- English

- 中文版

The FOMC remain deeply divided as to the appropriate future path for policy, however another 25bp cut is likely to be delivered at the conclusion of the December meeting. Guidance as to the pace of further easing into next year, however, is likely to remain elusive.

A Cut Is Coming

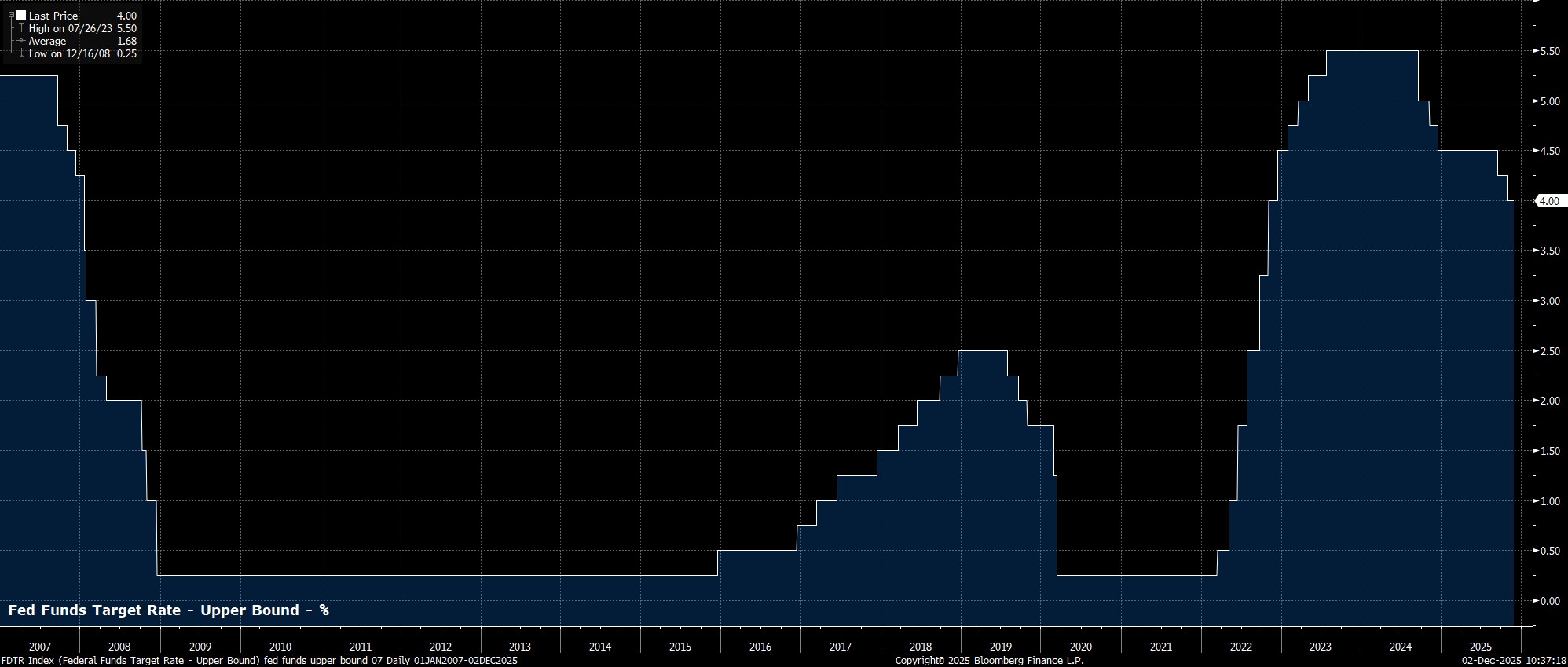

Despite Chair Powell, at the October press conference, noting that a cut this time out is ‘far from’ a foregone conclusion, it indeed appears that the FOMC will deliver a third straight 25bp cut at the upcoming confab, lowering the target range for the fed funds rate to 3.50% - 3.75%.

Such a move is, again, likely to be framed as a ‘risk management’ one, with the Committee continuing to remove policy restriction, in an attempt to support a stalling US labour market, amid a belief that tariff-induced inflation will prove largely temporary.

Money markets, per the USD OIS curve, price around a 90% chance of such an outcome, a probability that the FOMC have not sought to pushback on, and one that leaves the Committee running the risk of an ugly, and unwarranted, tightening in financial conditions if they weren’t to deliver another cut at the final meeting of the year.

Committee Remains Divided

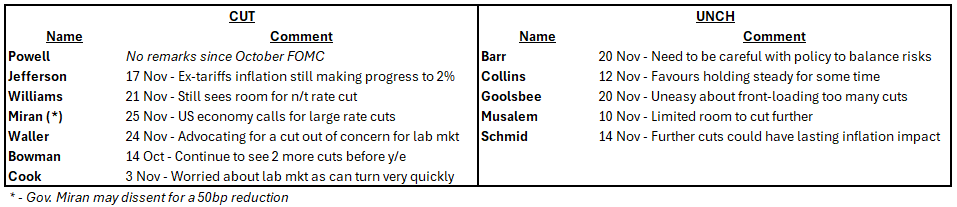

Despite the near-certainty of a rate cut being on the cards, such a move is almost certain not to come via a unanimous vote among policymakers, with the Committee still deeply divided as to not only the appropriate direction of travel for policy, but also the appropriate magnitude of moves to be making.

In fact, these divisions on the FOMC, as opposed to the consensus-building that has been a hallmark of Chair Powell’s tenure to date, could be said to represent the ‘BoE-ification’ of the Fed, where policymakers increasingly adopt more independent views, turning Fed watching into a game of ‘vote counting’.

Examining remarks made by policymakers since the October meeting suggests that the most likely scenario is for a 7-5 vote in favour of a 25bp reduction this time around.

While Chair Powell has made no public remarks since the October presser, it can be reasonably assumed that he is in favour of another 25bp cut, given the lack of hawkish pushback on market expectations. He is likely to be joined in such a vote by those outlined in the above table, while there is a chance that Powell plumping for a cut could also swing some of the more undecided hawks, such as Governor Barr, and Chicago Fed President Goolsbee, in favour of such a move as well. Governor Miran, meanwhile, is likely to prefer a larger 50bp cut at this meeting, though has stated he will vote in favour of a 25bp cut if his vote is the marginal one.

On the flip side, it seems unlikely that Collins, Musalem, or Schmid will do anything other than dissent for rates to remain unchanged, not least given that Schmid dissented in such a direction last time out.

While there is historical precedent for the FOMC to be deeply divided, dissent has become increasingly unusual during Powell’s term. In any case, while we last saw three dissents against a policy action in 2019, we’ve not seen four dissents against an action since October 1992, and have only seen five dissents twice in the history of the FOMC, with the most recent of those being over 40 years ago. It’s also worth noting that there is no provision for what happens in the event of a 6-6 split among policymakers, though the assumption is that in such a scenario the target range for the fed funds rate would be maintained at its current level.

Statement Likely Little Changed

In contrast to the potentially complicated vote split, the accompanying policy statement is likely to be little changed from that issued last time out, not least considering that the government shutdown, despite now being resolved, has delayed key data releases such as the November jobs and CPI reports until after the FOMC meeting.

Consequently, the Committee will likely again note that overall economic activity continues to expand at a ‘moderate’ pace, that inflation remains ‘somewhat elevated’, and that unemployment ‘remains low’, despite the headline U-3 rate having ticked up to a cycle high 4.4% in the September jobs report, the most recent month for which data is available. Despite a better-than-expected +119k NFP print that month, the Committee will likely still judge that risks to the employment side of the dual mandate have continued to rise.

Furthermore, policymakers will likely retain their data-dependent guidance in terms of future policy moves, noting that additional ‘adjustments’ to the fed funds rate will remain contingent on how the economy evolves, and offering no pre-commitment as to the timing of future rate moves.

Updated Forecasts Similar To September

Turning to the updated Summary of Economic Projections, on the whole the latest round of forecasts is likely to be broadly similar to those unveiled after the September meeting, again reflecting the lack of official, top-tier economic data released since the prior forecast round.

Consequently, the Committee is again likely to pencil in a growth outlook that sees real GDP rising around 2% YoY through the horizon, while also projecting that both headline and core PCE will return to the 2% target by the end of 2028. Given downside risks facing the labour market, there is some potential for a modest upward revision to unemployment expectations, particularly with headline joblessness already running close to the year-end 4.5% projection at the end of Q3, though any increase is likely to be short-lived.

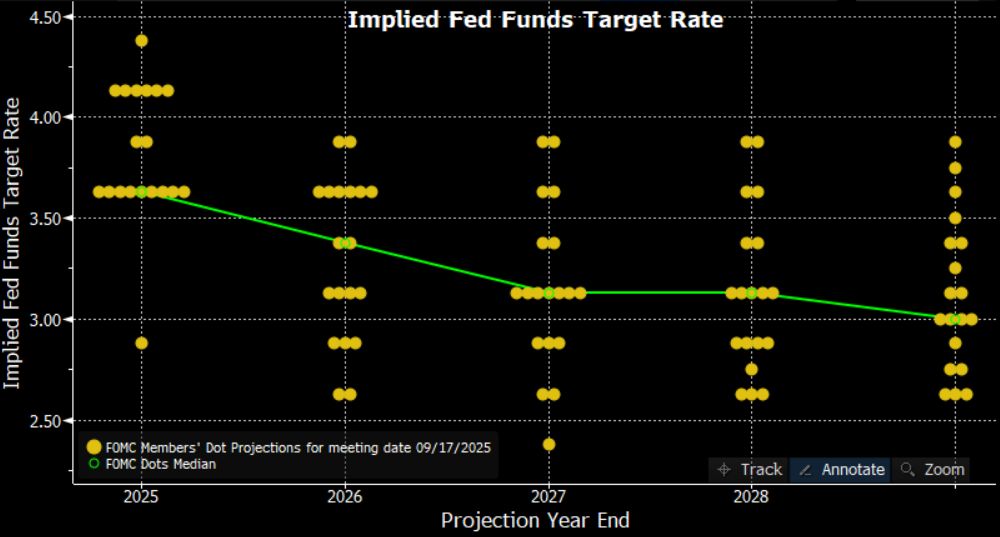

Dots In Focus For 2026 Outlook

Ordinarily, given the likely unchanged projections, one would expect the accompanying ‘dot plot’ to be relatively little changed as well. However, taking into account both the significant dispersion in the September dots, and the deeply divided nature of the Committee, that seems far from a foregone conclusion.

In fact, while the September ‘dot plot’ pointed to a median expectation that just one further 25bp cut will be delivered next year, it would only take a single policymaker above the current median to dovishly revise their dot, in order for the median to fall to pencilling in two 25bp reductions in 2026. On the other hand, two policymakers hawkishly revising their ‘dot’ would drag the median higher to point to rates remaining unchanged all year.

Hence, there is the potential for significant gyrations in market-based rate expectations post-event, on just a handful of Committee members marginally revising their future policy path.

Chair Powell’s Press Conference

The final element of intrigue over the December FOMC will be Chair Powell’s post-meeting press conference.

That said, it seems unlikely that Powell will offer anything particularly concrete in terms of forward guidance, not least considering the high degree of uncertainty which continues to cloud the economic outlook, as well as the fact that Powell will only be at the helm for another three FOMC meetings.

In any case, Powell will likely repeat his now-familiar view that there is no ‘risk-free’ policy path ahead, while also again stressing that there are ‘strongly differing views’ among FOMC members on the course that policy should take moving into 2026.

Conclusion

Overall, while the December meeting will likely be among the closest calls in recent memory, a 25bp cut remains the base case, with the doves likely winning the argument for the time being, enabling another ‘risk management’ cut to be delivered.

Looking ahead, however, the pace of rate reductions moving forwards remains more uncertain, not only as the Committee continue to follow a data-dependent approach, but also as the fed funds rate inches closer to its neutral level, making each rate reduction a somewhat tougher prospect than the one before it.

Into 2026, the Committee’s reaction function is likely to remain heavily tilted towards the employment side of the dual mandate, with there being a very high bar for an upside inflation surprise to force something of a hawkish pivot from policymakers. Consequently, despite more of a ‘meeting-by-meeting’ approach likely being adopted next year, another rate cut in January remains a distinct possibility, especially with three jobs reports due prior to that meeting, with a majority of members likely favouring further ‘risk management’ cuts unless and until a more concrete rebound in labour market conditions becomes obvious.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.