- English

- 中文版

Trading Crypto Volatility: Navigating XRP, SOL & Bitcoin in a Fast-Paced Market

Seasoned crypto investors understand that no market goes up in perpetuity or a linear fashion - and as tokenisation becomes a greater part of our lives, investors know they will have to navigate periods of heightened drawdown and volatility (vol) along the way.

That period of drawdown and vol has been in play since Trump’s inauguration, but with various indicators reaching levels of ‘Extreme fear’, crypto traders need to be open-minded to dynamic changes both in the macro news flow but also aggressive reversals in sentiment and the price action.

Drawdown in Crypto in Fitting with the Rotation seen in US Equity Factors

The fact is while we’ve seen an 80%+ max drawdown in the ultra-speculative plays ($Trump), and 25%+ max drawdowns across our full suite of crypto, these trends are in fitting with what we’re seeing across other risky areas of the capital markets and notably within US equity sectors, factors and styles, where we’ve seen:

- High-beta US equities significantly underperform low-volatility defensive equities.

- Trader’s increasing short position on the high leverage, lower ‘quality’ US equities – The Goldman Sachs High Short Interest equities basket is -21% since December.

- US small caps are significantly underperforming larger (higher quality) cap US stocks.

- The US Mag7 equity basket has fallen 16% since 18 December.

- Cyclically sensitive US equities have significantly underperformed defensive equity plays.

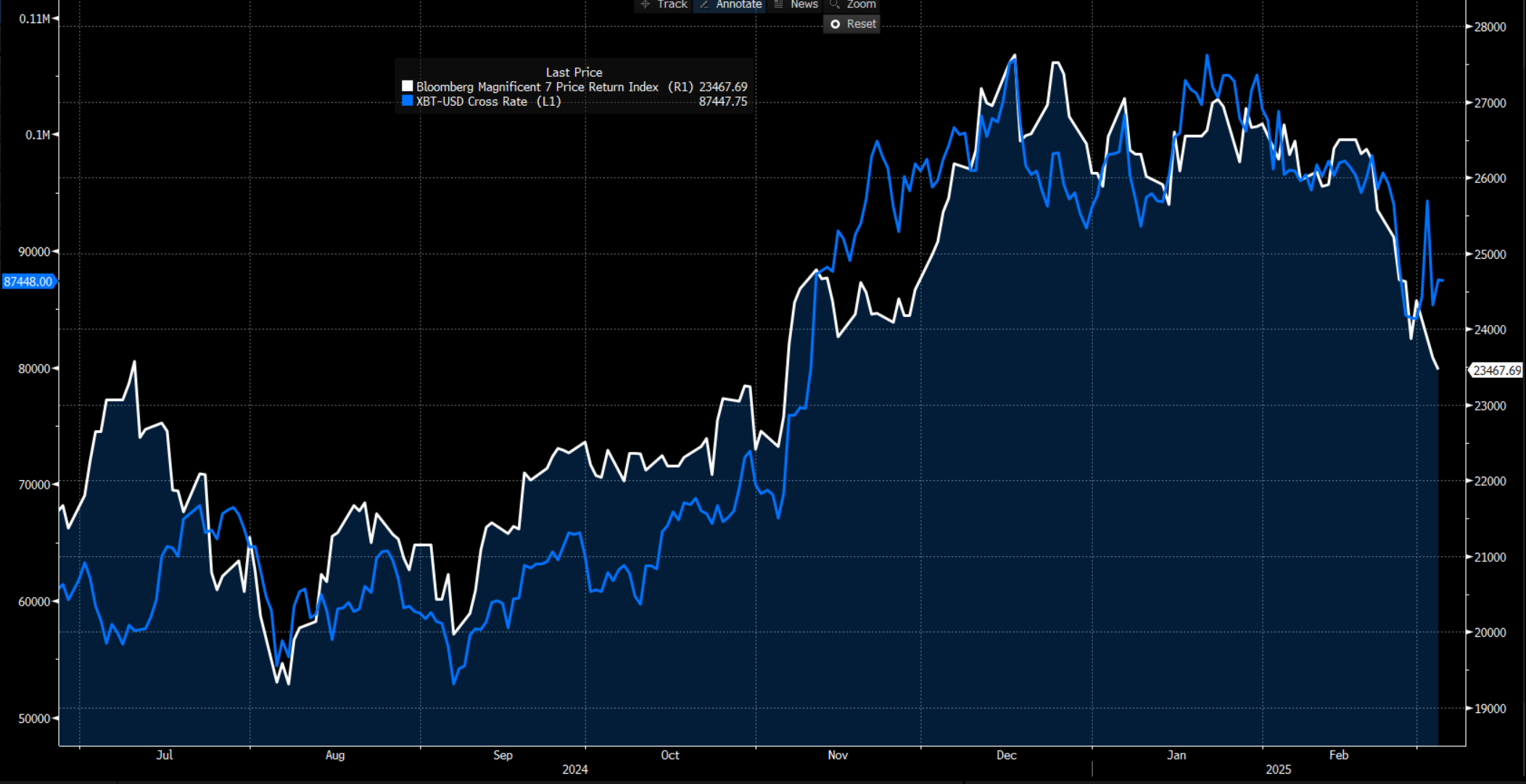

Mag7 basket (white) vs Bitcoin (blue)

Essentially, there has been a broad migration out of risky markets, and into high-quality defensives – that is, companies with low leverage, compelling gearing and predictable and less economically sensitive cash flows.

This backdrop of capital preservation is not a backdrop conducive to buying cryptocurrencies either, especially on the meme side, which put in their best work in periods of low cross-asset volatility, increasing excess liquidity and elevated market confidence and positive momentum.

Factors Behind the Rotation Out of Risky Markets

The move to a more defensive position has been driven by a number of factors:

- Concerns on the near-term investment case for US AI/high growth tech plays, heightened by saturated positioning and extreme valuations.

- Trump’s tariff and immigration policy, as well as DOGE's efficiency drive, is expected to lead to slower US economic activity.

- The Federal Reserve adopting a firm wait-and-see approach to further policy changes.

- $Trump and Melania Meme coins launched in mid-January and were aggressively sold from inception.

- The $1.6B ETH hack resulted in a short-term loss of confidence with concerns that could lead to new supply being dumped on the market.

- Weakness (in price) breeds further weakness – with a consistent move lower in the trend, traders cut out of long positions in a bid to live to fight another day.

While the ultra-high volatility meme names have seen a drawdown of 50-60%+, Bitcoin has also not been spared with a max drawdown of 28% from the 20 January highs – this marks the 7th largest drawdown since 2014.

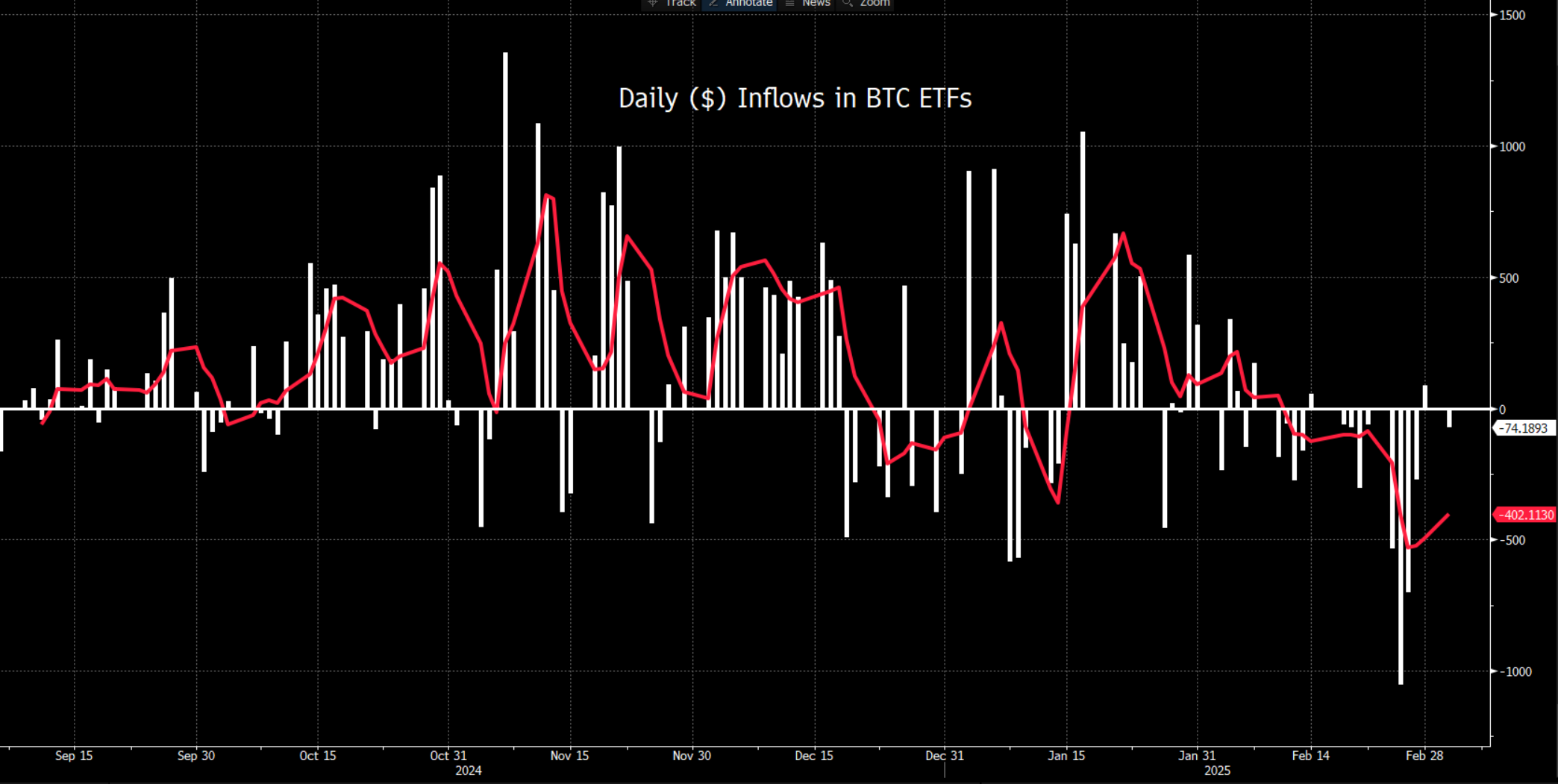

Investors from the TradeFi world have been instrumental in pushing Bitcoin into $109k, with the daily flows into the BTC ETFs explaining a large degree of the variance in BTC.

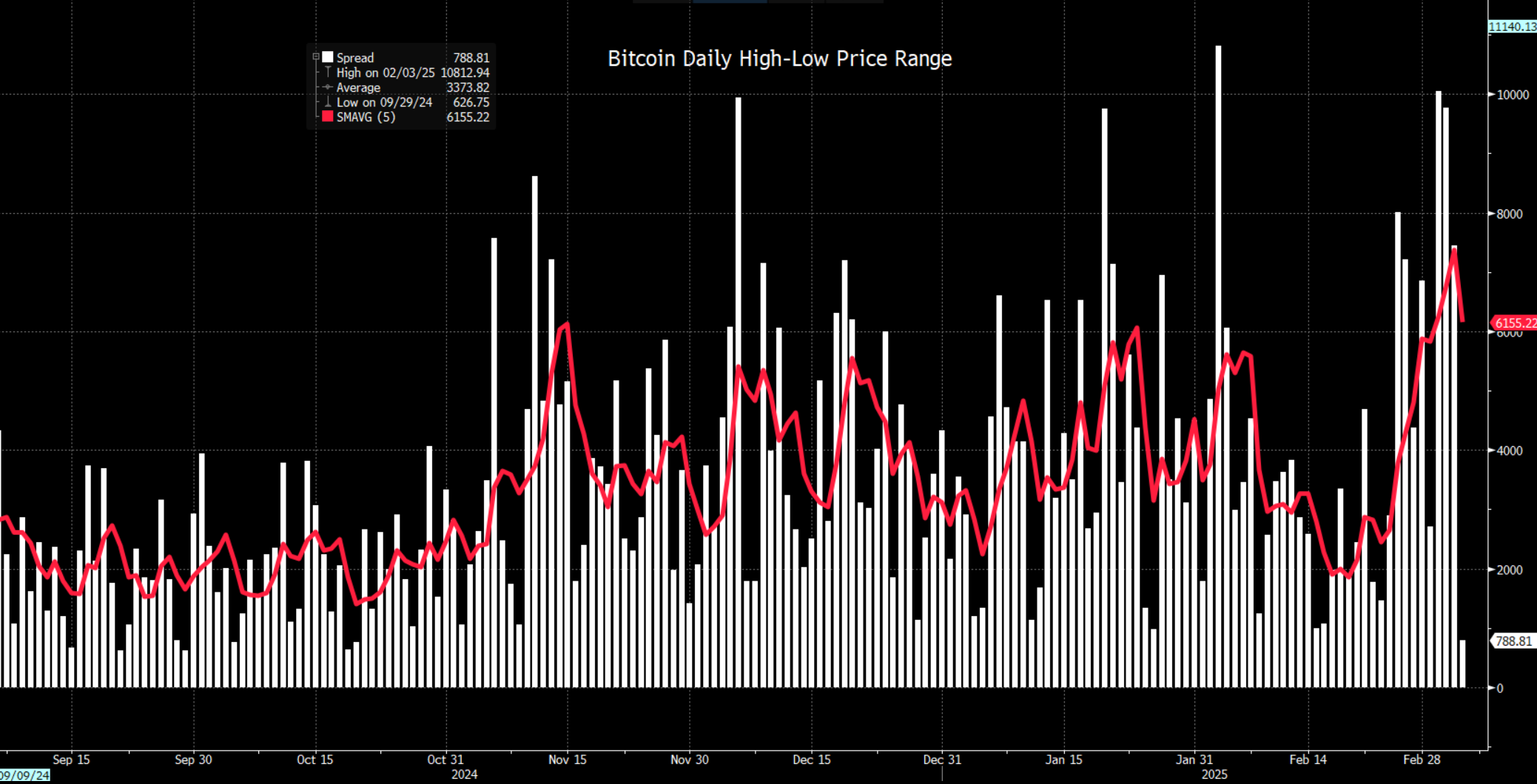

The players buying the BTC ETFs are typically more conservative in nature and attracted to BTC when its 30-day realised volatility is around 35%, and not at 55% and multi-year highs – which is where we are now - so it’s no surprise to see consistent outflows from the BTC ETFs of late.

If the volatility in Bitcoin and crypto falls, then one can assume we’ll see these inflows could resume in earnest and push the Bitcoin price higher.

A Crypto Reserve is in the Works.

Trump's recent post on Truth Social messaging his directive to the working group to move forward on the Crypto Strategic Reserve, and to include SOL, XRP and ADA in the holdings, offered new inspiration for the crypto bulls. The reaction on Sunday (2 March) was prolific but ultimately short-lived, and the reversal lower in the following session was equally as violent, with many questioning the actual viability of a Crypto Reserve that included XRP, ADA and SOL.

The key aspect in the communication is the Crypto Reserve is to be founded on “lawfully-seized assets” – this is fine for Bitcoin, as the US already holds $19b of seized coins. However, to add XRP, SOL and ADA into a Reserve would mean doing so through open-market purchases. If they are going to use US taxpayer’s dollars for these purchases, then it would need Congressional sign-off and that seems unlikely.

A Crypto Reserve is clearly in the works though and would be a huge positive for the crypto movement, and while we know Trump has assembled a pro-crypto team around him, doing so with the inclusion of ADA, SOL and XRP comes with challenges.

Looking Ahead to Friday’s White House Crypto Summit

We’ll likely learn more on the Crypto Reserve this Friday, at the first-ever White House Crypto Summit, with additional focus on regulation, and speculation that Trump will also push to make crypto free of capital gains – although, any changes to tax legislation would need to be passed through Congress.

Naturally, the Crypto Summit will be a crypto love-in and a huge show of support for the crypto movement, pushing developments to make the US the powerhouse that takes the scene forward. The probability of buyers of Bitcoin and crypto (more broadly) into and through the Summit seems elevated, but for now, the price action is fickle, with massive intraday trading ranges, multi-year high volatility and traders quick to fade rallies – this is a trader’s market and for those with an agnostic view on direction.

A better tone in risk equity, with the MAG7 basket turning higher, would also add tailwinds to crypto prices, and while correlations do break down, many in the crypto world continue to take their directional steer through the US equity channels.

That said, the backdrop for longer-term price appreciation in Bitcoin and select crypto remains in place, and this period of high vol and drawdown should resolve with new highs. Increased adoption, a more favourably regulatory environment, reduced supply, and Trump championing your cause, all play into that assumption.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.