- English

- 中文版

WHERE WE STAND – Was there anyone who really missed the release of the US jobs report on Friday? Would anyone really take the nervousness and twitchiness anticipating the payrolls data, not to mention the hecticness after the release, over a relatively chilled Friday afternoon?

It’s certainly not a trade I’d be taking! In fact, if the BLS want to keep their releases on ice for a bit longer, I think I can rather get used to it. Anyway, it did make me chuckle, as the week came to a close, to see the very same folk who last month claimed the BLS data is unreliable, or rigged, this month claim that it’s a disaster the payrolls figures weren’t released on schedule. You can’t have it both ways!

Whatever, we did at least get last month’s ISM services survey as the week wrapped up, with the headline figure falling to a below-consensus 50.0, the lowest level since May, indicating the sector stagnated in September. The details of the report weren’t especially great either, with new orders growth slowing to a crawl, and employment contracting for the fourth month running, even as the prices paid metric remained north of 60.0 for the 10th straight month.

Frankly, I’m not going to place too much weight on the PMI data. Although ‘beggars can’t be choosers’ right now, given the US data vacuum amid the ongoing government shutdown, the PMIs have had a bit of a ropey track record in recent months, over-stating the negative impacts of policy uncertainty compared to the ‘hard’ data we’ve been getting. The Atlanta Fed’s GDPNow model still points to growth of 3.8% annl. QoQ in the third quarter, basically unchanged from the pace seen in Q2, and that’s good enough for me to remain comfortable in my view that the underlying US economy is still in very resilient shape indeed.

That said, the aforementioned data vacuum means that participants have little to nothing to latch onto in terms of a trading theme or narrative right now, especially since – at long last – logic appears to have prevailed and the ongoing pantomime in Washington DC is largely being ignored. As a result, trading conditions have become rather choppy, with most major assets trading in rather listless and rudderless fashion; there doesn’t seem to be much sign of that changing any time soon, certainly given the incredibly barren nature of this week’s calendar (see below).

Still, I guess the most notable movers on Friday again came in the precious metals space, with gold and silver both rallying strongly, seeing the former return towards the record highs set earlier last week. $3,900/oz did seem like a tough nut to crack for a while, though now that level has decisively given way, the bulls will quickly look towards $4,000/oz, especially as the fundamental bull case of reserve allocators diversifying away from the dollar, the risk of inflation expectations un-anchoring, and runaway DM government spending, remains a solid one. In any case, selling an asset printing all time highs on a near daily basis is often akin to a one way trip down the road to ruin.

Conditions elsewhere were considerably less exciting, and actually rather dull, which can hardly be considered surprising given the death of catalysts, and the ease with which markets shrugged off that ISM survey. The weekend has proved a little spicier, though, especially after Takaichi’s surprise victory in Japan’s LDP leadership race.

Stocks, hence, ended the day basically unchanged, as an early day rally fizzled out, though the S&P still notched a healthy gain on the week. I remain bullish here, with momentum firmly favouring further upside, and this week’s relatively light docket likely allowing markets to take the ‘path of least resistance’ in that direction. Of course, the upcoming Q3 earnings season will test the first leg – solid earnings growth – of my bull case, though with the underlying economy remaining robust, and with a looser monetary backdrop on the horizon, I’d still be a dip buyer if any were to emerge.

As for FX and rates, there’s really little for me to say, with both G10 FX and DM Govvies doing little more than go on a random walk for most of the day, and no significant theme emerging. I remain a dollar bull, as the Fed’s ‘run it hot’ approach tilts risks to the outlook to the upside, though it’s frankly tough to envisage the market doing anything besides trading in this rather choppy, and messy, nature until some sort of catalyst emerges.

That catalyst, of course, probably won’t come until the government shutdown comes to an end, and economic releases resume as normal. Hey, maybe we do need that BLS data after all!

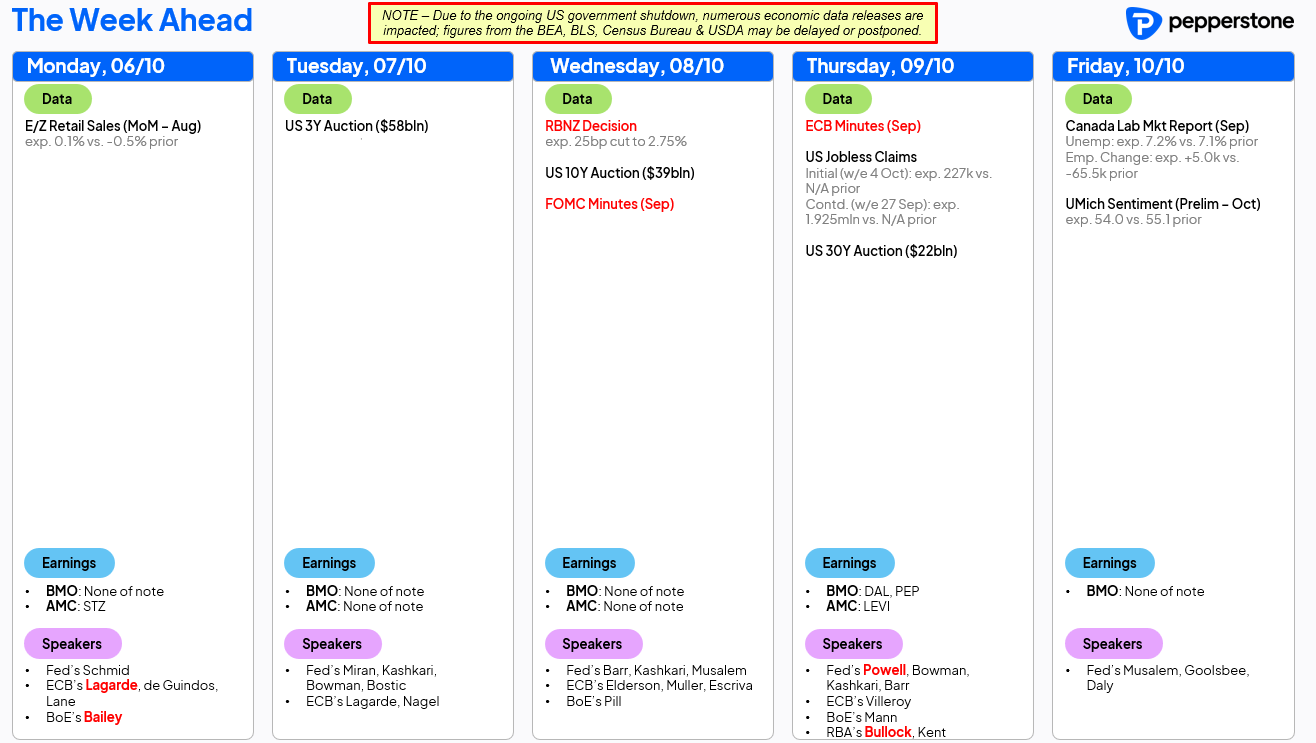

LOOK AHEAD – Those hunting for a catalyst are unlikely to find one on this week’s economic docket, no matter how closely one interrogates the schedule.

There is, to be honest, not entirely much going on, unless a 25bp cut from the RBNZ, or minutes from last month’s FOMC and ECB meetings ‘float your boat’. Suffice to say, I’m not banking on them to make waves for financial markets, and nor should this week’s Treasury supply, though longer-end auctions will be watched closely, especially given the indigestion seen with recent long-end supply on this side of the pond.

Other than that, all we really have to get our teeth into this week is another ridiculously busy schedule of central bank speakers, as well as endless political headlines from Washington DC – I’m not sure which of those 2 is worse!

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.