’, before now moving on to AI. Naturally, as the makeup of the economy shifts, the makeup of the market will shift too – that is, simply, how cap weighted indices are supposed to work.

Secondly, particularly when it comes to the ‘picks and shovels’ AI plays, such as NVDA and AVGO, the key question is whether sales are showing any sign of slowing. Clearly, that’s not the case – order books are full to the brim, while the aforementioned hyperscalers, and others, continue to increase their capex at a remarkably rapid rate. In many ways, the biggest issue for these chipmakers will be whether they are actually geared up to meet the incredible demand that is coming their way.

Finally, for those hyperscalers, the key question is whether the huge amount of capex spent on AI can be effectively monetised. Judging by the most recent earnings reports, it certainly seems that that will prove to be the case, not only boosting the stocks in question as their big bets on AI pay off, but likely also resulting in investment in the space only increasing further in the quarters ahead, further boosting the semiconductor names that we’re now all familiar with.

To be clear, none of this is to say that markets will forever head higher in a straight line. That is, as always, highly unlikely, and in fact such a move would be rather unhealthy, implying stretched positioning, and potentially even a degree of complacency.

It is, however, to say that the bull case for these AI-focused names remains firmly intact. By extension, the bull case for the broader market remains a solid one too.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.