- English

- 中文版

Energy Outlook 2025: Balancing Surplus and Geopolitical Risks

The U.S. energy policy under the new administration seeks to combine deregulation with a potential return to Trump-era sanctions. While deregulation is expected to boost domestic production by 0.4–0.5 million barrels per day (mb/d) in 2025, lifting U.S. output from the current 13.2 mb/d, this incremental increase faces limitations when set against broader global dynamics. A revival of the “maximum pressure” strategy against Iran, and sanctions on Venezuelan oil, and possibly Russia would remove considerable volumes of oil from the global market. Iran, for instance, currently produces 3.5 mb/d and exports 1.5 mb/d, with China accounting for the bulk of these exports. Sanctioning Iranian oil could remove these barrels from the market, tightening global supply - a scenario that would likely outweigh any benefits from increased U.S. output.

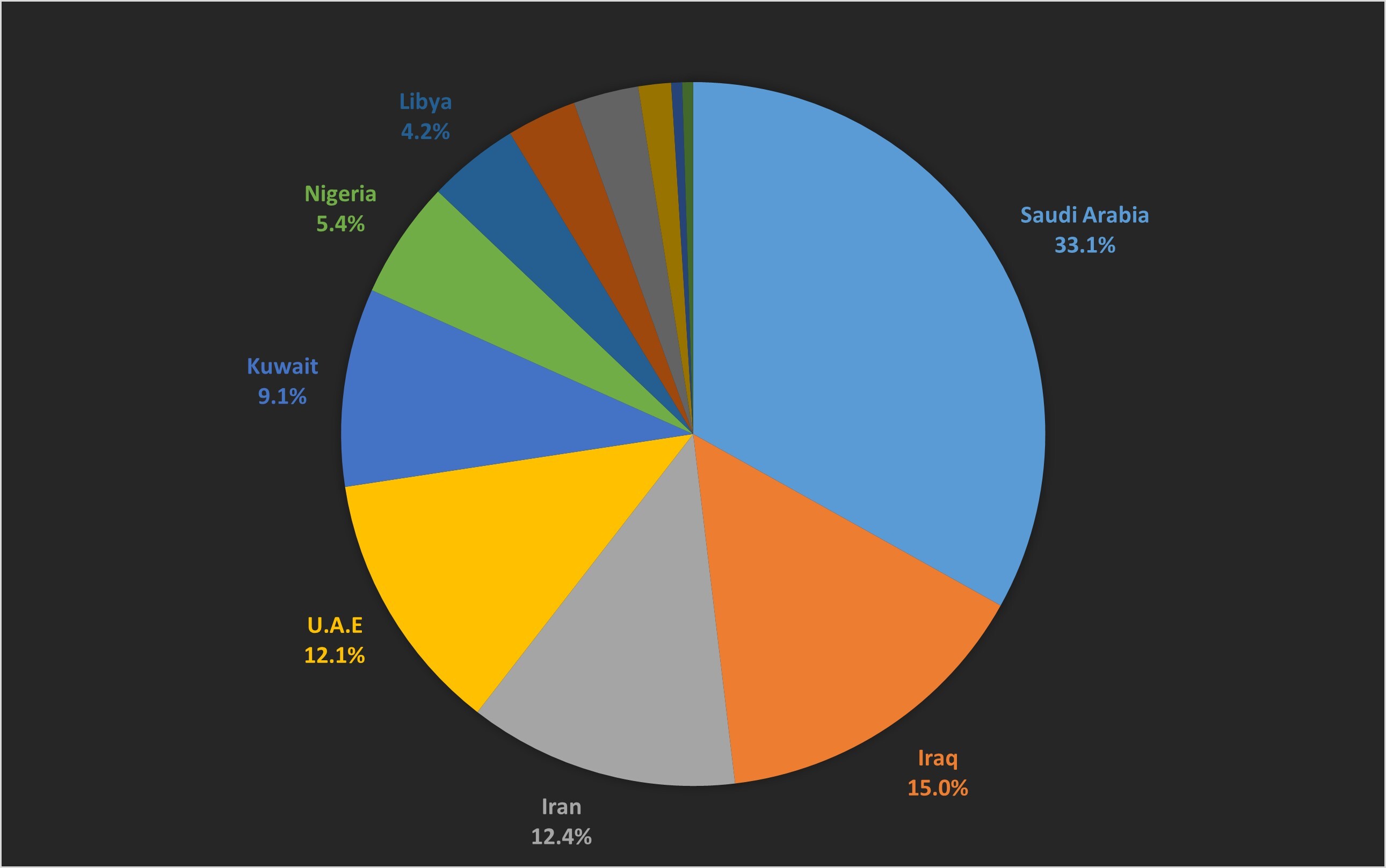

The geopolitical landscape for the oil market in 2025 is shaped by mounting risks, with Iran and Saudi Arabia at the centre of the equation. The 2023 China-brokered rapprochement between these two regional powers marked a notable shift in Middle Eastern diplomacy, reducing the likelihood of Gulf Cooperation Council GCC nations, particularly Saudi Arabia and the UAE, ramping up production to offset potential supply losses from Iran. While GCC producers might partially step in to stabilise markets, their willingness to do so will depend on regional political developments and OPEC+ strategies, leaving a potential supply vacuum should Iranian exports be sanctioned.

Iran’s crude exports remain a key vulnerability, historically highly sensitive to U.S. sanctions. A renewed “maximum pressure” campaign in 2025 could remove up to 1.5 mb/d of Iranian oil from global supply, a volume that non-OPEC+ producers are unlikely to fully compensate in the short term. Meanwhile, Russia, already operating near capacity, lacks the flexibility to increase production meaningfully within 12–18 months. These factors collectively highlight the market’s limited ability to respond to sudden supply disruptions, increasing the likelihood of price volatility. OPEC+, and specifically Saudi Arabia, is positioned as the linchpin in maintaining market stability amid these risks. However, the kingdom’s response will depend heavily on its strategic priorities and willingness to absorb potential economic and political costs. With these uncertainties, geopolitical tensions could rapidly undermine projections of stability, leaving prices susceptible to supply-side shocks.

From a global perspective, oil supply is projected to remain in surplus in 2025, largely due to non-OPEC+ producers. Nations like Brazil, Norway, and Senegal are leading the charge, leveraging advancements in deepwater offshore drilling to bring volumes to market. By December 2025, global oil supply is expected to reach 105.9 mb/d, outpacing demand, which is forecasted at 104.7 mb/d. The surplus of 1.2 mb/d, though seemingly robust, may not provide the buffer needed to absorb geopolitical shocks, particularly if Iranian or Venezuelan crude is abruptly removed from the market. Additionally, while non-OPEC+ supply is expected to grow, the growth rate is anticipated to slow into 2026, with the surplus narrowing to 1.1 mb/d. On the demand side, regional demand growth remains centered on Asia, particularly India and China. India’s rapidly expanding economy and infrastructure development are driving incremental demand, while China’s recovery from economic slowdowns is reinvigorating its crude appetite. These two nations will account for the majority of demand increases in 2025, solidifying their positions as the pivotal drivers of global energy consumption.

Price expectations for 2025 remain anchored in the $70–$75 range for Brent crude, with WTI prices likely averaging in the mid-$60s. These projections assume no major geopolitical shocks. However, the market’s vulnerability means that moderate disruptions - such as sanctions removing Iranian or Venezuelan barrels could push prices higher. Conversely, a downside risk scenario involving Brent falling to the $40 - $50 range, while unlikely, would require significant market intervention to restore balance. Non-OPEC+ producers, while instrumental in driving the surplus, may struggle to profit or adjust production to stabilise prices in such a scenario given the limited influence on the energy market globally.

The outlook for 2025 underscores the delicate balance between supply surpluses and geopolitical risks. On the supply side, the continued growth from non-OPEC+ nations offers a cushion against small disruptions. However, the potential for sanctions, coupled with limited spare capacity from key producers, highlights the market’s vulnerability to shocks. On the demand side, the reliance on India and China as growth engines emphasizes the importance of regional economic trends in shaping global balances.

In short, the oil market in 2025 is poised for a year of caution, with surpluses providing a degree of stability but geopolitical risks keeping volatility alive. For market participants, monitoring the intersection of U.S. policy decisions, Middle Eastern diplomacy, and non-OPEC+ production trends will be critical in navigating this evolving landscape.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.