- English

- 中文版

February 2025 BoE Review; A Cautious Cut With A Dovish Surprise

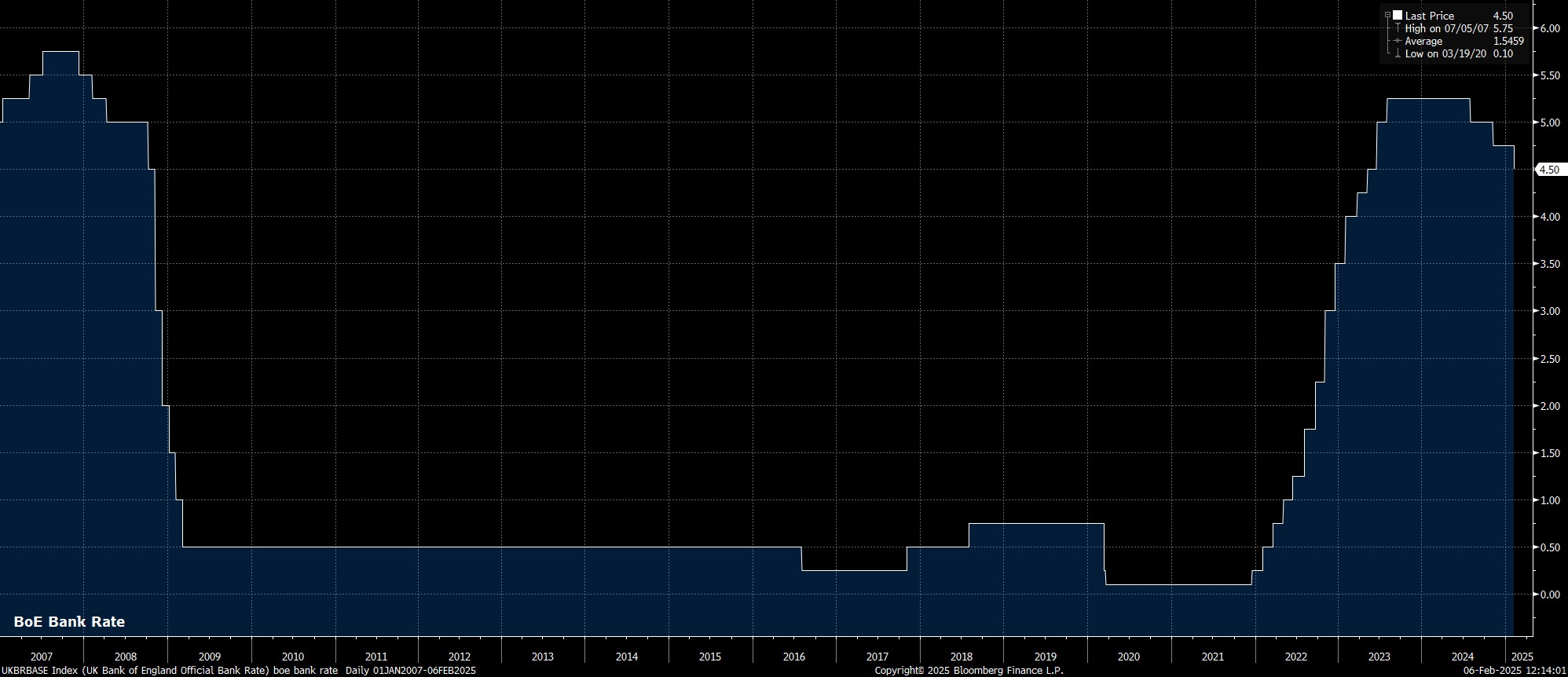

The Bank of England’s Monetary Policy Committee delivered this cycle’s third rate cut at the conclusion of the first meeting of the year, with policymakers voting in favour of a 25bp cut, lowering Bank Rate to 4.50%, continuing to gradually remove policy restriction.

In contrast to the decisions seen in 2025, the MPC are now unanimous in their belief that Bank Rate should be reduced, with today’s cut coming via a surprising 9-0 vote. Perhaps even more surprisingly, two policymakers, Dhingra and Mann, would’ve preferred a 50bp cut to begin the year. The latter of those dissents is, perhaps, a little ludicrous, considering how Mann spent last year as the MPC’s resident uber-hawk, and now appears intent on taking up residence as an uber-dove.

Accompanying the decision to deliver another Bank Rate cut was the MPC’s latest policy statement.

Here, the policy guidance largely mirrored that which the Committee have used for the bulk of this cycle. As such, the statement reiterated that a “gradual and careful” approach to removing policy restriction remains appropriate, and that policy must remain “restrictive for sufficiently long” in order to bear down on the risks of inflationary pressures becoming embedded. At the same time, the MPC reiterated that focus will remain on the “risks of inflation persistence”, and that a ‘meeting-by-meeting’ approach will continue to be followed.

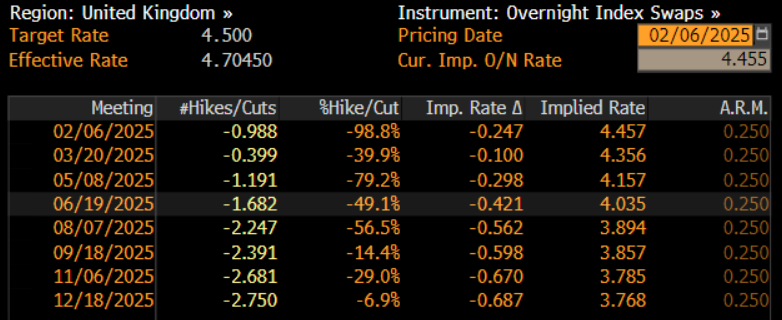

Despite unchanged guidance, the dovish vote split sparked a significant repricing of market-based rate expectations, moving to price three further 25bp cuts this year, compared to the two that were foreseen pre-meeting.

Along with the policy statement, the February MPC meeting also brought an update to the Bank’s economic forecasts.

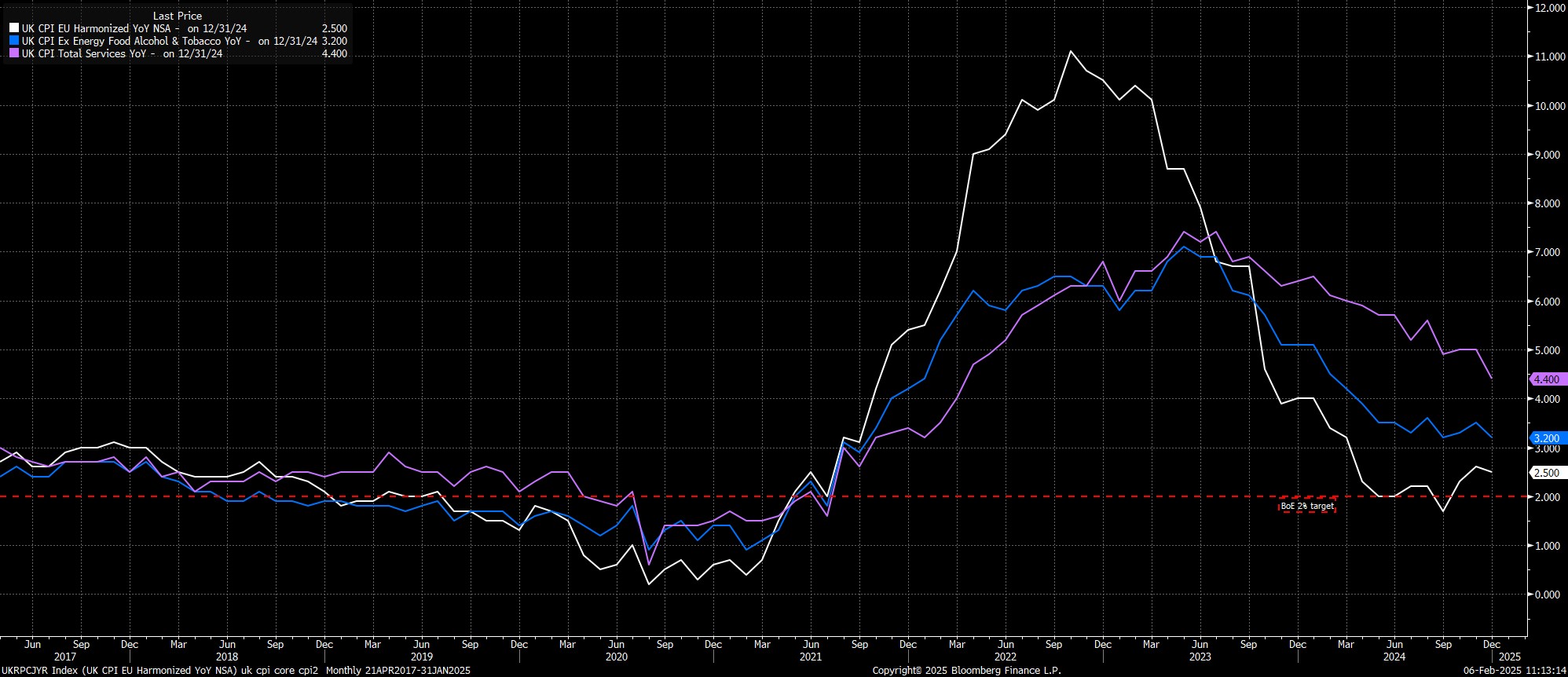

On inflation, the Bank now see CPI peaking at 3.7% this year, compared to the 2.8% foreseen in the November forecast round. Furthermore, headline CPI is not seen returning to the 2% target until 3 years from now, making the calls, from some, to plump for a ‘jumbo’ 50bp rate reduction even more perplexing.

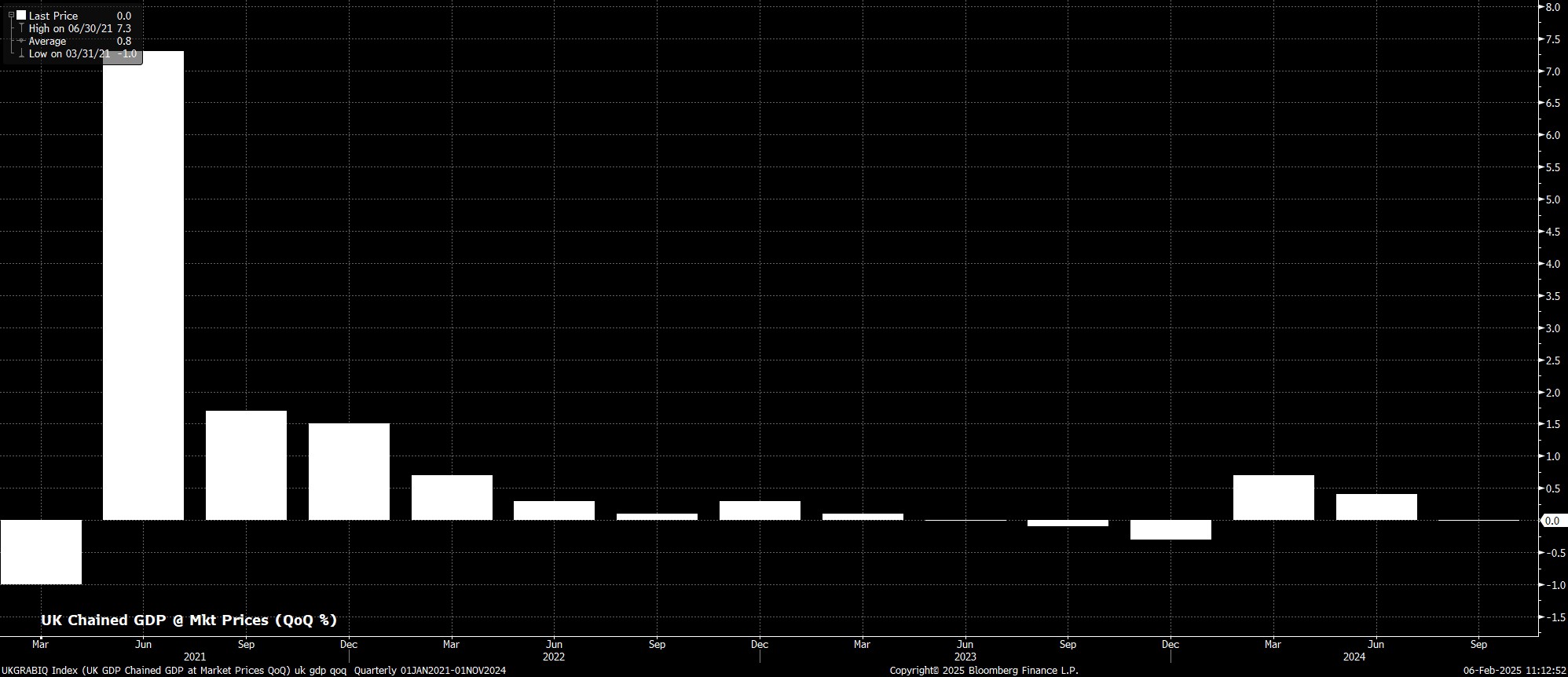

Meanwhile, in terms of economic growth, the outlook remains an anaemic one, with the year-ahead GDP growth call slashed from 1.4%, to 0.4%, though activity is seen recovering further along the forecast horizon. While this is one reason for policymakers to want to provide support to the economy via more aggressive action, the Bank’s mandate is price stability, not propping up growth and, in turn, raising the risks of inflation persistence.

Commenting on the above at the post-meeting press conference, Governor Bailey noted that the MPC do expect to be able to deliver further rate cuts, and that how much, and how fast, rates can be cut will be decided on a meeting-by-meeting basis.

On the whole, it’s tough to see the February MPC meeting as a game-changer in terms of the policy outlook. While, in an ideal world, the ‘Old Lady’ would likely seek to ease policy much quickly, and to a greater extent, in order to prop up the ailing economy, stubbornly high inflation, and elevated risks of persistence, simply don’t permit them to make a dovish pivot at this moment in time.

Looking forward, the base case remains that the current predictable pace of easing, with one 25bp cut being delivered per quarter, amounting to a total of 100bp of rate cuts being delivered this year, and Bank Rate ending 2025 at 3.75%. That said, risks to this base case do tilt towards a more dovish outcome, particularly if increased labour market slack acts as a significant drag on demand, in turn exerting downward pressure on stubborn services inflation. For now, though, the MPC seem likely to err on the side of caution.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.