- English

- 中文版

Trading a progressive reopening – Chinese equity market primed to break out

Increased client flow

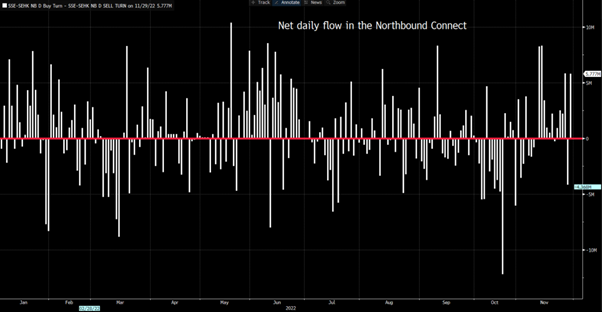

On the floor yesterday we saw sizeable moves in Chinese/HK markets, with upbeat client activity in the HK50 and CHINAH indices CFD, while USDCNH also saw some flow from APAC clients, with the cross falling 1.4% to 7.1400 – the rally in the yuan is interesting, because, in theory, a reopening is a negative for the Chinese yuan, as it would result in a deteriorating trade deficit – however, if we look at the upbeat flows through the Shanghai-HK northbound ‘connect’ it seems these capital flows are causing the strength in the yuan – it feels like this will be the play for the near-term where good news and progress on the reopening front manifests in higher Chinese bond yields, capital inflows and in a stronger yuan.

As we’re so accustomed to when we do see an outsized rally in the CNH (offshore yuan) we’ve seen the China proxies, such as the AUD and NZD working well – while we’ve seen some support for crude and copper.

On the equity front, clients have centred their attention on the HK50, although it’s the CHINAH which is seeing a modestly greater percentage changes – both set-ups are becoming progressively more bullish, although of the Chinese/HK equity indices CFD Pepperstone offers to clients to trade (CHINAH, CN50, HK50) it’s the CN50 appears best placed to see a bullish break out on a closing basis.

Trading China

My preference is to adopt a momentum approach and to buy strength – focusing on the HK50, this suggests waiting for a daily close above 18,466, or for more aggressive traders, placing buy-stop orders above this level and waiting for the momentum to push the move higher into the 200-day MA (19,833) and potentially further – should we see the upside break, using a basic mechanical exit such as a 3 & 8-day EMA crossover could keep you in the trade if price powers higher – obviously there is no guarantee that will be the case, but using a mechanical stop removes the emotion attached with being long in a rally and taking profits potentially too early.

The news flow justifies the rally in Chinese equity indices CFD

By way of news flow, the situation is clearly fluid – while we have been treated to bouts of speculation around the reopening, there have been some substance for traders to justify the risk rally. Having recently been treated to the 16-point plan to assist the property industry, we’ve seen additional measures to help property developers access funding - where notably the CSRC (China Security Regulatory Commission) lifted a ban that’s been in place since 2015 allowing developers the ability to issue equity to buy property assets - it is clear the CSRC want to see stability in A-share listed developers and Chinese real estate stocks have naturally rallied hard on the news flow, underpinning the positive flow seen in the broader index move.

On the reopening front its small but incremental steps forward – in yesterday’s State Council address we heard a more thorough plan to lift vaccination rates in the elderly, while the Council refrained from using the term “Covid Zero’ for the first time since June – the market heard rhetoric in fitting with the recently relaxed guidelines set out in the “20 Optimised Measures”, and there is a feeling that at the margin authorities are slowly moving towards living with higher case counts.

While some in the market talk about a higher chance of a forced reopening, the wide consensus remains that reopening, while it will be non-linear, is set to really kick into life after the “Two Sessions” meetings in March 2023. Of course, traders live in the future, so we’re already attempting to price that outcome in advance – this could change especially as China moves towards the Winter period and an earlier Chinese New Year. We should learn more during the December Politburo meetings and Central Economic Work Conference.

So we watch development here with interest, and as Chinese markets show real life the movement and flow offer interesting trading opportunities.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.