- English

- 中文版

CBA H1 26 Earnings Preview: RBA Resumes Rate Hikes, Focus on Profitability and Asset Quality

.jpg)

With inflation prints remaining above expectations at the start of the year, the Reserve Bank of Australia (RBA) resumed its rate-hiking cycle on February 3. Against this backdrop, CBA’s H1 2026 earnings report, due February 11, has become a key focus for the market.

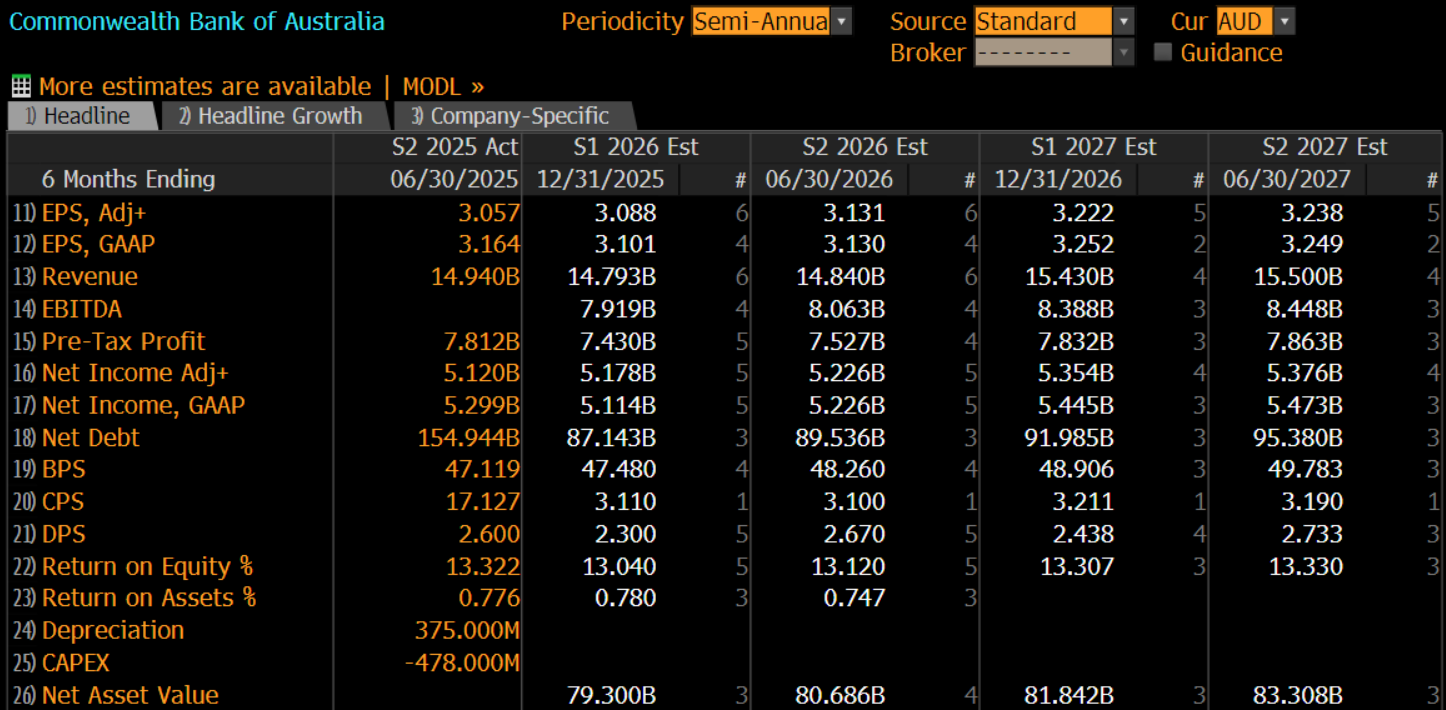

Market consensus indicates that traders remain cautious about CBA’s H1 performance. Adjusted earnings per share (EPS) are forecast at AUD 3.088, while adjusted net profit is expected around AUD 5.18 billion, both slightly above the prior period.

However, revenue is projected at AUD 14.79 billion, down from H2 2025’s AUD 14.94 billion, pointing to persistent top-line headwinds.

As Australia’s largest retail bank, CBA’s earnings report not only reflects its profitability but also serves as an important indicator for assessing interest rate changes, asset quality, and dividend stability.

Price Pressure from Rate Hike Expectations and Fund Rotation

Despite continued institutional inflows, CBA’s share price has been under pressure since mid-2025, with a peak-to-trough drawdown exceeding 20% from its June high.

Rising underlying asset prices and a rotation of funds into the resources sector have been key factors weighing on bank shares. Additionally, heightened expectations of RBA rate hikes at year-end have challenged CBA’s premium valuation, which is based on a “high-quality, low-growth” narrative.

Post-earnings, if the stock can reclaim the 100-day moving average and December high of AUD 163, further upside may be unlocked. Conversely, if bears gain momentum, year-end lows at AUD 150.4 and 147 could provide support.

Key Focus: Profitability and Asset Quality

Essentially, CBA’s appeal to traders is rooted more in its stable, high dividend than in rapid share price appreciation.

In a backdrop of rising inflation and tighter interest rate conditions, the market will closely monitor how the rate environment affects profitability and asset quality, with particular attention to:

- Net Interest Margin (NIM)

NIM is a core driver of bank profitability. With RBA rate hike expectations rising, lending rates may increase, supporting margin expansion. However, heightened competition for deposits and concerns over margin pressure remain. Management commentary on NIM trends, business-segment margin performance, and forward pricing strategies will be closely watched. - Asset Quality and Loan Loss Provisions

Loan loss provisions are expected to remain low, but residential mortgages and corporate loans face potential pressure in a rising-rate environment. Traders will monitor changes in non-performing loan ratios, incremental provisions, and detailed performance by loan segment to assess future credit risk trends and profit resilience. - Revenue and Cost Structure

Beyond net interest income, CBA’s initiatives in payment innovation and digital services—such as participation in Mastercard’s agentic payment transactions—may provide new avenues for non-interest income growth. Meanwhile, changes in operating costs and technology investment will also materially affect overall profitability. - Dividends and Capital Management

At current high valuations, whether CBA maintains a stable dividend policy will directly influence shareholder return expectations. Capital adequacy, including CET1 ratios and trends, will remain a key metric for assessing the bank’s ability to withstand future market volatility and maintain capital buffers.

Manage Positions Amid Earnings Day Volatility

Overall, market expectations for CBA’s H1 2026 earnings remain cautious. However, its robust fundamentals, solid asset quality, diversified revenue streams, and stable dividend support short-term defensive value.

In the context of rising rates, management commentary on NIM, loan loss provisions, and dividends will be key for traders in assessing profitability resilience and valuation sustainability.

Futures markets indicate that implied volatility for earnings day is 3.35%, well above the historical average of 0.67%. In a high-valuation environment, disappointing earnings or higher-than-expected loan loss provisions could trigger rapid market repricing. Accordingly, traders need to be vigilant about risk controls and position sizing on earnings day.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.