- English

- 中文版

Gold Outlook: Price Hovers Around $5,000 as Nonfarm Payrolls and Geopolitics Take Center Stage

.jpg)

Over the past week, gold has traded within a wide range. Repeated shifts in geopolitical developments, combined with swings in trader risk appetite, have limited the metal’s ability to trend unilaterally. Meanwhile, ongoing central bank purchases and a temporarily weaker dollar have provided solid support for gold’s downside.

This week, the U.S. January nonfarm payrolls and CPI data will be released, and the U.S. and Iran will hold their second round of negotiations. The convergence of these key events could give gold the impetus to break out of its current consolidation, so traders should remain alert to the risk of heightened volatility.

Technical Observation: Gold Consolidates, $5,000 as the Key Threshold

Gold briefly dipped to around $4,400 last week but remained largely within the $4,630–$5,100 range. Long and short positions have alternated frequently, with daily charts showing multiple long bodies and extended wicks, indicating significant intraday swings.

Although gold closed the week up 1.6%, in the current high-volatility environment this appears more like a repricing of risk rather than a clear return of a bullish trend.

On Monday morning, gold once again tested the $5,000 level, which now serves as a critical short-term pivot:

- If prices can hold above $5,000 on a daily close, the $5,100 level becomes an important reference for confirming bullish momentum, potentially reopening trend-following opportunities;

- If $5,000 fails to hold, gold is likely to continue range-bound trading, with support at $4,800 and $4,630 remaining key.

Geopolitical Uncertainty Sustains Safe-Haven Demand

Geopolitical developments remain a major factor influencing gold.

Last week, reports on whether the U.S. and Iran would enter negotiations repeatedly fluctuated. While talks were ultimately held in Oman, progress was limited. Iran insisted on restricting discussions to its nuclear program, while the U.S. sought to include Iran’s ballistic missile program and its support for regional armed groups.

These core differences are unlikely to be resolved in the short term, and both sides remain firmly positioned outside of the negotiation table.

Meanwhile, the U.S. threatened tariffs on countries trading with Iran. Although the likelihood of a direct military confrontation remains low in the near term, this “talk while pressuring” approach significantly increases uncertainty around the negotiations and keeps safe-haven demand elevated.

Against this backdrop, combined with ongoing localized conflicts in Ukraine, gold continues to hold its value as a safe-haven asset.

Central Bank Buying and a Softer Dollar Support Gold

Beyond short-term geopolitical disturbances, ongoing central bank purchases remain a key pillar supporting gold. As of the end of January, China has increased its gold reserves for 15 consecutive months.

Considering that gold still represents a relatively small portion of China’s foreign reserves compared to the global average, this accumulation trend is likely to continue in the foreseeable future, providing medium-term support for gold.

At the same time, the dollar index has eased slightly from last week’s high of 98, and U.S. Treasury yields have also drifted lower since mid-January. This has provided additional support for dollar-denominated gold.

Watching U.S. Data and Geopolitical Developments

Overall, gold remains range-bound. Geopolitical uncertainty, sustained central bank buying, and a temporarily weaker dollar collectively provide support. However, higher CME margins, three consecutive weeks of falling COMEX net longs, and a lack of fresh catalysts have constrained gold’s upside.

In the medium to long term, the path of least resistance for gold remains upward. Yet the market is currently in a high-frequency volatility mode, driven by economic data, policy signals, and geopolitical news. For traders, managing position size is more important than betting on direction.

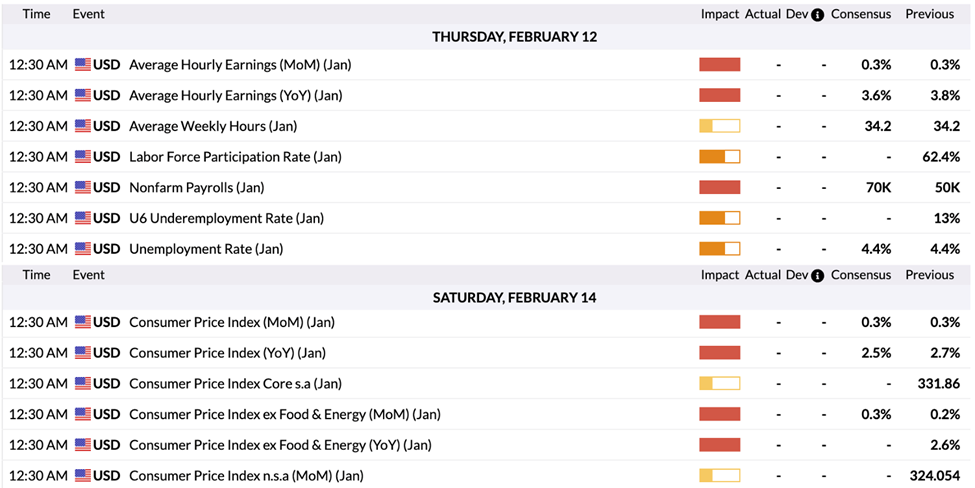

This week is particularly crucial, with a dense schedule of U.S. data releases. Wednesday’s January nonfarm payrolls and Friday’s CPI report could serve as triggers for short-term volatility.

The market generally expects job gains to rebound from 50,000 to 70,000, with the unemployment rate holding at 4.4%, while both headline and core CPI are expected to ease slightly.

- If data broadly meets expectations, showing a steady labor market and moderating inflation, it could reinforce expectations for a mid-year rate cut, potentially pressuring gold in the near term;

- However, given that ADP data previously came in below expectations, markets remain alert to the risk of a payroll “miss.” Should employment weaken significantly (30,000–50,000 jobs added), unemployment rise, and CPI show persistent inflation, stagflation concerns could increase, providing temporary support for gold.

In addition, traders should monitor the latest statements from Federal Reserve officials and any developments from the second round of U.S.-Iran talks. Any new policy or geopolitical signals could be quickly amplified in the current high-volatility environment and reflected in gold prices.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.