- English

- 中文版

Grim UK GDP and more to come

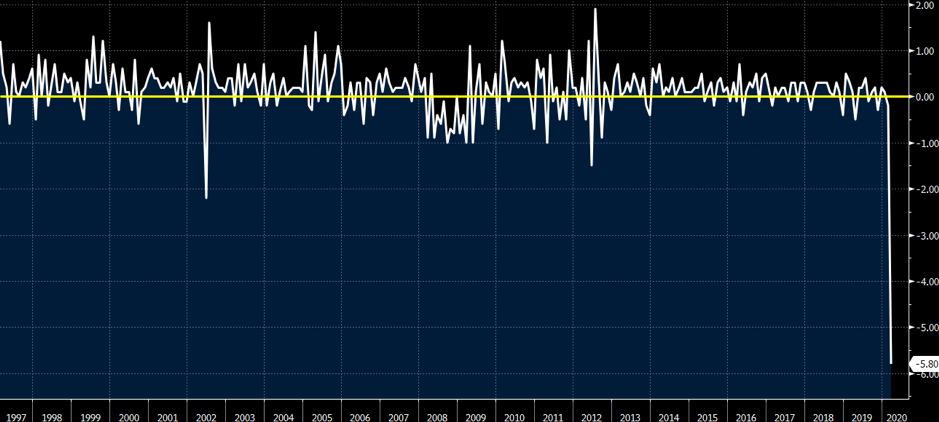

UK monthly GDP falls off a cliff

The sharp contraction seen in today’s GDP data came as little surprise, as the economy shrank 5.8% in March, the largest drop since the monthly series began in 1997. The declines were felt in almost all sectors with the pandemic ending more than four years of uninterrupted growth in UK household spending.

The fall in the first quarter was in fact slightly better than estimates and less severe than the latest Bank of England forecasts. It was also less than the 3.8% slump suffered by the euro zone in the first three months of the year, though this reflects the later start of the UK lockdown measures.

It’s important to note that the lockdown was only in place for seven working days from January to March, although even then it resulted in the largest quarterly contraction since the peak of the GFC in 2008-9. This means more records will be broken after the next data release as the UK went into full lockdown mode. In fact, the Bank of England said last week that the contraction in the second quarter could approach 25% and lead to the largest annual decline in 300 years.

Baby steps out

Key going forward for the economy will be how the UK manages the three-step lockdown easing plan. After the delay to the country’s exit, the government has struggled to clearly articulate its strategy. But given that social distancing measures are here to stay for a while, many sectors will find it very challenging to return to profitability any time soon, with long-term investment plans also put on hold.

The BoE stated at last week’s meeting that the economy could rebound if coronavirus restrictions are lifted, forecasting a 15% recovery after a historic 14% fall in GDP for 2020 as a whole. However, this recovery might be slower if consumers proved more cautious.

Struggling sterling

The pound is the weakest major so far this month and the risks are piling up in a month that has historically been weak. Sterling has fallen every May over the past decade and all but four times since 2000. The slow and now rather vague response by PM Johnson’s government is concerning, MPC members have kept the door open for negative rates and the lack of progress in post-Brexit talks linger in the background, with the June deadline fast approaching. Remember that under the UK’s withdrawal agreement with the EU, both sides currently have until 31 December to ratify a trade deal and rules for future co-operation. Any extension to this December deadline has to be made by 1 July.

Ready to trade?

Opening a Pepperstone account is simple. Apply in minutes. Start your Pepperstone journey today.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.