- English

- 中文版

Rate Cuts Resume

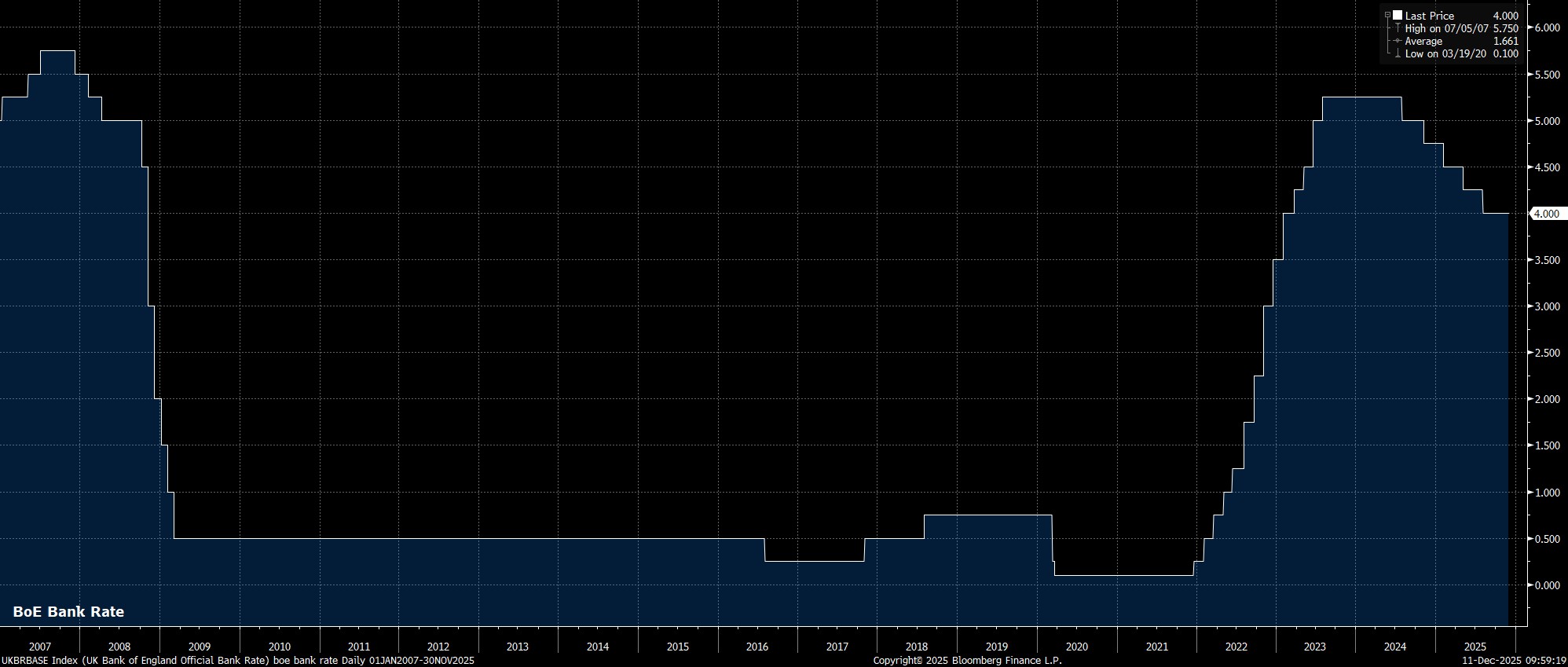

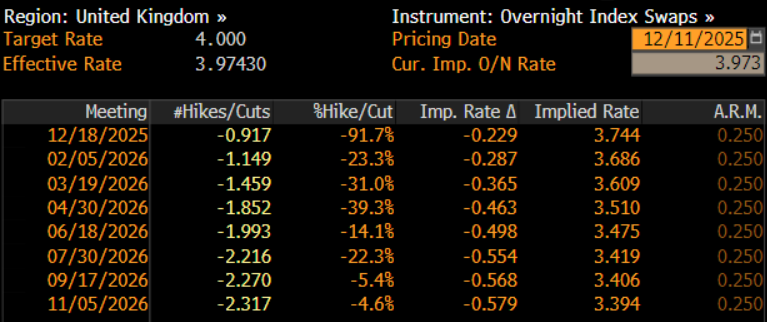

As noted, the MPC are set to vote in favour of a 25bp cut at the conclusion of the December meeting, in turn lowering Bank Rate to 3.75%, which would represent the lowest level since the first quarter of 2023.

Such an outcome would not only be in keeping with consensus expectations, but also with money market pricing, where the GBP OIS curve discounts around a 90% chance of a Christmas rate cut, while pricing a total of 58bp of easing by this time next year.

Three Reasons To Ease

The case for another rate reduction, despite the ‘Old Lady’ having held Bank Rate steady since August, rests on three key pillars.

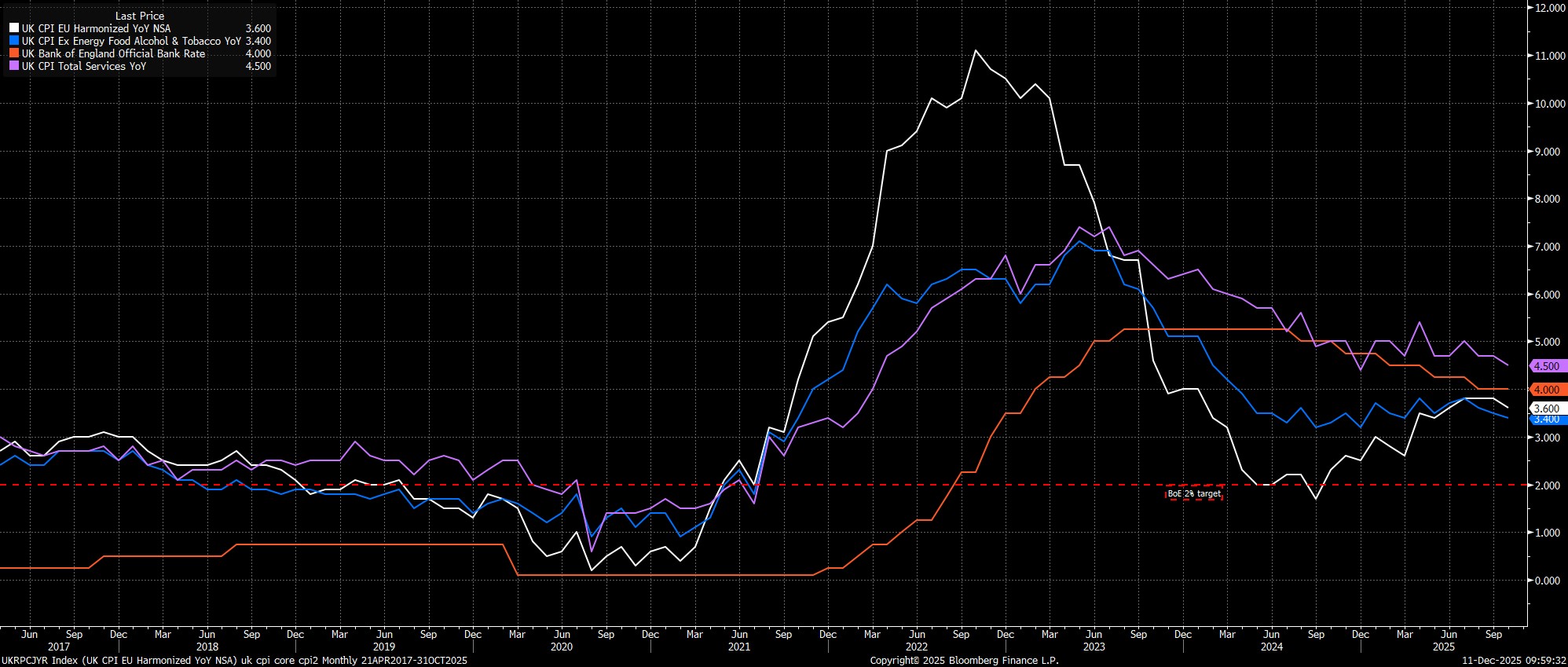

Firstly, and most importantly, is that policymakers now possess increased confidence that inflation has put in a peak. Headline prices rose 3.8% YoY in both August and September, before easing to 3.6% YoY in October, and with the MPC now forecasting continued disinflation, taking CPI back to the 2% target by early-2027. Meanwhile, the risk of price pressures becoming persistent has also subsided considerably, with core CPI now at a YTD low 3.4% YoY, and services CPI also at its lowest levels in a year, at 4.5% YoY.

On this, note that the MPC will have advance sight of the November inflation data, due for public release on 17th Dec, during their upcoming policy deliberations.

Secondly, an increasing margin of slack continues to emerge in the UK labour market. Headline unemployment stood at 5.0% in the three months to September, a 4-year high, while the economy has also, per the PAYE payrolls data, shed jobs in eleven of the last twelve months. Though earnings pressures remain relatively intense, at just shy of 5.0% YoY, the vast majority of these pressures are concentrated in the public sector, with private sector earnings having moderated notably, again reducing the risk of sustained upside inflation risks.

Lastly, the autumn Budget has now been and gone. While the Budget itself contained nothing by way of measures aimed at boosting economic growth, the announcement now being in the rear view mirror does at least mean that a significant degree of uncertainty that had been clouding the economic outlook has now lifted. More importantly, though, the Budget contained little to fuel the inflation fire, and in fact incorporated a handful of disinflationary measures, including cuts to consumer energy bills, and a rail fares freeze.

Committee Divisions Persist

Although another 25bp cut is on the cards, in keeping with the recent theme of MPC decisions, the December call is unlikely to be a unanimous one.

Having voted 5-4 in favour of holding Bank Rate steady at the November confab, it would obviously only take one member to flip their vote, in order for a cut to be delivered. Taking into account recent remarks, is seems near-certain that Governor Bailey will join the doves at the final meeting of the year, with there also being the possibility of either Dep. Gov. Lombardelli or Chief Economist Pill also voting in favour for another cut. The base case, then, is for a 25bp cut to be delivered courtesy of a 6-3 vote, given the very slim chance of external members Greene and Mann doing anything other than preferring to stand pat.

Guidance To Remain Unchanged

While the vote split provides some degree of intrigue, the policy statement, and its forward guidance, is unlikely to do so.

In fact, the MPC’s forward guidance is likely to be unchanged from that issued after the prior meeting. Namely, that Bank Rate is set to remain on a ‘gradual downwards path’ if disinflationary progress continues to be made, and that the extent of any further cuts will hinge on how the inflation outlook evolves. In other words, reiterating that a ‘data-dependent’ and ‘meeting-by-meeting’ approach remains the MPCs ‘modus operandi’ for the time being.

Further Cuts On The Cards

In light of that guidance, further Bank Rate reductions are on the cards as we move into 2026, potentially as soon as the February meeting, if the labour market materially weakens further, and providing that further disinflationary progress continues to be made.

That said, with the Bank estimating that the neutral rate could be as high as 3.50%, there may be limited room for significant rate reductions over the next twelve months, especially as policymakers will also likely seek to ensure a positive real Bank Rate, so long as headline CPI remains north of the 2% target.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.