- English

- 中文版

Gold Outlook: Price Breaks $3,800, Least Resistance Path Remains Upward

.jpg)

Over the past week, the gold market remained dominated by bulls, with prices successfully breaking above $3,800 today, setting yet another record high. Expectations for further Fed rate cuts have supported this non-yielding asset, while Trump’s new tariff policies, geopolitical tensions, and potential U.S. government shutdown risks have provided ongoing safe-haven buying. In addition, momentum traders’ participation and continued inflows into gold ETFs have been key drivers supporting the steady upward push in prices.

This week, traders will closely monitor U.S. fiscal policy developments and employment data, including the nonfarm payroll report, which could guide gold’s next move.

Technical Review: Strong “Buy-the-Dip” Resilience

Looking at the XAUUSD daily chart, gold’s resilience in “buy-the-dip” behavior has been reaffirmed. Despite a minor midweek pullback, bulls quickly stepped in around $3,700, helping the weekly close finish up more than 2%, maintaining a steady uptrend. On Monday, prices surged through $3,800 during intraday trading, with bulls actively seeking new upside.

This strength has not only highlighted gold itself but also lifted silver, platinum, and other precious metals to multi-year highs, sparking enthusiasm among both institutional and retail investors. However, it is worth noting that the daily RSI for gold remains above 70, indicating overbought conditions and signaling potential short-term consolidation or pullback pressure.

Whether gold can close above $3,800 is crucial. Holding this level would make $3,900 and some institutional forecasts of $4,000 this year more achievable. If prices retreat below $3,800, support may emerge around $3,700, with the next support level potentially near $3,630 if that fails.

Economic Data Pointing to Rate Cuts: A Boost for Non-Yielding Gold

The push past $3,800 was driven by multiple factors. From a fundamental perspective, U.S. core PCE rose 2.9% year-on-year in August, with a 0.2% month-on-month increase, broadly in line with expectations. This mild data fits perfectly within gold’s “ideal range”: it is not high enough to trigger fears of aggressive Fed tightening, nor too low to diminish gold’s safe-haven appeal, reinforcing expectations for further rate cuts this year.

Meanwhile, the University of Michigan Consumer Sentiment Index came in well below consensus, further supporting a dovish Fed stance. Market pricing shows an 88% probability of a rate cut in October, with a 65% chance of another cut in December. For a non-yielding asset like gold, this is clearly supportive.

Government Shutdown + Geopolitical Risks: Safe-Haven Demand Remains Strong

Beyond policy expectations, safe-haven demand is another key driver for gold. With the U.S. government potentially facing a shutdown at the start of the new fiscal year on October 1, traders have to contend with this risk. The most immediate impact of a shutdown would be delays in key economic data releases—the nonfarm payrolls report this Friday and the October 15 CPI could be affected.

This would leave the market temporarily without crucial reference points, creating uncertainty in trading decisions. If nonfarm data is delayed, the Fed loses an important basis for its next rate decision, which supports gold as a safe-haven.

Industries relying on federal funding, such as defense contractors, research institutions, and certain healthcare services, would face cash-flow pressures. The longer a shutdown lasts, the more pronounced its effects on economic growth, consumer confidence, and business investment. Historical experience shows that market sentiment typically recovers quickly after a shutdown, but in the short term, gold remains a preferred safe-haven asset.

Geopolitical risks are also significant. Last weekend, Trump ordered U.S. troops deployed to Portland, while tensions flared in other major cities over immigration policies, boosting short-term safe-haven demand and pushing gold higher. Long-term effects depend on whether tensions escalate. If unrest remains localized and does not disrupt supply chains or economic activity, markets are likely to treat it as political noise. If events spread and disrupt logistics, systemic risks could emerge, further supporting gold.

In addition to policy and geopolitical factors, capital flows are another driving force. In September, gold ETFs saw net inflows of $11 billion, equivalent to about 89 tons of gold, pushing year-to-date ETF holdings to their highest level since 2022.

Meanwhile, the USD is encountering resistance around 98.7, while the 5-year real yield holds at a relatively low 1.32%, both providing added support for gold. Combined, these factors are fueling strong upward momentum.

Employment Data Will Be Key for Gold’s Next Move

Overall, gold bulls remain in control. Expectations for Fed rate cuts and strong safe-haven demand provide the backdrop, while inflows provide the actual driving force. Unless a major unexpected event occurs - such as Trump suddenly loosening immigration policies or the Fed changing its rate-cut stance - the path of least resistance for gold remains upward, and any pullbacks are likely to be shallow.

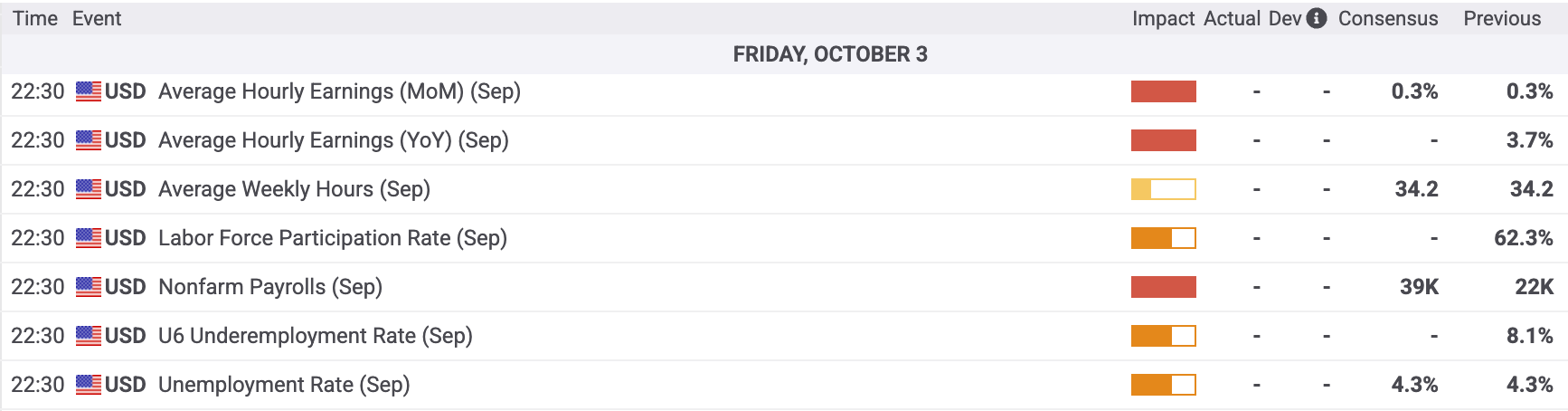

Looking ahead, attention turns to U.S. labor market data, with the nonfarm payroll report remaining a key focus, especially this Friday, October 3. Leading indicators ahead of the report - JOLTs job openings, ADP employment, and ISM services PMI employment subcomponents - will provide clues for nonfarm trends.

If the Bureau of Labor Statistics releases the data on time, the market consensus forecasts 39,000 new jobs in September, up from 22,000 previously, with the unemployment rate holding at 4.3%.

Weaker-than-expected employment, with additions below 50,000 and stable unemployment, would strengthen the Fed’s case for easing in October, further boosting gold. Even if employment improves modestly, it is unlikely to shift market expectations for an October rate cut, so short-term pressure on gold may remain limited.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.