- English

- 中文版

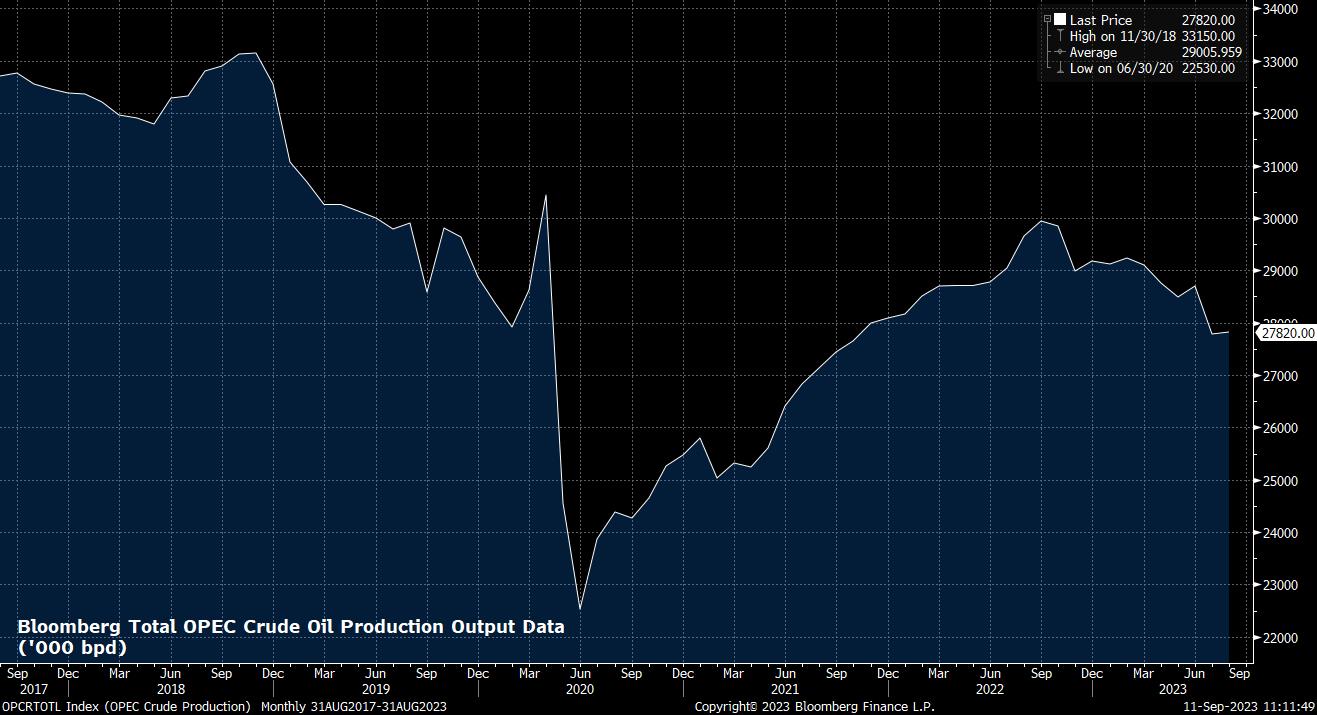

On the fundamental side, tightening supply has been the primary driver of upside, with a range of factors causing the market to come into better balance. Recently, the Saudi-led production cuts (which include additional cuts from Russia, and the broader OPEC+ alliance) were surprisingly extended to the end of the year, compared to the expected one-month long extension, with all parties leaving the prospect of deeper cuts on the table.

Other supply factors are also in the mix. Weather-related supply risks, particularly for WTI crude, have yet to disappear as the North Atlantic hurricane season intensifies, though storms have thus far avoided the primary energy-related resources in the Gulf of Mexico.

Elsewhere, the prospect of industrial action in Nigeria, and other oil producing nations, continues to loom large, while geopolitical risk continues to linger, most notably as the war in Ukraine remains ongoing, with little sign of any upcoming resolution.

Interestingly, crude has been able to rally considerably – Brent has gained over 25% since the July bottom – despite increasing concern over global industry. The economic recovery in China remains sluggish at best, while manufacturing PMIs continue to dive further into contractionary territory across developed markets, with leading sub-indices within those surveys implying continued soft demand going forward. It is this softening of demand that poses the most significant risk to the bulls at present, even if it appears clear that OPEC+ et al. are determined to engineer a sustained period of higher prices over the medium-term.

Turning to the charts, Brent has broken above the $90bbl mark for the first time since November 2022, which has in turn sparked a brief period of consolidation for the front month contract. Given how far the rally has come, in a relatively short space of time, this shouldn’t be particularly surprising, with downside likely limited to the April and August highs, which now provide support, at $87.50bbl.

To the upside, the $93bbl mark stands out, as both the top of the ascending channel that is currently driving proceedings, and as the 76.4% retracement of the declines seen during Q4 22 and Q1 23. Above this level, the bulls are likely to have $95bbl, then the autumn 2022 highs around $98.60bbl on their radars.

The story is similar for WTI, with the front month contract also trading at its highest levels since Q4 22, just shy of long-standing resistance around $87.75bbl.

Above this level, the psychologically important $90bbl stands out as the next upside target, above which the late-2022 double-top at $93.50-$93.65bbl marks the following resistance level. As with Brent, downside appears likely to be limited, with buyers likely lurking in the $83.50-$84.50bbl region.

As a final word on crude, it’s important to recognise the implications that a sustained rally in oil prices could have. The percentage change in Brent is no positive on a YoY basis, meaning that energy is now becoming a driver of, not a drag on, inflation. While central banks may look through this when setting policy, given the preference to monitor core inflation rates, it would be folly for traders to entirely ignore a rise in headline inflation, particularly at a time when equity markets are particularly sensitive to incoming data and shifts in rate expectations. Furthermore, rising oil prices are likely to pose a stiff headwind to economic growth, potentially deepening the manufacturing downturn that is already underway across much of DM.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)